|

市場調查報告書

商品編碼

1509247

無源光纖網路設備市場:依結構、按組件、按地區Passive Optical Network Equipment Market, By Structure (Gigabit Passive Optical Network Equipment, and Ethernet Passive Optical Network Equipment), By Component (Optical Line Terminal, and Optical Network Terminal ), By Geography |

||||||

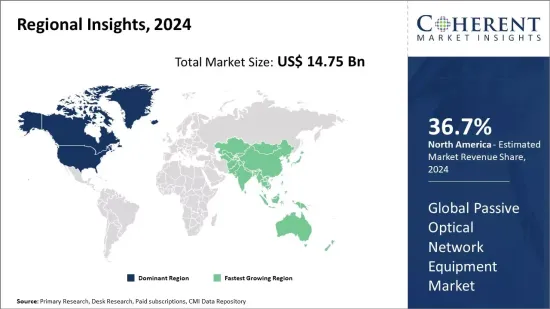

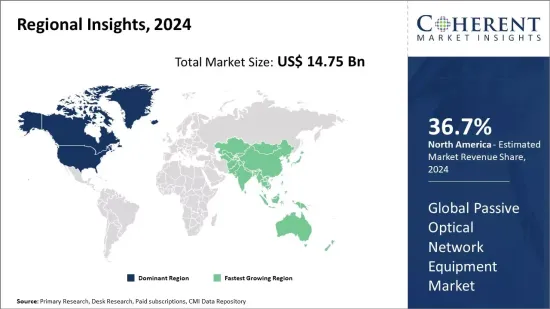

2024年全球被動光纖網路設備市值為147.5億美元,預計2031年將達到375.9億美元,2024年至2031年的複合年成長率為14.3%。

雲端服務的日益採用以及頻寬頻來的網路流量的增加迫使網路營運商尋求不斷發展的網路基礎設施。無源光纖網路(PON) 正在成為營運商的首選,因為它們可以經濟高效地向家庭和企業用戶提供高速寬頻和多媒體服務。 PON 部署在光纖到府 (FTTH) 和光纖到大樓 (FTTB) 應用中變得越來越流行,滿足了全球對被動光纖網路設備的需求。

市場動態:

全球無源光纖網路設備市場是由光纖部署的增加以及虛擬實境、線上遊戲和 4K/8K 視訊串流等頻寬密集型應用需求的增加所推動的。光纖到 X 網路的日益普及正在推動對 PON 設備的需求。然而,高昂的初始實施成本以及與傳統銅纜和同軸系統的兼容性問題預計將阻礙預測期內的市場成長。同時,從 GPON 到 NG-PON2 的遷移以及 5G回程傳輸網路中 PON 的實施等發展可能會在未來幾年帶來新的成長機會。

本研究的主要特點

該報告對全球被動光纖網路設備市場進行了詳細分析,並提供了以2023年為基準年的預測期(2024-2031年)的市場規模和年複合成長率(CAGR%)。

它闡明了不同細分市場的潛在收益成長機會,並解釋了該市場有吸引力的投資提案矩陣。

它還涵蓋市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景、Adtran Inc.、Calix, Inc.、思科系統公司、華為技術有限公司、三菱電機公司。方案公司、諾基亞公司、Verizon Communications Inc.、中興通訊公司、飛思卡爾半導體公司、日立有限公司、Tellabs, Inc.、Broadcom、NXP 和Qualcomm 等主要企業採用的競爭策略的主要考察。

該報告的見解將幫助負責人和公司經營團隊就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

全球無源光纖網路設備市場報告迎合了該行業的各種相關人員,如投資者、供應商、產品製造商、經銷商、新進業者和財務分析師。

透過用於分析全球無源光纖網路設備市場的各種策略矩陣,將有助於相關人員做出決策。

目錄

第1章 研究目的與前提

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告說明

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map(COM)

第3章市場動態、法規及趨勢分析

- 市場動態

- 促進因素

- 抑制因素

- 市場機會

- 監管場景

- 產業動態

- 併購

- 新系統的引入/核准

- COVID-19 大流行的影響

第4章2019-2031年全球無源光纖網路設備市場(依結構)

- Gigabit被動光纖網路(GPON)設備

- 乙太網路光纖網路(EPON)設備

第5章全球無源光纖網路設備市場,按組成部分,2019-2031

- 光線路終端(OLT)

- 光纖網路終端(ONT)

第6章2019-2031年全球無源光纖網路設備市場(按地區)

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Adtran Inc.

- Calix, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd

- Mitsubishi Electric Corporation

- Motorola Solutions Inc.

- Nokia Corporation

- Verizon Communications Inc.

- ZTE Corporation

- Freescale Semiconductor Inc.

- Hitachi Ltd.

- Tellabs, Inc.

- Broadcom

- NXP

- Qualcomm

第8章 命運之輪

- 命運之輪

- 分析師觀點

- Coherent Opportunity Map

第9章 參考文獻及調查方法

- 參考

- 調查方法

The global passive optical network equipment market is estimated to be valued at US$ 14.75 Bn in 2024 and is expected to reach US$ 37.59 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 14.3% from 2024 to 2031.

The rising adoption of cloud services and bandwidth intensifying network traffic has compelled network operators to look for evolving network infrastructures. Passive optical networks (PONs) have emerged as a preferred option among operators as they help deliver high-speed broadband and multimedia services to residential as well as business users in a cost-effective manner. PON deployments are gradually gaining traction in fiber-to-the-home (FTTH) and fiber-to-the-building (FTTB) applications, thereby supporting the demand for passive optical networking equipment worldwide.

Market Dynamics:

The global passive optical network equipment market is driven by increasing fiber optic deployments and the rising demand for bandwidth-intensive applications like virtual reality, online gaming, and 4K/8K video streaming. Rising adoption of Fiber to the X networks is propelling the demand for PON equipment. However, high initial deployment costs and compatibility issues related to legacy copper and coaxial systems are expected to hinder the market growth during the forecast period. On the other hand, developments like GPON to NG-PON2 migrations and PON implementations in 5G backhaul networks are likely to introduce new growth opportunities over the coming years.

Key Features of the Study:

This report provides an in-depth analysis of the global passive optical network equipment market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year

It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players like Adtran Inc., Calix, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd, Mitsubishi Electric Corporation, Motorola Solutions Inc., Nokia Corporation, Verizon Communications Inc., ZTE Corporation, Freescale Semiconductor Inc., Hitachi Ltd., Tellabs, Inc., Broadcom, NXP, and Qualcomm

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global passive optical network equipment market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global passive optical network equipment market

Detailed Segmentation:

- By Structure

- Gigabit Passive Optical Network (GPON) Equipment

- Ethernet Passive Optical Network (EPON) Equipment

- By Component

- Optical Line Terminal (OLT)

- Optical Network Terminal (ONT)

- By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- Adtran Inc.

- Calix, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd

- Mitsubishi Electric Corporation

- Motorola Solutions Inc.

- Nokia Corporation

- Verizon Communications Inc.

- ZTE Corporation

- Freescale Semiconductor Inc.

- Hitachi Ltd.

- Tellabs, Inc.

- Broadcom

- NXP

- Qualcomm

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Structure

- Market Snippet, By Component

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Passive Optical Network Equipment Market, By Structure, 2019-2031 (US$ Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Gigabit Passive Optical Network (GPON) Equipment

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

- Ethernet Passive Optical Network (EPON) Equipment

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

5. Global Passive Optical Network Equipment Market, By Component, 2019-2031 (US$ Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Optical Line Terminal (OLT)

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

- Optical Network Terminal (ONT)

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

6. Global Passive Optical Network Equipment Market, By Region, 2019-2031 (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- North America

- Regional Trends

- Market Size and Forecast, By Structure, 2019-2031 (US$ Bn)

- Market Size and Forecast, By Component, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Structure, 2019-2031 (US$ Bn)

- Market Size and Forecast, By Component, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- U.K.

- Germany

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Structure, 2019-2031 (US$ Bn)

- Market Size and Forecast, By Component, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Structure, 2019-2031 (US$ Bn)

- Market Size and Forecast, By Component, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Structure, 2019-2031 (US$ Bn)

- Market Size and Forecast, By Component, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

7. Competitive Landscape

- Company Profiles

- Adtran Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Calix, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Cisco Systems, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Huawei Technologies Co., Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Mitsubishi Electric Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Motorola Solutions Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Nokia Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Verizon Communications Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- ZTE Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Freescale Semiconductor Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Hitachi Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Tellabs, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Broadcom

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- NXP

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Qualcomm

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Adtran Inc.

8. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. Reference and Research Methodology

- References

- Research Methodology

- About us and Sales Contact