|

市場調查報告書

商品編碼

1673078

網路安全保險市場:按保險類型、承保範圍、公司規模、最終用戶和地區分類Cyber Security Insurance Market, By Insurance Type, By Coverage Type, By Enterprise Size, By End user, By Geography |

||||||

2025 年全球網路安全保險市場規模估計為 193.5 億美元,預計到 2032 年將達到 714.4 億美元,2025 年至 2032 年的年複合成長率(CAGR)為 20.5%。

| 報告範圍 | 報告詳細資訊 | ||

|---|---|---|---|

| 基準年 | 2024 | 2025 年市場規模 | 193.5億美元 |

| 效能資料 | 2020-2024 | 預測期 | 2025-2032 |

| 預測期:2025 年至 2032 年複合年成長率 | 20.50% | 2032 年金額預測 | 714.4億美元 |

業界的見解

網路威脅的快速增加給全球企業帶來了重大挑戰。隨著網路攻擊的頻率和規模不斷成長,企業正在投入更多資源來加強其安全態勢並防範財務和聲譽風險。這導致對網路安全保險的需求上升,這種保險可以幫助公司將部分風險轉移給保險公司。網路安全保險涵蓋與資料外洩、網路中斷、勒索軟體攻擊以及違反隱私法導致的訴訟相關的費用。網路安全保險可協助組織管理風險、限制影響並確保網路攻擊後的業務永續營運。

市場動態

針對敏感資料和關鍵基礎設施的複雜網路攻擊案例不斷增加,是推動網路安全保險市場發展的主要因素。報告預測,到 2025 年,網路犯罪造成的損失將超過每年 10 兆美元。保險公司意識到了這一威脅,並正在利用他們的專業知識來幫助企業。然而,由於保險合約定義不標準化且新風險無法準確評估,承保業務帶來了挑戰。保險公司正在投資組建專家團隊,以掌握不斷變化的威脅情況。同時,政府對資料保護的強制要求不斷增加,也推動了合規保險的需求。這對保險公司來說是一個創新保險範圍、滿足產業特定需求的機會。

研究的主要特點

- 本報告對全球網路安全保險市場進行了詳細分析,並以 2024 年為基準年,給出了預測期(2025-2032 年)的市場規模和年複合成長率(CAGR %)。

- 它還強調了各個領域的潛在商機並說明了該市場的有吸引力的投資提案矩陣。

- 它還提供了對市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景以及主要企業採用的競爭策略的重要見解。

- 它根據公司亮點、產品系列、關鍵亮點、財務表現和策略等參數,概述了全球網路安全保險市場的主要企業。

- 全球網路安全保險市場報告針對該行業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進業者和金融分析師。

- 相關人員可以透過全球網路安全保險市場分析中使用的各種策略矩陣更輕鬆地做出決策。

目錄

第1章 調查目的與前提條件

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告描述

- 市場定義和範圍

- 執行摘要

- 一致的機會圖 (COM)

第3章市場動態、法規與趨勢分析

- 市場動態

- 驅動程式

- 限制因素

- 機會

- 監管情景

- 產業趨勢

- 合併和收購

- 新系統推出/核准

- 新冠肺炎疫情的影響

4. 2020 年至 2032 年全球網路安全保險市場(依保單類型)

- 介紹

- 獨立

- 相容類型

5. 2020 年至 2032 年按保險類型分類的全球網路安全保險市場

- 介紹

- 成員

- 責任險

6. 2020 年至 2032 年全球網路安全保險市場(依公司規模)

- 介紹

- 中小型企業

- 大型企業

7. 2020 年至 2032 年全球網路安全保險市場(依最終使用者分類)

- 介紹

- 醫療

- 零售

- BFSI

- 資訊科技和通訊

- 製造業

- 其他(政府、旅遊及旅遊業)

8. 2020 年至 2032 年全球網路安全保險市場(按地區分類)

- 介紹

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第9章 競爭格局

- 公司簡介

- BitSight

- Prevalent

- RedSeal

- SecurityScorecard

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher &Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

第 10 章分析師建議

- 興衰

- 一致的機會地圖

第 11 章調查方法

- 參考

- 調查方法

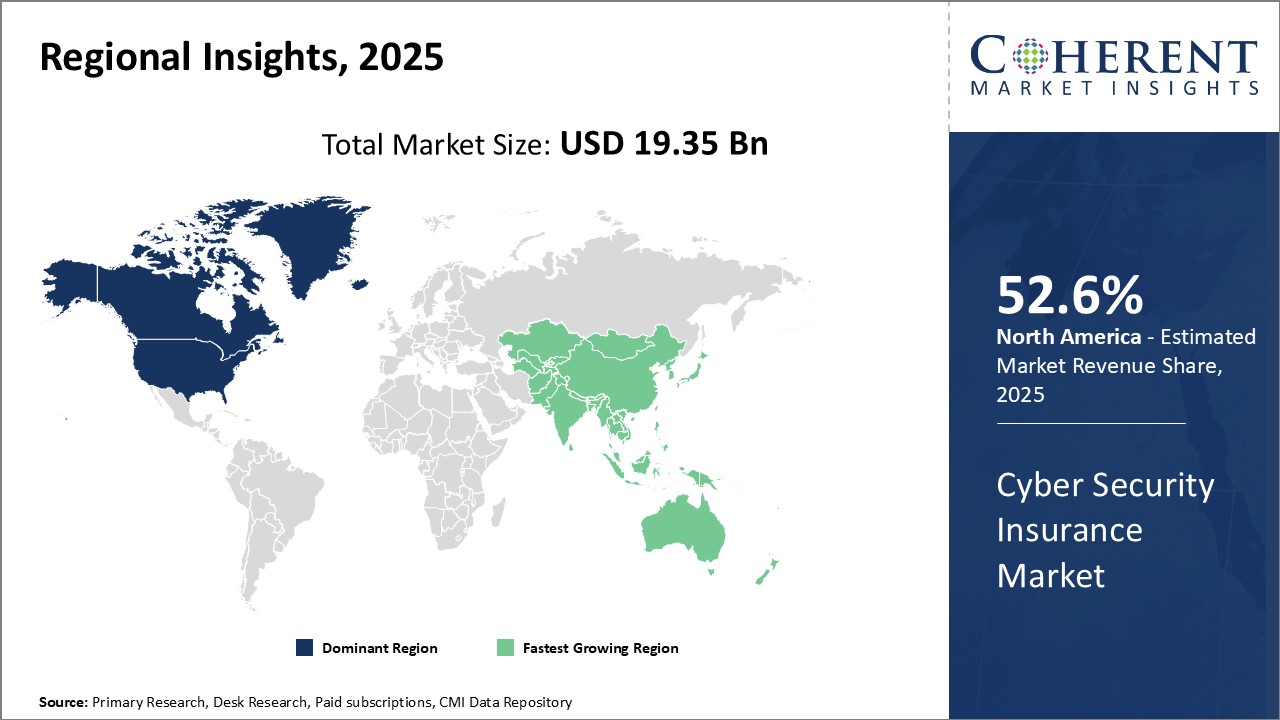

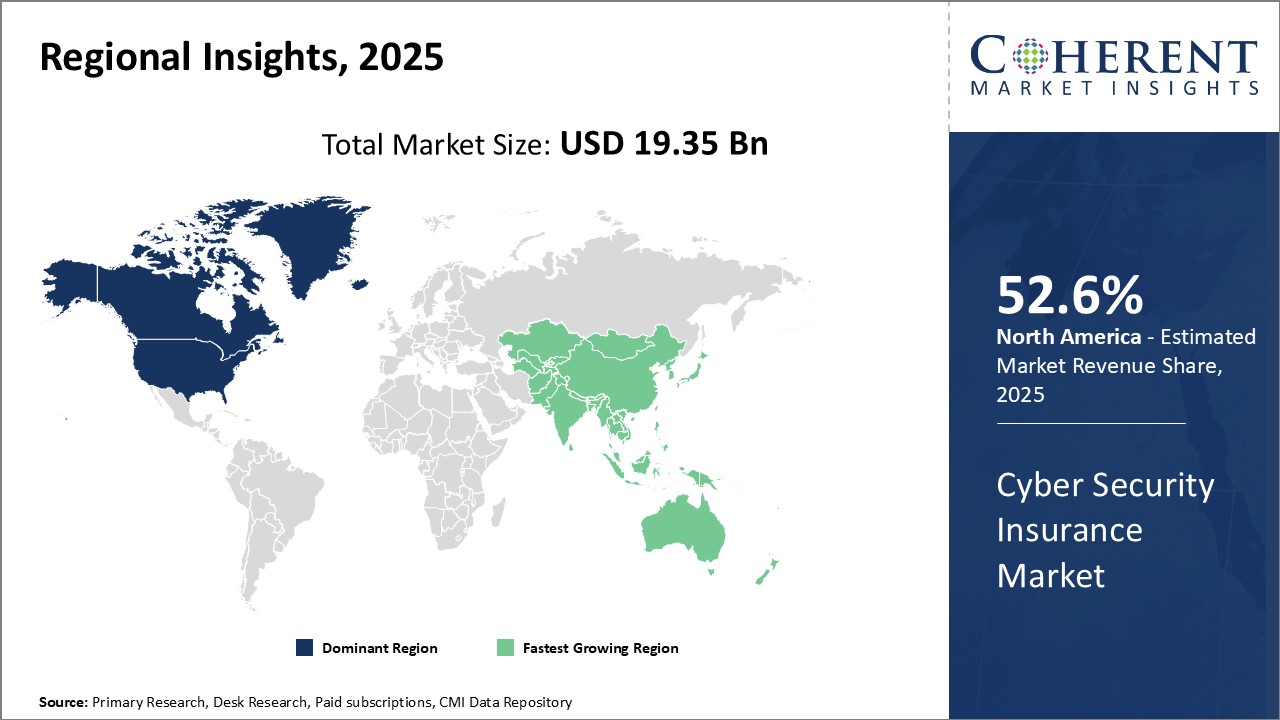

Global Cyber Security Insurance Market is estimated to be valued at USD 19.35 Bn in 2025 and is expected to reach USD 71.44 Bn by 2032, growing at a compound annual growth rate (CAGR) of 20.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 19.35 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 20.50% | 2032 Value Projection: | USD 71.44 Bn |

Report Description:

The rapid rise in cyber threats has posed significant challenges for businesses globally. As cyberattacks continue to grow in frequency and scale, organizations are allocating greater resources to strengthen their security posture and protect against financial and reputational risks. This has boosted demand for cybersecurity insurance which helps businesses transfer some risks to insurers. Cybersecurity insurance provides coverage for costs associated with data breaches, network disruptions, ransomware attacks, and litigation arising from privacy law violations. It assists organizations in managing risks, containing impacts, and ensuring business continuity in the wake of a cyberattack.

Market Dynamics:

Growing instances of sophisticated cyberattacks targeting sensitive data and critical infrastructure is a key driver propelling the cybersecurity insurance market. According to reports, cybercrime costs are projected to surpass US$ 10 trillion annually by 2025. Insurers are recognizing this threat and leveraging their expertise to assist businesses. However, the lack of standardized policy definitions and accurately assessing emerging risks pose challenges for underwriting practices. Insurers are investing in expert teams to stay abreast of the evolving threat landscape. Meanwhile, increasing government mandates for data protection are creating demand for compliant policies. This is an opportunity for insurers to innovate covers catering to industry specific requirements.

Key features of the study:

- This report provides in-depth analysis of the global cybersecurity insurance market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global cybersecurity insurance market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include BitSight, Prevalent, RedSeal, SecurityScorecard, Cyber Indemnity Solutions, Allianz, AIG, Aon, Arthur J. Gallagher & Co, Travelers Insurance, AXA XL, Axis, Chubb, Travelers Indemnity Company, American International Group, Inc., Beazley Group, CNA Financial Corporation, AXIS Capital Holdings Limited, BCS Financial Corporation, Zurich Insurance, and The Hanover Insurance, Inc.

- The global cybersecurity insurance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global cybersecurity insurance market.

Market Segmentation

- By Insurance Type

- Standalone

- Tailored

- By Coverage Type

- First-party

- Liability Coverage

- By Enterprise Size

- SMEs

- Large Enterprise

- By End user

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Others (Government, Travel & Tourism)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- BitSight

- Prevalent

- RedSeal

- SecurityScorecard

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher & Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Insurance Type

- Market Snippet, By Coverage Type

- Market Snippet, By Enterprise Size

- Market Snippet, By End user

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launch/Approvals

- Impact of the COVID-19 Pandemic

4. Global Cybersecurity Insurance Market, By Insurance Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Standalone

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Tailored

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

5. Global Cybersecurity Insurance Market, By Coverage Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- First-party

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Liability Coverage

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

6. Global Cybersecurity Insurance Market, By Enterprise Size, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- SMEs

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Large Enterprise

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

7. Global Cybersecurity Insurance Market, By End user, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Healthcare

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Retail

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- BFSI

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- IT & Telecom

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Manufacturing

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Others (Government, Travel & Tourism)

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

8. Global Cybersecurity Insurance Market, By Region, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

9. Competitive Landscape

- Company Profiles

- BitSight

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Prevalent

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- RedSeal

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- SecurityScorecard

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher & Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

- BitSight

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Research Methodology

- References

- Research Methodology

- About us and Sales Contact