|

市場調查報告書

商品編碼

1716601

燃氣火管工業鍋爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gas Fire Tube Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

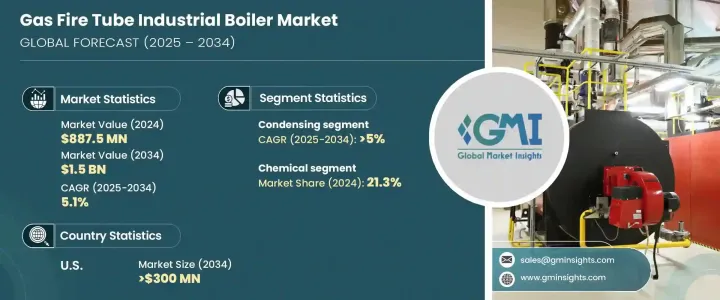

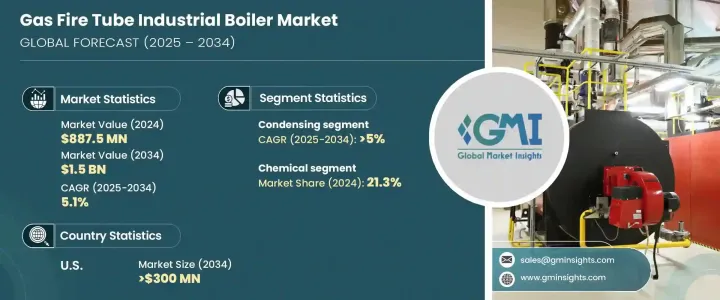

2024 年全球燃氣火管工業鍋爐市場規模達到 8.875 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.1%。這一成長主要得益於主要經濟體工業化步伐的加快,以及能源基礎設施投資的增加。向更清潔能源的轉變,以及注重減少排放和提高效率的鍋爐技術的進步,預計將進一步推動市場發展。

遠端監控和預測性維護解決方案的日益成長的趨勢將繼續推動對火管工業鍋爐的需求。這種轉變與全球日益關注永續經濟成長和智慧建築管理系統的採用相一致。此外,鍋爐技術的不斷進步,例如數位監控和複雜的燃燒控制系統,可能會推動各行業對產品的採用率提高。用於開發使用永續、耐腐蝕材料的高效能鍋爐的投資也顯著增加,這將為市場參與者帶來新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.875億美元 |

| 預測值 | 15億美元 |

| 複合年成長率 | 5.1% |

工業發展、現代化以及對高效、可靠的蒸汽發電系統不斷成長的需求將進一步滲透到市場。此外,對節能供熱技術的重視,加上鍋爐系統中數位技術的整合,將為業務帶來更美好的前景。隨著對清潔能源解決方案的推動力度不斷加大,對支持這些綠色措施的鍋爐的需求也日益成長,進一步促進了市場擴張。

市場根據技術分為冷凝系統和非冷凝系統,這兩種系統都因其對環境的影響最小、效率提高和供暖成本節省而越來越受歡迎。尤其是冷凝式機組,預計到 2034 年,受能源成本上升和環境法規趨嚴的推動,其複合年成長率將超過 5%。政府對節能設備的激勵和回扣也將在加速採用方面發揮關鍵作用。

在應用方面,化學工業在 2024 年將以 21.3% 的佔有率引領市場。新興經濟體不斷增加的基礎設施投資和高效鍋爐系統的採用將繼續刺激該行業的成長。在美國,燃氣火管工業鍋爐市場價值在 2022 年為 1.922 億美元,到 2024 年將成長至 2.133 億美元,預計到 2034 年將超過 3 億美元。

由於嚴格的能源效率法規和氣候變遷緩解策略的實施,北美市場預計將以超過 4.5% 的複合年成長率擴張。該地區在低溫系統中採用耐腐蝕材料以及在高海拔地區開發工業項目可能會推動市場持續成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- < 10 百萬英熱單位/小時

- 10 - 25 百萬英熱單位/小時

- 25 - 50 百萬英熱單位/小時

- 50 - 75 百萬英熱單位/小時

- > 75 百萬英熱單位/小時

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 食品加工

- 紙漿和造紙

- 化學

- 煉油廠

- 原生金屬

- 其他

第7章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 冷凝

- 無凝結

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 奧地利

- 德國

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 菲律賓

- 日本

- 韓國

- 澳洲

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第9章:公司簡介

- ALFA LAVAL

- Babcock & Wilcox

- Babcock Wanson

- Clayton Industries

- Cleaver-Brooks

- EPCB Boiler

- Fulton

- Hurst Boiler & Welding

- IHI Corporation

- Johnston Boiler

- Miura America

- Rentech Boilers

- Thermax

- Thermodyne Boilers

- Viessmann

The Global Gas Fire Tube Industrial Boiler Market reached USD 887.5 million in 2024 and is projected to expand at a CAGR of 5.1% between 2025 and 2034. This growth is largely driven by the increasing pace of industrialization across key economies, coupled with rising investments in energy infrastructure. The shift towards cleaner energy sources, along with advancements in boiler technologies that focus on emissions reduction and enhanced efficiency, is expected to further boost the market.

The increasing trend towards remote monitoring and predictive maintenance solutions will continue to fuel demand for fire tube industrial boilers. This shift is aligned with the growing global focus on sustainable economic growth and the adoption of smart building management systems. In addition, continuous advancements in boiler technologies, such as digital monitoring and sophisticated combustion control systems, are likely to drive higher product adoption across industries. There is also a noticeable increase in investments aimed at developing high-efficiency boilers using sustainable, corrosion-resistant materials, which will open new opportunities for market players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $887.5 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 5.1% |

Industrial development, modernization, and a rising demand for efficient and reliable steam generation systems are set to further penetrate the market. Additionally, the emphasis on energy-efficient heating technologies, combined with the integration of digital technologies in boiler systems, will provide an enhanced outlook for the business. As the push for clean energy solutions intensifies, there is a growing demand for boilers that support these green initiatives, further contributing to market expansion.

The market is segmented by technology into condensing and non-condensing systems, both of which are gaining traction due to their minimal environmental impact, improved efficiency, and cost savings in heating. The condensing segment, in particular, is expected to grow steadily at a CAGR of over 5% until 2034, driven by higher energy costs and stricter environmental regulations. Government incentives and rebates for energy-efficient equipment will also play a key role in accelerating adoption.

In terms of application, the chemical sector led the market with a 21.3% share in 2024. The increasing infrastructure investments and adoption of high-efficiency boiler systems in emerging economies will continue to stimulate growth in this sector. In the U.S., the market for gas fire tube industrial boilers was valued at USD 192.2 million in 2022, growing to USD 213.3 million in 2024, and expected to surpass USD 300 million by 2034.

The North American market is expected to expand at a CAGR of over 4.5% due to stringent energy efficiency regulations and the implementation of climate change mitigation strategies. The region's adoption of corrosion-resistant materials in low-temperature systems and the development of industrial projects in high-altitude areas are likely to drive continued market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 25 MMBTU/hr

- 5.4 25 - 50 MMBTU/hr

- 5.5 50 - 75 MMBTU/hr

- 5.6 > 75 MMBTU/hr

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 Food processing

- 6.3 Pulp & paper

- 6.4 Chemical

- 6.5 Refinery

- 6.6 Primary metal

- 6.7 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ALFA LAVAL

- 9.2 Babcock & Wilcox

- 9.3 Babcock Wanson

- 9.4 Clayton Industries

- 9.5 Cleaver-Brooks

- 9.6 EPCB Boiler

- 9.7 Fulton

- 9.8 Hurst Boiler & Welding

- 9.9 IHI Corporation

- 9.10 Johnston Boiler

- 9.11 Miura America

- 9.12 Rentech Boilers

- 9.13 Thermax

- 9.14 Thermodyne Boilers

- 9.15 Viessmann