|

市場調查報告書

商品編碼

1664845

冷凍食品加工機械市場機會、成長動力、產業趨勢分析及 2024 - 2032 年預測Frozen Food Processing Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

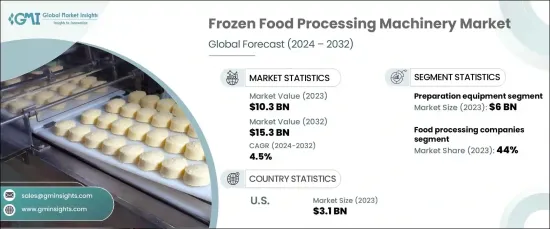

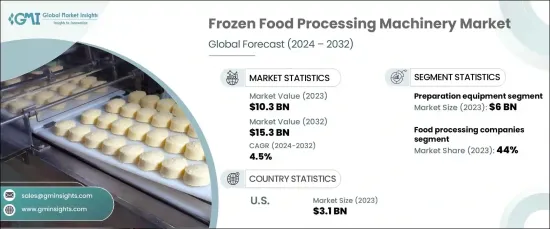

2023 年全球冷凍食品加工機械市場價值為 103 億美元,預計 2024 年至 2032 年期間將以 4.5% 的強勁複合年成長率成長。速凍和低溫方法等冷凍技術的創新在透過保存質地和營養成分來維持食品品質方面發揮關鍵作用。這對於滿足日益成長的冷凍水果、蔬菜和海鮮的需求至關重要。

快餐店(QSR)的擴張和線上食品配送產業的蓬勃發展正在推動冷凍食品產業的成長。這些行業嚴重依賴冷凍產品,因此需要先進的加工機械來滿足高需求。此外,全球超市和大賣場的激增也加速了零售業對冷凍食品的依賴。零售商正在加大對最先進設備的投資,以滿足不斷變化的消費者偏好並確保產品品質。

| 市場範圍 | |

|---|---|

| 起始年份 | 2023 |

| 預測年份 | 2024-2032 |

| 起始值 | 103億美元 |

| 預測值 | 153億美元 |

| 複合年成長率 | 4.5% |

儘管取得了重大進步,但小型製造商(尤其是新興市場的製造商)仍面臨明顯的障礙。現代設備的高昂前期成本加上預算限制,往往會限制他們使用尖端機械的機會。供應鏈中斷進一步使關鍵零件和包裝材料的供應變得複雜,從而導致生產延遲。這些挑戰對於努力在這個充滿活力的市場中競爭的小型企業構成了巨大的障礙。

就機械類型而言,製備設備在 2023 年佔據市場主導地位,創造了 60 億美元的收入。預計 2024 年至 2032 年期間,該領域將以約 4.7% 的複合年成長率穩步成長。這些機器確保尺寸和形狀的一致性,這對於保持產品品質和最佳化冷凍過程至關重要。

2023 年,食品加工公司佔據了約 44% 的市場佔有率,預計這一趨勢將以類似的成長軌跡持續到 2032 年。因此,對高性能機械的投資激增,使公司能夠滿足日益成長的消費者期望。

美國仍然是冷凍食品加工機械市場的主導者,2023 年市場價值為 31 億美元。這些進步正在提高生產效率、改善產品品質並滿足美國食品加工行業日益成長的需求。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 冷凍食品需求不斷成長

- 技術進步

- 產業陷阱與挑戰

- 高資本投入

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按機械類型,2021-2032 年

- 主要趨勢

- 製備設備

- 切刀

- 攪拌機

- 切片機

- 磨床

- 其他(削皮器等)

- 冷凍設備

- 速凍機

- 螺旋速凍機

- 平板冷凍機

- 個體速凍(IQF)設備

- 其他(隧道冷凍機等)

- 包裝設備

- 包裝機

- 裝袋機

- 裝盒機

- 其他(真空包裝機等)

- 其他(倉儲設備、傳送帶等)

第6章:市場估計與預測:依技術,2021-2032 年

- 主要趨勢

- 機械冷凍

- 低溫冷凍

第 7 章:市場估計與預測:按營運模式,2021 年至 2032 年

- 主要趨勢

- 半自動

- 自動的

第 8 章:市場估計與預測:按應用,2021 年至 2032 年

- 主要趨勢

- 水果和蔬菜

- 乳製品

- 肉類、家禽和海鮮

- 即食食品

- 烘焙產品

- 小吃

- 其他(湯、醬汁等)

第 9 章:市場估計與預測:按最終用途,2021-2032 年

- 主要趨勢

- 食品加工公司

- 餐廳及餐飲服務

- 零售和超市

- 其他(配送中心等)

第 10 章:市場估計與預測:按地區,2021-2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Air Products and Chemicals, Inc.

- Alfa Laval AB

- Bühler Group

- GEA Group AG

- Griffith Foods Inc.

- Hoshizaki Corporation

- Intralox

- JBT Corporation

- Marel

- OctoFrost Group

- SPX FLOW, Inc.

- Starfrost (UK) Ltd.

- Tetra Pak International SA

- The Middleby Corporation

The Global Frozen Food Processing Machinery Market was valued at USD 10.3 billion in 2023 and is projected to grow at a robust CAGR of 4.5% from 2024 to 2032. Driving this growth are advancements in automation, artificial intelligence (AI), and machine learning, which are revolutionizing food processing machinery by enhancing efficiency and cutting costs. Innovations in freezing technologies, such as quick freezing and cryogenic methods, are playing a pivotal role in maintaining food quality by preserving texture and nutrients. This is crucial for meeting the rising demand for frozen fruits, vegetables, and seafood.

The expansion of quick-service restaurants (QSRs) and the booming online food delivery sector are fueling the frozen food industry's growth. These sectors rely heavily on frozen products, spurring the need for advanced processing machinery to meet high demand. Additionally, the global proliferation of supermarkets and hypermarkets is accelerating the retail sector's reliance on frozen foods. Retailers are increasingly investing in state-of-the-art equipment to cater to evolving consumer preferences and ensure product quality.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $10.3 Billion |

| Forecast Value | $15.3 Billion |

| CAGR | 4.5% |

Despite significant advancements, smaller manufacturers, especially in emerging markets, face notable obstacles. High upfront costs for modern equipment, coupled with budget constraints, often limit their access to cutting-edge machinery. Supply chain disruptions further complicate the availability of critical components and packaging materials, leading to production delays. These challenges pose substantial barriers for smaller players striving to compete in this dynamic market.

In terms of machinery type, preparation equipment dominated the market in 2023, generating USD 6 billion in revenue. This segment is anticipated to grow at a steady CAGR of approximately 4.7% from 2024 to 2032. Preparation equipment-comprising tools for slicing, cutting, blending, and grinding-plays a critical role in frozen food production. These machines ensure consistency in size and shape, which is essential for maintaining product quality and optimizing freezing processes.

Food processing companies accounted for approximately 44% of the market share in 2023, and this trend is expected to continue with a similar growth trajectory through 2032. The rising demand for convenience foods with extended shelf lives has led to increased production among these companies. Consequently, investments in high-performance machinery have surged, enabling companies to meet growing consumer expectations.

The United States remains a dominant player in the frozen food processing machinery market, valued at USD 3.1 billion in 2023. The market is forecasted to expand at a CAGR of 4.9% from 2024 to 2032, driven by continuous innovation in freezing technologies. These advancements are enhancing production efficiency, improving product quality, and supporting the growing needs of the US food processing industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for frozen foods

- 3.6.1.2 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High capital investment

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machinery Type, 2021-2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Preparation equipment

- 5.2.1 Cutters

- 5.2.2 Blenders

- 5.2.3 Slicers

- 5.2.4 Grinders

- 5.2.5 Others (Peelers, Etc)

- 5.3 Freezing Equipment

- 5.3.1 Blast freezers

- 5.3.2 Spiral freezers

- 5.3.3 Plate freezers

- 5.3.4 Individual Quick Freezing (IQF) Equipment

- 5.3.5 Others (Tunnel Freezers, Etc)

- 5.4 Packaging equipment

- 5.4.1 Wrapping machines

- 5.4.2 Bagging machines

- 5.4.3 Cartoning machines

- 5.4.4 Others (Vacuum Packaging Machines, Etc)

- 5.5 Others (Storage Equipment, Conveyors, Etc)

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Mechanical freezing

- 6.3 Cryogenic freezing

Chapter 7 Market Estimates & Forecast, By Mode of Operation, 2021-2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Semi-Automatic

- 7.3 Automatic

Chapter 8 Market Estimates & Forecast, By Application, 2021-2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Fruits & vegetables

- 8.3 Dairy products

- 8.4 Meat, poultry, & seafood

- 8.5 Ready-to-Eat (RTE) meals

- 8.6 Bakery products

- 8.7 Snacks

- 8.8 Others (Soups, Sauces, Etc)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Food processing companies

- 9.3 Restaurants and foodservice

- 9.4 Retail & supermarkets

- 9.5 Others (Distribution Centers, Etc)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Air Products and Chemicals, Inc.

- 11.2 Alfa Laval AB

- 11.3 Bühler Group

- 11.4 GEA Group AG

- 11.5 Griffith Foods Inc.

- 11.6 Hoshizaki Corporation

- 11.7 Intralox

- 11.8 JBT Corporation

- 11.9 Marel

- 11.10 OctoFrost Group

- 11.11 SPX FLOW, Inc.

- 11.12 Starfrost (UK) Ltd.

- 11.13 Tetra Pak International S.A.

- 11.14 The Middleby Corporation