|

市場調查報告書

商品編碼

1664850

石油和天然氣市場中的物聯網 (IoT) 機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Internet of Things (IoT) in Oil and Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

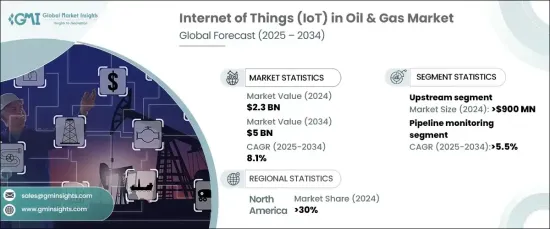

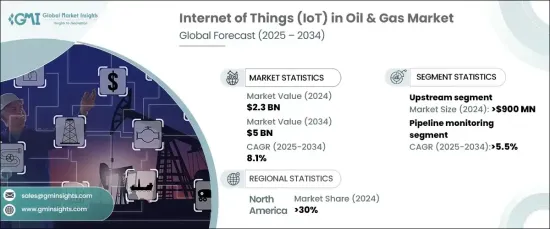

2024 年全球石油和天然氣物聯網市場價值為 23 億美元,預計 2025 年至 2034 年的複合年成長率為 8.1%。

石油和天然氣行業的公司正在採用物聯網解決方案來加強資產管理、簡化生產流程並確保更好地遵守環境法規。隨著這些技術越來越融入營運中,策略合作夥伴關係正在幫助加速它們在產業各個職能領域的實施。物聯網應用透過收集即時資料、遠端監控和預測性維護徹底改變了營運方式,進而提高了營運效能和安全標準。這些進步使公司能夠及早發現潛在問題,降低風險並最大限度地減少停機時間。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 50億美元 |

| 複合年成長率 | 8.1% |

此外,對綠色技術和永續性的日益重視正在加速物聯網在石油和天然氣營運中的應用。隨著環境問題和監管壓力加劇,該行業擴大轉向物聯網解決方案來最佳化能源使用和追蹤排放。物聯網技術還可以幫助檢測諸如氣體洩漏等危險,並監測環境影響,從而有助於永續實踐。這不僅降低了營運成本,而且符合能源效率、減少碳足跡和長期永續性的更廣泛目標。

物聯網在促進更綠色、更永續的營運方面發揮著重要作用,因為它支持產業向生態友善實踐的轉型。預計到 2032 年,綠色技術市場將產生可觀的收入,年成長率將超過 19%。此次擴張凸顯了永續性在石油和天然氣領域日益成長的重要性。

市場依營運分為上游、中游和下游。 2024年,上游領域將佔據相當大的佔有率,這得益於對監測鑽井和油井作業的物聯網解決方案的需求。物聯網設備提供有關設備健康狀況、井況和鑽井效率的即時洞察,從而增強探勘和生產過程。

隨著物聯網技術增強管道監控、儲存和運輸系統,中游領域也預計將顯著成長。這些解決方案可以實現即時資料收集,從而提高管道完整性並降低洩漏風險。

在應用方面,石油和天然氣市場的物聯網包括管線監控、車隊和資產管理、鑽井和井管理、生產最佳化、環境監測、安全管理等。其中,由於對即時監控和預測分析的需求不斷增加以維持管道的安全高效運行,管道監控預計將強勁成長。

北美在石油和天然氣領域的物聯網市場中處於領先地位,佔 2024 年全球收入的很大一部分。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 技術提供者

- 平台提供者

- 石油和天然氣營運商

- 經銷商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 使用案例

- 使用案例1

- 好處

- 投資報酬率

- 使用案例2

- 好處

- 投資報酬率

- 使用案例1

- 案例研究

- 案例研究 1

- 消費者姓名

- 挑戰

- 解決方案

- 影響

- 案例研究 2

- 消費者姓名

- 挑戰

- 解決方案

- 影響

- 案例研究 1

- 衝擊力

- 成長動力

- 即時監控和自動化技術的採用日益增多

- 擴大對數位轉型計畫的投資

- 更重視預測分析與預防性維護

- 更加重視提高安全標準和環境合規性

- 產業陷阱與挑戰

- 與物聯網設備相關的資料安全和隱私問題

- 缺乏具備物聯網和數位技術專業知識的熟練勞動力

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依供應量,2021 - 2034 年

- 主要趨勢

- 平台

- 服務

第6章:市場估計與預測:按營運,2021 - 2034 年

- 主要趨勢

- 上游

- 中游

- 下游

第 7 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 管道監控

- 車隊和資產管理

- 鑽井與油井管理

- 生產最佳化

- 環境監測

- 安全與緊急管理

- 其他

第 8 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 國家石油公司 (NOC)

- 獨立石油公司(IOC)

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- ABB

- Baker Hughes

- British Petroleum (BP)

- China National Petroleum Corporation (CNPC)

- Cisco

- ConocoPhillips

- Emerson Electric

- Equinor

- ExxonMobil

- Gazprom

- General Electric

- Halliburton

- Honeywell

- Repsol

- Schlumberger

- Shell

- Siemens Energy

- TotalEnergies

- Woodside Petroleum

- Yokogawa

The Global Internet Of Things In Oil And Gas Market was valued at USD 2.3 billion in 2024 and is projected to grow at a CAGR of 8.1% from 2025 to 2034. The increasing focus on real-time monitoring, operational efficiency, and improved safety measures are key factors driving the adoption of IoT technologies in the industry.

Companies in the oil and gas sector are embracing IoT solutions to enhance asset management, streamline production processes, and ensure better environmental compliance. As these technologies become more integrated into operations, strategic partnerships are helping speed up their implementation across various functions within the industry. IoT applications are revolutionizing operations by enabling the collection of real-time data, remote monitoring, and predictive maintenance, which in turn boosts operational performance and safety standards. These advancements allow companies to detect potential issues early, reducing risks and minimizing downtime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5 Billion |

| CAGR | 8.1% |

Moreover, the growing emphasis on green technologies and sustainability is accelerating the adoption of IoT in oil and gas operations. As environmental concerns and regulatory pressures intensify, the sector is increasingly turning to IoT solutions to optimize energy usage and track emissions. IoT technologies also help detect hazards, such as gas leaks, and monitor environmental impacts, contributing to sustainable practices. This not only reduces operational costs but also aligns with broader goals for energy efficiency, carbon footprint reduction, and long-term sustainability.

The IoT's role in promoting greener, more sustainable operations is significant, as it supports the industry's transition to eco-friendly practices. The green technology market is projected to generate substantial revenue by 2032, reflecting a robust annual growth rate of over 19%. This expansion highlights the growing importance of sustainability in the oil and gas sector.

The market is segmented based on operations into upstream, midstream, and downstream. In 2024, the upstream segment held a substantial share, driven by the demand for IoT solutions in monitoring drilling and well operations. IoT devices provide real-time insights into equipment health, well conditions, and drilling efficiency, enhancing exploration and production processes.

The midstream segment is also expected to see significant growth, with IoT technologies enhancing pipeline monitoring, storage, and transportation systems. These solutions enable real-time data collection to improve pipeline integrity and reduce the risk of leaks.

In terms of applications, the IoT in oil and gas market includes pipeline monitoring, fleet and asset management, drilling and well management, production optimization, environmental monitoring, safety management, and more. Among these, pipeline monitoring is expected to grow at a robust pace due to the increasing demand for real-time monitoring and predictive analytics to maintain safe and efficient pipeline operations.

North America is leading the IoT market in oil and gas, accounting for a significant portion of global revenue in 2024. The region's strong oil and gas infrastructure, combined with substantial investments in digital technologies, is driving the adoption of IoT solutions for asset management, safety, and pipeline monitoring.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 Platform providers

- 3.2.3 Oil & gas operators

- 3.2.4 Distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Used cases

- 3.7.1 Used case 1

- 3.7.1.1 Benefits

- 3.7.1.2 ROI

- 3.7.2 Used case 2

- 3.7.2.1 Benefits

- 3.7.2.2 ROI

- 3.7.1 Used case 1

- 3.8 Case study

- 3.8.1 Case study 1

- 3.8.1.1 Consumer name

- 3.8.1.2 Challenge

- 3.8.1.3 Solution

- 3.8.1.4 Impact

- 3.8.2 Case study 2

- 3.8.2.1 Consumer name

- 3.8.2.2 Challenge

- 3.8.2.3 Solution

- 3.8.2.4 Impact

- 3.8.1 Case study 1

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of real-time monitoring and automation technologies

- 3.9.1.2 Expanding investments in digital transformation initiatives

- 3.9.1.3 Enhanced focus on predictive analytics and preventive maintenance

- 3.9.1.4 Greater emphasis on improving safety standards and environmental compliance

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data security and privacy concerns related to IoT devices

- 3.9.2.2 Shortage of skilled workforce with expertise in IoT and digital technologies

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Platform

- 5.3 Service

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Upstream

- 6.3 Midstream

- 6.4 Downstream

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Pipeline monitoring

- 7.3 Fleet & asset management

- 7.4 Drilling & well management

- 7.5 Production optimization

- 7.6 Environmental monitoring

- 7.7 Safety & emergency management

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 National oil companies (NOCs)

- 8.3 Independent oil companies (IOCs)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Baker Hughes

- 10.3 British Petroleum (BP)

- 10.4 China National Petroleum Corporation (CNPC)

- 10.5 Cisco

- 10.6 ConocoPhillips

- 10.7 Emerson Electric

- 10.8 Equinor

- 10.9 ExxonMobil

- 10.10 Gazprom

- 10.11 General Electric

- 10.12 Halliburton

- 10.13 Honeywell

- 10.14 Repsol

- 10.15 Schlumberger

- 10.16 Shell

- 10.17 Siemens Energy

- 10.18 TotalEnergies

- 10.19 Woodside Petroleum

- 10.20 Yokogawa