|

市場調查報告書

商品編碼

1665067

汽車燃料電池監測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Fuel Cell Monitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

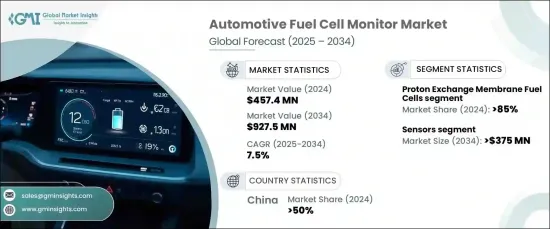

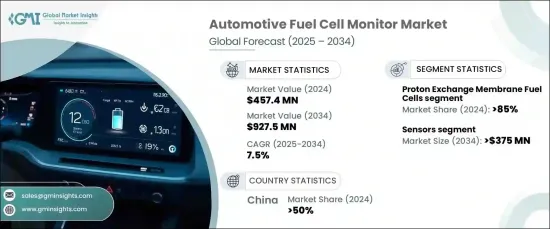

2024 年全球汽車燃料電池監視器市場價值為 4.574 億美元,預計 2025 年至 2034 年的年複合成長率(CAGR) 為 7.5%。預計 2025 年至 2034 年的複合年成長率(CAGR) 為 7.5%。對清潔、永續能源解決方案的需求激增,推動了汽車燃料電池監測器市場的成長。

感測器技術的進步在改變燃料電池監控方面發揮關鍵作用。這些創新可以更準確、即時地追蹤燃料電池的性能和健康狀況。新興的半導體技術,加上人工智慧和機器學習的力量,正在增強監控系統以預測潛在故障、最佳化性能並延長燃料電池組件的使用壽命。這些突破簡化了燃料電池的監控,降低了成本,並顯著提高了燃料電池系統的可靠性和效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.574 億美元 |

| 預測值 | 9.275 億美元 |

| 複合年成長率 | 7.5% |

市場按燃料電池類型細分,主要類別包括鹼性燃料電池 (AFC)、質子交換膜燃料電池 (PEMFC)、磷酸燃料電池 (PAFC) 和固態氧化物燃料電池 (SOFC)。 2024 年,質子交換膜燃料電池 (PEMFC) 領域將佔據市場主導地位,佔有 85% 的佔有率。預計到 2034 年,該部分的收入將達到 7.5 億美元。

汽車燃料電池監控器市場也按組件分類,包括控制單元、感測器、通訊模組等。預計到 2034 年,感測器領域將創收 3.75 億美元。透過分散式光纖感測和先進的半導體感測器的整合,這些溫度感測器現在可以提供關鍵燃料電池組件的即時映射。透過檢測即使是微小的溫度變化,它們有助於防止熱應力並最佳化燃料電池系統的整體性能和壽命。

2024年,中國將佔據全球汽車燃料電池監控器市場50%的佔有率。中國政府一直是這一成長的主要推動力,提供慷慨的補貼、稅收優惠和國家發展計畫來推動燃料電池汽車的普及。中國高度重視發展氫能基礎設施和提升本地製造能力,正將自己定位為氫動力汽車技術的全球領導者。中國國有企業和私人企業都在投入大量資金來開發先進的燃料電池監控系統,以提高氫動力汽車的效率、可靠性和成本效益。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 零件製造商

- 燃料電池系統供應商

- 汽車OEM

- 技術整合商

- 最終用途

- 成本明細

- 利潤率分析

- 技術差異化

- 先進的感測器整合

- 人工智慧驅動的診斷

- 模組化系統設計

- 多層安全系統

- 其他

- 重要新聞及舉措

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 全球脫碳計劃

- 車輛感測技術的進步

- 燃料電池成本大幅降低

- 燃料電池汽車基礎設施投資不斷成長

- 產業陷阱與挑戰

- 燃料電池監測器的複雜技術整合

- 具競爭力的電池電動技術

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第6章:市場估計與預測:按燃料電池,2021 - 2032 年

- 主要趨勢

- 質子交換膜燃料電池 (PEMFC)

- 固態氧化物燃料電池 (SOFC)

- 鹼性燃料電池(AFC)

- 磷酸燃料電池(PAFC)

第7章:市場估計與預測:按組件,2021 - 2032 年

- 主要趨勢

- 感應器

- 控制單元

- 通訊模組

- 其他

第 8 章:市場估計與預測:按監測功能,2021 - 2032 年

- 主要趨勢

- 氫氣監測

- 燃料電池堆監控

- 熱管理

- 空氣供應

- 洩漏檢測

第 9 章:市場估計與預測:按銷售管道,2021 - 2032 年

- 主要趨勢

- OEM

- 售後市場

第 10 章:市場估計與預測:按地區,2021 - 2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- AVL

- Bosch

- Dilico Engineering

- dSpace

- Gamma Technologies

- Hans Turck

- Horiba

- H-TEC Education

- Infineon

- IST

- Kolibrik

- Marquardt

- Nedstack

- PST Process Sensing

- Smart Testsolutions

- Texas Instruments

- Vaisala

- Vitronic

- Zeiss

The Global Automotive Fuel Cell Monitor Market was valued at USD 457.4 million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2025 to 2034. As governments across the globe continue to tighten emissions regulations and set ambitious carbon neutrality targets, automakers are increasing their investments in zero-emission technologies, especially fuel cell systems. This surge in demand for clean, sustainable energy solutions is driving the growth of the automotive fuel cell monitor market.

Advancements in sensor technology are playing a pivotal role in transforming fuel cell monitoring. These innovations allow for more accurate, real-time tracking of fuel cell performance and health. Emerging semiconductor technologies, coupled with the power of artificial intelligence and machine learning, are enhancing monitoring systems to predict potential failures, optimize performance, and extend the lifespan of fuel cell components. These breakthroughs are simplifying fuel cell monitoring, driving down costs, and significantly improving both the reliability and efficiency of fuel cell systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $457.4 Million |

| Forecast Value | $927.5 Million |

| CAGR | 7.5% |

The market is segmented by fuel cell type, with key categories including Alkaline Fuel Cells (AFC), Proton Exchange Membrane Fuel Cells (PEMFC), Phosphoric Acid Fuel Cells (PAFC), and Solid Oxide Fuel Cells (SOFC). In 2024, the Proton Exchange Membrane Fuel Cells (PEMFC) segment dominated the market, holding an 85% share. This segment is expected to generate USD 750 million by 2034. Researchers are making significant strides in developing next-generation membrane materials that offer enhanced durability, improved conductivity, and better resistance to temperature fluctuations, further advancing PEMFC technology.

The automotive fuel cell monitor market is also categorized by components, including control units, sensors, communication modules, and others. The sensors segment is projected to generate USD 375 million by 2034. Notably, temperature sensors are undergoing significant upgrades, offering higher precision and multi-point monitoring capabilities within fuel cell systems. With the integration of distributed fiber optic sensing and advanced semiconductor sensors, these temperature sensors can now provide real-time mapping of crucial fuel cell components. By detecting even small temperature variations, they help prevent thermal stress and optimize the overall performance and longevity of fuel cell systems.

In 2024, China held a dominant 50% share of the global automotive fuel cell monitor market. The Chinese government has been a major driver of this growth, offering generous subsidies, tax incentives, and national development plans to promote the adoption of fuel cell vehicles. With a strong focus on developing hydrogen infrastructure and advancing local manufacturing capabilities, China is positioning itself as a global leader in hydrogen-powered vehicle technology. Both state-owned enterprises and private companies in China are receiving significant investments to develop cutting-edge fuel cell monitoring systems that enhance the efficiency, reliability, and cost-effectiveness of hydrogen-powered vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturers

- 3.2.2 Fuel cell system providers

- 3.2.3 Automotive OEM

- 3.2.4 Technology integrators

- 3.2.5 End Use

- 3.3 Cost breakdown

- 3.4 Profit margin analysis

- 3.5 Technology differentiators

- 3.5.1 Advanced sensor integrations

- 3.5.2 AI-driven diagnostics

- 3.5.3 Modular system design

- 3.5.4 Multi-layered safety systems

- 3.5.5 Others

- 3.6 Key news & initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Global decarbonization initiatives

- 3.9.1.2 Advancements in vehicle sensing technologies

- 3.9.1.3 Significant cost reductions in fuel cells

- 3.9.1.4 Growing fuel cell vehicle infrastructure investments

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Complex technical integration of fuel cell monitors

- 3.9.2.2 Competitive battery electric technologies

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicles (LCV)

- 5.3.2 Heavy Commercial Vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Fuel Cell, 2021 - 2032 ($Bn, Units)

- 6.1 Key trends

- 6.2 Proton Exchange Membrane Fuel Cells (PEMFC)

- 6.3 Solid Oxide Fuel Cells (SOFC)

- 6.4 Alkaline Fuel Cells (AFC)

- 6.5 Phosphoric Acid Fuel Cells (PAFC)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2032 ($Bn, Units)

- 7.1 Key trends

- 7.2 Sensors

- 7.3 Control unit

- 7.4 Communication modules

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Monitoring Function, 2021 - 2032 ($Bn, Units)

- 8.1 Key trends

- 8.2 Hydrogen monitoring

- 8.3 Fuel cell stack monitoring

- 8.4 Thermal management

- 8.5 Air supply

- 8.6 leakage detection

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2032 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2032 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AVL

- 11.2 Bosch

- 11.3 Dilico Engineering

- 11.4 dSpace

- 11.5 Gamma Technologies

- 11.6 Hans Turck

- 11.7 Horiba

- 11.8 H-TEC Education

- 11.9 Infineon

- 11.10 IST

- 11.11 Kolibrik

- 11.12 Marquardt

- 11.13 Nedstack

- 11.14 PST Process Sensing

- 11.15 Smart Testsolutions

- 11.16 Texas Instruments

- 11.17 Vaisala

- 11.18 Vitronic

- 11.19 Zeiss