|

市場調查報告書

商品編碼

1665110

食品包裝機市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Food Packaging Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

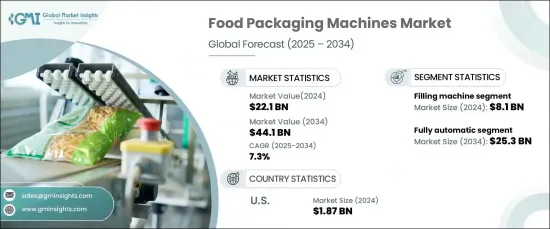

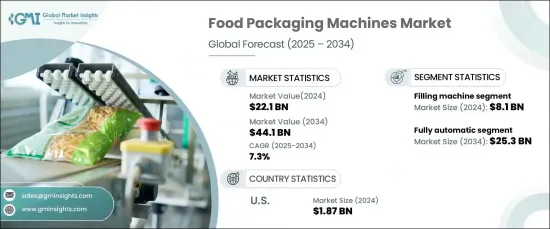

2024 年全球食品包裝機械市場價值為 221 億美元,將大幅成長,預計 2025 年至 2034 年的複合年成長率為 7.3%。隨著消費者對新鮮、方便和保質食品的需求不斷成長,食品製造商越來越依賴先進的包裝機來滿足這些需求。對包裝食品的需求不斷成長,加上對產品安全、保存和保存期限的重視,推動市場向前發展。

技術進步進一步推動了市場的擴張,自動化機器因其最佳化生產流程、提高一致性和降低營運成本的能力而受到青睞。隨著便利食品、即食食品和飲料越來越受歡迎,創新包裝解決方案的需求也變得更加明顯。此外,環境問題正在影響包裝設計,迫使製造商採用永續材料和環保工藝,創造額外的成長機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 221億美元 |

| 預測值 | 441億美元 |

| 複合年成長率 | 7.3% |

市場按所用機器的類型進行細分,包括灌裝機、封口機、包裝機、貼標機、裝盒機和其他類型的包裝設備。其中,灌裝機佔據市場主導地位,2024 年的收入為 81 億美元。隨著對包裝飲料、乳製品和即食食品的需求不斷增加,灌裝機領域預計在未來幾年將穩定成長。

自動化是市場的關鍵驅動力,手動、半自動和全自動機器各自佔據一定的市場佔有率。全自動機器佔據領先地位,到 2024 年將佔據 52% 的市場佔有率。它們提高了營運效率,確保了可擴展性並降低了成本,使其在大批量生產環境中特別有益。隨著製造商不斷優先考慮營運效率和產品質量,全自動機器正在成為食品包裝行業的首選。

在美國,2024 年食品包裝機市值為 18.7 億美元,預計 2025 年至 2034 年的複合年成長率為 8%。這些進步使製造商能夠簡化生產、減少浪費並確保食品保持最高的品質標準。隨著美國公司不斷突破創新界限,它們將在未來幾年推動國內和全球市場的成長。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費者對簡便食品和即食食品的需求不斷成長

- 包裝機械的技術進步

- 越來越重視永續性和環保包裝

- 產業陷阱與挑戰

- 初期資本投入及營運成本高

- 適應多樣化包裝形式的複雜性

- 成長動力

- 技術概覽

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按機器類型,2021 年至 2034 年

- 主要趨勢

- 灌裝機

- 封口機

- 包覆機

- 貼標機

- 裝盒機

- 其他(碼垛機等)

第6章:市場估計與預測:依自動化水平,2021-2034 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第 7 章:市場估計與預測:按食品類型,2021-2034 年

- 主要趨勢

- 烘焙及糖果食品

- 乳製品

- 冷凍食品

- 水果和蔬菜

- 肉類、家禽和海鮮

- 小吃

- 其他(即食食品等)

第 8 章:市場估計與預測:依包裝形式,2021-2034 年

- 主要趨勢

- 包包

- 瓶子

- 罐頭

- 紙箱

- 袋裝

- 其他(籃子、罐子、托盤等)

第 9 章:市場估計與預測:按包裝材料,2021-2034 年

- 主要趨勢

- 玻璃

- 金屬

- 紙板

- 塑膠

- 其他(可生物分解材料等)

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接銷售

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 12 章:公司簡介

- APACKS (Automated Packaging Systems)

- Barry-Wehmiller Companies

- Coesia

- Douglas Machine

- EconoCorp

- GEA Group

- Industria Macchine Automatiche

- Jacob White Packaging Ltd.

- KHS Group

- Krones AG

- ProMach

- Sealed Air Corporation

- Serac Group

- Sidel Group

- Tetra Pak International

The Global Food Packaging Machines Market, valued at USD 22.1 billion in 2024, is set to see substantial growth, with a CAGR of 7.3% projected from 2025 to 2034. The market plays a vital role in the food processing industry by providing essential solutions that ensure the efficient and safe packaging of a wide array of food products. As consumer demand for fresh, convenient, and long-lasting food items continues to rise, food manufacturers are increasingly relying on advanced packaging machines to meet these needs. This growing demand for packaged food, coupled with the emphasis on product safety, preservation, and shelf life, is driving the market forward.

Technological advancements are further fueling the market's expansion, with automated machines gaining traction due to their ability to optimize production processes, improve consistency, and reduce operational costs. As convenience foods, ready-to-eat meals, and beverages grow in popularity, the need for innovative packaging solutions becomes more pronounced. Moreover, environmental concerns are influencing packaging design, pushing manufacturers to adopt sustainable materials and eco-friendly processes, creating additional opportunities for growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.1 Billion |

| Forecast Value | $44.1 Billion |

| CAGR | 7.3% |

The market is segmented by the type of machines used, including filling machines, sealing machines, wrapping machines, labeling machines, cartooning machines, and other types of packaging equipment. Among these, filling machines dominate the market, accounting for USD 8.1 billion in revenue in 2024. These machines are indispensable for packaging a wide variety of food products, especially liquids, powders, and solids. As demand for packaged beverages, dairy products, and ready-to-eat meals continues to increase, the filling machine segment is expected to see steady growth in the years ahead.

Automation is a critical driver of the market, with manual, semi-automatic, and fully automatic machines each holding a share of the market. Fully automatic machines are the leaders, making up 52% of the market in 2024. By 2034, this segment is expected to be worth USD 25.3 billion, as fully automated machines offer numerous advantages. They increase operational efficiency, ensure scalability, and reduce costs, making them particularly beneficial in high-volume production environments. As manufacturers continue to prioritize operational efficiency and product quality, fully automatic machines are becoming the preferred option in the food packaging industry.

In the U.S., the food packaging machines market was valued at USD 1.87 billion in 2024, with a projected growth rate of 8% CAGR from 2025 to 2034. The U.S. continues to be a leader in developing innovative packaging technologies, particularly in automation and smart packaging. These advancements enable manufacturers to streamline production, minimize waste, and ensure that food products maintain the highest quality standards. As U.S. companies push the boundaries of innovation, they are poised to drive both national and global market growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer demand for convenience and ready-to-eat foods

- 3.6.1.2 Technological advancements in packaging machinery

- 3.6.1.3 Rising focus on sustainability and eco-friendly packaging

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial capital investment and operational costs

- 3.6.2.2 Complexity in adapting to diverse packaging formats

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling machine

- 5.3 Sealing machine

- 5.4 Wrapping machine

- 5.5 Labelling machine

- 5.6 Cartoning machine

- 5.7 Others (palletizing machine, etc.)

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Food Type, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Bakery and confectionary food

- 7.3 Dairy products

- 7.4 Frozen food

- 7.5 Fruits and vegetables

- 7.6 Meat, poultry and seafood

- 7.7 Snacks

- 7.8 Others (ready-to-eat meals, etc.)

Chapter 8 Market Estimates & Forecast, By Packaging Format, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.1.1 Bags

- 8.1.2 Bottles

- 8.1.3 Cans

- 8.1.4 Cartons

- 8.1.5 Pouches

- 8.1.6 Others (baskets, jars, trays, etc.)

Chapter 9 Market Estimates & Forecast, By Packaging Material, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.1.1 Glass

- 9.1.2 Metal

- 9.1.3 Paperboard

- 9.1.4 Plastic

- 9.1.5 Others (biodegradable material, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 APACKS (Automated Packaging Systems)

- 12.2 Barry-Wehmiller Companies

- 12.3 Coesia

- 12.4 Douglas Machine

- 12.5 EconoCorp

- 12.6 GEA Group

- 12.7 Industria Macchine Automatiche

- 12.8 Jacob White Packaging Ltd.

- 12.9 KHS Group

- 12.10 Krones AG

- 12.11 ProMach

- 12.12 Sealed Air Corporation

- 12.13 Serac Group

- 12.14 Sidel Group

- 12.15 Tetra Pak International