|

市場調查報告書

商品編碼

1665313

非冷凝式低溫工業鍋爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Non-Condensing Low Temperature Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

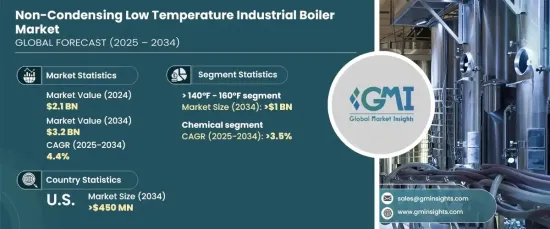

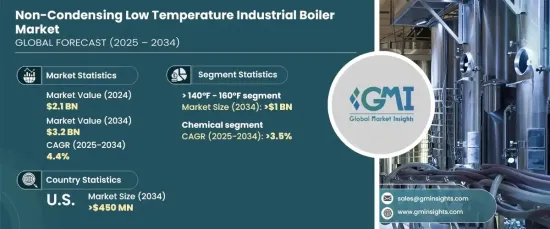

2024 年全球非冷凝低溫工業鍋爐市場價值為 21 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.4%。對節能技術的投資以及耐用和耐腐蝕組件的整合,為該行業的前景帶來了樂觀。

預計到 2034 年,溫度範圍從 >140°F 到 160°F 的領域將產生 10 億美元的收入。此系列的非冷凝鍋爐經過精心設計,可在嚴苛的條件下提供最佳的運作效率和穩定的性能。製造商越來越注重利用先進的材料和創新的設計來延長產品的使用壽命,以提高耐用性。物聯網 (IoT) 支援的遠端監控和預測性維護系統的整合有望進一步減少停機時間、最佳化營運並增加各行業對這些系統的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 4.4% |

到 2034 年,化學工業預計將以 3.5% 的速度成長。現代工業鍋爐現在配備了先進的安全技術、自動關閉功能和即時監控功能,以確保符合嚴格的監管標準。對化學產品的需求不斷成長,特別是製藥、農業化學品和特種化學品等行業的需求,也促進了該行業的擴張。這表明化學工業對高效、環保的加熱解決方案的依賴性日益增強。

在美國,非冷凝式低溫工業鍋爐市場預計到 2034 年將創收 4.5 億美元。美國環保署(EPA)和州級當局製定的嚴格排放法規正在推動產業採用更先進的系統來提高傳熱效率並減少排放。此外,傳統暖氣系統的現代化,加上對低維護、持久解決方案的更多關注,預計將進一步加強美國市場的成長

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模與預測:按溫度,2021 年至 2034 年

- 主要趨勢

- ≤ 120°F

- > 120°F - 140°F

- > 140°F - 160°F

- > 160°F - 180°F

第 6 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 火管

- 水管

第 7 章:市場規模與預測:依產能,2021 – 2034 年

- 主要趨勢

- < 10 百萬英熱單位/小時

- 10 - 25 百萬英熱單位/小時

- 25 - 50 百萬英熱單位/小時

- 50 - 75 百萬英熱單位/小時

- 75 - 100 百萬英熱單位/小時

- 100 - 175 百萬英熱單位/小時

- 175 - 250 百萬英熱單位/小時

- > 250 百萬英熱單位/小時

第 8 章:市場規模與預測:按燃料,2021 – 2034 年

- 主要趨勢

- 天然氣

- 油

- 煤炭

- 其他

第 9 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 食品加工

- 紙漿和造紙

- 化學

- 煉油廠

- 原生金屬

- 其他

第 10 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 奧地利

- 德國

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 菲律賓

- 日本

- 韓國

- 澳洲

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第 11 章:公司簡介

- Babcock Wanson

- Bosch Industriekessel

- Cleaver-Brooks

- Cochran

- Ferroli

- Fulton

- Hurst Boiler & Welding

- IHI

- Maxima Boilers

- Miura America

- Parker Boiler

- Precision Boilers

- Thermax

- Vaillant

- Viessmann

The Global Non-Condensing Low Temperature Industrial Boiler Market was valued at USD 2.1 billion in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2034. This growth is being driven by the modernization of outdated industrial systems and strategic upgrades to boiler infrastructure. Investments in energy-efficient technologies, along with the integration of durable and corrosion-resistant components, are contributing to an optimistic outlook for the industry.

The segment for temperatures ranging from >140°F to 160°F is projected to generate USD 1 billion in revenue by 2034. The segment growth is driven by its use in sectors that require precise temperature control, such as refineries, food processing, and chemical manufacturing. Non-condensing boilers in this range are engineered to deliver optimal operational efficiency and consistent performance under demanding conditions. Manufacturers are increasingly focusing on enhancing durability by utilizing advanced materials and innovative designs to extend the lifespan of their products. The integration of Internet of Things (IoT)-enabled remote monitoring and predictive maintenance systems is further expected to reduce downtime, optimize operations, and increase the adoption of these systems across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 4.4% |

The chemical sector is poised to grow at a rate of 3.5% through 2034. This growth is fueled by the increasing implementation of strict environmental regulations aimed at reducing emissions and improving energy management. Modern industrial boilers now come equipped with advanced safety technologies, automated shutdown functions, and real-time monitoring capabilities to ensure compliance with stringent regulatory standards. The growing demand for chemical products, particularly in industries such as pharmaceuticals, agrochemicals, and specialty chemicals, is also contributing to the sector's expansion. This demonstrates the rising dependence on efficient and environmentally friendly heating solutions within the chemical industry.

In the United States, the non-condensing low-temperature industrial boiler market is projected to generate USD 450 million by 2034. The growing demand for reliable, cost-effective heating systems, coupled with ongoing industrial expansion, is boosting market prospects. The stringent emission regulations set by the U.S. Environmental Protection Agency (EPA) and state-level authorities are driving industries to adopt more advanced systems that improve heat transfer efficiency and reduce emissions. Additionally, the modernization of legacy heating systems, combined with a greater focus on low-maintenance, long-lasting solutions, is expected to further strengthen market growth in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Temperature, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 ≤ 120°F

- 5.3 > 120°F - 140°F

- 5.4 > 140°F - 160°F

- 5.5 > 160°F - 180°F

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 Fire-tube

- 6.3 Water-tube

Chapter 7 Market Size and Forecast, By Capacity, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 < 10 MMBTU/hr

- 7.3 10 - 25 MMBTU/hr

- 7.4 25 - 50 MMBTU/hr

- 7.5 50 - 75 MMBTU/hr

- 7.6 75 - 100 MMBTU/hr

- 7.7 100 - 175 MMBTU/hr

- 7.8 175 - 250 MMBTU/hr

- 7.9 > 250 MMBTU/hr

Chapter 8 Market Size and Forecast, By Fuel, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Natural gas

- 8.3 Oil

- 8.4 Coal

- 8.5 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 Food processing

- 9.3 Pulp & paper

- 9.4 Chemical

- 9.5 Refinery

- 9.6 Primary metal

- 9.7 Others

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 France

- 10.3.2 UK

- 10.3.3 Poland

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Austria

- 10.3.7 Germany

- 10.3.8 Sweden

- 10.3.9 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Philippines

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.4.6 Australia

- 10.4.7 Indonesia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 Iran

- 10.5.3 UAE

- 10.5.4 Nigeria

- 10.5.5 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

- 10.6.3 Chile

Chapter 11 Company Profiles

- 11.1 Babcock Wanson

- 11.2 Bosch Industriekessel

- 11.3 Cleaver-Brooks

- 11.4 Cochran

- 11.5 Ferroli

- 11.6 Fulton

- 11.7 Hurst Boiler & Welding

- 11.8 IHI

- 11.9 Maxima Boilers

- 11.10 Miura America

- 11.11 Parker Boiler

- 11.12 Precision Boilers

- 11.13 Thermax

- 11.14 Vaillant

- 11.15 Viessmann