|

市場調查報告書

商品編碼

1635453

商業鍋爐:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Commercial Boilers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

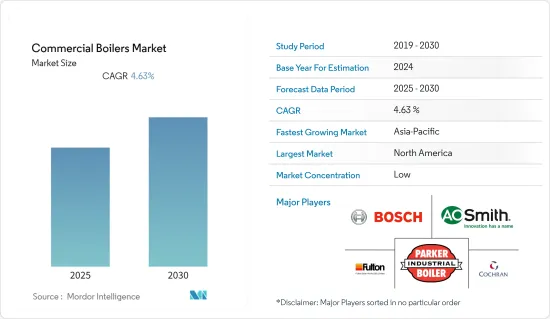

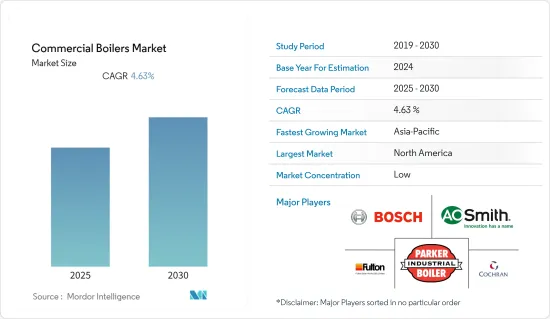

預計商用鍋爐市場在預測期內的複合年成長率為 4.63%。

主要亮點

- 商用鍋爐是一種燃燒可燃燃料產生熱量並為住宅或商業建築供暖的加壓系統。燃燒器、燃燒室、熱交換器、控制設備和煙囪只是構成商用鍋爐的部分零件。

- 這些組件對於商業鍋爐的最佳運作至關重要。然而,為了商業鍋爐的高效運行,包括印度在內的各個地區的政府都根據聯邦法規(CFR)和印度鍋爐規則(IBR)強制要求在商業鍋爐中安裝安全附件。

- 此外,商業空間供暖需求的不斷成長是推動市場成長的主要因素。除此之外,擴大採用節能解決方案以及增加對綠色建築開發的投資以最大限度地減少碳排放,正在推動對商用鍋爐的需求不斷增加。

- 此外,各國政府也採取了多項有利舉措來安裝新的商用鍋爐和升級現有鍋爐。由於最新的商用鍋爐技術提供了更高的效率和更低的排放氣體,更嚴格的環境法規的推出正在加快產品的採用速度。

- 2022 年 4 月,博世商工宣布推出最新商用鍋爐系列 Condens 7000 WP。該新系列取代了廣受歡迎的伍斯特博世 GB162 V2,並採用獨特的設計,以簡單性為理念,減少安裝時間。此外,與 GB162 V2 相比,安裝人員在安裝 Condens 7000 WP 時可將平均安裝時間縮短多達 60%,從而騰出時間用於其他安裝和更廣泛的管理任務。

商用鍋爐市場趨勢

醫療保健預計將佔據很大的市場佔有率

- 醫療保健產業使用鍋爐進行清洗、消毒和空間加熱。升級醫療保健基礎設施是世界各地政策制定者的首要任務,並將繼續推動醫療保健產業的新投資。

- 疫情導致的個人住院人數急劇增加和國家醫療保健支出增加,進一步加強了對醫療保健行業的投資,並推動了市場的研究領域。例如,根據CMS的數據,2021年美國國民醫療支出占GDP比率為18.2%,預計2028年將增加至19.7%。

- 此外,政府以先進熱水系統取代傳統暖氣系統的政策,加上醫療設施的發展,可能會動搖對商用鍋爐的需求。

- 此外,隨著人們越來越接受創新和永續的暖氣系統,對節能供暖解決方案的需求不斷成長,預計也將增加醫療保健領域的行業收益。醫療保健領域的採用增加以及現有系統的替換增加以滿足嚴格的建築規範將為該行業增加價值。

- 2022 年 8 月,ELCO 將在醫療保健莊園舉辦一場展覽,透過提供暖氣和生活熱水以及結合自然能源,為醫療機構帶來一些獨特的挑戰。市場供應商的這些舉措和發展可能會在未來幾年推動市場研究領域的發展。

北美佔據主要市場佔有率

- 該地區的市場正在經歷更換和升級現有暖氣系統以及提高鍋爐運作能力的轉變。高昂的營運和維護成本、不斷上漲的燃料價格以及嚴格的政府法規正在推動該地區以節能供暖系統取代現有供暖系統。

- 該地區政府機構越來越關注減少環境碳排放和實施綠色建築標準,這增加了對這些鍋爐的需求。高能源效率、極低的碳排放和低供熱成本是推動市場需求飆升的關鍵因素。對無污染燃料供暖系統的需求和國內住宿行業投資的增加預計將支持市場成長。

- 此外,市場參與者還投資利用最新技術和升級來改進他們的鍋爐。 2021 年 6 月,高效能熱水器製造商 Lochinvar 推出了採用 Hellcat 燃燒技術的 CREST 冷凝鍋爐,具有即時 O2 調整功能。此鍋爐可用於大規模商業應用。 Hellcat 燃燒技術有助於減少監控和維護並延長鍋爐的使用壽命。

- 該區域市場也因採用業務擴大策略,這對市場來說是個好徵兆。例如,2021 年 1 月,傑里科石油公司宣布達成協議,收購 Hydrogen Technologies Inc. 的所有資產。收購後,該公司更新了其網站並發布了一份企業演示文稿,概述了 HTI 的新型專利高溫清潔 H2steam 動態燃燒室鍋爐。此鍋爐可透過閉合迴路過程生產熱水、高溫蒸氣以及零排放氫氣的熱電聯產(CHP)。

商用鍋爐產業概況

商用鍋爐市場適度分散,有多家全球和區域參與者。主要參與者包括 Cochran Limited、Bosch Thermotechnology 和 AO Smith Corporation。該市場的參與者正在推出創新的新產品並建立夥伴關係和協作,以獲得市場競爭優勢。

- 2022年4月-沃爾夫推出CGB-2-68/75/100瓦斯冷凝鍋爐,可滿足高熱功率等密集使用需求。具有最新的創新、可調節的控制功能和高品質的組件。

- 2021 年 3 月 - Vismann 推出了最受歡迎的新一代燃氣冷凝鍋爐 Vitodens 100-W。 Vitodens 100-W 的新控制平台具有整合式 WiFi,有助於鍋爐的試運行和維修。據該公司稱,現在可以遠端監控和調整客戶的鍋爐。不需要第三方控制,透過為 Vitodens 鍋爐配備 ViCare 恆溫器,住宅就擁有了負載補償智慧型手機控制的暖氣系統。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 整個商業設施的空間加熱需求不斷增加以及工業部門的成長

- 增加對商業部門的投資,以實現經濟和生態學永續的基礎設施發展

- 市場限制因素

- 安裝和製造成本高

第6章 市場細分

- 按燃料類型

- 天然氣

- 油

- 煤炭

- 其他

- 依技術

- 縮合

- 非冷凝

- 按能力

- 低於 10MMBtu/小時

- 10~50 MMBtu/Hr

- 其他

- 按最終用戶產業

- 辦公室

- 衛生保健

- 教育機構

- 款待

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Cochran Limited

- Bosch Thermotechnology(Bosch Thermotechnik GmbH)

- AO Smith Corporation

- Fulton Boiler Company

- Parker Boiler

- Superior Boiler Works, Inc.

- Vaillant Group

- Weil-McLain(SPX Corporation)

- Slant/Fin Corporation

- Energy Kinetics Inc.

- Cleaver-Brooks Inc.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91865

The Commercial Boilers Market is expected to register a CAGR of 4.63% during the forecast period.

Key Highlights

- A commercial boiler is a pressurized system that creates heat by burning a combustible fuel to provide heating for residential and commercial buildings. The burner, combustion chamber, heat exchanger, controls, and exhaust stacks are just a few of the components that make up a commercial boiler.

- These components are essential for a commercial boiler's optimal operation. However, due to the efficient operation of commercial boilers, governments in various regions, including India, have mandated the installation of safety accessories in commercial boilers under the Code of Federal Regulations (CFR) and the India Boiler Regulation (IBR).

- Moreover, the escalating demand for space heating in commercial spaces represents the primary factor driving the market growth. Besides this, the rising adoption of energy-efficient solutions, coupled with the increasing investments in developing green buildings to minimize carbon emissions, is augmenting the demand for commercial boilers.

- Additionally, governments of various countries are taking several favorable initiatives to install new commercial boilers and upgrade the existing ones. Implementing stringent environmental regulations accelerates product adoption rates as modern commercial boiler technologies offer greater efficiency and lower emission discharge.

- In April 2022, Bosch Commercial & Industrial announced the launch of its latest commercial boiler series, the Condens 7000 WP. The new series replaces the popular Worcester Bosch GB162 V2 with a unique design developed to increase install time with simplicity in mind. Moreover, installers can expect to save up to 60% on average installation times when fitting the Condens 7000 WP compared to the GB162 V2, freeing up time to complete other installs or wider administrative work.

Commercial Boilers Market Trends

Healthcare is Expected to Hold a Significant Market Share

- The healthcare industry uses boilers for cleaning, sterilizing, and space heating. Upgrading healthcare infrastructure is the primary priority among policymakers worldwide, continuously driving new investment in the healthcare sector.

- The exponential surge in the hospitalization of individuals and increase in national health expenditure owing to the pandemic has further bolstered investment in the healthcare sector, which will drive the studied segment for the market. For instance, according to CMS, the U.S. national health expenditure forecast as a percentage of GDP in 2021 was 18.2%, which will increase in 2028 to 19.7%.

- Moreover, government policies toward replacing conventional heating systems with advanced water heating systems coupled with the development of medical facilities will sway the demand for commercial boilers.

- Further, the growing requirements for energy-efficient heating solutions in line with the rising shift toward the acceptance of innovative sustainable heating systems will boost the industry revenue in the healthcare sector. Increasing deployments across the healthcare sector and growing replacement of the existing systems to cater to the stringent building standards will foster the industry value.

- In August 2022, ELCO announced an exhibit at Healthcare Estates that will provide heating and domestic hot water along with the inclusion of renewables, presenting some unique challenges to healthcare facilities. These initiatives and developments by the vendors in the market will drive the studied segment of the market over the coming years.

North America to Hold Significant Market Share

- The market in the region is witnessing a shift towards replacing or upgrading the existing heating systems and improving the operational ability of boilers. The high operating and maintenance cost, rising fuel prices, and stringent government regulations have set the tone for replacing the existing heating system with the energy-efficient heating system in the region.

- Increasing the focus of government bodies on reducing carbon emissions to the environment and implementing green building codes in the region augmented the demand for these boilers. High energy efficiency, minimal carbon emission, and low heating cost are critical factors surging market demand. The need for clean fuel heating systems and increasing investment in the domestic lodging sector are expected to support the market growth.

- Further, the market players are also investing in advancing boilers with the latest technologies and upgrades. In June 2021, Lochinvar, a manufacturer of high-efficiency water heaters, announced the CREST condensing boiler with Hellcat Combustion Technology, featuring Real-time O2 trim. These boilers can be used in large commercial applications. The Hellcat Combustion Technology helps decrease monitoring and maintenance and extends the boiler's life.

- The regional market is also witnessing significant adoption of business augmenting strategies which bodes well for the market. For instance, in January 2021, Jericho Oil Corporation announced its agreement to acquire all the assets of Hydrogen Technologies Inc. After the acquisition, the company introduced a re-branded website and Corporate Presentation outlining HTI's patented and novel high-temperature cleanH2steam Dynamic Combustion Chamber boiler that enables zero-emissions hydrogen to generate heat hot-water, high-temperature steam, and Combined Heat & Power (CHP) through a closed-loop process.

Commercial Boilers Industry Overview

The Commercial Boilers Market is moderately fragmented with the presence of some global and regional players. Some of the key players are Cochran Limited, Bosch Thermotechnology, and A.O. Smith Corporation, among others. The players in this market are introducing new innovative products and forming partnerships and collaborations to gain a competitive advantage in the market.

- April 2022 - WOLF launched the CGB-2-68/75/100 gas condensing boiler, making it possible to meet intensive use needs of high thermal power, etc. It has the latest technological innovations, regulation control capacity, and quality components.

- March 2021 - Viessmann introduced the next generation of its most popular gas-condensing boiler, the Vitodens 100-W, with PIONEERING capabilities for installers. The WiFi-integrated Vitodens 100-W's new control platform makes commissioning and servicing the boiler easier. According to the company, remotely monitoring and adjusting customers' boilers is now possible. No third-party controls are required, meaning a Vitodens boiler with ViCare Thermostat provides homeowners with a load-compensating smartphone-controlled heating system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in need for space heating across commercial establishments and growth of the industrial sector

- 5.1.2 Increase in investments in the commercial sector toward development of economically & ecologically sustainable infrastructure

- 5.2 Market Restraints

- 5.2.1 High installation and production cost

6 MARKET SEGMENTATION

- 6.1 Fuel Type

- 6.1.1 Natural gas

- 6.1.2 Oil

- 6.1.3 Coal

- 6.1.4 Others

- 6.2 Technology

- 6.2.1 Condensing

- 6.2.2 Non-condensing

- 6.3 Capacity

- 6.3.1 Less Than 10 MMBtu/Hr

- 6.3.2 10-50 MMBtu/Hr

- 6.3.3 Others

- 6.4 End-User Industries

- 6.4.1 Offices

- 6.4.2 Healthcare

- 6.4.3 Educational Institutions

- 6.4.4 Hospitality

- 6.4.5 Other End-User Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cochran Limited

- 7.1.2 Bosch Thermotechnology (Bosch Thermotechnik GmbH)

- 7.1.3 A.O. Smith Corporation

- 7.1.4 Fulton Boiler Company

- 7.1.5 Parker Boiler

- 7.1.6 Superior Boiler Works, Inc.

- 7.1.7 Vaillant Group

- 7.1.8 Weil-McLain (SPX Corporation)

- 7.1.9 Slant/Fin Corporation

- 7.1.10 Energy Kinetics Inc.

- 7.1.11 Cleaver-Brooks Inc.

8 INVESTMENTS ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219