|

市場調查報告書

商品編碼

1665339

床墊和床墊組件市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Mattress and Mattress Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

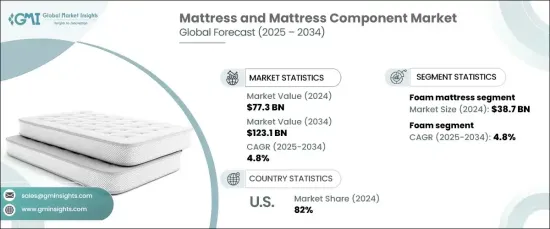

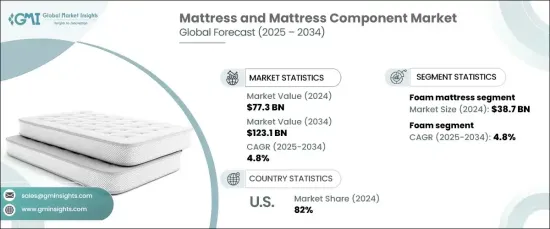

2024 年全球床墊和床墊組件市場估值達到 773 億美元,預計 2025 年至 2034 年期間將以 4.8% 的複合年成長率穩步成長。 這一成長得益於消費者偏好的轉變、床墊技術的進步、對健康和保健的日益關注以及對創新睡眠解決方案的需求不斷成長。

隨著消費者越來越重視健康和福祉,優質睡眠的重要性已成為焦點。這一趨勢推動了對提供卓越舒適性、支撐性和壓力緩解功能的床墊的需求。記憶泡沫、凝膠泡沫、混合系統和可調節底座等先進材料越來越受到買家的青睞。此外,針對特定健康問題(如背痛和關節不適)而客製化的床墊正在引發人們對旨在提高睡眠品質和整體健康的治療解決方案的興趣。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 773億美元 |

| 預測值 | 1231億美元 |

| 複合年成長率 | 4.8% |

市場將產品分為泡棉、混合、彈簧、乳膠和其他床墊類型。尤其是泡棉床墊,它佔據了該領域的主導地位,2024 年的估值為 387 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長。這種適應性使得泡棉床墊對於尋求改善睡眠品質或緩解慢性疼痛和肌肉骨骼問題的消費者來說非常有吸引力。

在床墊組件類別中,市場分為泡棉、彈簧、乳膠、填充物和其他。泡沫組件部分在 2024 年佔據了 50% 的市場佔有率,預計在預測期內將以 4.8% 的複合年成長率成長。泡沫材料,尤其是記憶泡沫,因其卓越的塑形能力和支撐力而備受讚譽,成為有特殊睡眠需求或健康相關要求的人士的首選。

在美國,床墊和床墊組件市場在 2024 年佔據了令人印象深刻的 82% 的佔有率。有環保意識的買家擴大選擇由永續材料製成的床墊,例如有機棉、天然乳膠和環保記憶泡沫。隨著購物者致力於最大限度地減少對環境的影響,同時創造更健康、無毒的生活空間,無毒、可生物分解和有機的選擇越來越受歡迎。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算。

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析。

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 商業部門不斷成長

- 生活方式改變,消費支出增加

- 產業陷阱與挑戰

- 市場飽和且競爭激烈

- 永續性問題

- 成長動力

- 成長潛力分析

- 原料分析

- 消費者購買行為分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 泡棉床墊

- 混合床墊

- 彈簧床墊

- 乳膠床墊

- 其他(水床、氣墊床等)

第6章:市場估計與預測:依組件類型,2021-2034 年

- 主要趨勢

- 泡棉

- 彈簧

- 乳膠

- 填充物

- 其他(滴答聲等)

第 7 章:市場估計與預測:按規模,2021-2034 年

- 主要趨勢

- 小(最多 3 誇脫)

- 中號(3 至 7 誇脫)

- 大號(7 誇脫以上)

第 8 章:市場估計與預測:按價格範圍,2021 年至 2034 年

- 主要趨勢

- 單一尺寸

- 雙人床尺寸

- 全尺寸或雙倍尺寸

- 特大床

- 其他

第 9 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市

- 專賣店

- 其他(個體店等)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 12 章:公司簡介

- Ashley Furniture Industries

- DreamCloud

- Hästens

- Helix Sleep

- IKEA

- Kingsdown

- Leggett & Platt

- Purple Innovation

- Relyon

- Saatva

- Serta Simmons Bedding

- Simmons Bedding Company

- Sleep Number Corporation

- Stearns & Foster

- Tempur Sealy International

The Global Mattress And Mattress Component Market reached a valuation of USD 77.3 billion in 2024 and is expected to grow at a steady CAGR of 4.8% between 2025 and 2034. This growth is driven by shifting consumer preferences, advancements in mattress technology, a growing focus on health and wellness, and an increasing demand for innovative sleep solutions.

As consumers place greater emphasis on health and well-being, the importance of quality sleep has taken center stage. This trend has fueled the demand for mattresses that offer superior comfort, support, and pressure relief. Advanced materials such as memory foam, gel-infused foam, hybrid systems, and adjustable bases are gaining traction among buyers. Additionally, mattresses tailored to address specific health concerns, such as back pain and joint discomfort, are driving interest in therapeutic solutions designed to enhance sleep quality and overall wellness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.3 Billion |

| Forecast Value | $123.1 Billion |

| CAGR | 4.8% |

The market categorizes its products into foam, hybrid, innerspring, latex, and other mattress types. Foam mattresses, in particular, dominated the segment with a valuation of USD 38.7 billion in 2024 and are projected to grow at a 4.8% CAGR through 2034. These mattresses are widely recognized for their ability to conform to body shapes, providing exceptional pressure relief. This adaptability makes foam mattresses highly appealing to consumers looking to improve sleep quality or alleviate chronic pain and musculoskeletal issues.

In the mattress components category, the market is segmented into foam, innerspring, latex, fillings, and others. The foam component segment accounted for a significant 50% market share in 2024 and is expected to expand at a 4.8% CAGR during the forecast period. Foam materials, especially memory foam, are celebrated for their superior contouring capabilities and support, making them a top choice for individuals with specific sleep needs or health-related requirements.

In the United States, the mattress and mattress component market claimed an impressive 82% share in 2024. A growing focus on sustainability is reshaping consumer choices in this region, driven by heightened environmental awareness. Eco-conscious buyers are increasingly opting for mattresses crafted from sustainable materials such as organic cotton, natural latex, and eco-friendly memory foam. Non-toxic, biodegradable, and organic options are gaining popularity as shoppers aim to minimize environmental impact while creating healthier, toxin-free living spaces.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing commercial sector

- 3.6.1.2 Changing lifestyle and increasing consumer spending

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Raw material analysis

- 3.9 Consumer buying behavior analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Million Units)

- 5.1 Key trends

- 5.2 Foam mattress

- 5.3 Hybrid mattress

- 5.4 Innerspring mattress

- 5.5 Latex mattress

- 5.6 Others (waterbed, airbed, etc.)

Chapter 6 Market Estimates & Forecast, By Component Type, 2021-2034 (USD Million) (Million Units)

- 6.1 Key trends

- 6.2 Foam

- 6.3 Innerspring

- 6.4 Latex

- 6.5 Fillings

- 6.6 Others (ticking, etc.)

Chapter 7 Market Estimates & Forecast, By Size, 2021-2034 (USD Million) (Million Units)

- 7.1 Key trends

- 7.2 Small (up to 3 quarts)

- 7.3 Medium (3 to 7 quarts)

- 7.4 Large (above 7 quarts)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Million) (Million Units)

- 8.1 Key trends

- 8.2 Single size

- 8.3 Twin size

- 8.4 Full or double size

- 8.5 King size

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets

- 10.3.2 Specialty stores

- 10.3.3 Others (individual stores, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Ashley Furniture Industries

- 12.2 DreamCloud

- 12.3 Hästens

- 12.4 Helix Sleep

- 12.5 IKEA

- 12.6 Kingsdown

- 12.7 Leggett & Platt

- 12.8 Purple Innovation

- 12.9 Relyon

- 12.10 Saatva

- 12.11 Serta Simmons Bedding

- 12.12 Simmons Bedding Company

- 12.13 Sleep Number Corporation

- 12.14 Stearns & Foster

- 12.15 Tempur Sealy International