|

市場調查報告書

商品編碼

1684631

床墊罩市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Mattress Topper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

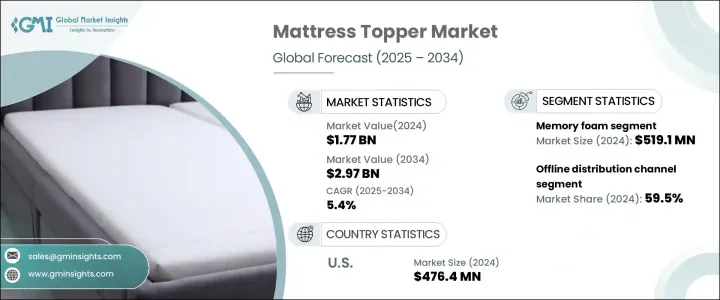

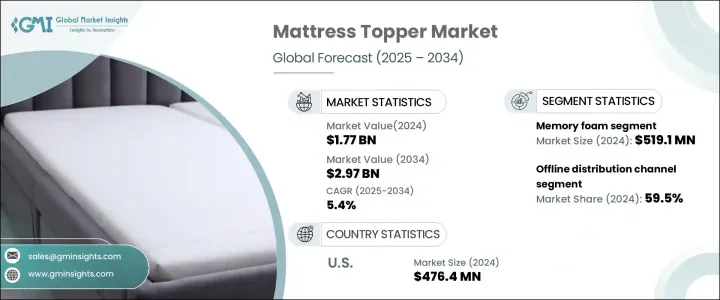

全球床墊市場正在蓬勃發展,2024 年價值將達到 17.7 億美元,預計 2025 年至 2034 年的複合年成長率為 5.4%。隨著消費者越來越認知到睡眠品質對日常生活和健康的影響,對床墊罩等增強舒適度的產品的需求正在上升。人們在選擇寢具時變得更加挑剔,尋找能夠舒適、緩解疼痛和改善睡眠的材料和設計。

隨著消費者致力於解決背痛、壓力點不適和睡眠障礙等常見問題,市場已開始轉向更高品質的寢具解決方案。床墊罩因其能夠透過提供額外的支撐和溫度調節來顯著改善睡眠品質而受到關注。此外,隨著越來越多的人尋求能夠提供寧靜和恢復性睡眠體驗的解決方案,失眠和睡眠呼吸中止症等睡眠相關問題的日益普遍也加速了需求。消費者擴大選擇有助於自己健康的產品,突顯出他們在購買床上用品時越來越注重健康。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17.7 億美元 |

| 預測值 | 29.7 億美元 |

| 複合年成長率 | 5.4% |

在市場上可用的各種材料中,記憶泡沫在 2024 年佔據領先地位,價值為 5.191 億美元。這種材料繼續佔據市場主導地位,預計到 2034 年其市場價值將達到 57 億美元。此外,它還以其耐用性、運動隔離功能和保持一致溫度調節的能力而聞名,使其成為尋求高品質睡眠解決方案的消費者的首選。

床墊市場也按分銷管道細分,其中線下零售佔據最大佔有率,到 2024 年將達到 59.5%。透過店內購物,他們可以在購買之前親自評估床墊的質地、硬度和舒適度。專業床墊零售商、家具店和百貨公司持續提供個人化的購物體驗,知識淵博的員工會引導顧客做出最符合他們需求的選擇。預計 2025 年至 2034 年期間,店內體驗的複合年成長率將達到 5.1%。

在美國,床墊罩市場在 2024 年創造了 4.764 億美元的產值。人們對失眠和睡眠呼吸中止症等睡眠障礙的認知不斷提高,也促使消費者投資購買能夠提供更高舒適度和支撐力的床墊。市場的擴張證明了優質睡眠對個人整體健康和福祉的重要性。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 越來越重視睡眠品質和健康意識

- 酒店和醫療保健行業的成長

- 人口老化和骨科問題

- 產業陷阱與挑戰

- 市場競爭激烈

- 產品壽命有限且品質不穩定

- 成長動力

- 技術與創新格局

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 記憶泡沫

- 凝膠記憶泡沫

- 乳膠

- 羽毛和羽絨

- 羊毛

- 聚氨酯泡沫

- 纖維填充/聚酯

第6章:市場估計與預測:依規模,2021 – 2034 年

- 主要趨勢

- 雙

- 加大雙人間

- 滿的

- 女王

- 國王

- 其他(加州加大雙人床)

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

- 飯店及度假村

- 醫院及療養院

- 宿舍

第 8 章:市場估計與預測:按功能分類,2021 年至 2034 年

- 主要趨勢

- 冷卻床墊罩

- 減壓床墊罩

- 矯形床墊罩

第 9 章:市場估計與預測:按價格,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務平台

- 品牌網站

- 離線

- 專賣店

- 百貨公司

- 超市/大賣場

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 12 章:公司簡介

- American Textile Company

- Avenco

- Bear Mattress

- Ikea

- Linenspa

- Novaform

- Restonic Mattress Corporation

- Saatva

- Sealy Corporation

- Serta Simmons Bedding LLC

- Silentnight Group

- Sleep Innovations

- Tempur-Pedic

- The Purple Mattress

- Zinus

The Global Mattress Topper Market is thriving, valued at USD 1.77 billion in 2024, with a projected growth rate of 5.4% CAGR from 2025 to 2034. This steady expansion is fueled by growing awareness about the crucial role sleep plays in overall health. As consumers increasingly recognize the impact of sleep quality on daily functioning and well-being, the demand for products that enhance comfort, such as mattress toppers, is on the rise. People are becoming more selective when it comes to bedding, seeking out materials and designs that promote comfort, relieve pain, and support better sleep.

The market has seen a shift towards higher-quality bedding solutions as consumers aim to address common issues such as back pain, discomfort from pressure points, and sleep disorders. Mattress toppers are gaining attention for their ability to significantly improve sleep quality by providing additional support and temperature regulation. Moreover, the growing prevalence of sleep-related issues like insomnia and sleep apnea is accelerating demand as more people search for solutions that offer a restful and restorative sleep experience. Consumers are increasingly opting for products that contribute to their well-being, highlighting the shift toward health-conscious decisions in purchasing bedding products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.77 Billion |

| Forecast Value | $2.97 Billion |

| CAGR | 5.4% |

Among the variety of materials available in the market, memory foam holds the leading position in 2024, valued at USD 519.1 million. This material continues to dominate the market, with forecasts predicting it will reach USD 5.7 billion by 2034. Memory foam's unique ability to conform to the body's shape and weight offers excellent relief from joint pain, back pain, and pressure points. Additionally, it is known for its durability, motion isolation features, and the ability to maintain consistent temperature regulation, making it the preferred choice for consumers looking for high-quality sleep solutions.

The mattress topper market is also segmented by distribution channels, with offline retail holding the largest share at 59.5% in 2024. Despite the increasing popularity of online shopping, offline retail remains the preferred channel for many consumers. In-store shopping allows them to physically assess the texture, firmness, and comfort of mattress toppers before making a purchase. Specialty mattress retailers, furniture stores, and department stores continue to offer a personalized shopping experience, with knowledgeable staff guiding customers to the best choices for their needs. This in-store experience is projected to grow at a 5.1% CAGR from 2025 to 2034.

In the U.S., the mattress topper market generated USD 476.4 million in 2024. The large population and rising disposable incomes are driving the demand for high-end, customized options. The growing awareness of sleep disorders, such as insomnia and sleep apnea, is also prompting consumers to invest in mattress toppers that provide enhanced comfort and support. The market expansion is a testament to how important quality sleep has become to individuals' overall health and well-being.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising focus on sleep quality and health awareness

- 3.2.1.2 Growth in hospitality and healthcare sectors

- 3.2.1.3 Aging population and orthopedic concerns

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Intense market competition

- 3.2.2.2 Limited product lifespan and quality variability

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 – 2034, (USD Million)

- 5.1 Key trends

- 5.2 Memory foam

- 5.3 Gel memory foam

- 5.4 Latex

- 5.5 Feather and down

- 5.6 Wool

- 5.7 Polyurethane foam

- 5.8 Fiberfill/polyester

Chapter 6 Market Estimates & Forecast, By Size, 2021 – 2034, (USD Million)

- 6.1 Key trends

- 6.2 Twin

- 6.3 Twin XL

- 6.4 Full

- 6.5 Queen

- 6.6 King

- 6.7 Other (California king)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 Hotels & resorts

- 7.3.2 Hospitals & nursing homes

- 7.3.3 Dormitories

Chapter 8 Market Estimates & Forecast, By Functionality, 2021 – 2034, (USD Million)

- 8.1 Key trends

- 8.2 Cooling mattress toppers

- 8.3 Pressure-relief mattress toppers

- 8.4 Orthopedic mattress toppers

Chapter 9 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Million)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Million)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce platforms

- 10.2.2 Brand websites

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Department stores

- 10.3.3 Supermarkets/hypermarkets

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Malaysia

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 American Textile Company

- 12.2 Avenco

- 12.3 Bear Mattress

- 12.4 Ikea

- 12.5 Linenspa

- 12.6 Novaform

- 12.7 Restonic Mattress Corporation

- 12.8 Saatva

- 12.9 Sealy Corporation

- 12.10 Serta Simmons Bedding LLC

- 12.11 Silentnight Group

- 12.12 Sleep Innovations

- 12.13 Tempur-Pedic

- 12.14 The Purple Mattress

- 12.15 Zinus