|

市場調查報告書

商品編碼

1665358

二輪車安全解決方案市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Two-Wheeler Safety Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

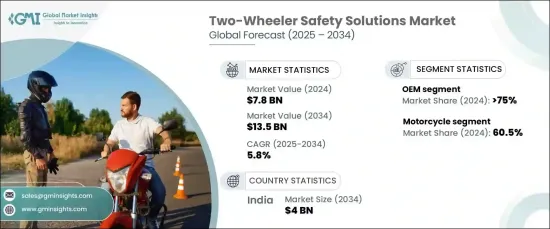

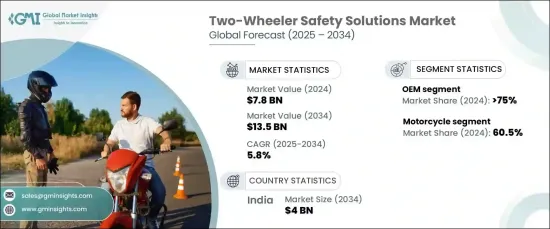

2024 年全球二輪車安全解決方案市值為 78 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.8%。這些創新透過碰撞偵測、緊急警報和自適應巡航控制等系統實現了即時資料分析、預測安全機制和更好的騎士保護。此外,物聯網頭盔和穿戴式裝置有助於保持持續連接,提供潛在危險警報並提高道路態勢感知能力。

消費者安全意識的增強推動了對這些先進安全解決方案的需求。教育舉措、媒體對事故的報導以及便捷的資訊獲取都提高了人們對騎士安全重要性的認知。這種轉變在年輕的城市騎乘者中尤其明顯,他們更有可能採用新技術,例如連網頭盔和高級騎乘輔助系統 (ARAS)。隨著安全意識強的消費者群體不斷壯大,製造商和售後市場供應商致力於提供經濟實惠且方便用戶使用的解決方案來滿足這一需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 78億美元 |

| 預測值 | 135億美元 |

| 複合年成長率 | 5.8% |

市場分為原始設備製造商(OEM)和售後市場部分。 OEM 佔據最大的市場佔有率,到 2024 年將達到 75% 以上。防鎖死煞車系統 (ABS)、牽引力控制和碰撞偵測等安全解決方案正在成為新車型的標準,尤其是高性能摩托車的標準。另一方面,售後市場也正在經歷顯著的成長。隨著越來越多的駕駛者尋求升級現有車輛的安全性,附加安全氣囊、先進照明系統和防盜功能等售後解決方案變得越來越受歡迎。這些解決方案受益於人們道路安全意識的不斷提高,以及具有成本效益且易於安裝的功能。

市場進一步按車型細分,2024 年摩托車將佔據整個市場的 60.5%。摩托車引擎更大、速度更快,通常需要複雜的安全解決方案,包括轉彎 ABS 和牽引力控制系統,以提高駕駛穩定性並降低事故風險。踏板車市場雖然規模較小,但也穩定成長。踏板車通常用於擁擠城市的短途通勤,因此對組合煞車系統 (CBS) 和碰撞偵測系統等經濟實惠的安全功能有需求。隨著電動滑板車的普及和共享出行的擴大,人們對開發城市通勤安全解決方案的關注度也不斷提高。

預計到 2034 年,印度二輪車安全解決方案市場規模將達到 40 億美元。印度許多城市的快速城市化和日益嚴重的交通堵塞進一步刺激了對 ABS 和智慧頭盔等增強安全技術的需求。

報告內容

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 零件製造商

- 售後市場供應商

- 技術提供者

- 原物料供應商

- 最終用戶

- 利潤率分析

- 二輪車安全解決方案案例研究

- 專利分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 都市化進程加快,交通擁擠加劇

- 整合人工智慧、物聯網和感測器以開發先進的安全功能

- 嚴格的安全規定

- 消費者對騎乘安全的意識不斷增強

- 產業陷阱與挑戰

- 先進安全系統成本高昂

- 低成本汽車的採用有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 主動安全系統

- 防鎖死煞車系統 (ABS)

- 牽引力控制系統 (TCS)

- 自適應巡航控制 (ACC)

- 高級駕駛輔助系統 (ARAS)

- 被動安全系統

- 安全氣囊

- 智慧頭盔

- 防護服

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 摩托車

- 踏板車

第 7 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Alpinestars

- Autoliv

- BMW Motorrad

- Bosch

- Continental

- Dainese

- Delphi

- Denso

- Harman

- Helite

- Honda

- Kawasaki

- Klim

- Magneti Marelli

- NXP

- Racer Gloves

- Spidi

- Valeo

- Yamaha

- ZF

The Global Two-Wheeler Safety Solutions Market was valued at USD 7.8 billion in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2034. The growing integration of advanced technologies, such as Artificial Intelligence (AI), the Internet of Things (IoT), and sensors, has significantly enhanced two-wheeler safety. These innovations enable real-time data analysis, predictive safety mechanisms, and improved rider protection through systems like crash detection, emergency alerts, and adaptive cruise control. In addition, IoT-powered helmets and wearables help maintain continuous connectivity, offering alerts about potential hazards and improving situational awareness on the road.

The increased awareness of safety among consumers has driven the demand for these advanced safety solutions. Educational initiatives, media coverage of accidents, and easy access to information have all raised awareness about the importance of rider safety. This shift is particularly noticeable among younger, urban riders who are more likely to adopt new technologies, such as connected helmets and Advanced Rider Assistance Systems (ARAS). As the safety-conscious consumer base grows, manufacturers and aftermarket suppliers are focused on providing affordable and user-friendly solutions to meet this demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $13.5 Billion |

| CAGR | 5.8% |

The market is divided into Original Equipment Manufacturer (OEM) and aftermarket segments. OEMs hold the largest market share, representing more than 75% in 2024. This is largely due to the growing integration of safety features in new motorcycles and scooters. Safety solutions like Anti-lock Braking Systems (ABS), traction control, and collision detection are becoming standard in new models, especially in high-performance motorcycles. On the other hand, the aftermarket sector is also witnessing notable growth. As more riders seek to upgrade the safety of their existing vehicles, aftermarket solutions like additional airbags, advanced lighting systems, and anti-theft features are becoming increasingly popular. These solutions benefit from rising awareness of road safety and the availability of cost-effective, easy-to-install features.

The market is further segmented by vehicle type, with motorcycles commanding a 60.5% share of the total market in 2024. This dominance is driven by the higher adoption of advanced safety features in high-performance motorcycles, especially in areas with higher traffic congestion and accident risks. Motorcycles, with larger engines and faster speeds, often require sophisticated safety solutions, including cornering ABS and traction control systems, to improve rider stability and reduce accident risks. The scooter segment, though smaller, is also growing steadily. Scooters are commonly used for short-distance commutes in crowded cities, creating a demand for affordable safety features such as combined braking systems (CBS) and crash detection systems. As the popularity of electric scooters rises and shared mobility expands, the focus on developing safety solutions for urban commuting continues to grow.

The Indian two-wheeler safety solutions market is projected to reach USD 4 billion by 2034. The demand is being driven by increasing motorcycle and scooter adoption alongside rising safety awareness. Rapid urbanization and higher traffic congestion in many Indian cities have further fueled the need for enhanced safety technologies like ABS and smart helmets.

Report Content

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturers

- 3.2.2 Aftermarket suppliers

- 3.2.3 Technology providers

- 3.2.4 Raw material suppliers

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Case study of two-wheeler safety solutions

- 3.5 Patent analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising urbanization and increasing traffic congestion

- 3.9.1.2 Integration of AI, IoT, and sensors to develop advanced safety features

- 3.9.1.3 Stringent safety regulations

- 3.9.1.4 Growing awareness among consumers about rider safety

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of advanced safety systems

- 3.9.2.2 Limited adoption in low-cost vehicles

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Active safety systems

- 5.2.1 Anti-lock Braking Systems (ABS)

- 5.2.2 Traction Control Systems (TCS)

- 5.2.3 Adaptive Cruise Control (ACC)

- 5.2.4 Advanced Rider Assistance Systems (ARAS)

- 5.3 Passive safety systems

- 5.3.1 Airbags

- 5.3.2 Smart helmets

- 5.3.3 Protective clothing

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Motorcycles

- 6.3 Scooters

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Alpinestars

- 9.2 Autoliv

- 9.3 BMW Motorrad

- 9.4 Bosch

- 9.5 Continental

- 9.6 Dainese

- 9.7 Delphi

- 9.8 Denso

- 9.9 Harman

- 9.10 Helite

- 9.11 Honda

- 9.12 Kawasaki

- 9.13 Klim

- 9.14 Magneti Marelli

- 9.15 NXP

- 9.16 Racer Gloves

- 9.17 Spidi

- 9.18 Valeo

- 9.19 Yamaha

- 9.20 ZF