|

市場調查報告書

商品編碼

1684687

連網汽車技術市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Connected Vehicle Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

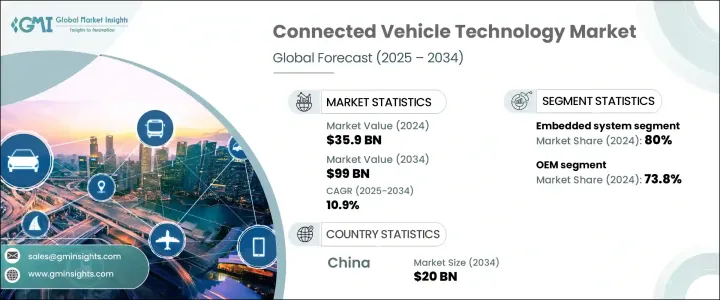

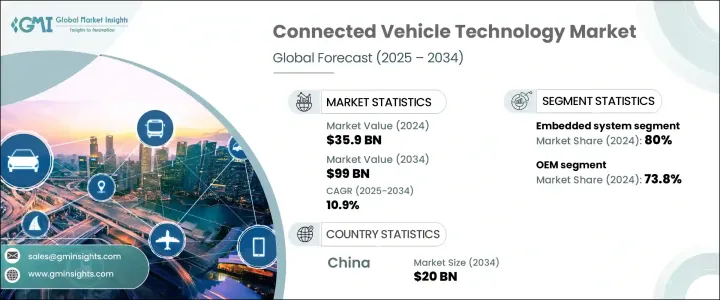

2024 年全球連網汽車技術市場價值為 359 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 10.9%。這一成長主要得益於數位解決方案的快速採用以及對更智慧、更安全、更有效率的交通運輸日益成長的需求。這一成長主要得益於政府激勵措施,例如車輛安全功能的稅收減免和汽車購買補貼,這些措施鼓勵消費者和製造商採用尖端汽車技術。連接性已成為現代汽車設計的一個重要方面,汽車製造商專注於將先進的遠端資訊處理、資訊娛樂和安全系統整合到他們的車型中。隨著技術的不斷發展,人工智慧、5G 網路和基於雲端的平台的日益廣泛使用,正在增強車與一切 (V2X) 通訊,改善整體駕駛體驗並確保更高的安全標準。

電動和自動駕駛汽車的日益普及也推動了市場擴張,因為這些汽車嚴重依賴嵌入式系統進行導航、診斷和遠端監控。汽車製造商擴大與科技公司合作,開發安全、高效能的數位解決方案,以增強連接性並保持網路安全。消費者的期望正在轉向車內個人化、無縫的數位體驗,這進一步推動製造商的創新。隨著無線(OTA)更新的興起,汽車製造商現在可以在購買後增強車輛功能,使汽車保持最新的軟體改進。這一趨勢使得連網汽車技術成為一種必需品而非選擇,加速了其在全球的普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 359億美元 |

| 預測值 | 990億美元 |

| 複合年成長率 | 10.9% |

車聯網技術市場主要分為V2X通訊和嵌入式系統。嵌入式系統由於在製造過程中直接整合到車輛中,將在 2024 年佔據最大佔有率。這些系統包括遠端資訊處理、資訊娛樂和導航解決方案,可改善使用者體驗、提高車輛性能並實現即時資料交換。隨著自動駕駛的推動,嵌入式系統變得更加重要,支援進階駕駛輔助系統 (ADAS) 和預測性維護解決方案。汽車製造商正在利用人工智慧驅動的分析來最佳化效能並提高道路安全,使嵌入式系統成為連網汽車生態系統的支柱。

連網汽車技術主要被兩個領域所採用:原始設備製造商(OEM)和售後市場。 2024 年, OEM領域佔據了 73.8% 的市場佔有率,反映了該行業對工廠安裝的連接解決方案的高度重視。製造商正在將遠端資訊處理和 V2X 通訊功能嵌入到新車輛中,以滿足消費者對無縫數位整合日益成長的需求。這種直接整合增強了車輛安全性、最佳化了性能並提高了駕駛效率,使 OEM 成為市場成長的主要驅動力。隨著越來越多的汽車製造商投資於智慧製造和基於雲端的平台,原始設備製造商在塑造連網移動未來方面的作用不斷擴大。

在積極的行銷活動、不斷成長的汽車銷售以及消費者對高科技汽車功能的強烈需求的推動下,中國聯網汽車技術市場預計將在 2034 年創造 200 億美元的市場規模。該國致力於減少排放和推動智慧交通解決方案的承諾也正在加速其應用。整個亞太地區的市場正在快速擴張,政府和汽車行業領導者積極推動該行業的數位轉型。隨著消費者對高階連結功能的興趣日益成長,北美也經歷了類似的發展勢頭。越來越多的購車者現在優先考慮配備整合數位解決方案的車輛,這使得連網汽車技術成為汽車產業未來的核心組成部分。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 汽車原廠設備製造商

- 技術提供者

- 電信公司

- 平台開發者

- 最終用戶

- 供應商概況

- 利潤率分析

- 車連網技術用例

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 安全功能的需求不斷增加

- 5G 連接的進步

- 人工智慧與機器學習的融合

- 不斷增加的政府法規和激勵措施

- 產業陷阱與挑戰

- 資料隱私和安全問題

- 實施成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按技術,2021-2034 年,

- 主要趨勢

- V2X 通訊

- 嵌入式系統

第6章:市場估計與預測:依車型,2021-2034,

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

- 電動車 (EV)

第 7 章:市場估計與預測:按應用,2021-2034 年,

- 主要趨勢

- 自動駕駛

- 出遊即服務 (MaaS)

- 資訊娛樂

- 車隊管理

- 安全和保障

- 車輛診斷與維護

第 8 章:市場估計與預測:依最終用途,2021-2034 年,

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Aptiv

- Atos

- AWS

- Bosch

- Cisco

- Continental

- Denso

- Ericsson

- Harman (Samsung Electronics)

- IBM

- Infineon Technologies

- Intel

- Microsoft

- Mobileye

- NXP Semiconductors

- Orange

- Qualcomm

- Telenor

- Verizon

- Vodafone

The Global Connected Vehicle Technology Market, valued at USD 35.9 billion in 2024, is set to expand at a CAGR of 10.9% between 2025 and 2034. The growth is driven by the rapid adoption of digital solutions and the increasing demand for smarter, safer, and more efficient transportation. This growth is fueled by government incentives such as tax breaks on vehicle safety features and subsidies for car purchases, which encourage both consumers and manufacturers to embrace cutting-edge automotive technologies. Connectivity has become an essential aspect of modern vehicle design, with automakers focusing on integrating advanced telematics, infotainment, and safety systems into their models. As technology continues to evolve, the growing use of artificial intelligence, 5G networks, and cloud-based platforms is enhancing vehicle-to-everything (V2X) communication, improving overall driving experiences, and ensuring higher safety standards.

The rising popularity of electric and autonomous vehicles is also propelling market expansion, as these vehicles rely heavily on embedded systems for navigation, diagnostics, and remote monitoring. Automakers are increasingly collaborating with technology companies to develop secure, high-performance digital solutions that enhance connectivity while maintaining cybersecurity. Consumer expectations are shifting towards personalized, seamless digital experiences within their vehicles, further pushing manufacturers to innovate. With the rise of over-the-air (OTA) updates, car manufacturers can now enhance vehicle functionality post-purchase, keeping cars up to date with the latest software improvements. This trend is making connected vehicle technology a necessity rather than an option, accelerating its adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.9 Billion |

| Forecast Value | $99 Billion |

| CAGR | 10.9% |

The market for connected vehicle technology is primarily divided into V2X communication and embedded systems. Embedded systems commanded the largest share in 2024 due to their direct integration into vehicles during the manufacturing process. These systems include telematics, infotainment, and navigation solutions that improve user experience, enhance vehicle performance, and enable real-time data exchange. With the push toward autonomous driving, embedded systems are becoming even more critical, supporting advanced driver-assistance systems (ADAS) and predictive maintenance solutions. Automakers are leveraging AI-driven analytics to optimize performance and increase road safety, making embedded systems the backbone of the connected vehicle ecosystem.

Connected vehicle technology is utilized by two major segments: original equipment manufacturers (OEMs) and the aftermarket. In 2024, the OEM segment held a commanding 73.8% market share, reflecting the industry's strong focus on factory-installed connectivity solutions. Manufacturers are embedding telematics and V2X communication capabilities into new vehicles, addressing growing consumer demands for seamless digital integration. This direct integration enhances vehicle safety, optimizes performance, and improves driving efficiency, positioning OEMs as the primary drivers of market growth. As more automakers invest in smart manufacturing and cloud-based platforms, the role of OEMs in shaping the future of connected mobility continues to expand.

China connected vehicle technology market is on track to generate USD 20 billion by 2034, driven by aggressive marketing campaigns, increasing vehicle sales, and a strong consumer appetite for high-tech automotive features. The country's commitment to reducing emissions and advancing smart transportation solutions is also accelerating adoption. The Asia-Pacific region as a whole is witnessing rapid market expansion, with governments and automotive leaders actively promoting digital transformation in the sector. North America is experiencing similar momentum as consumer interest in advanced connectivity features grows. A rising number of car buyers now prioritize vehicles equipped with integrated digital solutions, solidifying connected vehicle technology as a core component of the automotive industry's future.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automotive OEMs

- 3.1.2 Technology providers

- 3.1.3 Telecommunication companies

- 3.1.4 Platform developers

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Use cases of connected vehicle technology

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for safety features

- 3.8.1.2 Advancements in 5G connectivity

- 3.8.1.3 Integration of AI and machine learning

- 3.8.1.4 Growing government regulations and incentives

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Data privacy and security concerns

- 3.8.2.2 High cost of implementation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034, ($Bn)

- 5.1 Key trends

- 5.2 V2X communication

- 5.3 Embedded system

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021-2034, ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 Light Commercial Vehicles (LCVs)

- 6.3.2 Heavy Commercial Vehicles (HCVs)

- 6.4 Electric Vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034, ($Bn)

- 7.1 Key trends

- 7.2 Autonomous driving

- 7.3 Mobility as a Service (MaaS)

- 7.4 Infotainment

- 7.5 Fleet management

- 7.6 Safety and security

- 7.7 Vehicle diagnostics and maintenance

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034, ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Atos

- 10.3 AWS

- 10.4 Bosch

- 10.5 Cisco

- 10.6 Continental

- 10.7 Denso

- 10.8 Ericsson

- 10.9 Harman (Samsung Electronics)

- 10.10 IBM

- 10.11 Infineon Technologies

- 10.12 Intel

- 10.13 Microsoft

- 10.14 Mobileye

- 10.15 NXP Semiconductors

- 10.16 Orange

- 10.17 Qualcomm

- 10.18 Telenor

- 10.19 Verizon

- 10.20 Vodafone