|

市場調查報告書

商品編碼

1666526

精密齒輪箱機械市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Precision Gearbox Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

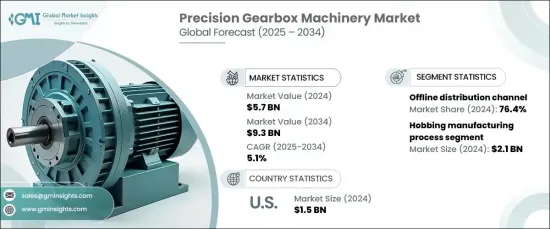

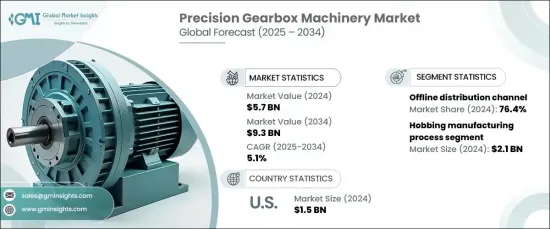

2024 年全球精密齒輪箱機械市場規模達到 57 億美元,預計 2025 年至 2034 年期間複合年成長率為 5.1 %。隨著行業技術的不斷進步,對精密變速箱解決方案的需求激增,以確保複雜機械的高效可靠運作。特別是汽車和航太領域強調安全性和準確性,推動採用符合嚴格性能和可靠性標準的先進變速箱。

市場也受益於製造業和工業過程中自動化和機器人技術的快速應用。企業正在將物聯網和智慧感測器等尖端技術整合到齒輪系統中,以實現即時監控、預測性維護和提高營運效率。這些創新不僅最佳化了電力傳輸,而且還透過減少能源損失來支持永續發展目標。人們越來越關注能源效率和減少環境影響,這進一步推動了先進變速箱解決方案的發展,強化了其作為現代工業運作基石的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 57億美元 |

| 預測值 | 93億美元 |

| 複合年成長率 | 5.1% |

滾齒製造流程在 2024 年貢獻了 21 億美元的產值,預計未來十年將以 5.5% 的強勁複合年成長率成長。工業界青睞滾齒,因為它具有無與倫比的生產複雜形狀和細齒廓齒輪的能力,這對於高性能應用至關重要。這種製造技術可確保卓越的精度、一致性和成本效率,使其成為各行業精密齒輪大規模生產的首選。

2024 年,線下分銷通路佔據 76.4% 的市場佔有率,預計在預測期內以 5% 的複合年成長率成長。由於需要個人化服務、技術諮詢和直接互動,線下管道仍然是首選。這些管道對於汽車、航太和製造等行業尤其重要,這些行業中的企業優先考慮對技術規格進行實際評估,以確保購買前變速箱解決方案的可靠性。

由於美國強大的製造業基礎和在自動化和機器人的領導地位,美國精密變速箱機械市場將在 2024 年創造 15 億美元的收入。美國是領先的機械和設備製造商的所在地,它促進持續創新並確保尖端變速箱技術的穩定供應。中國對工業自動化和精密工程的重視進一步擴大了對高性能齒輪系統的需求,鞏固了其作為全球市場成長關鍵貢獻者的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 模組化廚房越來越受歡迎

- 創新與產品開發

- 有序廚房的需求

- 可支配所得增加

- 產業陷阱與挑戰

- 低品質產品的耐用性問題

- 缺乏標準化

- 成長動力

- 技術與創新格局

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按製造程序,2021 年至 2034 年

- 主要趨勢

- 滾齒

- 研磨

- 轉向

- 珩磨

第 6 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 行星

- 直角

- 平行線

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 工具機

- 物料處理

- 包裝

- 機器人

- 汽車

- 越野車

- 風塔

- 農業

- 鐵路

- 海洋

- 其他

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 離線

- OEM (原始設備製造商)

- 專賣店/陳列室

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- DANOBAT

- DMG MORI

- DVS Technology Group

- EMAG

- Gleason Corporation

- Lagun Engineering

- Liebherr-International Deutschland

- Matrix Precision

- Nidec

- Reishauer

- Samputensili Cutting Tools

- JG WEISSER SOHNE

- Starrag Group

The Global Precision Gearbox Machinery Market reached USD 5.7 billion in 2024 and is projected to expand at a CAGR of 5.1% from 2025 to 2034. This growth reflects the rising demand for high-performance gear systems across key sectors, including automotive, aerospace, energy, and robotics. As industries continue to advance technologically, the need for precision gearbox solutions has surged to ensure the efficient and reliable operation of complex machinery. In particular, the automotive and aerospace sectors emphasize safety and accuracy, driving the adoption of advanced gearboxes that meet stringent performance and reliability standards.

The market is also benefiting from the rapid adoption of automation and robotics in manufacturing and industrial processes. Businesses are integrating cutting-edge technologies such as IoT and smart sensors into gear systems to enable real-time monitoring, predictive maintenance, and enhanced operational efficiency. These innovations not only optimize power transmission but also support sustainability goals by reducing energy losses. The growing focus on energy efficiency and minimizing environmental impact further fuels the development of advanced gearbox solutions, reinforcing their role as a cornerstone of modern industrial operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $9.3 Billion |

| CAGR | 5.1% |

The hobbing manufacturing process contributed USD 2.1 billion in 2024 and is forecasted to grow at a robust CAGR of 5.5% during the next decade. Industries favor hobbing for its unparalleled ability to produce gears with intricate shapes and fine-tooth profiles, which are essential for high-performance applications. This manufacturing technique ensures exceptional accuracy, consistency, and cost efficiency, making it the go-to choice for large-scale production of precision gears across industries.

In 2024, offline distribution channels accounted for 76.4% of the market share and are projected to grow at a CAGR of 5% over the forecast period. Offline channels remain a preferred choice due to the need for personalized service, technical consultations, and direct interactions. These channels are particularly vital for sectors such as automotive, aerospace, and manufacturing, where businesses prioritize hands-on evaluations of technical specifications to ensure the reliability of gearbox solutions before purchase.

The US precision gearbox machinery market generated USD 1.5 billion in 2024, driven by the country's robust manufacturing base and leadership in automation and robotics. Home to leading machinery and equipment manufacturers, the US fosters continuous innovation and ensures a steady supply of cutting-edge gearbox technologies. The nation's focus on industrial automation and precision engineering further amplifies the demand for high-performance gear systems, solidifying its position as a key contributor to global market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing preference for modular kitchens

- 3.2.1.2 Innovation and product development

- 3.2.1.3 Demand for organized kitchens

- 3.2.1.4 Rise in disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Durability concerns in low-quality products

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Manufacturing Process, 2021 – 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Hobbing

- 5.3 Grinding

- 5.4 Turning

- 5.5 Honing

Chapter 6 Market Estimates & Forecast, By Product, 2021 – 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Planetary

- 6.3 Right angle

- 6.4 Parallel

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Machine tools

- 7.3 Material handling

- 7.4 Packaging

- 7.5 Robotics

- 7.6 Automobile

- 7.7 Off-road vehicles

- 7.8 Wind towers

- 7.9 Agriculture

- 7.10 Railways

- 7.11 Marine

- 7.12 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce website

- 8.3 Offline

- 8.3.1 OEM (Original equipment manufacturer)

- 8.3.2 Specialty stores / showrooms

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 DANOBAT

- 10.2 DMG MORI

- 10.3 DVS Technology Group

- 10.4 EMAG

- 10.5 Gleason Corporation

- 10.6 Lagun Engineering

- 10.7 Liebherr-International Deutschland

- 10.8 Matrix Precision

- 10.9 Nidec

- 10.10 Reishauer

- 10.11 Samputensili Cutting Tools

- 10.12 J.G. WEISSER SOHNE

- 10.13 Starrag Group