|

市場調查報告書

商品編碼

1666545

超薄玻璃市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ultra-Thin Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

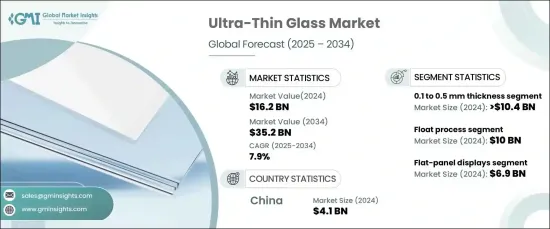

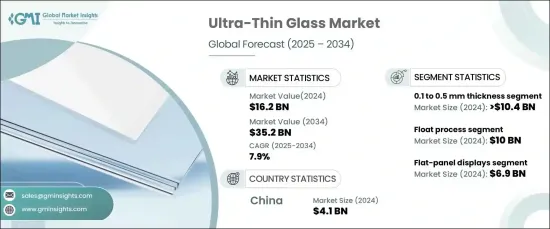

2024 年全球超薄玻璃市場規模將達到 162 億美元,預計 2025-2034 年期間複合年成長率將達到 7.9%。這一成長是由消費性電子、汽車和能源領域不斷成長的需求推動的,這些領域中輕質、靈活和耐用的材料至關重要。

0.1 至 0.5 毫米厚度部分佔據市場主導地位,2024 年的市場規模為 104 億美元,預計在 2025-2034 年期間將保持 7.7% 的複合年成長率的穩定成長。此厚度範圍內的超薄玻璃因其獨特的強度、柔韌性和透明度組合而廣泛採用。這些特性使其非常適合需要精確度的應用,例如軟性顯示器、穿戴式裝置和輕量面板。在汽車和能源領域,超薄玻璃擴大用於減輕重量、提高燃油效率和增強能源解決方案,例如太陽能電池板。此外,對永續和高性能材料的需求不斷成長,推動了其應用,而環保生產方法的進步為市場創造了新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 162億美元 |

| 預測值 | 352億美元 |

| 複合年成長率 | 7.9% |

浮法製程是超薄玻璃的主要生產方法,2024 年的價值為 100 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 7.8%。 該工藝可確保生產高品質、均勻且厚度精確的玻璃板,非常適合一致性和性能至關重要的應用。浮法製程支援薄型、輕型玻璃的開發,這種玻璃擴大應用於需要先進材料的行業,例如消費性電子、汽車和可再生能源。該工藝能夠滿足對耐用、高清晰度玻璃的需求,從而推動其在市場上持續保持重要地位。

中國引領全球超薄玻璃市場,2024 年貢獻 41 億美元,預計 2025 年至 2034 年的複合年成長率為 8.8%。中國在生產技術方面的進步和對永續性的重視進一步加速了市場的成長。作為全球製造業中心,中國完全有能力滿足軟性顯示器、輕量化組件和節能應用領域對超薄玻璃日益成長的需求。

整體而言,在技術進步、輕質材料需求不斷成長以及全球各行業對節能和永續解決方案的強力推動下,超薄玻璃市場將大幅擴張。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費性電子產品需求不斷成長

- 太陽能板滲透率不斷提高

- 由於其靈活性和強度,在醫療設備和感測器中的應用日益廣泛

- 產業陷阱與挑戰

- 製造流程複雜,原物料價格波動

- 來自塑膠和陶瓷等替代材料的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按厚度,2021-2034 年

- 主要趨勢

- 小於0.1毫米

- 0.1 至 0.5 毫米

- 0.5 至 1.2 毫米

第 6 章:市場估計與預測:按生產流程,2021-2034 年

- 主要趨勢

- 下拉工藝

- 溢流熔合工藝

- 浮法工藝

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 半導體基板

- 平面顯示器

- 觸控設備

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AGC Inc.

- Central Glass Co. Ltd.

- Changzhou Almaden Co. Ltd.

- Corning Inc.

- CSG Holdings Co. Ltd.

- Emerge Glass

- Luoyang Glass Co. Ltd.

- Nippon Sheet Glass Co., Ltd.

- Noval Glass Co. Ltd.

- Schott AG

- Taiwan Glass Ind

- Xinyi Glass Holdings Ltd.

The Global Ultra-Thin Glass Market reached USD 16.2 billion in 2024 and is projected to grow at a robust CAGR of 7.9% during 2025-2034. This growth is driven by rising demand across consumer electronics, automotive, and energy sectors, where lightweight, flexible, and durable materials are essential.

The 0.1 to 0.5 mm thickness segment dominated the market, accounting for USD 10.4 billion in 2024, and is expected to maintain steady growth at a 7.7% CAGR during 2025-2034. Ultra-thin glass in this thickness range is witnessing high adoption due to its unique combination of strength, flexibility, and transparency. These properties make it highly suitable for applications requiring precision, such as flexible displays, wearable devices, and lightweight panels. In the automotive and energy sectors, ultra-thin glass is increasingly used to reduce weight, improve fuel efficiency, and enhance energy solutions, such as solar panels. Additionally, the growing demand for sustainable and high-performance materials is boosting its adoption, while advancements in eco-friendly production methods are creating new opportunities in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.2 Billion |

| Forecast Value | $35.2 Billion |

| CAGR | 7.9% |

The float process, a key production method for ultra-thin glass, was valued at USD 10 billion in 2024 and is anticipated to grow at a CAGR of 7.8% throughout 2025- 2034. This process ensures the production of high-quality, uniform glass sheets with precise thickness, making it ideal for applications where consistency and performance are critical. The float process supports the development of thin, lightweight glass, which is increasingly used in industries requiring advanced materials, such as consumer electronics, automotive, and renewable energy. The process's ability to meet the demand for durable, high-clarity glass drives its continued significance in the market.

China leads the global ultra-thin glass market, contributing USD 4.1 billion in 2024, with a projected CAGR of 8.8% from 2025 to 2034. The country's market dominance is fueled by its strong consumer electronics sector, growing automotive industry, and increasing investment in renewable energy solutions. China's advancements in production technologies and focus on sustainability are further accelerating the market growth. As a global manufacturing hub, China is well-positioned to meet the rising demand for ultra-thin glass in flexible displays, lightweight components, and energy-efficient applications.

Overall, the ultra-thin glass market is set for significant expansion, driven by technological advancements, increasing demand for lightweight materials, and a strong push for energy-efficient and sustainable solutions across industries worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for consumer electronics

- 3.6.1.2 Growing penetration in solar panels

- 3.6.1.3 Rising use in medical devices and sensors due to its flexibility and strength

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complex manufacturing process and fluctuating raw material prices

- 3.6.2.2 Competition from alternative materials such as plastics and ceramics

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Less than 0.1 mm

- 5.3 0.1 to 0.5 mm

- 5.4 0.5 to 1.2 mm

Chapter 6 Market Estimates & Forecast, By Production Process, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Downdraw process

- 6.3 Overflow- fusion process

- 6.4 Float process

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Semiconductors substrate

- 7.3 Flat-panel displays

- 7.4 Touch-control devices

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AGC Inc.

- 9.2 Central Glass Co. Ltd.

- 9.3 Changzhou Almaden Co. Ltd.

- 9.4 Corning Inc.

- 9.5 CSG Holdings Co. Ltd.

- 9.6 Emerge Glass

- 9.7 Luoyang Glass Co. Ltd.

- 9.8 Nippon Sheet Glass Co., Ltd.

- 9.9 Noval Glass Co. Ltd.

- 9.10 Schott AG

- 9.11 Taiwan Glass Ind

- 9.12 Xinyi Glass Holdings Ltd.

![超薄玻璃市場:趨勢、機遇和競爭分析[2023-2028]](/sample/img/cover/42/1300081.png)