|

市場調查報告書

商品編碼

1666582

氫能儲存市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hydrogen Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

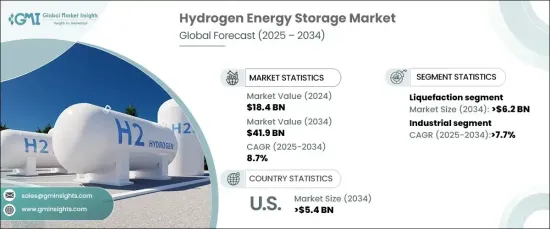

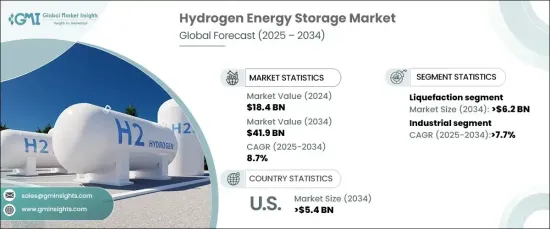

2024 年全球氫能儲存市場價值為 184 億美元,預計將大幅成長,預計 2025 年至 2034 年的複合年成長率為 8.7%。氫能儲存提供了一種有效的解決方案,它可以在發電量低的時期捕獲多餘的再生能源並將其轉化為電能,確保可靠的能源供應。

氫儲存技術的進步正在改變市場格局。壓縮和低溫液態氫儲存方法由於其效率和可擴展性而變得越來越受歡迎。此外,基於材料的儲存選項,包括金屬氫化物和液態有機氫載體,為各種應用提供了更安全、更節省空間的解決方案。固態和基於氨的儲氫系統等新興技術也在積極開發中,進一步使該產業多樣化。這些創新解決了與儲存密度、運輸和效率相關的關鍵挑戰,加強了氫氣作為可行能源載體的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 184億美元 |

| 預測值 | 419億美元 |

| 複合年成長率 | 8.7% |

在儲存方法方面,液化領域預計將出現顯著成長,到 2034 年將達到 62 億美元。隨著全球脫碳努力的加強,這種方法支持了對清潔能源載體日益成長的需求。擴大對氫基礎設施的投資進一步推動了液化技術的採用。

在應用方面,工業部門在預測期內的複合年成長率預計將超過 7.7%。各行各業越來越注重整合氫儲存系統以提高能源效率並減少排放。氫氣是各種工業過程中的關鍵組成部分,符合全球氣候目標並支持向永續能源解決方案的過渡。

在再生能源和脫碳計畫的策略性投資的推動下,美國氫能儲存市場規模預計到 2034 年將超過 54 億美元。該國承諾在2050年實現淨零排放,加速了氫氣生產和儲存系統的發展。對來自再生能源的綠氫的重視凸顯了其在該國能源轉型策略中的關鍵作用。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模與預測:依方法,2021 – 2034 年

- 主要趨勢

- 壓縮

- 液化

- 基於材料

第 6 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 工業的

- 運輸

- 固定式

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 世界其他地區

第8章:公司簡介

- Air Liquide

- Air Products

- Cockerill Jingli Hydrogen

- Engie

- FuelCell Energy

- GKN Hydrogen

- Gravitricity

- Hydrogen in Motion

- ITM Power

- Linde

- McPhy Energy

- Nel

- SSE

The Global Hydrogen Energy Storage Market, valued at USD 18.4 billion in 2024, is poised for substantial growth, with an anticipated CAGR of 8.7% from 2025 to 2034. This growth is largely fueled by the rising adoption of renewable energy sources such as solar and wind, which are inherently variable and can create challenges in maintaining grid stability. Hydrogen energy storage offers an effective solution by capturing excess renewable energy and converting it into electricity during periods of low generation, ensuring a reliable energy supply.

Advancements in hydrogen storage technologies are transforming the market landscape. Compressed and cryogenic liquid hydrogen storage methods are becoming increasingly popular due to their efficiency and scalability. In addition, material-based storage options, including metal hydrides and liquid organic hydrogen carriers, provide safer and more space-efficient solutions for various applications. Emerging technologies such as solid-state and ammonia-based hydrogen storage systems are also under active development, further diversifying the industry. These innovations address critical challenges related to storage density, transportation, and efficiency, strengthening hydrogen's role as a viable energy carrier.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.4 Billion |

| Forecast Value | $41.9 Billion |

| CAGR | 8.7% |

In terms of storage methods, the liquefaction segment is expected to witness significant growth, reaching USD 6.2 billion by 2034. Its appeal lies in its ability to store hydrogen in a compact form with high energy density, making it suitable for large-scale applications. This method supports the increasing demand for clean energy carriers as global decarbonization efforts intensify. Expanding investments in hydrogen infrastructure further drive the adoption of liquefaction technologies.

On the application front, the industrial sector is projected to grow at a CAGR of over 7.7% during the forecast period. Industries are increasingly focusing on integrating hydrogen storage systems to enhance energy efficiency and reduce emissions. Hydrogen serves as a critical component in various industrial processes, aligning with global climate goals and supporting the transition toward sustainable energy solutions.

The U.S. hydrogen energy storage market is forecast to exceed USD 5.4 billion by 2034, driven by strategic investments in renewable energy and decarbonization initiatives. The nation's commitment to achieving net-zero emissions by 2050 has accelerated the development of hydrogen production and storage systems. The emphasis on green hydrogen, derived from renewable energy sources, highlights its pivotal role in the country's energy transition strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Method, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Compression

- 5.3 Liquefaction

- 5.4 Material-based

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Industrial

- 6.3 Transportation

- 6.4 Stationary

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Netherlands

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Air Liquide

- 8.2 Air Products

- 8.3 Cockerill Jingli Hydrogen

- 8.4 Engie

- 8.5 FuelCell Energy

- 8.6 GKN Hydrogen

- 8.7 Gravitricity

- 8.8 Hydrogen in Motion

- 8.9 ITM Power

- 8.10 Linde

- 8.11 McPhy Energy

- 8.12 Nel

- 8.13 SSE