|

市場調查報告書

商品編碼

1666638

極低硫燃料油 (VLSFO) 市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Very Low Sulphur Fuel Oil (VLSFO) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

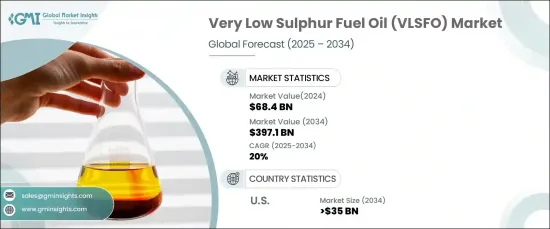

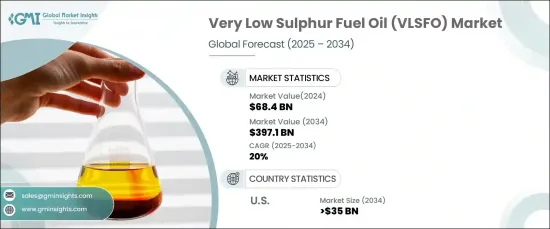

2024 年全球極低硫燃料油市場價值 684 億美元,預計將大幅擴張,預計 2025 年至 2034 年的複合年成長率為 20%。預計將大幅擴張,預計 2025 年至 2034 年的複合年成長率為 20%。這種轉變不僅推動了對低硫燃料的需求,也促使煉油廠提高生產能力以滿足不斷變化的標準,從而進一步推動市場成長。

除了監管促進因素外,航運業正在快速發展,環保意識的增強也促進了對 VLSFO 的需求增加。永續航運實踐現在比以往任何時候都更加受到關注,目的是減少碳排放和保護海洋生態系統。向環保燃料的轉變與這些目標完全一致。隨著更多加油設施的投入使用以及歐洲和亞太等主要地區的船舶交通量不斷增加,VLSFO 市場在這些地區已廣泛應用。企業正在投資創新技術,以最佳化營運效率,同時確保遵守環境法規,從而確保市場持續擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 684億美元 |

| 預測值 | 3971億美元 |

| 複合年成長率 | 20% |

採用低硫推進技術改造現有船舶的趨勢進一步推動了 VLSFO 的需求。隨著海上客運量的持續成長和區域港口的發展,市場的發展趨勢仍然積極。此外,政府對擴大海軍艦隊的投資,特別是在國防領域,例如航空母艦和潛艦等軍艦,也可能增加這些領域對 VLSFO 的需求。

在美國,超低硫燃料油 (VLSFO) 市場規模預計到 2034 年將達到 350 億美元。此外,當地法規正在促進使用更清潔的燃料,而減少海上活動污染的需求進一步推動了對 VLSFO 的需求。隨著人們對豪華性和可靠性船舶的需求不斷成長,對營運可靠性的關注度也不斷提高,這繼續推動市場的成長。隨著經濟持續穩定和對環保航運的更加重視,美國 VLSFO 市場預計將在未來十年繼續蓬勃發展。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 西班牙

- 俄羅斯

- 英國

- 義大利

- 法國

- 德國

- 比利時

- 荷蘭

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 新加坡

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第6章:公司簡介

- BP

- Chevron

- Exxon Mobil

- Hindustan Petroleum

- Indian Oil

- Marathon Petroleum

- Mediterranean Fuels

- Phillips 66

- Rosneft

- Saudi Aramco

- Shell

- Sinopec

- TotalEnergies

- Viva Energy

- Vitol

The Global Very Low Sulphur Fuel Oil Market, valued at USD 68.4 billion in 2024, is poised for significant expansion, with an expected CAGR of 20% from 2025 to 2034. This market surge is largely driven by the stringent sulphur emission regulations enforced by the International Maritime Organization (IMO) since 2020. These regulations require shipping companies worldwide to transition to VLSFO, a cleaner marine fuel alternative that complies with the new sulphur content standards. This shift is not only pushing the demand for low-sulphur fuels but also prompting refineries to enhance their production capabilities to meet these evolving standards, further fueling market growth.

Beyond regulatory drivers, the maritime sector is growing rapidly, with rising environmental awareness also contributing to the increased demand for VLSFO. Sustainable shipping practices are now more than ever a central focus, with the aim to reduce carbon emissions and protect marine ecosystems. The shift toward eco-friendly fuels aligns perfectly with these objectives. As more bunkering facilities become available and vessel traffic intensifies in key regions like Europe and Asia-Pacific, the VLSFO market is seeing widespread adoption across these regions. Companies are investing in innovative technologies to optimize operational efficiency while ensuring compliance with environmental regulations, thus ensuring continued market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.4 Billion |

| Forecast Value | $397.1 Billion |

| CAGR | 20% |

The trend toward retrofitting existing vessels with low-sulphur propulsion technologies is boosting the VLSFO demand even further. As seaborne passenger traffic continues to grow and regional ports develop, the market's trajectory remains positive. In addition, government investments in expanding naval fleets, particularly in the defense sector with military vessels such as aircraft carriers and submarines, will likely increase the demand for VLSFO in these segments as well.

In the U.S., the Very Low sulphur Fuel Oil (VLSFO) market is projected to reach USD 35 billion by 2034. The increasing demand for low-sulphur fuels is being driven by tighter sulphur emission regulations and the proximity of refineries that can meet the new standards. Additionally, local regulations are fostering the adoption of cleaner fuels, while the need to reduce pollution from seaborne activities is further pushing the demand for VLSFO. The growing focus on operational reliability, in line with the rising demand for vessels that offer luxury and dependability, continues to fuel the market's growth. With ongoing economic stability and a stronger focus on eco-friendly shipping, the U.S. VLSFO market is expected to continue flourishing in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 North America

- 5.2.1 U.S

- 5.2.2 Canada

- 5.3 Europe

- 5.3.1 Spain

- 5.3.2 Russia

- 5.3.3 UK

- 5.3.4 Italy

- 5.3.5 France

- 5.3.6 Germany

- 5.3.7 Belgium

- 5.3.8 Netherlands

- 5.4 Asia Pacific

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 South Korea

- 5.4.4 India

- 5.4.5 Australia

- 5.4.6 Singapore

- 5.5 Middle East & Africa

- 5.5.1 UAE

- 5.5.2 Saudi Arabia

- 5.5.3 Turkey

- 5.5.4 South Africa

- 5.6 Latin America

- 5.6.1 Brazil

- 5.6.2 Mexico

- 5.6.3 Argentina

Chapter 6 Company Profiles

- 6.1 BP

- 6.2 Chevron

- 6.3 Exxon Mobil

- 6.4 Hindustan Petroleum

- 6.5 Indian Oil

- 6.6 Marathon Petroleum

- 6.7 Mediterranean Fuels

- 6.8 Phillips 66

- 6.9 Rosneft

- 6.10 Saudi Aramco

- 6.11 Shell

- 6.12 Sinopec

- 6.13 TotalEnergies

- 6.14 Viva Energy

- 6.15 Vitol