|

市場調查報告書

商品編碼

1666657

太陽能電纜市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Solar Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

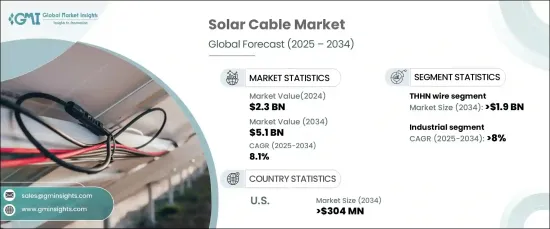

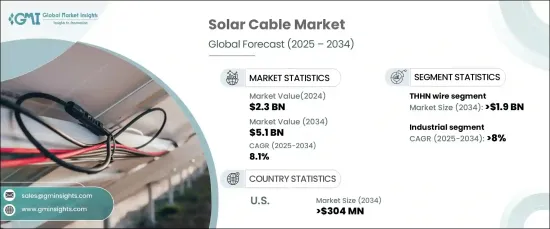

受全球太陽能專案快速擴張的推動,全球太陽能電纜市場預計在 2024 年實現 23 億美元的強勁複合年成長率,從 2025 年到 2034 年,複合年成長率達 8.1%。隨著政府激勵措施不斷加強、永續發展要求不斷加強以及對淨零排放的追求,再生能源投資激增。太陽能電纜在住宅、商業和公用事業規模的太陽能裝置的連接和傳輸電力方面發揮關鍵作用,使其成為再生能源基礎設施中不可或缺的一部分。

技術進步大大提高了太陽能電纜的效率、耐用性和安全性。提高抗紫外線能力、耐高溫能力和延長使用壽命等創新可確保在惡劣的環境條件下達到最佳性能。這項技術進步與太陽能系統與能源儲存解決方案和智慧電網的日益融合相一致,為更永續和可靠的能源生態系統鋪平了道路。全球對再生能源目標的承諾日益增加以及太陽能光電 (PV) 系統成本的下降也推動了市場的發展,從而繼續擴大其可及性和採用範圍。由於中國和印度的大規模太陽能發展,亞太地區引領了這一成長勢頭,同時,在支持性政策框架和財政激勵措施的推動下,北美和歐洲也正在經歷穩步成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 51億美元 |

| 複合年成長率 | 8.1% |

由於其出色的耐用性、多功能性和成本效益,THHN 線材市場的規模預計將在 2034 年超過 19 億美元。熱塑性高耐熱尼龍塗層 (THHN) 電線以其強大的絕緣性能而聞名,可確保高效的能量傳輸,同時減少功率損耗。它們具有優異的耐熱、防潮和耐磨性能,是室內和室外太陽能應用的理想選擇。隨著太陽能光電系統的部署擴展到住宅、商業和公用事業規模的項目,對可靠和高性能 THHN 電線的需求持續上升。

在工業領域,預計到 2034 年,太陽能電纜市場的複合年成長率將超過 8%,這得益於人們迅速採用太陽能來實現永續發展目標並最大限度地降低營運費用。隨著企業尋求抵消不斷上漲的電力成本並利用政府激勵措施,大規模工業太陽能裝置變得越來越普遍。這些裝置需要強大的基礎設施,包括耐用的太陽能電纜,以確保持續的能量傳輸和系統可靠性。利用太陽能增強的製造和施工流程進一步推動了對高效能電纜解決方案的需求。

隨著住宅、商業和公用事業規模項目擴大採用太陽能系統,美國太陽能電纜市場規模預計到 2034 年將超過 3.04 億美元。投資稅收抵免(ITC)等聯邦舉措和州級激勵措施正在刺激太陽能的廣泛安裝,而雄心勃勃的可再生能源目標(包括到 2050 年實現淨零排放)則推動了對太陽能基礎設施的持續投資。高品質的太陽能電纜對於實現這些目標至關重要,可確保先進的太陽能系統高效可靠地運作。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第3章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 4 章:市場規模與預測:按類型,2021 – 2034 年

- 主要趨勢

- 直流絲

- USE-2 線

- THHN 焊絲

第 5 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第6章:市場規模及預測:依目前,2021 – 2034 年

- 主要趨勢

- 交流

- 直流

第 7 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Alpha Wire

- Allied Wire and Cable

- Belden

- Fujikura

- Furukawa Electric

- General Cable

- Havells

- Helukabel

- Hellenic Group

- Kabelwerk Eupen

- KEI Industries

- Lapp Group

- Leoni

- LS Cable and System

- Nexans

- Northwire

- Polycab

- Prysmian Group

- RR Kabel

- Southwire Company

- TE Connectivity

The Global Solar Cable Market, valued at USD 2.3 billion in 2024, is poised to grow at a robust CAGR of 8.1% from 2025 to 2034, driven by the rapid expansion of solar energy projects worldwide. Investments in renewable energy have surged in response to escalating government incentives, sustainability mandates, and the pursuit of net-zero emissions. Solar cables play a pivotal role in connecting and transmitting power across residential, commercial, and utility-scale solar installations, making them indispensable to the renewable energy infrastructure.

Technological advancements are significantly enhancing the efficiency, durability, and safety of solar cables. Innovations such as improved UV resistance, temperature tolerance, and enhanced lifespan ensure optimal performance under harsh environmental conditions. This technological progress aligns with the increasing integration of solar energy systems with energy storage solutions and smart grids, paving the way for a more sustainable and reliable energy ecosystem. The market is also buoyed by a growing global commitment to renewable energy targets and the declining cost of solar photovoltaic (PV) systems, which continue to expand accessibility and adoption. While the Asia Pacific region leads this surge, thanks to large-scale solar developments in China and India, North America and Europe are also experiencing steady growth, driven by supportive policy frameworks and financial incentives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 8.1% |

The THHN wire segment is poised to exceed USD 1.9 billion by 2034 due to its exceptional durability, versatility, and cost-effectiveness. Thermoplastic High Heat-Resistant Nylon-coated (THHN) wires are renowned for their robust insulation properties, which ensure efficient energy transmission while reducing power losses. Their superior resistance to heat, moisture, and abrasion makes them ideal for both indoor and outdoor solar applications. As the deployment of solar PV systems expands across residential, commercial, and utility-scale projects, the demand for reliable and high-performance THHN wires continues to rise.

In the industrial sector, the solar cable market is projected to grow at a CAGR exceeding 8% through 2034, fueled by the rapid adoption of solar energy to achieve sustainability goals and minimize operational expenses. Large-scale industrial solar installations are becoming increasingly common as businesses seek to offset rising electricity costs and capitalize on government incentives. These installations require robust infrastructure, including durable solar cables, to ensure consistent energy transmission and system reliability. Enhanced manufacturing and construction processes leveraging solar energy further drive the need for efficient cable solutions.

The U.S. solar cable market is expected to surpass USD 304 million by 2034, driven by the growing adoption of solar energy systems across residential, commercial, and utility-scale projects. Federal initiatives such as the Investment Tax Credit (ITC) and state-level incentives are spurring widespread installations, while ambitious renewable energy targets, including net-zero emissions by 2050, fuel ongoing investments in solar infrastructure. High-quality solar cables are integral to achieving these goals, ensuring the efficient and reliable operation of advanced solar energy systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Strategic dashboard

- 3.2 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 4.1 Key trends

- 4.2 PW wire

- 4.3 USE-2 wire

- 4.4 THHN wire

Chapter 5 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Industrial

Chapter 6 Market Size and Forecast, By Current, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 AC

- 6.3 DC

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Alpha Wire

- 8.2 Allied Wire and Cable

- 8.3 Belden

- 8.4 Fujikura

- 8.5 Furukawa Electric

- 8.6 General Cable

- 8.7 Havells

- 8.8 Helukabel

- 8.9 Hellenic Group

- 8.10 Kabelwerk Eupen

- 8.11 KEI Industries

- 8.12 Lapp Group

- 8.13 Leoni

- 8.14 LS Cable and System

- 8.15 Nexans

- 8.16 Northwire

- 8.17 Polycab

- 8.18 Prysmian Group

- 8.19 RR Kabel

- 8.20 Southwire Company

- 8.21 TE Connectivity