|

市場調查報告書

商品編碼

1666913

採礦浮選化學品市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Mining Flotation Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

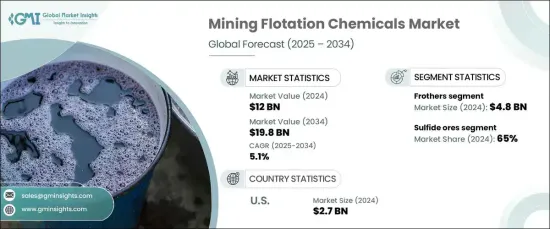

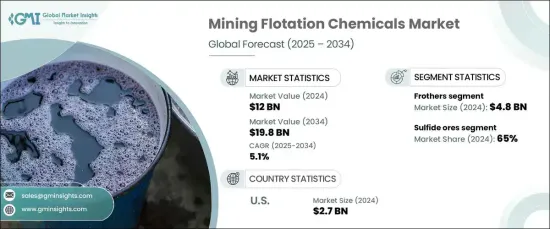

2024 年全球礦業浮選化學品市場價值為 120 億美元,預計 2025 年至 2034 年期間將以 5.1% 的強勁複合年成長率成長。透過在礦漿表面形成穩定的泡沫層,它們使礦物顆粒黏附在氣泡上,從而促進有效萃取。這項技術始終處於採礦業進步的前沿,並支持從建築到技術等各個行業。

隨著工業化和基礎設施的快速發展,全球對基本金屬和礦物的需求不斷成長,從而推動了對採礦浮選化學品的需求。隨著各國不斷投資大型項目,對高效和永續的開採方法的重視程度也不斷提高。浮選化學品對於最佳化礦物回收率、減少浪費和提高整體加工效率至關重要。隨著礦物加工技術的不斷創新,市場有望利用全球採礦活動日益增加所帶來的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 120億美元 |

| 預測值 | 198億美元 |

| 複合年成長率 | 5.1% |

市場按化學品類型細分,包括起泡劑、收集劑、活化劑、分散劑和特殊化學品。起泡器佔據了市場的最大佔有率,對收入的貢獻巨大。它們在產生泡沫以促進礦物分離方面發揮著不可或缺的作用。另一個關鍵類別是捕收劑,其需求量正在上升,因為它們能增強礦物與氣泡的附著力,確保浮選過程中的更高效率。其他特種化學品在解決獨特的採礦挑戰中也發揮關鍵作用,進一步促進了它們在整個行業中的應用。

按礦石類型分類,市場包括硫化礦石和非硫化礦石。由於硫化礦在採礦作業中普遍存在,因此目前佔據主導地位。然而,由於非硫化礦石的工業用途廣泛,其需求正在激增。非硫化礦石中含有的磷酸鹽和鉀鹽等礦物擴大用於農業肥料和其他工業過程。礦業公司正在進行資源開採多元化,以利用這些經濟上可行的替代方案,進一步推動這一領域的成長。

在美國,截至 2024 年,採礦浮選化學品市場價值為 27 億美元,強勁的國內採礦業推動了市場穩步成長。國家努力減少對進口礦產的依賴並支持國內開採,這是一個重要的動力。礦物加工技術的進步,加上對採礦基礎設施的大量投資,正在促進浮選化學品的採用。關鍵礦物對高科技產業至關重要,是關注的焦點,而促進永續採礦實踐的政策進一步加速了市場擴張。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對賤金屬和貴金屬的需求不斷增加

- 礦石品位下降

- 浮選技術的進步

- 產業陷阱與挑戰

- 原物料價格波動

- 來自替代品的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按化學類型,2021-2034 年

- 主要趨勢

- 起泡器

- 收藏家

- 活化劑

- 分散劑

- 其他(抑制劑、表面改質劑)

第6章:市場估計與預測:依礦石類型,2021-2034 年

- 主要趨勢

- 硫化礦

- 非硫化物礦石

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 賤金屬開採

- 貴金屬開採

- 工業礦物開採

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 銅礦開採

- 金銀開採

- 鎳和鉑族金屬開採

- 鋅礦開採

- 其他(鐵礦石、煤礦)

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Arkema

- BASF SE

- Beijing Hengju

- Cheminova

- Chevron Phillips Chemical

- Clariant

- Cytec Industries

- Dow

- Huntsman

- Kemira

- NASACO

- Nouryon

- Rhodia

- Solvay

- Wacker Chemie

The Global Mining Flotation Chemicals Market, valued at USD 12 billion in 2024, is expected to grow at a robust CAGR of 5.1% from 2025 to 2034. These chemicals play an indispensable role in mineral separation, acting as critical agents in the flotation process. By forming a stable froth layer on the surface of the slurry, they enable mineral particles to adhere to air bubbles, facilitating efficient extraction. This technology remains at the forefront of advancements in the mining sector, supporting industries ranging from construction to technology.

The demand for mining flotation chemicals is fueled by the growing need for base metals and minerals worldwide, driven by rapid industrialization and infrastructure development. As nations continue to invest in large-scale projects, the emphasis on efficient and sustainable extraction methods intensifies. Flotation chemicals are integral to optimizing mineral recovery, reducing waste, and improving overall processing efficiency. With ongoing innovations in mineral processing technologies, the market is poised to capitalize on opportunities stemming from increasing mining activities across the globe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 5.1% |

The market is segmented by chemical types, including frothers, collectors, activators, dispersants, and specialty chemicals. Frothers command the largest share of the market, contributing significantly to revenue. Their role in creating froth that facilitates mineral separation makes them indispensable. Collectors, another key category, are experiencing rising demand as they enhance the attachment of minerals to air bubbles, ensuring higher efficiency during the flotation process. Other specialty chemicals also play pivotal roles in addressing unique mining challenges, further boosting their adoption across the sector.

When categorized by ore type, the market includes sulfide ores and non-sulfide ores. Sulfide ores currently dominate, thanks to their prevalence in mining operations. However, non-sulfide ores are witnessing a surge in demand due to their diverse industrial applications. Minerals like phosphate and potash, found in non-sulfide ores, are increasingly used in agriculture for fertilizers and in other industrial processes. Mining companies are diversifying resource extraction to capitalize on these economically viable alternatives, further driving growth in this segment.

In the United States, the mining flotation chemicals market is valued at USD 2.7 billion as of 2024, with steady growth bolstered by a strong domestic mining sector. The nation's push to reduce reliance on imported minerals and support domestic extraction has been a significant driver. Advancements in mineral processing technologies, coupled with substantial investments in mining infrastructure, are fostering the adoption of flotation chemicals. Critical minerals, essential for high-tech industries, are a focal point, with policies promoting sustainable mining practices further accelerating market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for base and precious metals

- 3.6.1.2 Declining ore grades

- 3.6.1.3 Advancements in flotation technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility of raw material

- 3.6.2.2 Competition from substitute

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Chemical Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Frothers

- 5.3 Collectors

- 5.4 Activators

- 5.5 Dispersants

- 5.6 Others (depressants, surface modifiers)

Chapter 6 Market Estimates & Forecast, By Ore Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Sulfide ores

- 6.3 Non-sulfide ores

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Base metal mining

- 7.3 Precious metal mining

- 7.4 Industrial minerals mining

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Copper mining

- 8.3 Gold and silver mining

- 8.4 Nickel and platinum group metals mining

- 8.5 Zinc mining

- 8.6 Others (iron ore, coal mining)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arkema

- 10.2 BASF SE

- 10.3 Beijing Hengju

- 10.4 Cheminova

- 10.5 Chevron Phillips Chemical

- 10.6 Clariant

- 10.7 Cytec Industries

- 10.8 Dow

- 10.9 Huntsman

- 10.10 Kemira

- 10.11 NASACO

- 10.12 Nouryon

- 10.13 Rhodia

- 10.14 Solvay

- 10.15 Wacker Chemie