|

市場調查報告書

商品編碼

1685699

礦業化學品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Mining Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

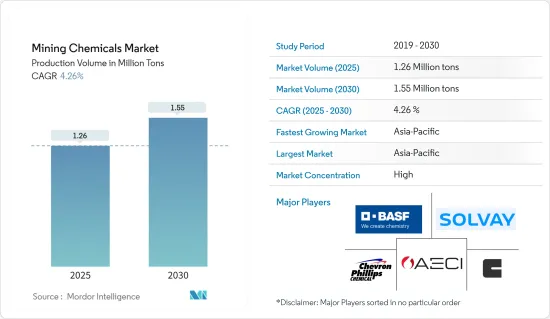

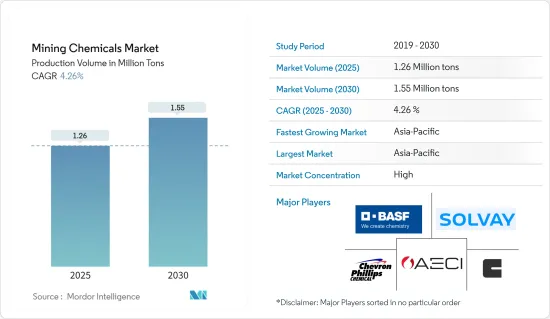

根據產量計算,採礦化學品市場規模預計將從 2025 年的 126 萬噸擴大到 2030 年的 155 萬噸,預測期內(2025-2030 年)的複合年成長率為 4.26%。

COVID-19 疫情阻礙了採礦化學品市場的發展,一些國家實施全國封鎖和嚴格的社交距離措施,影響了礦物加工和污水處理應用。然而,隨著礦產加工產業需求的恢復,放鬆管制後市場實現了顯著的成長率。

亞太地區和北美地區採礦活動的增加以及各終端行業對礦物的需求不斷增加,預計將推動採礦化學品市場的發展。

另一方面,與採礦和危險採礦化學品相關的嚴格政府法規預計將阻礙市場成長。

非洲尚未開發的採礦潛力和日益成長的稀土元素相關探勘活動預計將在未來幾年創造有利可圖的市場機會。

亞太地區佔據市場主導地位,預計在預測期內將呈現最高的複合年成長率。

礦業化學品市場趨勢

礦物加工中採礦化學品的使用增加

- 礦物處理又稱礦物選礦。它是一種提取冶金術,將有價值的礦物(通常從礦石中)濃縮並分離成可銷售的產品。礦物加工在礦場進行,且高度機械化。礦物加工每個階段使用的設備類型包括破碎/研磨設備、分級/篩選設備、濃縮設備和脫水設備。

- 礦山的盈利取決於從礦石中提取的所需礦物精礦的數量。因此,礦物加工的目的是為了在產品交付到市場之前獲得最大數量的礦物精礦。這是將礦石轉化為可出售和日常使用的產品的重要步驟。

- 礦物加工用於提取黃銅礦、鋁、鉻鐵礦、礬土、銅、金、鐵、赤鐵礦、鉛、鉬、磁鐵礦、鋅、錫、鎳、銀和鉑等金屬,以及煤、建築石材、花崗岩、粘土、鉀肥、石灰石、沙子和大理石等岩石。

- 工業礦石有鑽石、重晶石、磷灰石、石榴石、螢石、鋯石、石英、寶石、蛭石、矽灰石等。從事礦物加工業務的公司包括BASF、科萊恩、索理思、Syensqo 和藝康。 Syensqo 浮選藥劑廣泛應用於採礦業,適合各種加工條件和礦石類型。該公司的浮選藥劑可提高貴金屬和基底金屬的回收率,包括金、銅、銀、鉬、多金屬、鈷、鎳、鋰和鉑族金屬。

- 公司也向採礦業引入新產品和創新以獲得競爭優勢。例如,2023年10月,BASF宣布推出兩個針對採礦業的新型浮選藥劑品牌Luprofroth和Luproset。這些品牌拓展了公司的浮選業務,使BASF成為採礦業完整解決方案的提供者。

- 鋁和鋼開採需要大量化學品用於各種目的,包括提煉、分離、破碎和爆破。使用的化合物包括氫氧化鈉、硝酸銨、氫氧化鈣、堿灰和石灰。這些物質的使用受到管制,以確保工人和環境的安全。

- 根據世界鋼鐵協會預測,2022年全球粗鋼產量將達18.7億噸。根據國際鋁業協會預測,2023年終鋁產量將達7,059萬噸,較2022年水準成長2.25%。

- 因此,由於上述因素,預計礦物加工部門將在預測期內主導採礦化學品市場。

預計亞太地區將在預測期內佔據市場主導地位

- 預計預測期內亞太地區將主導採礦化學品市場。中國、日本和印度等國家對礦物加工和污水處理應用的採礦化學品的需求日益增加。

- 中國是世界最大礦業國家之一。中國是世界上最大的20多種金屬生產國。這些金屬包括鋁、金、石墨等。中國也是鋼鐵、鉛、鎂和稀土的主要生產國。中國也是鋅的主要出口國。

- 此外,中國在全球關鍵礦產供應鏈中佔據主導地位,約佔全球產量的60%和加工能力的85%。在政府大量投資的支持下,中國正積極開發深海鋰和鈷資源。這一戰略重點使中國成為這一新興採礦業的主導者,俄羅斯和韓國也在該領域取得了顯著進展。

- 由於智慧城市、印度製造宣傳活動等多項措施的實施,以及國家電力政策下對可再生能源計劃的加強重視,印度金屬和採礦業正與舉措同步成長。

- 預計本會計年度採礦業將成長 8.1%,較 2022-23 年的 4.1% 大幅上升。 2024 年 2 月,國營印度煤炭公司計劃在 5 個新礦區開始營運,並增加至少 16 個現有礦區的產能,以滿足不斷成長的燃料需求。

- 此外,日本正積極探索其專屬經濟區(EEZ)內的深海採礦,以減少對先進環保技術至關重要的進口礦產資源的依賴。日本的採礦業規模相對較小,但以金礦開採為主,主要分佈在北海道、九州和本州三島。目前已有多個黃金探勘計劃正在進行中,其中包括由日本黃金公司和巴里克黃金公司主導的項目。此外,住友金屬礦旗下的菱刈礦山在日本採礦業擴張中扮演重要角色。

- 由於上述因素,預計預測期內亞太地區採礦化學品市場將大幅成長。

礦業化學品產業概況

從本質上來說,採礦化學品市場是部分分散的。市場上的主要企業(不分先後順序)包括BASF SE、Solvay、AECI、Chevron Phillips Chemical Company LLC 和 Clariant。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區和北美的採礦活動增加

- 各終端產業對礦物的需求不斷增加

- 限制因素

- 政府對採礦和危險採礦化學品有嚴格的監管

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 功能

- 空氣中的化學物質

- 集電極

- 抑制劑

- 凝聚劑

- 冷凍櫃

- 分散劑

- 抽取劑

- 沖淡

- 抽取劑

- 研磨助劑

- 空氣中的化學物質

- 應用

- 礦物加工

- 污水處理

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 奈及利亞

- 南非

- 坦尚尼亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- AECI

- Arkema

- BASF SE

- Betachem(Pty)Ltd

- Chevron Phillips Chemical Company LLC

- CLARIANT

- CTC(Tennant Consolidated Group)

- Ecolab

- FMC Corporation

- Indorama Ventures Public Limited

- Kemira

- NASACO

- Orica Limited

- Qingdao Ruchang Mining Industry Co. Ltd

- Sasol Limited

- SNF Group

- Solvay

第7章 市場機會與未來趨勢

- 非洲尚未發現的採礦活動潛力

- 稀土探勘活動活性化

The Mining Chemicals Market size in terms of production volume is expected to grow from 1.26 million tons in 2025 to 1.55 million tons by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the mining chemicals market, as nationwide lockdowns in several countries and strict social distancing measures affected mineral processing and wastewater treatment applications. However, the market registered a significant growth rate after the restrictions were lifted due to the recovering demand from mineral processing industries.

Increasing mining activities in Asia-Pacific and North America and the rising demand for minerals across different end-use industries are expected to drive the market for mining chemicals.

On the other hand, stringent government regulations related to the mining industry and hazardous mining chemicals are expected to hinder the market's growth.

The undiscovered potential of mining activities in Africa and the rising exploration activities related to rare earth metals are expected to create lucrative market opportunities over the coming years.

Asia-Pacific dominates the market studied and is anticipated to witness the highest CAGR during the forecast period.

Mining Chemicals Market Trends

Increasing Use of Mining Chemicals in Mineral Processing

- Mineral processing is also called mineral dressing. It is a form of extractive metallurgy that usually separates valuable minerals from the ore into a concentrated, marketable product. Mineral processing is conducted at the mine site and is highly mechanical. The types of equipment used at each stage of mineral processing include crushing and grinding equipment, sizing and classification equipment, concentration equipment, and dewatering equipment.

- Mine profitability depends on the amount of desirable mineral concentrate that can be extracted from the ore. Hence, mineral processing is designed to yield the maximum amount of mineral concentrate before the product is supplied to the market. It is an essential step in converting ore into a product that can be sold and used for everyday applications.

- Mineral processing is used to extract metals, including chalcopyrite, aluminum, chromite, bauxite, copper, gold, iron, hematite, lead, molybdenum, magnetite, zinc, tin, nickel, silver, and platinum, and rocks, including coal, building stone, granite, clay, potash, limestone, sand, and marble.

- Industrial mineral ore includes diamond, barite, apatite, garnet, fluorite, zircon, quartz, gemstones, vermiculite, and wollastonite. Some of the companies operating in the mineral processing business are BASF, Clariant, Solenis, Syensqo, and Ecolab. Syensqo's floating reagents are broadly used in the mining industry and support a varied range of processing conditions and ore types. The company's flotation chemicals improve the recovery of precious and base metals, including gold, copper, silver, molybdenum, polymetallic, cobalt, nickel, lithium, and platinum group metals.

- Companies are also introducing new products and innovations in the mining industry to gain a competitive edge. For instance, in October 2023, BASF introduced two new flotation reagent brands, Luprofroth and Luproset, for the mining industry. These brands will expand the company's floatation business, and BASF will become a full solution provider for the mining industry.

- Aluminum and steel mining requires numerous chemicals for various purposes, such as refining, separation, grinding, and blasting. Among the compounds utilized are sodium hydroxide, ammonium nitrate, calcium hydroxide, soda ash, and lime. The use of these substances is regulated to guarantee worker and environmental safety.

- As per the World Steel Association, in 2022, the world produced 1.87 billion tonnes of crude steel. According to the International Aluminum Institute, by the end of 2023, aluminum production reached 70.59 million metric tonnes, up 2.25% from 2022 levels.

- Hence, owing to the above-mentioned factors, the mineral processing segment is expected to dominate the market for mining chemicals during the forecast period.

Asia-Pacific to Dominate the Market During the Forecast Period

- Asia-Pacific is expected to dominate the market for mining chemicals during the forecast period. The demand for mining chemicals from mineral processing and wastewater treatment applications is increasing in countries like China, Japan, and India.

- China has one of the largest mining industries in the world. China is the world's largest producer, often by a wide margin, of over 20 metals. These metals include aluminum, gold, graphite, and others. China is also a major producer of iron, steel, lead, magnesium, and rare earth metals. It is also a major exporter of zinc.

- Furthermore, China dominates the supply chain of global critical minerals, accounting for approximately 60% of worldwide production and 85% of processing capacity. The country is actively pursuing lithium and cobalt resources in the deep sea, backed by significant government investments. This strategic focus is positioning China as a dominant player in this emerging extractive sector, with Russia and South Korea also making notable strides in this field.

- The metals and mining industry in India is growing by implementing various initiatives such as the Smart Cities, Make in India Campaign, and rising focus on renewable energy projects under the National Electricity Policy, alongside infrastructure development.

- The growth of the mining sector is projected at 8.1% in the current fiscal year, a significant increase from 4.1% in 2022-23, attributed to the expansion of mining activities across the country. In February 2024, State-run Coal India planned to commence operations at five new mines and enhance the capacity of at least 16 existing ones to meet the escalating demand for fuel.

- Furthermore, Japan is actively seeking pathways to conduct deep-sea mining within its exclusive economic zone (EEZ) as a strategy to reduce dependency on imported mineral resources crucial for advanced and environmentally friendly technologies. Japan's mining sector, though relatively small, is primarily centered on gold mining, predominantly situated on three islands, namely Hokkaido, Kyushu, and Honshu. Several gold exploration projects, including those led by Japan Gold and Barrick Gold, are underway. Additionally, the Hishikari mine, owned by Sumitomo Metal Mining, plays a significant role in expanding Japan's mining industry.

- Owing to the factors mentioned above, the market for mining chemicals in Asia-Pacific is projected to grow significantly during the forecast period.

Mining Chemicals Industry Overview

The mining chemicals market is partially fragmented in nature. Some of the major players in the market (not in any particular order) include BASF SE, Solvay, AECI, Chevron Phillips Chemical Company LLC, and Clariant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Mining Activities in Asia-Pacific and North America

- 4.1.2 Rising Demand for Minerals Across Different End-use Industries

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations Related to Mining Industry and Hazardous Mining Chemicals

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Function

- 5.1.1 Flotation Chemicals

- 5.1.1.1 Collectors

- 5.1.1.2 Depressants

- 5.1.1.3 Flocculants

- 5.1.1.4 Frothers

- 5.1.1.5 Dispersants

- 5.1.2 Extraction Chemicals

- 5.1.2.1 Diluents

- 5.1.2.2 Extractants

- 5.1.3 Grinding Aids

- 5.1.1 Flotation Chemicals

- 5.2 Application

- 5.2.1 Mineral Processing

- 5.2.2 Wastewater Treatment

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Australia and New Zealand

- 5.3.1.8 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Nigeria

- 5.3.5.2 South Africa

- 5.3.5.3 Tanzania

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers And Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AECI

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 Betachem (Pty) Ltd

- 6.4.6 Chevron Phillips Chemical Company LLC

- 6.4.7 CLARIANT

- 6.4.8 CTC (Tennant Consolidated Group)

- 6.4.9 Ecolab

- 6.4.10 FMC Corporation

- 6.4.11 Indorama Ventures Public Limited

- 6.4.12 Kemira

- 6.4.13 NASACO

- 6.4.14 Orica Limited

- 6.4.15 Qingdao Ruchang Mining Industry Co. Ltd

- 6.4.16 Sasol Limited

- 6.4.17 SNF Group

- 6.4.18 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Undiscovered Potential of Mining Activities in Africa

- 7.2 Rising Exploration Activities Related to Rare Earth Metals