|

市場調查報告書

商品編碼

1666960

桿式人工採油系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Rod Artificial Lift System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

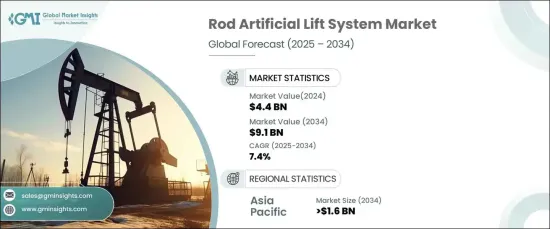

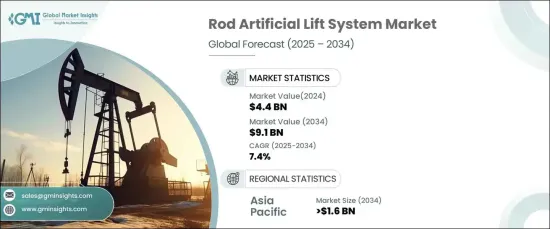

2024 年全球有桿人工採油系統市場價值為 44 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.4%。隨著操作員不斷尋求適合不同井況且具有成本效益、可靠性和適應性的系統,對這些系統的需求正在日益成長,特別是在新油田和非常規儲量的開發中。

技術進步也推動了市場擴張,包括自動化和提高系統耐用性和效率的增強材料。隨著全球向永續能源解決方案的轉變,對節能人工採油系統的推動進一步推動了市場需求。此外,能源基礎設施投資的增加和良好的監管環境也促進了這些系統在主要地區迅速普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 91億美元 |

| 複合年成長率 | 7.4% |

到 2034 年,亞太地區將為全球市場貢獻 16 億美元價值。隨著中國、印度和東南亞等國家持續提高能源產量,這些系統對於維持成熟油井的最佳產量變得不可或缺。技術創新和政府對能源產業投資的支持進一步推動了這一需求。能源需求的成長以及對更永續開採過程的推動,確保這些系統將在該地區的石油和天然氣領域發揮核心作用。

在北美,有桿人工採油系統市場預計在 2025 年至 2034 年間以 7% 的穩定速度成長。對於提高低壓井產量的有效解決方案的需求正在促進市場的成長。技術進步,包括材料的改進以提高耐用性和即時監控的整合,也促進了市場的發展。此外,政府的優惠政策和對油田基礎設施的大量投資正在加強該地區採用有桿人工採油系統。

美國有桿人工採油系統市場預計到 2034 年將創收 50 億美元,並且越來越重視最佳化成熟油田和非常規油田的產量。隨著營運商瞄準頁岩油藏和老化油井,對經濟高效、高性能解決方案的需求正在激增。材料強度和自動化程度的提高等技術創新正在支持這一趨勢。對能源安全的需求不斷成長,加上對油田基礎設施的大量投資,進一步推動了市場擴張,使美國成為有桿人工採油系統市場的關鍵參與者。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 挪威

- 荷蘭

- 亞太地區

- 中國

- 印度

- 印尼

- 馬來西亞

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 阿曼

- 科威特

- 奈及利亞

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第6章:公司簡介

- BCP Group

- ChampionX

- ELKAM ArtEfficial Lift

- Endurance Lift Solutions International

- General Electric

- Halliburton

- JJ Tech

- Levare

- Liberty Lift Solutions

- National Energy Services Reunited

- NOV

- NOVA Petroleum Services

- PetroLift Systems

- Q2 Artificial Lift Services

- SLB

- Tenaris

- Weatherford

The Global Rod Artificial Lift System Market, valued at USD 4.4 billion in 2024, is projected to expand at a CAGR of 7.4% between 2025 and 2034. This significant growth is primarily driven by the increasing demand for efficient hydrocarbon extraction solutions from aging and low-pressure wells. As operators continue to seek cost-effective, reliable, and adaptable systems for varying well conditions, the need for these systems is growing, particularly in the development of new oilfields and unconventional reserves.

The market expansion is also being fueled by technological advancements, including automation and enhanced materials that improve system durability and efficiency. With a global shift toward sustainable energy solutions, the push for energy-efficient artificial lift systems is further propelling market demand. Additionally, heightened investments in energy infrastructure and favorable regulatory environments are contributing to the rapid adoption of these systems across key regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 7.4% |

The Asia Pacific region is set to contribute USD 1.6 billion to the global market value by 2034. The region's growing oil and gas exploration, particularly in aging fields and unconventional reservoirs, is accelerating the need for rod artificial lift systems. As countries like China, India, and those in Southeast Asia continue to boost energy production, these systems are becoming indispensable for maintaining optimal output from mature wells. Technological innovations and government support for energy sector investments are further driving this demand. The rise in energy demands, along with a push for more sustainable extraction processes, ensures that these systems will play a central role in the region's oil and gas sector.

In North America, the rod artificial lift systems market is poised to grow at a steady pace of 7% between 2025 and 2034. The expansion is largely driven by the increasing exploration and production activities in unconventional oil and gas reserves, especially in shale formations. The demand for efficient solutions to enhance output from low-pressure wells is contributing to the market growth. Technological advancements, including improvements in materials for increased durability and the integration of real-time monitoring, are also bolstering the market development. Furthermore, favorable government policies and substantial investments in oilfield infrastructure are reinforcing the adoption of rod artificial lift systems across the region.

The U.S. rod artificial lift systems market is anticipated to generate USD 5 billion by 2034, with a growing emphasis on optimizing production in both mature and unconventional oil fields. As operators target shale reservoirs and aging wells, the demand for cost-effective, high-performance solutions is surging. Technological innovations, such as advancements in material strength and automation for enhanced performance, are supporting this trend. The rising need for energy security, coupled with significant investments in oilfield infrastructure, is further driving market expansion, positioning the U.S. as a key player in the rod artificial lift systems market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 North America

- 5.2.1 U.S.

- 5.2.2 Canada

- 5.3 Europe

- 5.3.1 UK

- 5.3.2 Norway

- 5.3.3 Netherlands

- 5.4 Asia Pacific

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Indonesia

- 5.4.4 Malaysia

- 5.5 Middle East & Africa

- 5.5.1 Saudi Arabia

- 5.5.2 UAE

- 5.5.3 Oman

- 5.5.4 Kuwait

- 5.5.5 Nigeria

- 5.6 Latin America

- 5.6.1 Brazil

- 5.6.2 Argentina

- 5.6.3 Mexico

Chapter 6 Company Profiles

- 6.1 BCP Group

- 6.2 ChampionX

- 6.3 ELKAM ArtEfficial Lift

- 6.4 Endurance Lift Solutions International

- 6.5 General Electric

- 6.6 Halliburton

- 6.7 JJ Tech

- 6.8 Levare

- 6.9 Liberty Lift Solutions

- 6.10 National Energy Services Reunited

- 6.11 NOV

- 6.12 NOVA Petroleum Services

- 6.13 PetroLift Systems

- 6.14 Q2 Artificial Lift Services

- 6.15 SLB

- 6.16 Tenaris

- 6.17 Weatherford