|

市場調查報告書

商品編碼

1640585

印度人工採油系統 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Artificial Lift Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

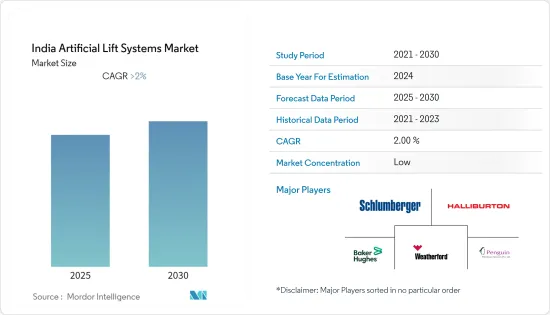

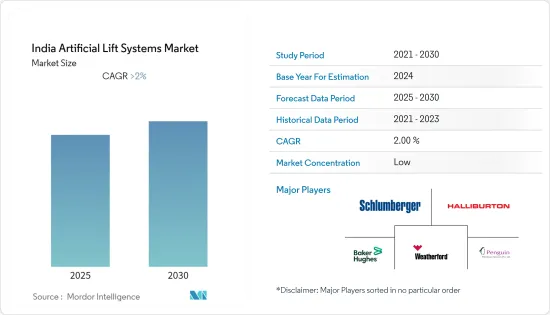

預計預測期內印度人工採油系統市場複合年成長率將超過 2%。

市場受到了 COVID-19 疫情的負面影響,主要原因是計劃延遲和取消,以及原油價格暴跌。然而,2022 年市場復甦了。

關鍵亮點

- 從長遠來看,需要提高採收率,越來越多的油井需要壓力支持才能開採,對能源和石化產品的需求不斷成長,以及能夠從困難地區經濟地開採石油的技術。系統和其他相關技術正在推動人工採油系統市場的成長。

- 然而,智慧注水和各種 IOR 技術的進步等因素正在抑制預測期內的市場成長。

- 但老油田和大多數新油田都需要某種形式的人工採油才能生產。這就是為什麼大公司幾乎在每個油田都常規採用人工採油的原因。隨著新探勘油田數量的增加,這些油田預計將為人工採油系統市場提供重大機會。

印度人工採油系統市場趨勢

電動潛水幫浦 (ESP) 需求增加

- 印度嚴重依賴原油進口來滿足其能源需求。根據最新的政府資料,2021年該國對原油進口的依賴程度達到約82%。

- 此外,國內原油產量已從 2011 年的每天 93.7 萬桶下降到 2021 年的每天 74.6 萬桶。印度主要石油生產商印度石油天然氣公司 (ONGC) 的產量有所下降,原因是孟買和尼拉姆希拉 (Neelam Heera) 油田出現技術問題,以及古吉拉突邦塔爾(Santal) 和博爾(Bhol) 油田產量低於預期。

- 產量下降也是由於油田老化導致產量降低的結果。在這些老化的油田中,電動潛水泵可能會被使用,這預計將增加對人工採油系統的需求。

- 與其他人工採油系統相比,ESP在印度石油和天然氣生產的目前使用相對較少。然而,即將到來的石油和天然氣領域的投資預計將為電動潛水泵市場提供長期機會。

- 因此,基於上述因素,預計預測期內印度電動潛水泵領域對人工採油系統的需求將大幅增加。

日益成熟的油田正在推動市場

- 越來越多的成熟天然氣田和老化的生產技術預計將對人工採油市場的成長產生重大影響。國內天然氣產量預計將從 2011 年的每天 41.5 億立方英尺下降到 2021 年的每天 27.6 億立方英尺。

- 獲取新蘊藏量的競爭日益激烈,給成熟蘊藏量帶來了最大限度提高產量的壓力。然而,利用這些成熟蘊藏量進行生產的成本並不一定會獲利,需要相關公司做出策略決策。成熟油田的營運需求總是獨一無二的,需要針對特定油田採用量身訂製的方法。

- 成熟和成熟油田所提供的機會足夠大,值得承擔經過計算的風險並採用技術複雜的流程來提高產量。

- 有限的預算,加上「長期」油價,為石油生產公司採用人工採油並保持資產績效創造了機會。

- 它還包括對定向鑽井的投資,該領域有很大機會發現碳氫化合物。目前低油價情勢促使該公司對其油井和相關基礎設施進行策略性細分,並採用各種油田服務,如纜線測井、撓曲油管、人工採油等,以精簡其成熟資產。自

- 因此,隨著成熟油田和正在成熟油田的出現以及油田數量的不斷增加,人工採油市場預計將在鑽井市場中發揮重要作用。

印度人工採油系統產業概況

印度人工採油系統市場適度細分。主要參與企業包括(不分先後順序)斯倫貝謝公司、哈里伯頓公司、威德福國際公司、貝克休斯公司和企鵝石油服務(P)有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(百萬美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- PESTLE分析

第 5 章 按類型細分市場

- 氣舉系統

- 抽杆式泵

- 潛水電泵

- 蛇泵抽水系統

- 噴射幫浦

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Baker Hughes Company

- Weatherford International PLC

- Schlumberger NV

- Penguin Petroleum Services(P)Limited

- Novomet Oilfield Services Company

- Halliburton Company

- United Drilling Tool Limited

- Apergy Corp.

第7章 市場機會與未來趨勢

The India Artificial Lift Systems Market is expected to register a CAGR of greater than 2% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19, mainly due to delays and cancellations of projects and the crude oil price crash. However, the market rebounded in 2022.

Key Highlights

- Over the long term, the need for enhanced recovery rates, a growing number of wells that require pressure support for extraction, increasing demand for energy, petrochemicals, and technological advancements that are enabling companies to extract oil from challenging areas economically are some of the factors driving the growth of artificial lifts system market.

- On the other hand, factors such as advancements in smart water flooding and various IOR technology are restraining the market growth during the forecast period.

- However, most of the new fields, as well as the older fields, require an artificial lift of some form for production. Hence, all the major companies are regularly adopting artificial lifts in almost all wells. As the number of new exploration fields is increasing, these fields are expected to provide major opportunities for the artificial lift system market.

India Artificial Lift Systems Market Trends

Electric Submersible Pumps (ESP) to Witness Significant Demand

- India is highly dependent on crude oil imports to fulfill its energy needs. According to the latest government data, the country's dependence on crude oil imports reached nearly 82% in 2021.

- Additionally, the country witnessed a decline in domestic crude oil production from 937 thousand barrels per day in 2011 to 746 thousand barrels per day in 2021. ONGC, the country's major oil producer, is witnessing a decline due to technical issues in Mumbai and Neelam Heera fields and less-than-expected production in Santhal and Ball fields in Gujarat.

- The decline in production is also the result of aging fields, which leads to a fall in output. Such aging fields are expected to provide the potential for the usage of electric submersible pumps, thus driving the demand for artificial lift systems.

- The current usage of ESPs in India for oil and gas production is relatively low compared to other artificial lift systems. However, the upcoming investments in the oil and gas sector are expected to provide an opportunity for the electric submersible pumps market in the long run.

- Therefore, based on the above-mentioned factors, the electric submersible pumps segment is expected to witness significant demand for artificial lift systems in India during the forecast period.

Increasing Maturing and Matured Fields to Drive the Market

- Mature and maturing oil & gas fields and a rising number of aging production technologies are expected to have a huge impact on the growth of the artificial lift market. Natural gas production in the country declined from 4.15 billion cubic feet per day in 2011 to 2.76 billion cubic feet per day in 2021.

- Increasing competitiveness for access to new reserves has put pressure on the maturing reserves for maximizing the output. However, the costs incurred for producing from such maturing reserves are not always profitable and have to be a strategic decision of the companies involved. The operational demands of the matured fields are always unique, and the approach needs to be tailored for specific fields.

- The opportunities presented by the matured and maturing fields are large enough to take a calculated risk and employ technically complex processes for enhancing production.

- The limited budgets available, combined with the 'Lower for Longer' oil prices throw open an opportunity for the companies in the oil production landscape to employ artificial lift and maintain the performance of the assets.

- The investments also include directional drilling, where there exists a significant opportunity for finding hydrocarbons. The current scenario of low oil price is the right opportunity for strategically segmenting the wells and related infrastructure, and employing various oilfield services, such as wireline logging, coiled tubing, and artificial lift, to enhance production from maturing assets.

- Hence, owing to the presence of matured and maturing fields, along with the number of fields are constantly increasing, artificial lift market is expected to play a quintessential role in the drilling markets.

India Artificial Lift Systems Industry Overview

The Indian artificial lift systems market is moderately fragmented. Some of the major players include (in no particular order) Schlumberger NV, Halliburton Company, Weatherford International PLC, Baker Hughes Company, and Penguin Petroleum Services (P) Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION BY TYPE

- 5.1 Gas-Lift Systems

- 5.2 Sucker Rod Pumps

- 5.3 Electric Submersible Pumps

- 5.4 Progressive Cavity Pump Lifting Systems

- 5.5 Jet Pumps

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Company

- 6.3.2 Weatherford International PLC

- 6.3.3 Schlumberger NV

- 6.3.4 Penguin Petroleum Services (P) Limited

- 6.3.5 Novomet Oilfield Services Company

- 6.3.6 Halliburton Company

- 6.3.7 United Drilling Tool Limited

- 6.3.8 Apergy Corp.