|

市場調查報告書

商品編碼

1666962

特種聚苯乙烯樹脂市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Specialty Polystyrene Resin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

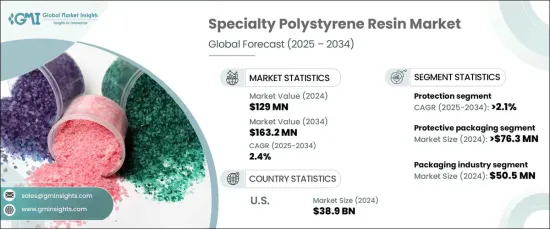

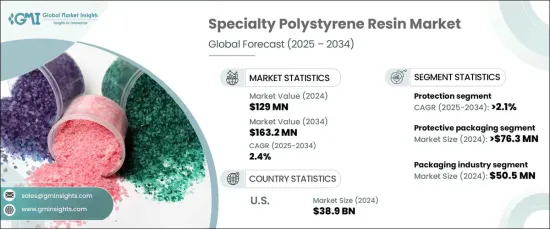

2024 年全球特種聚苯乙烯樹脂市場價值為 1.29 億美元,預計將穩定成長,預計 2025 年至 2034 年的複合年成長率為 2.4%。 特種聚苯乙烯樹脂因其卓越的性能特性而受到認可,包括增強的衝擊強度、耐熱性和持久的耐用性。與標準聚苯乙烯不同,這些樹脂適用於需要卓越功能的應用,使其成為電子、醫療設備和高性能包裝等領域的首選材料。隨著各行各業繼續優先考慮滿足嚴格性能要求的材料,特種聚苯乙烯樹脂的市場將會擴大。製造技術的進步、材料效率意識的提高以及各種應用中輕量化、經濟高效的解決方案的興起進一步推動了這一成長。

特種聚苯乙烯樹脂市場保護部分的估值在 2024 年達到 5,700 萬美元,預計預測期間的複合年成長率為 2.1%。本部分強調了材料在需要增加耐用性、抗衝擊性和熱穩定性的應用中的價值。從敏感電子設備的保護外殼到汽車領域的零件,特種聚苯乙烯樹脂滿足了運輸、搬運和儲存過程中可靠保護的關鍵需求。其重量輕且具有成本效益進一步增強了它們的吸引力,使其成為尋求最佳化性能和成本的行業的首選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.29億美元 |

| 預測值 | 1.632億美元 |

| 複合年成長率 | 2.4% |

保護性包裝產業的價值將於 2024 年達到 7,630 萬美元,預計未來十年的複合年成長率為 2.1%。對輕質、耐用且經濟高效的包裝解決方案的需求不斷成長,推動了特種聚苯乙烯樹脂的採用。這些材料具有出色的減震和隔熱性能,對於包裝電子產品和易腐爛物品等易碎物品來說是必不可少的。隨著電子商務的快速擴張,特別是在消費性電子和醫療保健行業的快速擴張,對堅固保護包裝的需求日益加劇。特種聚苯乙烯樹脂正在成為這一成長的基石,提供平衡強度、可靠性和成本的解決方案。

2024 年,美國特種聚苯乙烯樹脂市場價值為 3,890 萬美元,預計 2025 年至 2034 年的複合年成長率為 2.5%。包裝行業,尤其是食品包裝,顯著受益於該材料的透明度和保護性能。此外,隨著消費者和製造商越來越重視環保解決方案,對永續性和可回收性的日益關注正在影響市場動態。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對環保材料的需求不斷成長

- 擴大電子領域的應用

- 材料技術的進步

- 產業陷阱與挑戰

- 環境問題

- 回收挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按功能,2021 年至 2034 年

- 主要趨勢

- 保護

- 絕緣

- 輕的

- 耐用性

- 透明度

- 其他

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 保護性包裝

- 建築與施工

- 汽車與運輸

- 電氣和電子產品

- 衛生保健

- 其他

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 包裝產業

- 電子業

- 汽車產業

- 建築業

- 醫療保健產業

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Asahi Kasei

- BASF

- Braskem

- China Petrochemical Corporation

- ExxonMobil

- Formosa Plastics Corporation

- INEOS Styrolution

- LG Chem

- Mitsubishi Chemical Corporation

- SABIC

- Sinopec

- Styron (Dow)

- TotalEnergies

The Global Specialty Polystyrene Resin Market, valued at USD 129 million in 2024, is poised for steady growth, with projections indicating a CAGR of 2.4% from 2025 to 2034. Specialty polystyrene resin is recognized for its exceptional performance attributes, including enhanced impact strength, heat resistance, and long-lasting durability. Unlike standard polystyrene, these resins cater to applications that require superior functionality, making them a preferred material in sectors such as electronics, medical devices, and high-performance packaging. As industries continue to prioritize materials that meet stringent performance demands, the market for specialty polystyrene resin is set to expand. This growth is further fueled by advancements in manufacturing technologies, increasing awareness of material efficiency, and the rising trend of lightweight, cost-effective solutions across various applications.

The protection segment of the specialty polystyrene resin market achieved a valuation of USD 57 million in 2024, with expectations of a 2.1% CAGR over the forecast period. This segment underscores the material's value in applications necessitating added durability, impact resistance, and thermal stability. From protective casings for sensitive electronics to components in the automotive sector, specialty polystyrene resins address the critical need for reliable protection during shipping, handling, and storage. Their lightweight nature and cost-effectiveness further enhance their appeal, positioning them as a top choice for industries seeking to optimize both performance and cost.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $129 million |

| Forecast Value | $163.2 million |

| CAGR | 2.4% |

The protective packaging sector, valued at USD 76.3 million in 2024, is projected to grow at a CAGR of 2.1% over the next decade. The increasing demand for lightweight, durable, and cost-efficient packaging solutions drives the adoption of specialty polystyrene resins. These materials excel at shock absorption and thermal insulation, making them indispensable for packaging delicate items such as electronics and perishables. With the rapid expansion of e-commerce, particularly in the consumer electronics and healthcare industries, the need for robust protective packaging is intensifying. Specialty polystyrene resins are emerging as a cornerstone of this growth, delivering solutions that balance strength, reliability, and cost.

The U.S. specialty polystyrene resin market generated USD 38.9 million in 2024, with projections of a 2.5% CAGR from 2025 to 2034. The market's expansion in the U.S. is driven by the broad application of specialty polystyrene resins across industries, including packaging, electronics, automotive, and healthcare. The packaging sector, especially food packaging, benefits significantly from the material's clarity and protective properties. Furthermore, the rising focus on sustainability and recyclability is influencing market dynamics, as consumers and manufacturers increasingly prioritize environmentally friendly solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for eco-friendly materials

- 3.6.1.2 Expanding applications in electronics

- 3.6.1.3 Advancements in material technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental concerns

- 3.6.2.2 Recycling challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Function, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Protection

- 5.3 Insulation

- 5.4 Lightweight

- 5.5 Durability

- 5.6 Transparency

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Protective packaging

- 6.3 Building & construction

- 6.4 Automotive & transportation

- 6.5 Electrical & electronics

- 6.6 Healthcare

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Packaging industry

- 7.3 Electronics industry

- 7.4 Automotive industry

- 7.5 Construction industry

- 7.6 Healthcare industry

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Asahi Kasei

- 9.2 BASF

- 9.3 Braskem

- 9.4 China Petrochemical Corporation

- 9.5 ExxonMobil

- 9.6 Formosa Plastics Corporation

- 9.7 INEOS Styrolution

- 9.8 LG Chem

- 9.9 Mitsubishi Chemical Corporation

- 9.10 SABIC

- 9.11 Sinopec

- 9.12 Styron (Dow)

- 9.13 TotalEnergies