|

市場調查報告書

商品編碼

1627124

聚苯乙烯:市場佔有率分析、產業趨勢、成長預測(2025-2030)Polystyrene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

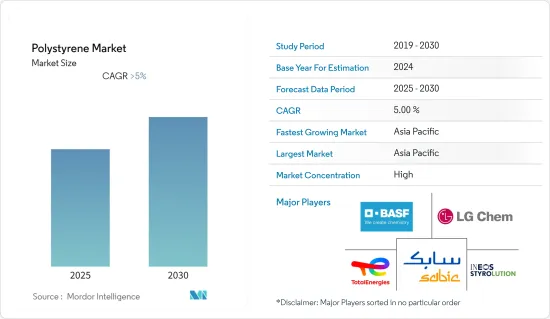

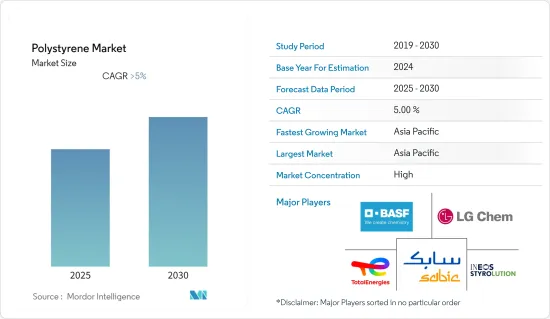

預計聚苯乙烯市場在預測期內的複合年成長率將超過 5%。

2020 年市場受到 COVID-19 的負面影響。由於封鎖、原料缺乏和勞動力短缺,2020 年全球住宅建築收入下降了 7%。然而,由於消費者對電子商務和食品宅配應用的支出趨勢不斷上升,對包裝產品(包括食品包裝和非食品包裝)的需求正在增加,這對聚苯乙烯的需求產生了積極影響。

主要亮點

- 短期來看,聚苯乙烯產業的回收和消費性電子市場的成長是推動市場的主要因素。近年來,由於對行動電話、可攜式運算設備、遊戲系統和其他個人電子設備的需求持續成長,全球消費性電子產業在全球快速成長。

- 另一方面,北美和歐洲對聚苯乙烯的禁令不斷加強以及高性能替代品的出現可能會阻礙市場。

- 預計生物基聚苯乙烯的發展將在預測期內成為市場機會。

- 亞太地區在全球市場中佔據主導地位,其中印度和中國等國家的消費量最高。

聚苯乙烯市場趨勢

高抗衝聚苯乙烯 (HIPS) 類型主導市場

- 高抗衝聚苯乙烯含有橡膠。透明度低於GPPS。主要用於需要抗衝擊的產品。

- HIPS 具有標準的流動性,但光澤度低於 GPPS。不易破裂,用於射出成型。 HIPS 還具有高尺寸穩定性。易於塗漆、粘貼,成本低。用於外殼和蓋子、低強度結構件、印刷圖形、模型和原型、設備等。 HIPS主要以高中檔銷售。其他牌號包括耐燃、高光澤牌號和耐環境應力開裂牌號。

- 包裝是 HIPS 最大的部分。用於食品包裝(肉類托盤、蛋盒、水果托盤、乳製品包裝等)、工業包裝、消費品包裝(盒式磁帶、CD封面等)。食品和飲料業約佔印度 GDP 的 3%,是該國最大的雇主,擁有超過 730 萬名員工。 2021年,雀巢印度公司董事長表示,在經濟成長、人口紅利和電子商務擴張等因素的推動下,印度包裝食品市場預計在未來5到10年內將加倍,達到700億美元。

- 在人口成長的推動下,預測期內對包裝食品和飲料的需求可能會進一步成長。從農村生活向城市生活的前所未有的轉變是影響全球包裝食品消費的主要人口趨勢。

- 然而,美國已禁止在盒子、容器和購物袋等食品包裝產品中使用聚苯乙烯,這可能會對市場成長產生負面影響。

- HIPS 也常用於電子和消費性電子應用,例如電腦機殼、電視機殼以及冷凍庫和冰箱內膽機殼。 JEITA公佈的資料顯示,2021年電子產品銷售量較2020年疫情期間大幅成長。

- 亞太地區是高抗衝聚苯乙烯的最大消費國。它還生產世界上大約一半的 HIPS。歐洲和北美是繼亞太地區之後的第二大消費者。預計亞太地區在預測期內將經歷最快的成長。

亞太地區主導市場

- 亞太地區由印度、中國等多個新興經濟體組成。未來幾年,建築和醫療保健等各種最終用戶行業的需求預計將大幅增加。

- 據住宅部預測,到2025年,中國建築業預計將維持GDP的6%。根據這項預測,中國政府於 2022 年 1 月宣布了一項五年計劃,重點是使建築業更加永續和高品質。

- 印度正準備透過升級都市區現有基礎設施來擁抱都市化。為了支持這一目標,該國正在審查房地產法、商品及服務稅、房地產投資信託基金等的改革,以消除建設目標不必要的延誤。工業和商業基礎設施已成為印度高成長產業之一。印度政府正在製定放寬規則等舉措,以吸引外國直接投資流入建築業,以促進該國的整體發展。

- 越南的建設產業是亞太地區最強大的國家之一。儘管它因 COVID-19 而失去了動力,但在 2021 年仍繼續強勁成長。

- 中國是世界上最大的電子產品生產中心,為韓國、新加坡和台灣等老牌上游生產商提供了激烈的競爭。智慧型手機、OLED電視和平板電腦等電子產品是家用電子電器領域成長最快的市場。隨著中階可支配收入的增加,預計在不久的將來對電子產品的需求將會增加。

- 此外,我國政府已開始實施支持和鼓勵醫療設備創新的政策。 「中國製造2025」舉措提高產業效率、產品品質和品牌聲譽。這有望增加國內醫療設備製造商的數量並提高市場競爭力。醫療設備領域的一次性產品對聚苯乙烯有需求,例如組織培養托盤、試管、培養皿、診斷組件和檢測套組外殼。

- 到2022年,印度醫療保健產業預計將達到3,720億美元,這主要是由於健康意識的提高、保險的普及、收入的增加和疾病的增加。印度的醫療保健產業受益於每年 1.6% 的人口成長。超過1億的人口老化、文明病的增加、收入的增加以及健康保險的普及正在推動該行業更先進、更精準的醫療設備的成長。

- 因此,隨著該國各種最終用戶產業的成長,預計在預測期內對聚苯乙烯的需求將增加。

聚苯乙烯產業概況

聚苯乙烯市場部分整合。主要公司包括BASF SE、SABIC、Total、LG Chem 和 INEOS Styrolution Group GmbH。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 聚苯乙烯產業的回收

- 消費性電子市場的成長

- 抑制因素

- 北美和歐洲增加聚苯乙烯禁令

- 高性能替代品的可用性

- 價值鏈分析

- 波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 通用聚苯乙烯 (GPPS)

- 高抗衝聚苯乙烯 (HIPS)

- 發泡聚苯乙烯 (EPS)

- 依表格類型

- 形式

- 薄膜和片材

- 射出成型

- 其他表格類型

- 按最終用戶產業

- 包裝

- 建築/施工

- 電力/電子

- 消費品

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Atlas Molded Products

- Alpek SAB de CV

- Americas Styrenics LLC(AmSty)

- BASF SE

- CHIMEI

- Formosa Chemicals & Fibre Corp.

- INEOS Styrolution Group GmbH

- Innova

- KUMHO PETROCHEMICAL

- LG Chem

- SABIC

- Synthos

- Total

- Trinseo

- Versalis SpA

第7章 市場機會及未來趨勢

- 生物基聚苯乙烯的開發研究正在進行中

The Polystyrene Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. The global residential home construction revenue witnessed a decline of 7% in 2020, owing to lockdowns, unavailability of raw materials, and shortage of laborers. However, demand for packaging products, including food packaging and non-food packaging, has increased owing to the rising trend of consumer spending on e-commerce and food delivery applications, thereby positively impacting the demand for polystyrene.

Key Highlights

- Over the short term, major factors driving the market studied are recycling in the polystyrene industry and the growing consumer electronics market. The global consumer electronics industry has been growing rapidly across the world over the years, owing to the consistently increasing demand for cellular phones, portable computing devices, gaming systems, and other personal electronic devices.

- On the flip side, increasing the ban on polystyrene across North America and Europe and the availability of high-performance substitutes will likely hinder the market.

- The development of bio-based polystyrene is expected to act as a market opportunity in the forecast period.

- Asia-Pacific dominated the market across the world, with the largest consumption in countries such as India and China.

Polystyrene Market Trends

High Impact Polystyrene (HIPS) Type to Dominate the Market

- High-impact polystyrene contains rubber. It is less transparent than GPPS. It is mainly used for products that require high-impact resistance.

- HIPS has a standard flow but is less glossy than GPPS. It is crack-resistant and is used in injection molding. HIPS also has good dimensional stability. It is easy to paint and glue and has a low cost. It is used for housing and covers, low-strength structural components, printed graphics, models and prototypes, fixtures, etc. Majorly, HIPS are sold in high and medium grades. Other grades include ignition resistance, high-gloss grades, and environment stress crack-resistant grades.

- Packaging is the largest segment for HIPS. It is used for food packaging (meat trays, egg cartons, fruit trays, dairy packaging, etc.), industrial packaging, and consumer packaging (cassettes, CD covers, etc.). The food and beverages industry accounts for ~3% of India's GDP and is the single largest employer in the country, with more than 7.3 million workforces. In 2021, Nestle India Chairman said that the Indian packaged food market is expected to double and grow up to USD 70 billion in the next 5-10 years, led by factors that include economic growth, demographic dividend, and growing e-commerce.

- Driven by the rise in population, demand for packaged food and beverage is set to witness further growth during the forecast period. The unprecedented shift from rural to urban living is a major demographic that is impacting the global consumption of packaged food.

- However, the United States has banned the use of polystyrene in food packaging products such as boxes, containers, and carry bags, which is likely to impact the market growth negatively.

- HIPS are also used majorly in electronic and appliance applications, such as in computer housings, TV housings, and freezer and refrigerator liners appliances housings. As per data published by JEITA, the electronics products revenue increased significantly in 2021 as a compared pandemic period of 2020.

- Asia-Pacific is the largest consumer of high-impact polystyrene. It also produces about half of the world's HIPS. Europe and North America follow Asia-Pacific in consumption. Asia-Pacific is forecasted to be the fastest-growing region during the forecast period.

Asia Pacific region to Dominate the Market

- Asia Pacific region consists of various emerging economies such as India and China. The demand for different end-user industries, such as construction and healthcare, is expected to rise significantly in the upcoming years.

- As per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025. Keeping in view the given forecasts, the Chinese government unveiled a five-year plan in January 2022 focused on making the construction sector more sustainable and quality-driven.

- India is gearing up to embrace urbanization by leveling up its existing infrastructure in cities. To support the same, the country has overhauled its reforms, such as the Real Estate Act, GST, REITs, etc., to eliminate unnecessary lags in construction targets. Industrial and commercial infrastructure in the country has emerged as one of the high-growth sectors. The Indian government has been formulating initiatives like easing the rules to attract FDI inflow in the construction sector to expedite development across the nation.

- The Vietnam construction industry is one of the best-performing countries in the Asia-Pacific (APAC) region. Despite losing momentum due to COVID-19, it has continued to grow strongly in 2021.

- China is the world's largest electronics production base and offers tough competition to the existing upstream producers, like South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, tablets, and so on, have the highest growth in the market in the consumer electronics segment. With the increase in the disposable income of the middle-class population, the demand for electronic products is projected to grow in the near future.

- Furthermore, the Chinese government has started implementing policies to support and encourage innovations in medical devices. The 'Made in China 2025' initiative aims to improve industry efficiency, product quality, and brand reputation. This is expected to increase the number of domestic medical device manufacturers, thus, increasing the competitiveness in the market. Demand for polystyrene exists in the medical device sector, in disposable items, such as tissue culture trays, test tubes, Petri dishes, diagnostic components, and housing for test kits, among many others.

- The healthcare sector in India is expected to reach USD 372 billion by 2022, mainly driven by increasing health awareness, access to insurance, rising income, and diseases. The medical sector in India is benefiting from the growing population at a rate of 1.6% per year. An aging population of over 100 million, rising incidences of lifestyle diseases, rising incomes, and increased penetration of health insurance are fueling the growth of more sophisticated and accurate medical devices in the industry.

- Hence, with the growth in the various end-user industries in the country, the demand for polystyrene is estimated to increase during the forecast period.

Polystyrene Industry Overview

The polystyrene market is partially consolidated in nature. Some of the major players include BASF SE, SABIC, Total, LG Chem, and INEOS Styrolution Group GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Recycling in the Polystyrene Industry

- 4.1.2 Growing Consumer Electronics Market

- 4.2 Restraints

- 4.2.1 Increasing Ban on Polystyrene across North America and Europe

- 4.2.2 Availability of High-performance Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 General Purpose Polystyrene (GPPS)

- 5.1.2 High Impact Polystyrene (HIPS)

- 5.1.3 Expandable Polystyrene (EPS)

- 5.2 Form Type

- 5.2.1 Foams

- 5.2.2 Films and Sheets

- 5.2.3 Injection Molding

- 5.2.4 Other Form Types

- 5.3 End-user Industry

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Electrical and Electronics

- 5.3.4 Consumer Goods

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Atlas Molded Products

- 6.4.2 Alpek S.A.B. de CV

- 6.4.3 Americas Styrenics LLC (AmSty)

- 6.4.4 BASF SE

- 6.4.5 CHIMEI

- 6.4.6 Formosa Chemicals & Fibre Corp.

- 6.4.7 INEOS Styrolution Group GmbH

- 6.4.8 Innova

- 6.4.9 KUMHO PETROCHEMICAL

- 6.4.10 LG Chem

- 6.4.11 SABIC

- 6.4.12 Synthos

- 6.4.13 Total

- 6.4.14 Trinseo

- 6.4.15 Versalis SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research to Develop Bio-based Polystyrene