|

市場調查報告書

商品編碼

1666974

開放式轉換開關市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Open Transition Transfer Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

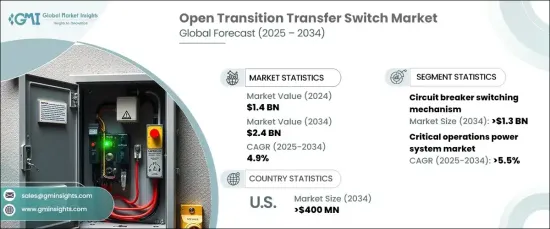

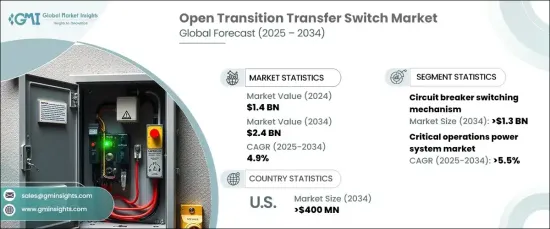

2024 年全球開放式轉換開關市場價值為 14 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.9%。對安全性、效率和遵守監管標準的日益重視繼續鼓勵了創新。政府推動再生能源整合的措施為該產業進一步開闢了新的途徑。自動化和連接技術的進步極大地改善了市場的產品,實現了無縫過渡和即時遠端監控。

智慧技術與這些系統的結合正透過應對現代能源挑戰來改變整個產業。旨在檢測和應對電力波動的自動化解決方案已獲得關注,並提供了增強的性能和可靠性。消費者對客製化的期望日益成長,以及遵守嚴格安全標準的需求促使製造商專注於創造滿足不斷變化的需求的穩健、高效的設計。這些進步與向永續和有彈性的能源基礎設施的更廣泛轉變相一致,將開放式轉換開關定位為當代電力系統的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 24億美元 |

| 複合年成長率 | 4.9% |

預計到 2034 年,基於斷路器的開關機制市場規模將超過 13 億美元。 它們能夠處理更高的故障電流並提供卓越的保護,因此成為許多應用中的首選。此外,自動化和智慧控制的不斷整合增強了這些系統的功能,進一步推動了它們的應用。製造商繼續透過專注於創新來競爭,提供優先考慮營運效率和可靠性的解決方案。

美國將繼續在市場上扮演重要角色,預計到 2034 年,該國開放式轉換開關產業的規模將超過 4 億美元。再生能源(尤其是太陽能)的採用不斷增加,進一步加速了需求,因為這些系統可以無縫地整合到混合能源設定中。美國製造商正專注於採用遠端診斷和監控功能等尖端技術,以改善產品功能並滿足日益成長的智慧能源解決方案需求。

隨著對可靠、高效和智慧電力傳輸系統的需求不斷成長,全球開放式轉換開關市場預計將持續成長。該行業對創新、安全和永續性的關注確保了其在現代能源管理系統中發揮的關鍵作用。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依營運方式,2021 – 2034 年

- 主要趨勢

- 手動的

- 非自動

- 自動的

- 旁路隔離

第 6 章:市場規模與預測:依轉換機制,2021 – 2034 年

- 主要趨勢

- 接觸器

- 斷路器

第 7 章:市場規模及預測:依安培等級,2021 年至 2034 年

- 主要趨勢

- ≤ 400 安培

- 401 安培至 1600 安培

- > 1600 安培

第 8 章:市場規模與預測,市場:按安裝,2021 – 2034 年

- 主要趨勢

- 緊急系統

- 法律要求的製度

- 關鍵操作電力系統

- 可選備用系統

第 9 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ABB

- AEG Power Solutions

- Briggs & Stratton

- Caterpillar

- Cummins

- Eaton

- Generac Power Systems

- General Electric

- Kohler

- Midwest Electric Products

- One Two Three Electric

- Schneider Electric

- Siemens

- Vertiv Group

- Victron Energy

The Global Open Transition Transfer Switch Market, valued at USD 1.4 billion in 2024, is projected to grow at a CAGR of 4.9% between 2025 and 2034. This growth is fueled by the rising need for dependable power backup systems across residential, commercial, and industrial applications. The increasing emphasis on safety, efficiency, and adherence to regulatory standards continues to encourage innovation. Government initiatives promoting renewable energy integration further open new avenues for the industry. Advancements in automation and connectivity technologies have significantly improved the market's offerings, enabling seamless transitions and real-time remote monitoring.

The integration of smart technologies into these systems is transforming the industry by addressing modern energy challenges. Automated solutions designed to detect and respond to power fluctuations have gained traction, providing enhanced performance and reliability. Growing consumer expectations for customization and the need for compliance with stringent safety standards drive manufacturers to focus on creating robust, efficient designs tailored to evolving demands. These advancements align with the broader shift toward sustainable and resilient energy infrastructure, positioning open transition transfer switches as essential components in contemporary power systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 4.9% |

Circuit breaker-based switching mechanisms are expected to exceed USD 1.3 billion by 2034. Their ability to handle higher fault currents and deliver superior protection has made them a preferred choice in many applications. Additionally, the growing incorporation of automation and intelligent controls is enhancing the functionality of these systems, further driving their adoption. Manufacturers continue to compete by focusing on innovation, offering solutions that prioritize operational efficiency and reliability.

The United States is set to remain a key player in the market, with the country's open transition transfer switch sector forecasted to surpass USD 400 million by 2034. Heightened concerns about power reliability and increasing reliance on backup power systems across multiple industries are key drivers in the region. The rise in renewable energy adoption, particularly solar, is further accelerating demand as these systems can seamlessly integrate into hybrid energy setups. US-based manufacturers are concentrating on incorporating cutting-edge technologies such as remote diagnostics and monitoring capabilities to improve product functionality and cater to the growing need for smart energy solutions.

As the demand for reliable, efficient, and intelligent power transfer systems continues to rise, the global open transition transfer switch market is poised for sustained growth. The industry's focus on innovation, safety, and sustainability ensures its role as a critical player in modern energy management systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Operations, 2021 – 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Non-automatic

- 5.4 Automatic

- 5.5 By-pass isolation

Chapter 6 Market Size and Forecast, By Switching Mechanism, 2021 – 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Contactor

- 6.3 Circuit Breaker

Chapter 7 Market Size and Forecast, By Ampere Rating, 2021 – 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 ≤ 400 Amp

- 7.3 401 Amp to 1600 Amp

- 7.4 > 1600 Amp

Chapter 8 Market Size and Forecast, Market, By Installation, 2021 – 2034 (‘000 Units, USD Million)

- 8.1 Key trends

- 8.2 Emergency systems

- 8.3 Legally required systems

- 8.4 Critical operations power systems

- 8.5 Optional standby systems

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units, USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 Saudi Arabia

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AEG Power Solutions

- 10.3 Briggs & Stratton

- 10.4 Caterpillar

- 10.5 Cummins

- 10.6 Eaton

- 10.7 Generac Power Systems

- 10.8 General Electric

- 10.9 Kohler

- 10.10 Midwest Electric Products

- 10.11 One Two Three Electric

- 10.12 Schneider Electric

- 10.13 Siemens

- 10.14 Vertiv Group

- 10.15 Victron Energy