|

市場調查報告書

商品編碼

1667085

基於接觸器的轉換開關市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Contactor Based Transfer Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

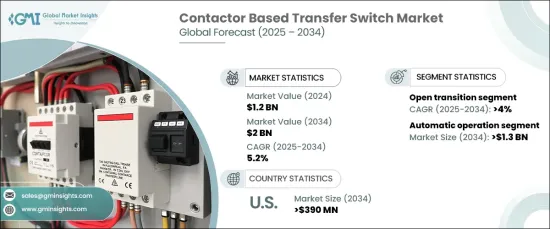

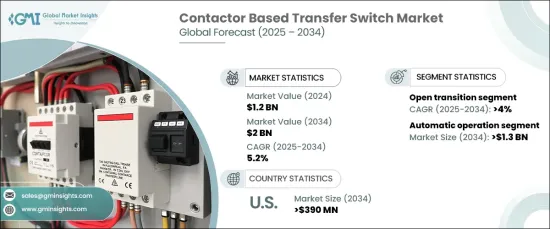

2024 年全球基於接觸器的轉換開關市場價值為 12 億美元,預計 2025 年至 2034 年期間將實現 5.2% 的穩定複合年成長率。隨著工業和住宅領域都認知到需要高效的電力傳輸系統來確保營運的連續性,市場正在不斷發展。隨著對能源彈性的需求迅速成長,特別是在關鍵設施中,基於接觸器的轉換開關市場已成為在各種應用中提供不間斷電力供應的關鍵參與者。

市場分為幾種類型,例如自動操作和基於開放式轉換接觸器的轉換開關。預計到 2034 年,自動操作部門將產生 13 億美元的收入。自動轉換開關 (ATS) 在醫療中心、資料中心和製造工廠等設施中變得越來越不可或缺。它們能夠檢測電源中斷並切換到備用電源而無需人工干預,這使得它們在這些高優先級領域至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 20億美元 |

| 複合年成長率 | 5.2% |

開放式轉換開關領域預計也將經歷強勁成長,到 2034 年預計複合年成長率為 4%。開放式轉換開關通常用於較不重要的應用,例如商業建築和輕工業設施,這些場合可以接受瞬時電源中斷。隨著越來越多的地區面臨電網不穩定和頻繁停電的情況,對包括開放式轉換開關在內的備用電源系統的需求正在增加。

在美國,基於接觸器的轉換開關市場預計到 2034 年將產生 3.9 億美元的產值。電網老化以及電力中斷情況的增多,加速了這些領域採用轉換開關。再生能源的整合和分散式能源資源的興起進一步推動了市場需求,因為這些技術需要先進、高效的電力傳輸解決方案。隨著電源備用電源成為現代化基礎設施的重要組成部分,對轉換開關的需求將隨著能源格局的變化而不斷成長。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依營運方式,2021 – 2034 年

- 主要趨勢

- 手動的

- 非自動

- 自動的

- 旁路隔離

第6章:市場規模與預測:依轉型,2021 – 2034 年

- 主要趨勢

- 關閉

- 打開

第 7 章:市場規模及預測:依安裝量,2021 – 2034 年

- 主要趨勢

- 緊急系統

- 法律要求的製度

- 關鍵操作電力系統

- 可選備用系統

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 亞太地區

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB

- AEG Power Solutions

- Blue Square Group

- Briggs & Stratton

- Caterpillar

- Cummins

- Eaton

- Generac Power Systems

- General Electric

- Kohler

- Midwest Electric Products

- One Two Three Electric

- Peterson

- Schneider Electric

- Siemens

- Taylor Power Systems

- Vertiv Group

The Global Contactor Based Transfer Switch Market was valued at USD 1.2 billion in 2024 and is projected to experience a steady growth rate of 5.2% CAGR from 2025 to 2034. This growth is largely driven by an increasing demand for reliable power backup solutions, with power outages becoming more frequent and unpredictable due to aging infrastructure and environmental factors. The market is evolving as both industries and residential sectors recognize the need for efficient power transfer systems that ensure continuity in operations. With a rapidly expanding need for energy resilience, particularly in critical facilities, the contactor-based transfer switch market has emerged as a key player in providing uninterrupted electricity supply across various applications.

The market is segmented into several types, such as automatic operation and open transition contactor-based transfer switches. The automatic operation segment is expected to generate USD 1.3 billion by 2034. This significant growth is attributed to the rising need for seamless and uninterrupted power transfer in industries where reliability is paramount. Automatic transfer switches (ATS) are becoming indispensable in facilities like healthcare centers, data centers, and manufacturing plants. Their ability to detect power interruptions and switch to backup sources without requiring manual intervention has made them crucial in these high-priority sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2 Billion |

| CAGR | 5.2% |

The open transition transfer switches segment is also expected to experience robust growth, with a forecasted CAGR of 4% through 2034. These switches are popular for their cost-effectiveness, ease of operation, and dependability. Open transition switches are typically used in less critical applications, such as commercial buildings and light industrial setups, where a momentary power interruption is acceptable. As more regions face grid instability and frequent power outages, the demand for backup power systems, including open transition transfer switches, is on the rise.

In the U.S., the contactor-based transfer switch market is anticipated to generate USD 390 million by 2034. This surge is driven by the growing need for reliable power systems in residential, commercial, and industrial sectors. The aging power grid, along with increasing instances of power interruptions, is accelerating the adoption of transfer switches in these sectors. The integration of renewable energy sources and the rise of distributed energy resources are further boosting market demand, as these technologies require advanced and efficient solutions for power transfer. As power backup becomes an essential part of modern infrastructure, the demand for transfer switches will continue to grow in response to these shifting energy landscapes.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Operations, 2021 – 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Non-automatic

- 5.4 Automatic

- 5.5 By-pass isolation

Chapter 6 Market Size and Forecast, By Transition, 2021 – 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Closed

- 6.3 Open

Chapter 7 Market Size and Forecast, By Installation, 2021 – 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 Emergency systems

- 7.3 Legally required systems

- 7.4 Critical operations power systems

- 7.5 Optional standby systems

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units, USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 India

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 South Africa

- 8.5.3 Saudi Arabia

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 AEG Power Solutions

- 9.3 Blue Square Group

- 9.4 Briggs & Stratton

- 9.5 Caterpillar

- 9.6 Cummins

- 9.7 Eaton

- 9.8 Generac Power Systems

- 9.9 General Electric

- 9.10 Kohler

- 9.11 Midwest Electric Products

- 9.12 One Two Three Electric

- 9.13 Peterson

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Taylor Power Systems

- 9.17 Vertiv Group