|

市場調查報告書

商品編碼

1667098

油井干預市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Well Intervention Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

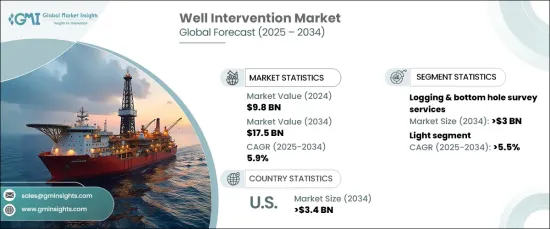

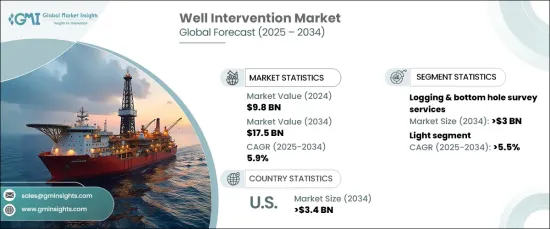

2024 年全球油井干預市場估值為 98 億美元,預計 2025 年至 2034 年的複合年成長率為 5.9%。需求激增主要歸因於發展中國家快速的都市化和工業成長。由於新油田尚未充分探勘,現有油田日趨老化,市場更加重視提高這些成熟資源的生產力。此外,由於地質條件的變化,對伐木服務的需求不斷成長,也促進了市場的成長。

預計油井干預產業將受益於幾個關鍵因素,包括對未開發資源的持續探勘和對頁岩生產的日益關注。用於收集關鍵地下資料的測井服務將繼續在這一發展中發揮重要作用。隨著成熟油井條件的惡化,測井服務變得更加重要。此外,海底產量的成長和政府旨在振興老化油田的舉措預計將在未來幾年推動產業擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 98億美元 |

| 預測值 | 175億美元 |

| 複合年成長率 | 5.9% |

預計到 2034 年,輕型井干預領域的成長率將超過 5.5%。這些技術包括連續油管、鋼絲繩和電纜等工具,有助於防止堵塞並能夠監測關鍵的井下資料,包括壓力和溫度變化。這些工具對於提高成熟油井的採收率至關重要。

預計到 2034 年,美國油井干預服務市場規模將超過 34 億美元。隨著更多成熟油田不斷被開發以及頁岩儲量的重要性日益增加,美國市場仍將是主要的成長動力。此外,中國快速的城市化和不斷擴大的工業基礎設施可能會對創新井下干涉技術的採用產生積極影響。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模與預測:依服務,2021 – 2034 年

- 主要趨勢

- 測井和井底勘測

- 管道/電源故障及維修

- 刺激

- 補救性固井

- 區域隔離

- 防砂

- 人工採油

- 釣魚

- 再穿孔

- 其他

第 6 章:市場規模與預測:按干預方式,2021 年至 2034 年

- 主要趨勢

- 光

- 中等的

- 高的

第 7 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 陸上

- 海上

- 淺的

- 深的

- 超深

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 挪威

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 印尼

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 埃及

- 奈及利亞

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- Archer

- Baker Hughes

- Calfrac

- ChampionX

- Cudd Energy

- DeepWell

- Expro

- Halliburton

- Helix

- Hunting Energy

- National Oilwell Varco

- Oceaneering

- Omega

- Schlumberger

- Superior Energy

- TechnipFMC

- Tenaris

- Trican

- Weatherford

- Weltec

The Global Well Intervention Market, with a valuation of USD 9.8 billion in 2024, is expected to expand at a CAGR of 5.9% from 2025 to 2034. The increasing need for well intervention services is driven by the growing number of mature oil and gas fields, alongside the rising demand for refined petroleum products. This demand surge is largely attributed to rapid urbanization and industrial growth in developing nations. As new oil fields remain underexplored and existing ones age, the market sees a greater focus on enhancing the productivity of these maturing resources. Furthermore, the growing requirement for logging services, prompted by changes in geological conditions, is contributing to market growth.

The well intervention sector is anticipated to benefit from several key factors, including the continuous exploration of untapped resources and the rising focus on shale production. Well logging services, used to collect critical subsurface data, will continue to play a significant role in this development. As conditions in mature wells degrade, logging services become even more essential. Additionally, subsea production growth and governmental initiatives aimed at revitalizing aging oilfields are expected to drive industry expansion in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $17.5 Billion |

| CAGR | 5.9% |

The light well intervention segment is predicted to grow at a rate exceeding 5.5% through 2034. The increased pressure to address supply-demand imbalances in the oil and gas industry will further promote the adoption of advanced intervention technologies. These technologies include tools like coiled tubing, slicklines, and wirelines, which help prevent blockages and are capable of monitoring critical downhole data, including pressure and temperature variations. Such tools are pivotal in enhancing the recovery rate from maturing wells.

The market for well intervention services in the United States is expected to surpass USD 3.4 billion by 2034. The demand for these services is fueled by an increase in low-pressure oil wells and a rising national energy consumption trend. As more mature oil fields continue to be developed and shale reserves gain increasing importance, the U.S. market will remain a key growth driver. Additionally, rapid urbanization and expanding industrial infrastructures in the country are likely to positively impact the adoption of innovative well intervention technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Service, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Logging & bottom hole survey

- 5.3 Tubing/Power failure & repair

- 5.4 Stimulation

- 5.5 Remedial cementing

- 5.6 Zonal isolation

- 5.7 Sand control

- 5.8 Artificial lift

- 5.9 Fishing

- 5.10 Reperforation

- 5.11 Others

Chapter 6 Market Size and Forecast, By Intervention, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Light

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Onshore

- 7.3 Offshore

- 7.3.1 Shallow

- 7.3.2 Deep

- 7.3.3 Ultra deep

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Norway

- 8.3.3 Netherlands

- 8.3.4 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Indonesia

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkiye

- 8.5.4 Egypt

- 8.5.5 Nigeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Archer

- 9.2 Baker Hughes

- 9.3 Calfrac

- 9.4 ChampionX

- 9.5 Cudd Energy

- 9.6 DeepWell

- 9.7 Expro

- 9.8 Halliburton

- 9.9 Helix

- 9.10 Hunting Energy

- 9.11 National Oilwell Varco

- 9.12 Oceaneering

- 9.13 Omega

- 9.14 Schlumberger

- 9.15 Superior Energy

- 9.16 TechnipFMC

- 9.17 Tenaris

- 9.18 Trican

- 9.19 Weatherford

- 9.20 Weltec