|

市場調查報告書

商品編碼

1667101

壓縮氫能儲存市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Compressed Hydrogen Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

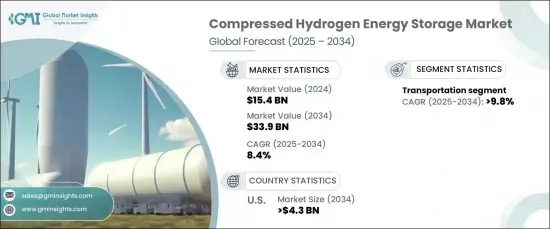

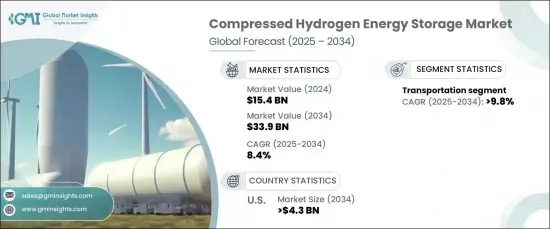

2024 年全球壓縮氫能儲存市場價值為 154 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.4%。壓縮氫儲存對於高效氫氣處理至關重要,使其能夠用於零排放能源系統。

世界各國政府和企業都在致力於實現雄心勃勃的氣候目標,刺激對氫基礎設施和技術的投資。壓縮氫氣在燃料電池汽車、電網穩定和備用電源系統中有著廣泛的應用。由於支持性政策和財政激勵,歐洲、北美和亞太等地區正在迅速採用氫儲存系統。氫能在全球能源轉型策略中的作用使得壓縮氫儲存成為清潔能源生態系統的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 154億美元 |

| 預測值 | 339億美元 |

| 複合年成長率 | 8.4% |

根據應用,市場分為運輸、工業、固定和其他用途。其中,交通運輸業預計到2034年將實現9.8%的複合年成長率。旨在促進清潔運輸解決方案的監管措施和激勵措施正在進一步加速市場擴張。

受美國對清潔能源計畫和脫碳努力的推動,美國壓縮氫能儲存市場預計到 2034 年將創收 43 億美元。交通運輸業,尤其是氫動力汽車的應用,在市場成長中發揮關鍵作用。此外,工業部門擴大將氫氣作為更清潔的能源替代品。高壓儲存技術和增強壓縮系統的進步正在提高效率並推動採用。

隨著氫氣不斷成為永續能源系統的基石,對可靠、高效的儲存解決方案的需求變得至關重要。壓縮氫儲存能夠很好地滿足日益成長的清潔能源需求,確保其在各種應用中的可用性。隨著不斷創新和基礎設施的不斷擴大,市場將實現大幅成長,從而增強氫在實現全球永續發展目標中的作用。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 工業的

- 運輸

- 固定式

- 其他

第6章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 世界其他地區

第7章:公司簡介

- Air Liquide

- Air Products

- Cockerill Jingli Hydrogen

- Engie

- FuelCell Energy

- GKN Hydrogen

- Gravitricity

- Hydrogen in Motion

- ITM Power

- Linde

- McPhy Energy

- Nel

- SSE

The Global Compressed Hydrogen Energy Storage Market was valued at USD 15.4 billion in 2024 and is projected to grow at a CAGR of 8.4% during 2025- 2034. The rising demand for sustainable energy solutions is driving the adoption of hydrogen as a key component in decarbonization strategies, especially in sectors where electrification is less viable, such as heavy industries and long-haul transportation. Compressed hydrogen storage is critical for efficient hydrogen handling, enabling its use in zero-emission energy systems.

Governments and corporations worldwide are committing to ambitious climate goals, spurring investments in hydrogen infrastructure and technologies. Compressed hydrogen offers versatile applications in fuel cell vehicles, grid stabilization, and backup power systems. Regions like Europe, North America, and Asia-Pacific are witnessing rapid adoption of hydrogen storage systems due to supportive policies and financial incentives. Hydrogen's role in global energy transition strategies has positioned compressed hydrogen storage as an essential element of the clean energy ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.4 Billion |

| Forecast Value | $33.9 Billion |

| CAGR | 8.4% |

The market is segmented by application into transportation, industrial, stationary, and other uses. Among these, the transportation sector is expected to register a CAGR of 9.8% through 2034. The increasing popularity of fuel cell electric vehicles (FCEVs), driven by their longer range and faster refueling capabilities compared to battery-electric vehicles, is a key growth factor. Regulatory measures and incentives aimed at promoting clean transportation solutions are further accelerating market expansion.

U.S. compressed hydrogen energy storage market is anticipated to generate USD 4.3 billion through 2034, fueled by the nation's focus on clean energy initiatives and decarbonization efforts. The transportation sector, particularly the adoption of hydrogen-powered vehicles, plays a pivotal role in market growth. Additionally, industrial sectors are increasingly turning to hydrogen as a cleaner energy alternative. Advances in high-pressure storage technologies and enhanced compression systems are improving efficiency and driving adoption.

As hydrogen continues to emerge as a cornerstone of sustainable energy systems, the need for reliable and efficient storage solutions becomes paramount. Compressed hydrogen storage is well-positioned to support the growing demand for clean energy, ensuring its availability across various applications. With ongoing innovation and expanding infrastructure, the market is poised for significant growth, reinforcing hydrogen's role in achieving global sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Industrial

- 5.3 Transportation

- 5.4 Stationary

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Netherlands

- 6.3.6 Russia

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Air Liquide

- 7.2 Air Products

- 7.3 Cockerill Jingli Hydrogen

- 7.4 Engie

- 7.5 FuelCell Energy

- 7.6 GKN Hydrogen

- 7.7 Gravitricity

- 7.8 Hydrogen in Motion

- 7.9 ITM Power

- 7.10 Linde

- 7.11 McPhy Energy

- 7.12 Nel

- 7.13 SSE