|

市場調查報告書

商品編碼

1667110

零排放飛機市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Zero Emission Aircraft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

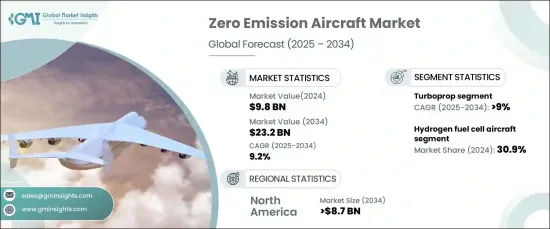

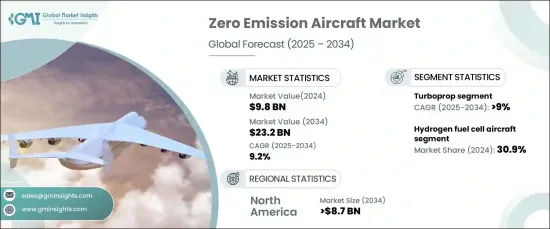

2024 年全球零排放飛機市場規模將達到 98 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 9.2%。隨著人們環境問題日益嚴重以及消費者對永續出行選擇的需求激增,對環保航空解決方案的需求比以往任何時候都高。隨著旅客擴大尋求更環保的替代品,航空公司優先考慮零排放飛機以符合永續發展目標。企業也正在採用這些環保解決方案來實現其社會責任目標,而投資者也在推動遵守環境、社會和治理 (ESG) 標準,加速採用更清潔的技術。

市場按飛機類型細分為電池電動飛機、氫燃料電池飛機、混合電動飛機和太陽能電動飛機。 2024年,氫燃料電池領域將以30.9%的市佔率領先市場。氫動力飛機利用燃料電池發電,為傳統噴射燃料提供永續的替代品。此技術特別適用於短程至中程航班,運行過程中實現零排放。燃料電池系統的持續創新正在提高其效率,使氫氣成為大幅減少航空碳足跡的關鍵解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 98億美元 |

| 預測值 | 232億美元 |

| 複合年成長率 | 9.2% |

根據飛機類型,市場還分為渦輪螺旋槳飛機、渦輪風扇飛機、翼身融合飛機(BWB)和全電動概念飛機。其中,渦輪螺旋槳飛機市場成長最快,2025-2034年期間的複合年成長率為9%。渦輪螺旋槳飛機以其燃油效率和與較短跑道的兼容性而聞名,它透過結合電力推進和永續燃料正在發生革命性的變化。這些技術進步使渦輪螺旋槳飛機成為區域和短途航線的理想選擇。混合電動和電池技術的整合進一步減少了排放,同時確保飛機保持這些應用所需的性能。

在大量投資和政府旨在減少航空相關碳排放的措施的推動下,北美零排放飛機市場預計到 2034 年將創收 87 億美元。該地區在電動和氫動力飛機的發展方面處於領先地位,並得到了老牌製造商和創新新創企業的大力貢獻。這些進步不僅支持了區域航空旅行的永續性,也促進了整個行業更廣泛地採用更清潔的技術。北美在這一領域的領導地位對於制定全球航空標準和實現全球減排目標至關重要。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 政府加強對清潔航空技術的支持

- 對永續和環保航空解決方案的需求不斷成長

- 電池和燃料電池系統的技術進步

- 航空公司減少碳排放的壓力越來越大

- 擴大綠色航空基礎設施和充電網路

- 產業陷阱與挑戰

- 零排放飛機的開發和生產成本高

- 目前電池技術的續航里程和能量密度有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依飛機類型,2021-2034 年

- 主要趨勢

- 電池電電動飛機

- 氫燃料電池飛機

- 油電混合飛機

- 太陽能電動飛機

第 6 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 渦輪螺旋槳

- 渦輪風扇系統

- 翼身融合(BWB)

- 全電動概念

第 7 章:市場估計與預測:按產能,2021-2034 年

- 主要趨勢

- 9 至 30

- 31 至 60

- 61 至 100

- 101 至 150

- 超過 150

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 商業的

- 軍隊

- 一般的

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Ampaire Inc.

- Aurora Flight Sciences (The Boeing Company)

- BETA Technologies, Inc.

- Bye Aerospace

- Equator Aircraft AS

- Evektor, spol. s ro

- Eviation

- Heart Aerospace

- Joby Aero, Inc.

- Lilium GmbH

- PIPISTREL doo

- Rolls-Royce plc

- Wright Electric

- ZeroAvia, Inc.

The Global Zero Emission Aircraft Market reached USD 9.8 billion in 2024 and is projected to grow at a robust CAGR of 9.2% from 2025 to 2034. With rising environmental concerns and a surge in consumer demand for sustainable travel options, the need for eco-friendly aviation solutions is higher than ever. As travelers increasingly seek greener alternatives, airlines prioritize zero-emission aircraft to align with sustainability goals. Corporations are also embracing these eco-conscious solutions to meet their social responsibility targets, while investors are pushing for adherence to environmental, social, and governance (ESG) standards, accelerating the adoption of cleaner technologies.

The market is segmented by aircraft type into battery electric, hydrogen fuel cell, hybrid electric, and solar electric aircraft. In 2024, the hydrogen fuel cell segment leads the market with a 30.9% share. Hydrogen-powered aircraft utilize fuel cells to generate electricity, providing a sustainable alternative to traditional jet fuels. This technology is especially suitable for short- to medium-haul flights, producing zero emissions during operation. Ongoing innovations in fuel cell systems are improving their efficiency, establishing hydrogen as a key solution to drastically reduce carbon footprints in aviation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 billion |

| Forecast Value | $23.2 billion |

| CAGR | 9.2% |

By aircraft type, the market is also divided into turboprop, turbofan, blended-wing body (BWB), and fully electric concepts. Among these, the turboprop segment is the fastest-growing, with a CAGR of 9% during 2025-2034. Known for its fuel efficiency and compatibility with shorter runways, the turboprop aircraft is being revolutionized through the incorporation of electric propulsion and sustainable fuels. These technological advancements are making turboprops ideal for regional and short-haul routes. The integration of hybrid-electric and battery technologies further reduces emissions while ensuring the aircraft maintains the performance required for these applications.

North America zero emission aircraft market is expected to generate USD 8.7 billion by 2034, fueled by significant investments and government initiatives aimed at reducing aviation-related carbon emissions. The region is leading the way in the development of electric and hydrogen-powered aircraft, with strong contributions from both established manufacturers and innovative startups. These advancements are not only supporting regional air travel sustainability but also contributing to the wider adoption of cleaner technologies across the industry. North America's leadership in this space is instrumental in shaping global aviation standards and achieving global emission reduction goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing government support for clean aviation technologies

- 3.6.1.2 Rising demand for sustainable and eco-friendly aviation solutions

- 3.6.1.3 Technological advancements in battery and fuel cell systems

- 3.6.1.4 Growing pressure for airlines to reduce carbon emissions

- 3.6.1.5 Expansion of green aviation infrastructure and charging networks

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and production costs of zero-emission aircraft

- 3.6.2.2 Limited range and energy density of current battery technology

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Battery electric aircraft

- 5.3 Hydrogen fuel cell aircraft

- 5.4 Hybrid electric aircraft

- 5.5 Solar electric aircraft

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Turboprop

- 6.3 Turbofan system

- 6.4 Blended-Wing Body (BWB)

- 6.5 Fully electrical concept

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 9 to 30

- 7.3 31 to 60

- 7.4 61 to 100

- 7.5 101 to 150

- 7.6 More than 150

Chapter 8 Market Estimates & Forecast, By End-use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Military

- 8.4 General

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ampaire Inc.

- 10.2 Aurora Flight Sciences (The Boeing Company)

- 10.3 BETA Technologies, Inc.

- 10.4 Bye Aerospace

- 10.5 Equator Aircraft AS

- 10.6 Evektor, spol. s r. o.

- 10.7 Eviation

- 10.8 Heart Aerospace

- 10.9 Joby Aero, Inc.

- 10.10 Lilium GmbH

- 10.11 PIPISTREL d.o.o.

- 10.12 Rolls-Royce plc

- 10.13 Wright Electric

- 10.14 ZeroAvia, Inc.