|

市場調查報告書

商品編碼

1667126

分散式控制系統 (DCS) 市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Distributed Control Systems (DCS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

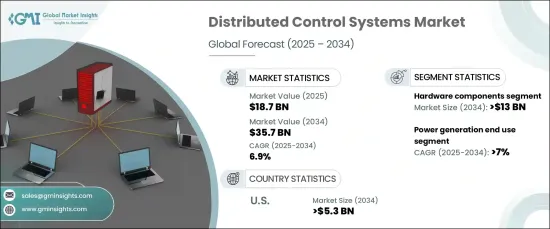

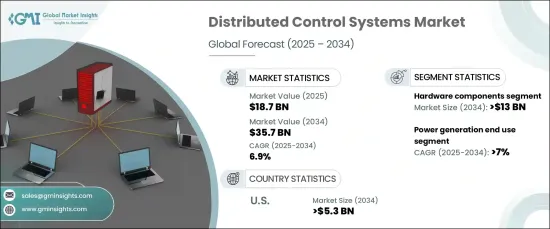

2024 年全球分散式控制系統市場規模達到 187 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.9%。各行各業都在不斷尋求能夠提高營運效率、改善安全性並減少人為干預的先進解決方案。在人工智慧 (AI)、機器學習和物聯網 (IoT) 等工業 4.0 技術的推動下,向智慧製造的轉變正在推動對這些系統的需求。隨著各行各業專注於透過數據驅動的洞察來最佳化營運,DCS 技術對於實現這些目標變得不可或缺。

此外,人們對節能解決方案的需求強勁,同時對再生能源的關注度不斷提高,所有這些都在塑造著市場。隨著組織轉向更永續的實踐,現有基礎設施的現代化成為首要任務,這進一步推動了對先進 DCS 解決方案的需求。對即時和遠端控制和管理複雜過程的能力的日益重視是另一個促進因素。 DCS 技術使業界能夠改善製程控制、提高生產力並確保遵守不斷變化的法規。隨著對卓越營運的需求不斷上升,DCS 系統正成為工業領域的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 187億美元 |

| 預測值 | 357億美元 |

| 複合年成長率 | 6.9% |

在組件方面,硬體部分預計到 2034 年將創收 130 億美元。為了支援這一趨勢,控制器和輸入/輸出系統等組件的需求量很大。在軟體方面,隨著各行各業致力於最佳化決策過程,先進製程控制、即時分析和人工智慧整合的解決方案越來越受歡迎。此外,對閘道器和交換器等網路組件的需求也在增加,物聯網整合在確保不同營運層面之間的無縫連接方面發揮著重要作用。

除了獨立的硬體和軟體解決方案外,供應商現在還提供結合兩種元素的捆綁解決方案,以簡化系統整合。這些捆綁包專門用於降低複雜性、增強互通性並簡化各部門 DCS 系統的部署。當各行各業都在尋求將新技術融入現有基礎設施的經濟高效的解決方案時,這一趨勢就顯得尤為重要。

發電產業在 DCS 市場中預計將顯著成長,預計到 2034 年複合年成長率將達到 7%。石油和天然氣、製藥、食品和飲料等關鍵產業也正在推動 DCS 的採用,以尋求提高營運效率和產品品質。此外,工業 4.0 和智慧工廠的不斷興起正在加速 DCS 在各種工業應用中的實施,從而進一步推動市場成長。

在美國,到 2034 年,分散式控制系統的需求將達到 53 億美元。利用物聯網、人工智慧和雲端技術的工業 4.0 計劃的興起繼續成為主要的成長動力。此外,為了確保平穩可靠的運行,對網路安全和生命週期服務的重視也推動了全國範圍內 DCS 解決方案的採用。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:按組件分類,2021 年至 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第 6 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 發電

- 石油和天然氣

- 化學品

- 礦業與金屬

- 食品和飲料

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- Azbil Corporation

- Concept Systems

- Emerson Electric

- Hitachi

- HollySys Group

- Honeywell International

- Ingeteam

- Mitsubishi Electric

- NovaTech

- Rockwell Automation

- Schneider Electric

- Siemens

- Toshiba Infrastructure Systems & Solutions

- Valmet

- Yaskawa Electric

- Yokogawa Europe

- ZAT

The Global Distributed Control Systems Market reached USD 18.7 billion in 2024 and is expected to exhibit a CAGR of 6.9% from 2025 to 2034. This market expansion is being driven by the increasing adoption of industrial automation across various sectors. Industries are increasingly seeking advanced solutions that can enhance operational efficiency, improve safety, and reduce human intervention. The shift toward smart manufacturing, boosted by Industry 4.0 technologies like artificial intelligence (AI), machine learning, and the Internet of Things (IoT), is propelling the demand for these systems. As industries focus on optimizing operations through data-driven insights, DCS technology is becoming indispensable in achieving these goals.

Additionally, there's a strong demand for energy-efficient solutions, along with a heightened focus on renewable energy sources, all of which are shaping the market. As organizations transition to more sustainable practices, the modernization of existing infrastructure is a key priority, further boosting the need for advanced DCS solutions. The growing emphasis on the ability to control and manage complex processes in real-time and remotely is another driving factor. DCS technology allows industries to improve process control, enhance productivity, and ensure compliance with evolving regulations. As the demand for operational excellence continues to rise, DCS systems are becoming an essential part of the industrial landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.7 Billion |

| Forecast Value | $35.7 Billion |

| CAGR | 6.9% |

In terms of components, the hardware segment is anticipated to generate USD 13 billion by 2034. The need for high reliability, scalability, and modularity is crucial for industries looking to upgrade their systems, especially as automation becomes more widespread. Components such as controllers and input/output systems are in high demand to support this trend. On the software side, solutions for advanced process control, real-time analytics, and AI integration are growing increasingly popular as industries work to optimize decision-making processes. Moreover, the demand for network components like gateways and switches is also on the rise, with IoT integration playing a significant role in ensuring seamless connectivity across different operational levels.

Alongside standalone hardware and software solutions, vendors are now offering bundled solutions that combine both elements to simplify system integration. These bundled packages are specifically designed to reduce complexity, enhance interoperability, and streamline the deployment of DCS systems across various sectors. This trend is especially important as industries seek cost-effective solutions to integrate new technologies into their existing infrastructure.

The power generation sector is poised for significant growth within the DCS market, with a projected CAGR of 7% through 2034. This growth is largely attributed to the increasing demand for automation in grid management, as well as the integration of renewable energy sources into power systems. Key industries such as oil and gas, pharmaceuticals, and food and beverage are also driving DCS adoption, seeking to enhance operational efficiency and product quality. Furthermore, the ongoing rise of Industry 4.0 and smart factories is accelerating the implementation of DCS across various industrial applications, further propelling market growth.

In the U.S., the demand for distributed control systems is set to generate USD 5.3 billion by 2034. This demand is supported by the ongoing need for advanced automation across crucial industries such as power generation, chemicals, and oil and gas. The rise of Industry 4.0 initiatives, which leverage IoT, AI, and cloud technologies, continues to be a major growth driver. Additionally, the emphasis on cybersecurity and lifecycle services to ensure smooth and reliable operations is also fueling the adoption of DCS solutions across the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Power generation

- 6.3 Oil & gas

- 6.4 Chemicals

- 6.5 Mining & metals

- 6.6 Food & beverage

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Azbil Corporation

- 8.3 Concept Systems

- 8.4 Emerson Electric

- 8.5 Hitachi

- 8.6 HollySys Group

- 8.7 Honeywell International

- 8.8 Ingeteam

- 8.9 Mitsubishi Electric

- 8.10 NovaTech

- 8.11 Rockwell Automation

- 8.12 Schneider Electric

- 8.13 Siemens

- 8.14 Toshiba Infrastructure Systems & Solutions

- 8.15 Valmet

- 8.16 Yaskawa Electric

- 8.17 Yokogawa Europe

- 8.18 ZAT