|

市場調查報告書

商品編碼

1667129

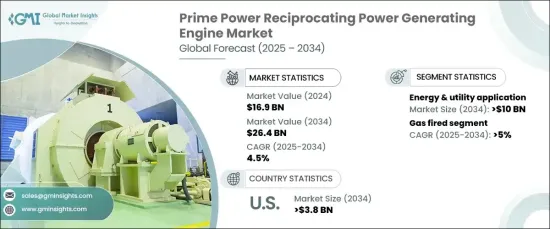

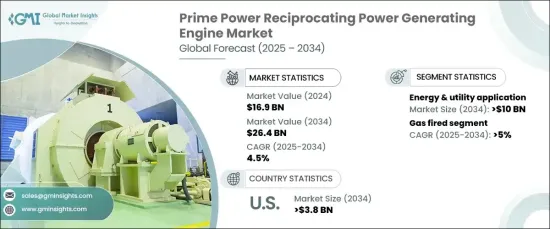

原動力往復式發電引擎市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Prime Power Reciprocating Power Generating Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球原動力往復式發電引擎市場價值為 169 億美元,預計 2025-2034 年期間的複合年成長率為 4.5%。這種成長主要由多個領域對可靠、穩定電力的日益成長的需求所推動,包括工業、醫療保健、資料中心和離網地點。這些引擎因其效率、壽命和處理大量功率負載的能力而受到高度評價,使其成為發電應用的首選。

預計能源和公用事業部門將主導市場,到 2034 年收入將達到 100 億美元。隨著基礎設施投資的成長和政府主導的電氣化計畫的不斷擴大,對這些引擎的需求將會上升,從而進一步支持市場的擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 169億美元 |

| 預測值 | 264億美元 |

| 複合年成長率 | 4.5% |

預計到 2034 年,燃氣動力市場的複合年成長率將達到 5%。全球對再生能源的日益重視也在推動對燃氣引擎的需求方面發揮了重要作用,燃氣引擎具有高轉化率、元件最佳化、燃燒效率高和維護成本低等優點。這些屬性有助於這些引擎在各行業中得到更廣泛的應用。

預計到 2034 年,美國主要動力往復式發電引擎市場將創收 38 億美元。現有電網的壓力加上不斷成長的電力需求,凸顯了這些引擎在提供可靠備用電源解決方案方面的重要性。此外,資料中心等關鍵設施對備用電源的需求不斷成長,也推動了這些引擎的採用。人們對可靠電源需求的認知不斷提高,進一步提升了市場的成長前景。

隨著產業和政府注重確保能源效率和永續性,對原動力往復式發電引擎的需求預計將繼續呈上升趨勢,在滿足日益成長的全球能源需求方面發揮關鍵作用。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模及預測:依燃料類型,2021 – 2034 年

- 主要趨勢

- 瓦斯

- 柴油

- 雙燃料

- 其他

第6章:市場規模及預測:依額定功率,2021 – 2034 年

- 主要趨勢

- 0.5 兆瓦 - 1 兆瓦

- > 1 兆瓦 - 2 兆瓦

- > 2 兆瓦 - 3.5 兆瓦

- > 3.5 兆瓦 - 5 兆瓦

- > 5 兆瓦 - 7.5 兆瓦

- >7.5兆瓦

第 7 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 工業的

- 熱電聯產

- 能源與公用事業

- 垃圾掩埋場和沼氣

- 其他

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 西班牙

- 荷蘭

- 丹麥

- 挪威

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 泰國

- 新加坡

- 印尼

- 馬來西亞

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 阿曼

- 科威特

- 伊朗

- 埃及

- 土耳其

- 約旦

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

第9章:公司簡介

- AB Volvo Penta

- Caterpillar

- Cummins

- Deere & Company

- DEUTZ AG

- Kirloskar

- KUBOTA Corporation

- MITSUBISHI HEAVY INDUSTRIES

- Perkins Engines Company

- Rehlko

- Rolls-Royce

- Sulzer

- Wartsila

- YANMAR HOLDINGS

- Yuchai International

The Global Prime Power Reciprocating Power Generating Engines Market was valued at USD 16.9 billion in 2024 and is projected to grow at a CAGR of 4.5% during 2025-2034. This growth is primarily driven by the increasing need for reliable, constant power across several sectors, including industries, healthcare, data centers, and off-grid locations. These engines are highly regarded for their efficiency, longevity, and capacity to handle substantial power loads, making them a favored choice in power generation applications.

The energy and utility sector is expected to dominate the market, with revenues generating USD 10 billion by 2034. These engines are gaining traction as prime movers due to their ability to achieve impressive electrical efficiencies-over 50% in a single cycle and up to 70% in combined cycles. As investments in infrastructure grow and government-led electrification initiatives continue to expand, the demand for these engines is set to rise, further supporting the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.9 Billion |

| Forecast Value | $26.4 Billion |

| CAGR | 4.5% |

The gas-powered segment of the market is forecast to grow at a CAGR of 5% through 2034. This is attributed to technological advancements that enhance engine performance and efficiency, as well as the increasing need to adhere to stringent environmental regulations. The growing global emphasis on renewable energy sources has also played a significant role in driving the demand for gas-fired engines, which offer benefits such as high translation, optimized elements, efficient combustion, and low maintenance. These attributes contribute to the broader adoption of these engines across various industries.

U.S. prime power reciprocating power generating engine market is anticipated to generate USD 3.8 billion by 2034. Factors contributing to this growth include the increasing need for uninterrupted power and the growing frequency of power disruptions due to extreme weather events. The strain on existing electrical grids, coupled with the rising electricity demand, has underscored the importance of these engines in providing a reliable backup power solution. Additionally, the growing demand for backup power in critical facilities, such as data centers, is driving the adoption of these engines. Increased awareness of the need for reliable power sources further boosts the market's growth prospects.

As industries and governments focus on ensuring energy efficiency and sustainability, the demand for prime power reciprocating power generating engines is expected to continue its upward trajectory, playing a crucial role in meeting the growing global energy demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel Type, 2021 – 2034 (Units, MW & USD Million)

- 5.1 Key trends

- 5.2 Gas-fired

- 5.3 Diesel-fired

- 5.4 Dual fuel

- 5.5 Others

Chapter 6 Market Size and Forecast, By Rated Power, 2021 – 2034 (Units, MW & USD Million)

- 6.1 Key trends

- 6.2 0.5 MW - 1 MW

- 6.3 > 1 MW - 2 MW

- 6.4 > 2 MW - 3.5 MW

- 6.5 > 3.5 MW - 5 MW

- 6.6 > 5 MW - 7.5 MW

- 6.7 > 7.5 MW

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (Units, MW & USD Million)

- 7.1 Key trends

- 7.2 Industrial

- 7.3 CHP

- 7.4 Energy & utility

- 7.5 Landfill & biogas

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (Units, MW & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Denmark

- 8.3.9 Norway

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Thailand

- 8.4.7 Singapore

- 8.4.8 Indonesia

- 8.4.9 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 Qatar

- 8.5.4 Oman

- 8.5.5 Kuwait

- 8.5.6 Iran

- 8.5.7 Egypt

- 8.5.8 Turkey

- 8.5.9 Jordan

- 8.5.10 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

- 8.6.4 Peru

Chapter 9 Company Profiles

- 9.1 AB Volvo Penta

- 9.2 Caterpillar

- 9.3 Cummins

- 9.4 Deere & Company

- 9.5 DEUTZ AG

- 9.6 Kirloskar

- 9.7 KUBOTA Corporation

- 9.8 MITSUBISHI HEAVY INDUSTRIES

- 9.9 Perkins Engines Company

- 9.10 Rehlko

- 9.11 Rolls-Royce

- 9.12 Sulzer

- 9.13 Wartsila

- 9.14 YANMAR HOLDINGS

- 9.15 Yuchai International