|

市場調查報告書

商品編碼

1667151

能源市場中的區塊鏈機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Blockchain in Energy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

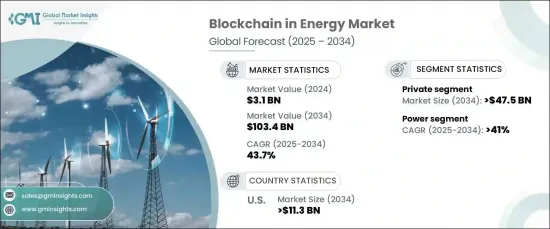

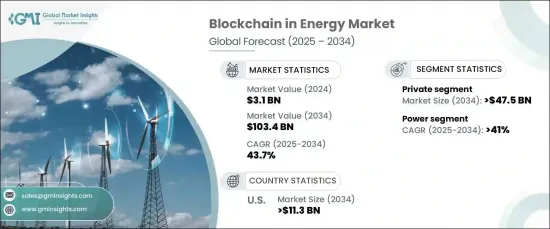

2024 年全球能源區塊鏈市場價值為 31 億美元,預計 2025 年至 2034 年期間的複合年成長率為 43.7%。 這一成長是由分散式帳本技術 (DLT) 在最佳化、保護和分散能源系統方面的日益廣泛的應用推動的。區塊鏈提供了一種透明、防篡改的方法來追蹤能源交易,包括再生能源證書(REC)、碳權、點對點能源交易和電網管理。這項技術提高了營運效率,減少了對中介機構的依賴,並促進了創新,特別是在再生能源整合、能源儲存和分散能源網路方面。

能源系統日益數位化,加上全球智慧電錶採用的增加,預計將推動區塊鏈的廣泛實施。此外,在能源部門私有化和政府節約電力措施的支持下,再生能源(RES)的擴張將進一步鼓勵區塊鏈在能源管理中的整合。這些發展實現了更有效率的能源追蹤、更高的電網可靠性和簡化的營運,為該領域採用區塊鏈創造了有利的環境。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 31億美元 |

| 預測值 | 1034億美元 |

| 複合年成長率 | 43.7% |

能源市場的區塊鏈分為公共和私人部分。預計私營部門將經歷資料成長,到 2034 年將產生 544 億美元的收入。對提供安全、授權存取和敏感資訊控制的區塊鏈解決方案的需求將成為該領域擴張的關鍵因素。此外,日益轉向符合監管和永續性要求的透明、防篡改解決方案將為區塊鏈市場創造有利可圖的機會。

從應用角度來看,能源市場的區塊鏈分為電力和油氣兩大領域。受交易成本降低和網路透明度提高的推動,到 2034 年,電力行業的複合年成長率預計將達到 43%。點對點(P2P)能源交易平台讓消費者和生產者無需中介直接交換能源,這將有助於降低成本並增加能源使用,尤其是在能源服務不足的地區。電力產業的持續數位化也將推動區塊鏈的採用,確保與電網營運和能源市場相關的敏感資料的安全。

預計到 2034 年,美國能源市場的區塊鏈將產生 130 億美元的收入。加州和紐約等地區向再生能源的轉變將進一步促進區塊鏈整合,降低交易成本並促進消費者和生產者之間的直接能源交換。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第 5 章:市場規模及預測:依類別,2021 – 2034 年

- 主要趨勢

- 民眾

- 私人的

第 6 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 力量

- 電網交易

- 點對點交易

- 能源融資

- 永續性歸因

- 電動車充電

- 其他

- 石油和天然氣

- 供應鏈

- 營運

- 貿易

- 安全

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 荷蘭

- 法國

- 西班牙

- 亞太地區

- 中國

- 日本

- 新加坡

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 千枝

第8章:公司簡介

- Accenture

- Electron

- Greeneum

- IBM

- Infosys Limited

- Kaleido

- LO3 Energy

- Oracle

- Power Ledger

- SAP

- Sun Exchange

- WePower

The Global Blockchain In Energy Market was valued at USD 3.1 billion in 2024 and is projected to grow at a CAGR of 43.7% from 2025 to 2034. This growth is driven by the increasing application of distributed ledger technology (DLT) in optimizing, securing, and decentralizing energy systems. Blockchain offers a transparent, tamper-proof method for tracking energy transactions, including renewable energy certificates (RECs), carbon credits, peer-to-peer energy trading, and grid management. This technology enhances operational efficiency, reduces reliance on intermediaries, and fosters innovation, particularly in renewable energy integration, energy storage, and decentralized energy networks.

The increasing digitization of energy systems, combined with the global rise in smart meter adoption, is expected to drive widespread blockchain implementation. Additionally, the expansion of renewable energy sources (RES), supported by energy sector privatization and government initiatives aimed at conserving electricity, will further encourage blockchain integration in energy management. These developments enable more efficient energy tracking, improved grid reliability, and streamlined operations, creating a favorable environment for blockchain adoption in the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $103.4 Billion |

| CAGR | 43.7% |

The blockchain in energy market is categorized into public and private segments. The private segment is anticipated to experience substantial growth, generating USD 54.4 billion by 2034. This growth is driven by the need for heightened security, faster transaction speeds, and greater control over data. The demand for blockchain solutions that provide secure, authorized access and control over sensitive information will be a key factor in this segment's expansion. Additionally, the growing shift toward transparent, tamper-proof solutions that meet regulatory and sustainability requirements will create lucrative opportunities for the blockchain market.

In terms of application, the blockchain in energy market is divided into power and oil & gas. The power sector is expected to grow at a CAGR of 43% by 2034, driven by lower transaction costs and improved network transparency. The demand for peer-to-peer (P2P) energy trading platforms, which allow consumers and producers to exchange energy directly without intermediaries, will help reduce costs and increase energy access, especially in underserved areas. The continued digitalization of the power sector will also drive blockchain adoption, ensuring the security of sensitive data related to grid operations and energy markets.

U.S. blockchain in energy market is expected to generate USD 13 billion by 2034. The growing adoption of distributed energy resources (DERs), such as solar, wind, and battery storage, will increase the demand for secure, decentralized platforms to manage these assets. The shift towards renewable energy in regions like California and New York will further promote blockchain integration, reducing transaction costs and facilitating direct energy exchanges between consumers and producers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Category, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Power

- 6.2.1 Grid transactions

- 6.2.2 Peer to peer transactions

- 6.2.3 Energy financing

- 6.2.4 Sustainability attribution

- 6.2.5 Electric vehicle charging

- 6.2.6 Other

- 6.3 Oil & gas

- 6.3.1 Supply chain

- 6.3.2 Operations

- 6.3.3 Trading

- 6.3.4 Security

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Netherlands

- 7.3.4 France

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 Singapore

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chie

Chapter 8 Company Profiles

- 8.1 Accenture

- 8.2 Electron

- 8.3 Greeneum

- 8.4 IBM

- 8.5 Infosys Limited

- 8.6 Kaleido

- 8.7 LO3 Energy

- 8.8 Oracle

- 8.9 Power Ledger

- 8.10 SAP

- 8.11 Sun Exchange

- 8.12 WePower