|

市場調查報告書

商品編碼

1642027

能源區塊鏈 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Blockchain in the Energy Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

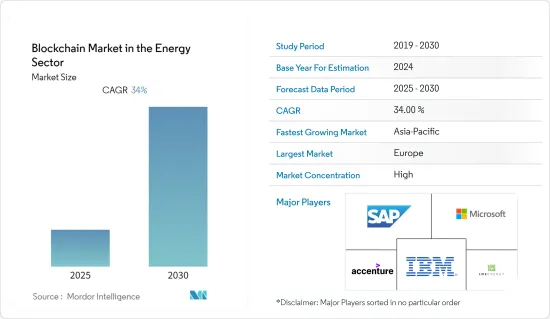

預測期內能源領域區塊鏈市場預計複合年成長率達 34%

關鍵亮點

- 區塊鏈技術可以幫助社區實現可再生能源目標,使電網更加可靠和高效,並減輕公用事業支付清潔能源發電的負擔。因此,預計在預測期內其採用率將會增加。

- 市場上的供應商預計將利用微電網日益成長的使用,因為它們允許在特定區域內進行電力交易,並且在主電網發生緊急情況時也能提供優勢(例如,充當備用解決方案)。其中一個例子是德國能源區塊鏈銷售商 OLI Systems 在歐洲微電網上進行的先導計畫。

- 區塊鏈在能源領域的最大好處是降低成本、減少環境破壞、在不犧牲隱私的情況下實現相關人員之間的更加開放。

- 像以太坊解決方案這樣的企業軟體解決方案也可以使石油和天然氣等傳統能源產業受益。這些私有區塊鏈網路允許石油和天然氣公司保護隱私和商業機密,方法是僅允許預先核准的相關人員存取資料並加入選定的聯盟。

- 在主要應用中,「付款」類別顯示出區塊鏈在能源領域的最高相關性和實施。分散式帳本技術有潛力透過追蹤電網材料的監管鏈來提高公共產業提供者的效率。除了來源追蹤之外,區塊鏈還為可再生能源的分配提供了獨特的解決方案。

新冠疫情危機凸顯了利用數位和能源技術對人民、企業和經濟的重要性。該公司知道人們在多大程度上依賴數位和能源解決方案來實現在家工作、家庭供暖、醫院營運和商業活動。

能源領域區塊鏈的市場趨勢

付款佔市場最大佔有率

- 區塊鏈帳本被應用於各個領域,包括降低交易成本、提高交易效率和識別能源來源。例如,IBM 的 Blockchain World Wire 網路徹底改變了跨境(外匯)付款。這使得近乎即時的貿易清算和最終付款成為可能。該方法充當雙方共用的約定的價值存儲,以整合付款指示訊息並利用數位資產來付款交易。此類產品功能可增強各領域的付款,可能促進市場競爭。

- 區塊鏈技術的使用也使得將付款系統連接到智慧電網成為可能。這使得企業希望在金融服務和智慧電網技術的整合上投入更多。

- 區塊鏈技術使得傳統的付款方式失效。他們也正在努力克服駭客攻擊和資料外洩問題。例如,電力公司 RWE 已經測試了區塊鏈技術,以管理德國和加州數百個自動電動車充電站的身份驗證和計費流程。

- 在能源領域使用區塊鏈還可以最大限度地減少公用事業公司的管理費用。透過促進公用事業公司和消費者之間的計費和計量流程,無需中介零售商或仲介,消費者可以節省成本。

預計美國將佔很大佔有率

- 當區塊鏈應用於能源產業時,能源交易等交易幾乎可以即時記錄和付款。由於相關人員都使用同一平台,因此不需要中介,也幾乎不需要調解。北美是區塊鏈技術的早期採用者,已在能源領域大量應用區塊鏈。

- 根據美國能源資訊署的數據,2021 年美國公用事業規模發電設施生產了約 4.12 兆千瓦時(kWh)的能源,約 41.16 億千瓦時。煤炭、天然氣、石油和其他氣體約佔發電燃料的61%。核能約佔19%,可再生能源約佔20%。小型太陽能光電系統額外發電490億度。如此大規模的能源生產使得在能源領域引入區塊鏈解決方案成為可能,以促進付款交易、風險和合規管理以及許多其他問題。

- 政府機構正在提供資金,採用區塊鏈來確保電網的安全。例如,美國能源局(DOE) 已向 TFA 實驗室提供約 20 萬美元的資金,以幫助保護國家電網的安全。提案的策略包括檢驗和保護電網上的設備免受惡意軟體的侵害,開發技術以提高常用家用電子電器產品的安全性,並使用區塊鏈技術來保護任何物品免受惡意軟體的侵害。一種價格合理的方法來保護任何物品免受盒子。

- Invenergy 是非上市公司,該公司和通用電氣可再生能源宣布,998 兆瓦的特拉弗斯風電中心將於 2022 年 3 月開始商業營運。這是北美第一個分階段建造的風電場。預計這些因素將在預測期內促進市場成長。

2022 年 1 月,BMW與 Energy Web 合作展示了使用可再生能源為電動車充電的區塊鏈解決方案。充電費用透過 Energy Web 的區塊鏈解決方案支付。

能源領域的區塊鏈產業概況

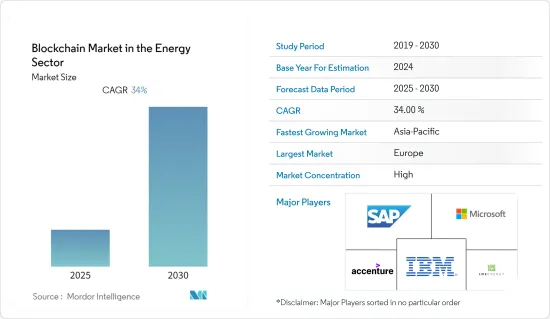

有許多大公司進入能源領域的區塊鏈市場,競爭非常激烈。就市場佔有率而言,SAP SE(SAP)、微軟公司、埃森哲公司和 IBM 公司是目前市場上最大的三大參與企業。這些大公司佔據了很大的市場佔有率,因此專注於在其他國家贏得更多的客戶。這些公司正在利用戰略合作計劃來增加市場佔有率和盈利。為了增強產品能力,在市場上營運的公司也在收購致力於能源技術區塊鏈的新興企業。

2022年7月,INFINITY與區塊鏈公司Yesports合作。此次合作旨在利用非同質化代幣(NFT)推出粉絲參與計畫。這筆交易凸顯了越來越多的電競組織希望藉助區塊鏈和 Web3 來建立粉絲參與策略。

2022年4月,英特爾宣布了英特爾的區塊鏈ASIC(專用積體電路)。據稱,該晶片可以使工作量證明共識網路中的哈希計算更加節能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 市場影響評估

- 市場促進因素

- 可變電費的出現和P2P交易的必要性

- 創業投資積極投入

- 市場限制

- 可擴展性約束

- 能源領域的區塊鏈-按地區分類的使用案例場景

第5章 市場區隔

- 按應用

- 支付

- 智慧合約

- 數位身份驗證

- 管治,風險與合規管理

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 日本

- 澳洲

- 紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 以色列

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 公司簡介

- SAP SE(SAP)

- Electron(Chaddenwych Services Limited)

- Accenture PLC

- IBM Corporation

- LO3 Energy Inc.

- GREENEUM

- Drift Marketplace Inc.

- IOTA Foundation

- Btl Group Ltd.

- Power Ledger Pty Ltd.

- ImpactPPA

第7章投資分析

第 8 章:未來機遇

The Blockchain Market in the Energy is expected to register a CAGR of 34% during the forecast period.

Key Highlights

- Blockchain technology helps regions meet their goals for renewable energy, makes grids more reliable and efficient, and cuts down on the amount of money utilities have to spend on clean energy generation. Thus, its adoption is expected to increase over the forecast period.

- Since microgrids allow electricity to be traded within a certain area and have other benefits during emergencies with the main grid (like acting as backup solutions), vendors on the market could take advantage of the growing use of microgrids. One illustration is the pilot project that German company OLI Systems, which sells energy blockchains, set up in Europe's microgrid.

- The biggest benefits of blockchain in the energy sector are lower costs, less damage to the environment, and more openness among stakeholders without sacrificing privacy.

- Software solutions, such as enterprise Ethereum solutions, can also help traditional energy sectors like oil and gas. With these private blockchain networks, oil and gas companies can protect their privacy and trade secrets by giving only pre-approved parties access to their data and letting them join select consortiums.

- Among significant applications, the 'payments' category exhibited the highest association and implementation of blockchain in the energy sector. By tracking the chain of custody for grid materials, distributed ledger technology can potentially improve utility providers' efficiencies. Beyond provenance tracking, blockchain offers unique solutions for renewable energy distribution.

The COVID-19 pandemic crisis made it more important for people, businesses, and the economy to use digital and energy technologies. The company knew how much it depended on digital and energy solutions to help people work from home, heat their homes, run hospitals, and run their businesses.

Blockchain in Energy Sector Market Trends

Payments Hold the Largest Share in the Market

- The blockchain ledger is used in many different fields to lower transaction costs, make exchanges more efficient, and find out where energy comes from. For instance, IBM's Blockchain World Wire network revolutionized cross-border (Forex) payments. It enabled nearly real-time transaction clearing and settlement with finality. By acting as an agreed-upon store of value shared between parties, the method integrated payment instruction messages and leveraged digital assets to settle transactions. Such product features that enhance payments in different sectors will create a competitive edge in the market.

- The use of blockchain technology also made it possible to connect payment systems to smart grids. This made the companies want to put even more money into combining financial services with smart grid technology.

- Blockchain technology has made traditional payment methods less effective. It is also advancing to overcome the issues of hacking and data breaches. For instance, RWE's power utility has tested blockchain technology to authenticate and manage the billing process for hundreds of autonomous electric vehicle charging stations in Germany and California.

- Using blockchain in the energy sector would also minimize the overhead for utilities. By facilitating the billing and metering process between the utility and the consumer instead of involving intermediary retailers and brokers, consumers benefit from lower costs.

United States is Expected to Hold Major Share

- When blockchain is used in the energy industry, transactions, like trading energy, can be recorded and settled almost immediately. Since all parties use the same platform, there is no need for an intermediary and little need for reconciliation. As early adopters of technology, North Americans are seeing a lot of blockchain being used in the energy sector.

- According to the US Energy Information Administration, utility-scale electricity-producing facilities in the US generated nearly 4.12 trillion kilowatt-hours (kWh), or about 4.116 billion kWh, of energy in 2021. Coal, natural gas, petroleum, and other gases made up about 61% of the fuel used to generate this power. Nuclear energy roughly accounted for 19% of the total, while renewable energy sources comprised about 20%. Small-scale solar photovoltaic systems generated an additional 49 billion kWh of electricity. Such massive energy production will enable the energy sector to adopt blockchain solutions to ease payment transactions, risk and compliance management, and many other issues.

- Government bodies are granting funds to incorporate blockchain to secure energy grids. For example, to assist in safeguarding the national power system, the US Department of Energy (DOE) is awarding TFA Labs almost USD 200,000 in funding. The suggested strategy calls for verifying and securing devices on the grid that are free of malware, creating technology to increase the security of commonly used consumer electronics, and offering a reasonably priced way to secure any item right out of the box using blockchain technology.

- Invenergy, a privately held company that builds, owns, and runs clean energy solutions around the world, and GE Renewable Energy announced that the 998-megawatt Traverse Wind Energy Center will begin commercial operations in March 2022. This was the first wind farm in North America to be built in a single phase. Such factors are expected to augment the market's growth during the forecast period.

In January 2022, BMW partnered with Energy Web to demonstrate a blockchain solution for recharging electric vehicles with renewable energy. The charging cost was routed through Energy Web's blockchain solution.

Blockchain in Energy Sector Industry Overview

There are a lot of big players in the energy blockchain market, which is very competitive. As far as market share goes, SAP SE (SAP), Microsoft Corp., Accenture PLC, and IBM Corp. are the three biggest players on the market right now. These big players have a big share of the market, so they are focusing on getting more customers in other countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability. To strengthen their product capabilities, the companies operating in the market are also acquiring start-ups working on blockchain in energy technologies.

In July 2022, INFINITY partnered with the blockchain company Yesports. This partnership aimed to launch a fan engagement program based on non-fungible tokens (NFTs). The deal highlighted an increasing number of esports organizations looking to rely on blockchain and Web3 to establish fan engagement strategies.

Intel announced in April 2022 that their new Intel Blockchain ASIC (application-specific integrated circuit) was coming out. This chip is supposed to make hashing for proof-of-work consensus networks more energy-efficient.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment Of The Impact Of COVID-19 On The Market

- 4.5 Market Drivers

- 4.5.1 Emergence of Variable Electricity Rates and Need for Peer-to-peer Trading

- 4.5.2 Aggressive Spending by Venture Capitalists

- 4.6 Market Restraints

- 4.6.1 Scalability Constraints

- 4.7 Blockchain In Energy Sector - Use Case Scenario Across The Region

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Payments

- 5.1.2 Smart Contracts

- 5.1.3 Digital Identities

- 5.1.4 Governance, Risk, and Compliance Management

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 Netherlands

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 Japan

- 5.2.3.2 Australia

- 5.2.3.3 New Zealand

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Israel

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE (SAP)

- 6.1.2 Electron (Chaddenwych Services Limited)

- 6.1.3 Accenture PLC

- 6.1.4 IBM Corporation

- 6.1.5 LO3 Energy Inc.

- 6.1.6 GREENEUM

- 6.1.7 Drift Marketplace Inc.

- 6.1.8 IOTA Foundation

- 6.1.9 Btl Group Ltd.

- 6.1.10 Power Ledger Pty Ltd.

- 6.1.11 ImpactPPA