|

市場調查報告書

商品編碼

1667178

連接器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Connector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

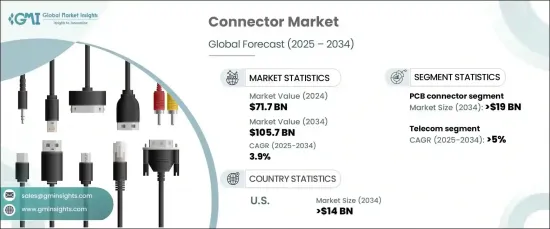

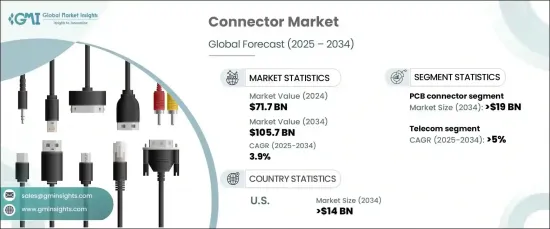

2024 年全球連接器市場價值為 717 億美元,預計將大幅成長,預計 2025 年至 2034 年的複合年成長率為 3.9%。隨著消費性電子、汽車和電信產業的不斷發展,對能夠節省空間且不影響訊號完整性或電源效率的連接器的需求比以往任何時候都更加迫切。電子元件小型化的推動改變了連接器的設計,推動了創新,使設備變得更緊湊,同時保持最佳功能。

智慧型手機、穿戴式裝置和筆記型電腦等多個技術領域都呈現出組件小型化和高效能化的趨勢。這些設備依靠緊湊的連接器來確保高密度電路中的無縫性能,使這些連接器成為最先進設備功能不可或缺的一部分。同時,物聯網 (IoT) 和可攜式裝置的快速發展進一步擴大了對可提高各種應用中內部元件效率和效能的連接器的需求。隨著各行各業認知到可靠連接在不斷發展的技術中的重要性,市場也正在經歷重大進步。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 717億美元 |

| 預測值 | 1057億美元 |

| 複合年成長率 | 3.9% |

在連接器市場的各個細分市場中,印刷電路板 (PCB) 連接器細分市場預計到 2034 年將產生 190 億美元的產值。隨著各行業繼續優先考慮緊湊設計的效率、可靠性和性能,對 PCB 連接器的需求大幅增加。

特別是電信業,預計在預測期內將實現 5% 的顯著複合年成長率。 5G網路的全球部署對高頻連接器產生了強勁的需求,高頻連接器對於基地台、天線和光纖系統的基礎設施至關重要。隨著資料中心迅速擴展以支援雲端運算服務,對能夠管理高速資料傳輸和確保可靠電源管理的連接器的需求日益增加,從而推動了該領域的市場成長。

在美國,連接器市場預計到 2034 年將達到 140 億美元。機器人和工業物聯網等先進技術融入生產流程,推動了對連接器的需求,以促進感測器、控制系統和機器之間的順暢通訊和資料交換。這一趨勢在智慧工廠和自動化系統中尤其明顯,連接器可確保可靠的效能和系統最佳化。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- PCB 連接器

- I/O 連接器

- 圓形連接器

- 光纖連接器

- 射頻同軸連接器

- 其他

第 6 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 電信

- 運輸

- 汽車

- 工業的

- 電腦及周邊設備

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- 3M

- AMETEK Inc.

- Amphenol Corporation

- Aptiv PLC

- AVX Corporation

- Foxconn Technology Group

- GTK UK Ltd.

- Japan Aviation Electronics Industry, Ltd.

- Luxshare Precision Industry Co., Ltd.

- Molex, Inc

- Rosenberger Group

- TE Connectivity

- YAZAKI Corporation

The Global Connector Market, valued at USD 71.7 billion in 2024, is poised for significant growth, with an anticipated CAGR of 3.9% from 2025 to 2034. This growth is fueled by the ever-increasing demand for smaller, high-performance connectors across a variety of industries. As consumer electronics, automotive, and telecommunications continue to evolve, the need for connectors that offer space-saving designs without compromising signal integrity or power efficiency is more pressing than ever. The push for miniaturization in electronic components has transformed connector designs, driving innovations that allow devices to become more compact while maintaining optimal functionality.

The rising trend toward miniaturized and high-performance components is evident across several technological fields, including smartphones, wearables, and laptops. These devices rely on compact connectors to ensure seamless performance in high-density circuits, making these connectors integral to the functionality of the most advanced gadgets. Alongside this, the rapid growth of the Internet of Things (IoT) and portable devices has further amplified the demand for connectors that can improve the efficiency and performance of internal components in a variety of applications. The market is also experiencing significant advancements as industries recognize the importance of reliable connectivity in their evolving technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $71.7 Billion |

| Forecast Value | $105.7 Billion |

| CAGR | 3.9% |

Among the various segments within the connector market, the Printed Circuit Board (PCB) connector segment is projected to generate USD 19 billion by 2034. PCB connectors play a crucial role in the development of modern electronic devices by enabling the seamless integration of high-density circuits, making them essential for cutting-edge consumer electronics. As industries continue to prioritize efficiency, reliability, and performance in compact designs, the demand for PCB connectors has surged significantly.

The telecommunications industry, in particular, is expected to see a notable CAGR of 5% during the forecast period. The global rollout of 5G networks has created a robust demand for high-frequency connectors, which are essential for the infrastructure of base stations, antennas, and fiber optic systems. As data centers expand rapidly to support cloud computing services, there is an increasing need for connectors that can manage high-speed data transfers and ensure reliable power management, fueling market growth in this sector.

In the United States, the connector market is anticipated to reach USD 14 billion by 2034. A key driver of this expansion is the increased automation across manufacturing industries. The integration of advanced technologies such as robotics and industrial IoT into production processes is driving the need for connectors that facilitate smooth communication and data exchange between sensors, control systems, and machines. This trend is especially pronounced in smart factories and automated systems, where connectors ensure reliable performance and system optimization.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (Million Units, USD Billion)

- 5.1 Key trends

- 5.2 PCB connectors

- 5.3 IO connectors

- 5.4 Circular connectors

- 5.5 Fiber optic connectors

- 5.6 RF coaxial connectors

- 5.7 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (Million Units, USD Billion)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Transportation

- 6.4 Automotive

- 6.5 Industrial

- 6.6 Computer & peripherals

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (Million Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Russia

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 South Africa

- 7.5.3 Saudi Arabia

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 3M

- 8.2 AMETEK Inc.

- 8.3 Amphenol Corporation

- 8.4 Aptiv PLC

- 8.5 AVX Corporation

- 8.6 Foxconn Technology Group

- 8.7 GTK UK Ltd.

- 8.8 Japan Aviation Electronics Industry, Ltd.

- 8.9 Luxshare Precision Industry Co., Ltd.

- 8.10 Molex, Inc

- 8.11 Rosenberger Group

- 8.12 TE Connectivity

- 8.13 YAZAKI Corporation