|

市場調查報告書

商品編碼

1684554

建築電力租賃市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Construction Power Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

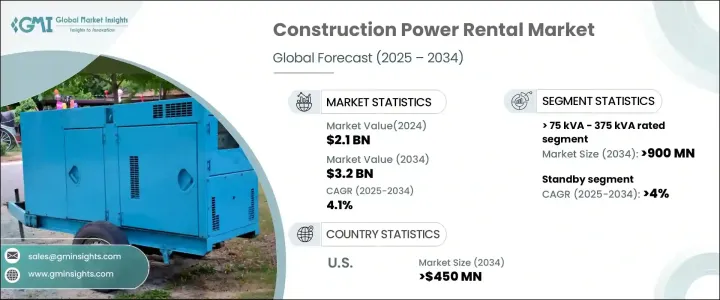

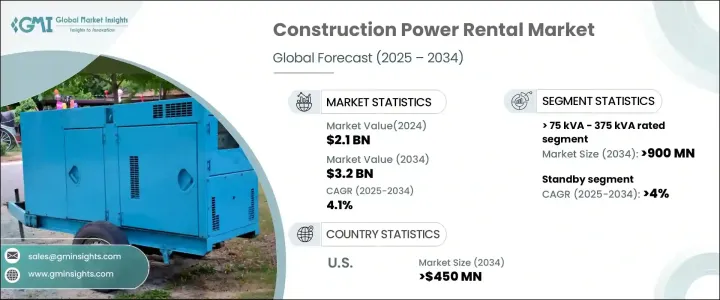

2024 年全球建築電力租賃市場價值為 21 億美元,預計將在 2025 年至 2034 年期間以 4.1% 的複合年成長率強勁成長。隨著建築項目變得越來越複雜和環保,對高效、環保電源的需求變得越來越優先。太陽能和風能等再生能源不斷融入臨時電力系統,為市場提供了動力。數位技術可以實現更好的能源管理和遠端監控,在提高電力租賃服務的效率和可靠性方面也發揮著至關重要的作用。此外,人們對將柴油等傳統燃料與更清潔的能源選擇相結合的混合動力系統的需求日益成長,以符合全球永續發展目標。

建築電力租賃市場中最有前景的部分之一是對額定功率在 75 kVA 至 375 kVA 之間的發電機的需求。預計到 2034 年,該領域將創收 9 億美元,反映出適用於中型建築工地的中檔發電機的需求日益成長。這些發電機旨在為重型建築設備和機械提供穩定可靠的電源,確保連續運作而不間斷。隨著越來越多的建築公司尋求減少停工時間和提高生產力,這些多功能發電機對於確保專案順利進行變得至關重要。同時,隨著建築公司面臨越來越大的減少環境影響的壓力,對使用柴油和再生能源的混合發電機的需求正在迅速增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 4.1% |

備用建築電力租賃市場也正在經歷顯著成長,預計到 2034 年將實現 4% 的複合年成長率。颶風和洪水等極端天氣事件發生的頻率日益增加,進一步凸顯了可靠的電源備用系統的重要性。此外,大型基礎設施項目和智慧城市發展通常需要在建設階段採用臨時電力解決方案,這也導致備用電源的需求不斷增加。

在美國,受技術創新、嚴格的環境法規以及臨時電力解決方案需求不斷成長的推動,建築電力租賃市場預計到 2034 年將創收 4.5 億美元。預計交通、能源和公用事業等領域建築業的快速成長將繼續支持這一擴張。嚴格的排放法規也鼓勵使用更清潔、更永續的能源。此外,自然災害發生的頻率不斷增加,對模組化、可擴展的電源解決方案的需求也越來越大,這對於災難復原工作至關重要。隨著建設項目的發展,對靈活、高效的電力租賃服務的需求也在不斷成長,以滿足多樣化和不斷成長的需求。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依功率等級,2021 – 2034 年

- 主要趨勢

- ≤ 75 千伏安

- > 75 千伏安 - 375 千伏安

- > 375 千伏安 - 750 千伏安

- >750千伏安

第 6 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 支援

- 調峰

- 初始/連續

第 7 章:市場規模與預測:按燃料,2021 – 2034 年

- 主要趨勢

- 柴油引擎

- 氣體

- 其他

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 俄羅斯

- 英國

- 德國

- 法國

- 西班牙

- 奧地利

- 義大利

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 菲律賓

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亞

- 阿爾及利亞

- 南非

- 安哥拉

- 肯亞

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第9章:公司簡介

- Aggreko

- APR Energy

- Atlas Copco

- Bredenoord

- Byrne Equipment Rental

- Caterpillar

- Cummins

- Generac Power Systems

- Herc Rentals

- HIMOINSA

- Paikane

- Perennial Technologies

- Powermak

- Rehlko

- Shenton Group

- Sudhir Power

- Teksan

- United Rentals

The Global Construction Power Rental Market, valued at USD 2.1 billion in 2024, is set to experience robust growth at a CAGR of 4.1% from 2025 to 2034. This expansion is largely attributed to key factors such as technological advancements, the growing demand for sustainable energy solutions, and an increase in infrastructure financing projects. As construction projects become more complex and environmentally conscious, the need for efficient, eco-friendly power sources is becoming a priority. The ongoing integration of renewable energy sources, such as solar and wind power, into temporary power systems is fueling the market. Digital technologies, which allow for better energy management and remote monitoring, are also playing a crucial role in improving the efficiency and reliability of power rental services. Moreover, there is a rising demand for hybrid power systems that combine traditional fuel sources like diesel with cleaner energy options, aligning with global sustainability goals.

One of the most promising segments within the construction power rental market is the demand for generators rated between 75 kVA and 375 kVA. This segment is projected to generate USD 900 million by 2034, reflecting the growing need for mid-range generators suitable for medium-scale construction sites. These generators are designed to provide a consistent and reliable power supply for heavy construction equipment and machinery, ensuring continuous operations without interruptions. With more construction companies seeking to reduce downtime and boost productivity, these versatile generators are becoming essential for keeping projects on track. At the same time, as construction companies face increasing pressure to reduce their environmental footprint, the demand for hybrid generators, which use both diesel and renewable energy, is rapidly increasing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 4.1% |

The standby construction power rental market is also witnessing notable growth and is projected to achieve a CAGR of 4% through 2034. As the need for backup power intensifies, especially in remote and developing regions, more construction projects are relying on reliable power systems to avoid costly delays. The growing frequency of extreme weather events, such as hurricanes and floods, further underscores the importance of dependable power backup systems. Additionally, large-scale infrastructure projects and smart city developments, which often require temporary power solutions during the construction phase, are contributing to the rising demand for standby power.

In the U.S., the construction power rental market is expected to generate USD 450 million by 2034, driven by technological innovations, stringent environmental regulations, and a rising demand for temporary power solutions. The rapid growth in construction across sectors like transportation, energy, and utilities is expected to continue supporting this expansion. Strict emissions regulations are also encouraging the use of cleaner, more sustainable power sources. Furthermore, the increasing frequency of natural disasters is leading to a greater demand for modular, scalable power solutions, which are essential for disaster recovery efforts. As construction projects evolve, so too does the need for flexible, efficient power rental services to meet diverse and growing demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 ≤ 75 kVA

- 5.3 > 75 kVA - 375 kVA

- 5.4 > 375 kVA - 750 kVA

- 5.5 > 750 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Peak shaving

- 6.4 Prime/continuous

Chapter 7 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Gas

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.4.9 Vietnam

- 8.4.10 Philippines

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Angola

- 8.6.6 Kenya

- 8.6.7 Mozambique

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

- 8.7.4 Chile

Chapter 9 Company Profiles

- 9.1 Aggreko

- 9.2 APR Energy

- 9.3 Atlas Copco

- 9.4 Bredenoord

- 9.5 Byrne Equipment Rental

- 9.6 Caterpillar

- 9.7 Cummins

- 9.8 Generac Power Systems

- 9.9 Herc Rentals

- 9.10 HIMOINSA

- 9.11 Paikane

- 9.12 Perennial Technologies

- 9.13 Powermak

- 9.14 Rehlko

- 9.15 Shenton Group

- 9.16 Sudhir Power

- 9.17 Teksan

- 9.18 United Rentals