|

市場調查報告書

商品編碼

1683413

東南亞國協施工機械租賃市場:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)ASEAN Construction Equipment Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

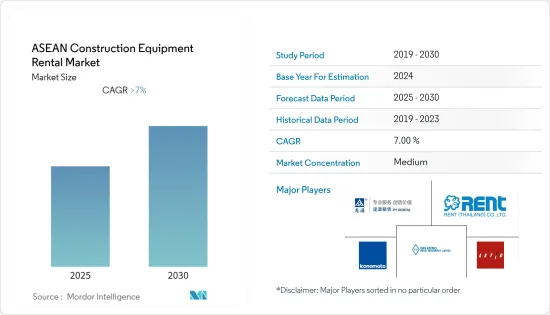

東南亞國協施工機械租賃市場預計在預測期內複合年成長率將超過7%

關鍵亮點

- 新冠肺炎疫情給東南亞國協施工機械租賃市場產生了負面影響。全球各地實施了封鎖和社交距離規定,一切非緊急活動停止。疫情引發的業務下滑給建築業帶來了嚴重的經濟打擊。不過,受惠於建設公司成本約束,以及設備租賃供應商服務改善,東南亞國協建築設備租賃市場預計將逐步復甦。

- 近年來,由於政府增加支出用於升級現有基礎設施以及開展新計畫,南亞國家(尤其是印度尼西亞和馬來西亞等國家)的建設活動大幅增加,而老撾、柬埔寨和泰國則正在進行新興的公共產業計劃(水電和熱電),從而增加了東南亞地區對施工機械的需求。

- 建築業的成長,尤其是在新興經濟體中的成長,以及施工機械維護成本降低等諸多成本效益,正在推動對租賃施工機械的需求。

- 租賃而非購買重型機械的趨勢已被證明對各行各業各種規模的企業都有益,減少管理費用、降低開支和維護成本預計將推動施工機械租賃市場的發展。對收益積極影響的其他趨勢包括日益成長的技術進步,從多功能機器到監測燃料消耗的應用程式。

東南亞國協施工機械租賃市場趨勢

增加建築業投資

- 過去幾年,全球基礎設施投資大幅增加。然而,2019年終,受經濟放緩影響,全球建築業出現下滑。由於冠狀病毒爆發,這種下降趨勢持續了整個 2020 年。然而,從2020年起,由於東南亞國協全部區域基礎設施活動的不斷增加,對施工機械的需求開始增強。

- 東南亞國協正經歷基礎建設熱潮,越南、泰國、菲律賓、馬來西亞和印尼等國均已核准大型計劃。在某些情況下,這些計劃得到了印度、日本和中國等其他主要經濟體提供的貸款和其他援助。例如,東南亞國協有多個鐵路和公路計劃,這將在預測期內進一步增加對機械的需求。

- 2021年3月,泰國政府宣布簽署曼谷至呵叻府之間泰中高鐵計劃相關三份合約。另外三份合約也將在文件準備好後簽署,包括 Bang Por-Phra Kaew 路段的土木工程、Bang Sue-Don Mueang 路段的土木工程以及 Don Mueang-Nawa Nakhon 路段的工程。

- 此外,公共和私人基礎設施投資,如印尼的國家中期發展計畫(4,600億美元)、越南的社會經濟發展計畫(615億美元)和菲律賓的「大建特建」發展計畫(718億美元),預計將為商用車提供銷售機會。

- 泰國是建築業投資最具吸引力的國家之一。根據《2015-2022年基礎建設投資計畫》,泰國政府計畫發展城際列車網路、加強高速公路、改善曼谷大都會圈的公共運輸、擴大海運和空運能力,以連接全國各地以及鄰國的重點地區。

- 2022年6月,離岸風力發電公司Corio Generation與越南建設公司FECON簽署了共同開發契約,在越南巴地頭頓省開發一個50萬千瓦的離岸風力發電計劃。該固定底部設施位於距離海岸約 23-35 公里處,將成為該國首個大型離岸風力發電計劃。

- 由於上述案例以及基礎設施領域新興市場的發展,預計市場在預測期內將出現樂觀的成長。

泰國可望引領東南亞國協施工機械租賃市場

- 泰國的建築支出隨著該國經濟的成長而成長。繼過去三年基礎設施支出大幅加速之後,公共投資正在推動泰國建築業的擴張。

- 由於泰國政府大規模的基礎設施投資,預計泰國各地對越野車的需求將會增加。東部經濟走廊是一個投資 499 億美元的計劃,是泰國 4.0 願景的一部分,旨在將泰國發展成為高價值的經濟和物流強國。東部經濟走廊涵蓋泰國東南部的北柳府、春武里府和羅勇府三個府,旨在將該地區轉變為重要的經濟中心,吸引國際投資並增加對施工機械的需求。

- 政府制定了藍圖(Remap 2036)來鼓勵可再生能源的擴張。 Remap 預計,由於太陽能板價格下降,泰國的太陽能發電量將在 2036 年達到 17GW。泰國政府對可再生能源領域的投資正在支撐該國施工機械市場的需求。

- 由於泰國政府加大對道路、高速公路、地鐵和機場建設的投入,預計履帶挖土機的需求將會成長。

- 預計遠端操作施工機械將增加對採礦用施工機械的需求,因為遠端操作機械通常更安全。由於政府對可再生能源計畫的投資增加,全地形起重機和挖土機可能會變得更加受歡迎。這是因為它對於太陽能、風能和水力發電設施的發展是必要的。迷你挖土機在泰國越來越受歡迎。由於廉價勞動力的短缺和城市發展計劃的需要,施工機械領域對小型挖土機的需求正在上升。

東南亞國協施工機械租賃業概況

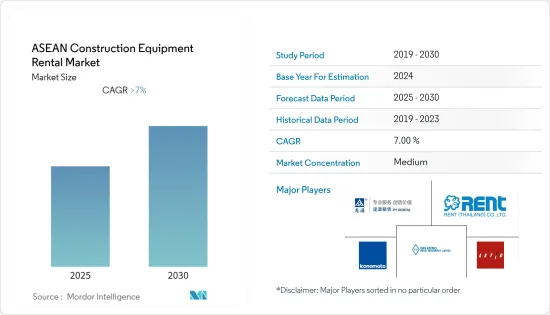

東南亞國協施工機械租賃市場由新興重機、Aktio Co.、Kanamoto、達豐控股、西尾租賃、Rent (Thailand)、上海龐源機械租賃等主導。

各公司都透過合資、合作的方式建立了子公司,並向東南亞國家擴張。這些因素大大擴大了各公司的影響力,也促進了收益與前一年同期比較增加。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按車型

- 土木機械

- 物料輸送

- 透過推進力

- 內燃機

- 混合

- 按國家

- 印尼

- 泰國

- 越南

- 新加坡

- 馬來西亞

- 菲律賓

- 其他東南亞國協

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Kanamoto Co. Ltd

- Aktio Co. Ltd

- Sin Heng Heavy Machinery Limited

- Nishio Rent All Co. Ltd

- Tat Hong Holdings Ltd

- Guzent

- Superkrane Mitra Utama

- Rent (Thailand) Co. Ltd

- Asia Machinery Solutions Vietnam Co. Ltd

- Shanghai Pangyuan Machinery Rental Co. Ltd

第7章 市場機會與未來趨勢

The ASEAN Construction Equipment Rental Market is expected to register a CAGR of greater than 7% during the forecast period.

Key Highlights

- The Covid-19 pandemic had a negative impact on the ASEAN Construction Equipment Rental market. With worldwide lockdown and social distancing norms implemented everywhere, all non-emergency activities were halted. The construction industry took a significant economic blow owing to the low business due to the pandemic. However, with the cost constraints of the construction companies and better services provided by the equipment rental providers, the ASEAN Construction equipment rental market is expected to revive gradually.

- Construction activities in South Asian countries have increased significantly over the last couple of years owing to the rising government spending for upgrading existing infrastructure combined with new projects, especially in countries such as Indonesia and Malaysia, and budding utility projects (Hydropower & Thermal Power) in Laos, Cambodia, and Thailand have resulted into the growing demand for construction equipment in South-East Asia region.

- The growing construction industry, especially in developing economies, along with the numerous cost benefits, such as reduced maintenance cost of the construction equipment, is driving the demand for rental construction equipment.

- The trend of leasing instead of purchasing heavy machinery has proven beneficial for companies of all sizes across numerous industries, with less administrative overhead and reduced expense and maintenance anticipated to drive the construction equipment rental market. Other trends positively impacting revenue include growing technological advancements ranging from multifunctional machinery to apps for monitoring fuel consumption.

ASEAN Construction Equipment Rental Market Trends

Increasing Investments Towards Construction Industry

- Over the past few years, there has been a significant increase in infrastructure spending across the globe. However, by the end of 2019, due to the slowdown in economy slowdown, the global construction industry witnessed a decline. This decline continued during 2020 due to the outbreak of the coronavirus. However, post-2020, the demand for Construction machinery started gaining momentum owing to rising infrastructure activities across the ASEAN region.

- ASEAN is witnessing an infrastructure boom, with major projects approved in Vietnam, Thailand, the Philippines, Malaysia, and Indonesia. In several cases, these have been facilitated through loans and other assistance provided by Other major economies like India, Japan, and China. Several rail and road projects to further add up to the demand for machinery in the ASEAN countries over the forecasted period.For instance,

- In March 2021, the Thai Government announced that it is set to sign three contracts in connection with the Thai-Sino high-speed train project between Bangkok and Nakhon Ratchasima. Additional three contracts, including civil works for the Ban Pho-Phra Kaew section, civil engineering works along the Bang Sue-Don Muang section and works between Don Muang and Nava Nakhon, will also be signed after the preparation of the documents.

- Additionally, investments in infrastructure, both public and private, like the Indonesian National Medium-term Development Plan (USD 460 billion), Vietnam Socio-Economic Development Plan (USD 61.5 billion), and the Philippine Development Plan "Build, Build, and Build" (USD 71.8 billion), are expected to offer opportunities for sales for commercial vehicles.

- Thailand has been one of the attractive countries for investment in the construction sector. Under the infrastructure investment plan 2015-2022, the government of Thailand planned to develop an intercity rail network, highway enhancement, public transportation in Bangkok metropolitans, and capacity expansion of maritime and air transport to link the key areas across the country and neighboring countries.

- In June 2022, Offshore wind company Corio Generation signed a joint development agreement with Vietnamese construction firm FECON for a 500MW offshore wind project in Vietnam's Ba Ria-Vung Tau province. Located around 23-35km from the coast, the proposed fixed-bottom facility would be among the country's first large-scale offshore wind projects.

- Owing to the above-mentioned instances and developments in the infrastructure sector, the market is expected to witness optimistic growth over the forecast period.

Thailand Is Expected To Lead The ASEAN Construction Equipment Rental Market

- Thailand's construction expenditure has evolved along with the country's economy. Following the acceleration of massive infrastructure spending over the past three years, public investment has helped Thailand's construction industry expand.

- The substantial infrastructural investment made by the Thai government is expected to increase the demand for off-road vehicles across the country. The EEC is a USD49.9 billion project that will be a part of Thailand's 4.0 initiative, which aims to make the nation a high-value-added economic and logistics powerhouse. The EEC, which encompasses the three provinces of Chachoengsao, Chonburi, and Rayong in southeast Thailand, aims to transform this area into a significant economic hub and draw international investment, which will increase demand for construction equipment.

- The government has developed a road map (Remap 2036) to encourage the expansion of renewable energy. Under Remap, solar power is anticipated to reach 17GW in 2036, thanks to reduced solar panel prices in Thailand. Thailand's government investment in the renewable energy sector supports demand in the country's construction equipment market.

- Given the increasing government spending on constructing roads, motorways, metros, and airports, the need for crawler excavators in Thailand is anticipated to rise.

- Since it is generally safer to operate machinery from a distance, remote operation of construction equipment is predicted to increase demand for construction equipment used in mining. All-terrain cranes and excavators will likely become more popular due to the government's increased investment in renewable energy plans. This is because they are necessary for developing solar, wind, and hydroelectric power facilities. Mini excavators are becoming more and more popular in Thailand. The shortage of inexpensive labor and the requirement for inner-city development projects have increased the demand for small excavators in the construction equipment sector.

ASEAN Construction Equipment Rental Industry Overview

The ASEAN construction equipment rental market is led by Sin Heng Heavy Machinery Limited, Aktio Co., Kanamoto Co. Ltd, Tat Hong Holdings Ltd, Nishio Rent All Co. Ltd, Rent (Thailand) Co. Ltd, Shanghai Pangyuan Machinery Rental Co. Ltd and among others.

The companies are venturing into the South East Asian countries by forming subsidiaries through joint ventures and collaborations. This factor has helped the companies expand their presence considerably and also helped in increasing revenue on a year-on-year basis.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Earth Moving Equipment

- 5.1.2 Material Handling

- 5.2 By Propulsion

- 5.2.1 IC Engine

- 5.2.2 Hybrid Drive

- 5.3 By Country

- 5.3.1 Indonesia

- 5.3.2 Thailand

- 5.3.3 Vietnam

- 5.3.4 Singapore

- 5.3.5 Malaysia

- 5.3.6 Philippines

- 5.3.7 Rest of the ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Kanamoto Co. Ltd

- 6.2.2 Aktio Co. Ltd

- 6.2.3 Sin Heng Heavy Machinery Limited

- 6.2.4 Nishio Rent All Co. Ltd

- 6.2.5 Tat Hong Holdings Ltd

- 6.2.6 Guzent

- 6.2.7 Superkrane Mitra Utama

- 6.2.8 Rent (Thailand) Co. Ltd

- 6.2.9 Asia Machinery Solutions Vietnam Co. Ltd

- 6.2.10 Shanghai Pangyuan Machinery Rental Co. Ltd