|

市場調查報告書

商品編碼

1684620

犬異位性皮膚炎市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Canine Atopic Dermatitis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球犬異位性皮膚炎市場價值為 14 億美元,預計 2025 年至 2034 年期間將以 8.9% 的強勁複合年成長率擴張。寵物主人對寵物的健康越來越關注,導致對先進的獸醫皮膚病治療的需求激增。隨著寵物護理的不斷發展,市場正在向更有效、更專業的治療轉變,這進一步推動了寵物護理的擴張。此外,將寵物人性化並將其視為家庭成員的全球趨勢正在推動市場成長。這些因素共同導致對能夠持久緩解病情的藥物、診斷和治療的需求大幅增加。

獸醫學的不斷進步也在市場發展中發揮著至關重要的作用。單株抗體等創新治療方法以及更新、更安全的療法正在獲得廣泛認可。這些治療方法因其緩解搔癢和發炎(犬異位性皮膚炎的主要症狀)的有效性而受到特別讚賞。隨著這些療法的不斷改進,其需求預計會增加,這將進一步加速市場成長。值得注意的是,研發活動不斷增加,不斷推出突破性的解決方案,為市場持續成功奠定基礎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 8.9% |

市場按產品類型細分,包括糖皮質激素、抗組織胺、免疫抑制劑、單株抗體和其他療法。糖皮質激素佔據市場主導地位,2024 年價值為 4.771 億美元。儘管出現了單株抗體和口服 JAK 抑制劑等更新、更昂貴的治療方法,但糖皮質激素由於其有效性、可負擔性和廣泛可用性仍然是一種受歡迎的選擇。這種可近性使得它們在那些可能無法輕易獲得先進獸醫護理的地區特別有用。

市場根據給藥途徑進一步分類,包括口服、外用和注射治療。 2024 年,口服藥物佔據市場主導地位,佔有 47.2% 的佔有率。口服治療通常受到寵物主人的青睞,因為其易於使用,可以增強對規定治療方案的依從性。這些療法可以快速緩解搔癢和發炎等症狀,通常在幾小時到幾天內就能見效。

美國犬異位性皮膚炎市場價值在 2024 年為 5.28 億美元,預計到 2034 年將達到 12 億美元。先進診斷工具和療法的採用,加上主要行業參與者提供創新解決方案,預計將維持美國市場的成長。隨著寵物主人對寵物狀況的了解越來越多且越來越關心,對有效治療方案的需求也將大幅增加。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有增加和寵物人性化

- 提高對皮膚病和先進治療選擇的認知

- 產業陷阱與挑戰

- 一些藥物的副作用

- 人類藥品的標籤外使用

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 糖皮質激素

- 抗組織胺藥

- 免疫抑制劑

- 單株抗體

- 其他產品

第 6 章:市場估計與預測:按管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 主題

- 注射劑

第 7 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 零售藥局

- 獸醫醫院藥房

- 網路藥局

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AB Science

- Boehringer Ingelheim

- Ceva

- Dechra Veterinary Products

- Elanco

- Kindred Biosciences

- Nextmune (Vimian)

- Phibro Animal Health Corporation

- Toray Industries

- Vetoquinol

- Virbac

- Zoetis

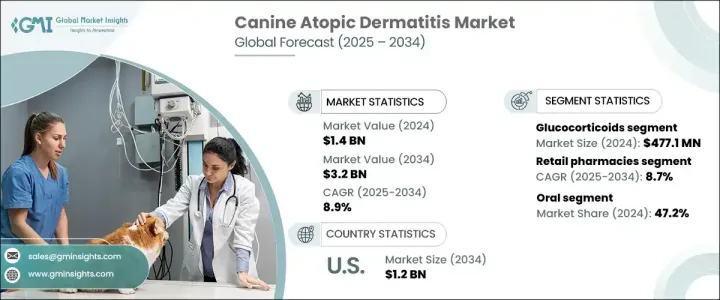

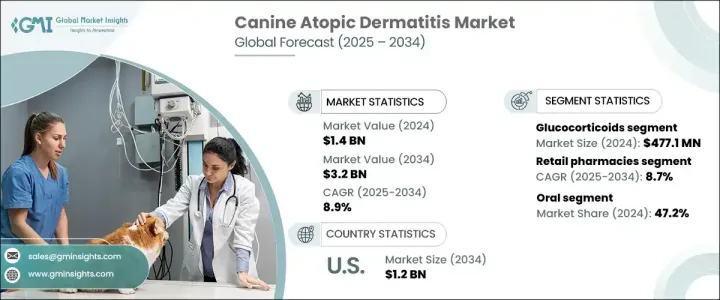

The Global Canine Atopic Dermatitis Market was valued at USD 1.4 billion in 2024 and is projected to expand at a robust CAGR of 8.9% from 2025 to 2034. This surge in market growth is driven by an increasing number of dogs diagnosed with atopic dermatitis and a growing focus on the health and well-being of companion animals. Pet owners are becoming more vigilant about their pets' wellness, leading to a spike in demand for advanced veterinary dermatology treatments. As pet care continues to evolve, the market is witnessing a shift towards more effective and specialized treatments, which is further driving the expansion. Additionally, the global trend of humanizing pets and treating them like family members is fueling market growth. These factors collectively contribute to a significant boost in demand for medications, diagnostics, and treatments that can offer lasting relief from the condition.

The ongoing advancements in veterinary medicine are also playing a crucial role in market progression. The availability of innovative treatments such as monoclonal antibodies and newer, safer therapies is gaining widespread acceptance. These treatments are particularly appreciated for their effectiveness in alleviating itching and inflammation, which are the primary symptoms of canine atopic dermatitis. As these therapies continue to improve, their demand is expected to increase, and this will further accelerate market growth. Notably, there has been a rise in research and development activities that continue to introduce groundbreaking solutions, positioning the market for continued success.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 8.9% |

The market is segmented by product type, including glucocorticoids, antihistamines, immunosuppressants, monoclonal antibodies, and other therapies. Glucocorticoids dominated the market, valued at USD 477.1 million in 2024. Medications such as prednisone and dexamethasone are commonly used in treating severe or acute cases of atopic dermatitis, providing rapid relief from inflammation. Despite the arrival of newer, costlier treatments like monoclonal antibodies and oral JAK inhibitors, glucocorticoids remain a popular option due to their effectiveness, affordability, and widespread availability. This accessibility makes them especially useful in regions where advanced veterinary care might not be readily available.

The market is further divided by route of administration, encompassing oral, topical, and injectable treatments. The oral segment led the market in 2024, holding a 47.2% share. Oral treatments are often preferred by pet owners due to their ease of use, which enhances adherence to prescribed treatment regimens. These therapies offer quick relief from symptoms such as itching and inflammation, often showing results within a few hours to days.

The U.S. canine atopic dermatitis market, valued at USD 528 million in 2024, is expected to reach USD 1.2 billion by 2034. The U.S. continues to hold a prominent position in the global market, driven by a rise in awareness regarding pet healthcare and a significant increase in the number of dogs suffering from atopic dermatitis. The adoption of advanced diagnostic tools and therapies, coupled with the presence of key industry players offering innovative solutions, is expected to sustain the growth of the U.S. market. As pet owners become more knowledgeable and concerned about their pets' conditions, the demand for effective treatment options is set to rise substantially.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership and humanization of pets

- 3.2.1.2 Increased awareness of skin disorders and advanced treatment options

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of few medications

- 3.2.2.2 Off-label use of human drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Glucocorticoids

- 5.3 Antihistamines

- 5.4 Immunosuppressants

- 5.5 mAbs

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Topical

- 6.4 Injectable

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Retail pharmacies

- 7.3 Veterinary hospital pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AB Science

- 9.2 Boehringer Ingelheim

- 9.3 Ceva

- 9.4 Dechra Veterinary Products

- 9.5 Elanco

- 9.6 Kindred Biosciences

- 9.7 Nextmune (Vimian)

- 9.8 Phibro Animal Health Corporation

- 9.9 Toray Industries

- 9.10 Vetoquinol

- 9.11 Virbac

- 9.12 Zoetis