|

市場調查報告書

商品編碼

1698228

異位性皮膚炎藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Atopic Dermatitis Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球異位性皮膚炎藥物市場價值為 121 億美元,預計 2025 年至 2034 年期間的複合年成長率為 9.9%。異位性皮膚炎藥物有助於控制皮膚發炎、搔癢和乾燥,針對病情發作並控制病情。這些治療方法包括局部用藥、全身性治療和生物製劑,根據病情嚴重程度進行選擇。異位性皮膚炎盛行率的上升、強大的藥物管道以及研發投入的增加正在推動市場成長。製藥公司正在推出新產品,積極的臨床試驗結果正在推動收入成長。

2023年,異位性皮膚炎藥物市場價值為111億美元。 2024 年,生物製劑領域將引領市場,佔據 41.3% 的收入佔有率,這得益於更高的療效和長期的症狀控制。由於生物製劑具有優異的治療效果和不斷成長的產品核准,其需求持續上升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 121億美元 |

| 預測值 | 310億美元 |

| 複合年成長率 | 9.9% |

根據給藥途徑,市場分為注射、外用和口服治療。 2024 年注射劑市場佔據主導地位,收入佔有率達 45.1%。針對發炎途徑的新型生物注射劑,如 IL-4、IL-13 和 JAK 抑制劑,正在擴大治療選擇。監管部門的批准加速了產品的推出,提高了主要市場的可及性和採用率。

患者人口統計細分包括兒科和成人類別。 2024 年兒科領域收入最高,為 87 億美元,這主要是由於兒童異位性皮膚炎發生率高。隨著監管機構批准更多針對年輕患者的治療方法,對兒科治療的需求持續成長。專為兒科用途設計的生物製劑的快速核准進一步推動了市場擴張。

分銷管道包括醫院藥房、零售藥局和電子商務。 2024 年,醫院藥局的收入為 58 億美元。這些藥房在管理需要專門或系統治療的患者方面發揮著至關重要的作用,確保對治療結果和潛在副作用進行適當的監測。

美國市場經歷了顯著成長,營收從 2023 年的 47 億美元成長到預計 2034 年的 131 億美元。不斷增強的認知和宣傳活動正在增加研究資金,並改善患者獲得先進治療方案的機會。監管機構繼續加快生物製劑的核准,特別是針對重症病例和兒科患者,進一步支持市場成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 異位性皮膚炎盛行率上升

- 生物療法的進展

- 皮膚病護理意識和可近性不斷提高

- 產業陷阱與挑戰

- 生物製劑和先進療法成本高昂

- 副作用和依從性問題

- 成長動力

- 成長潛力分析

- 監管格局

- 差距分析

- 專利分析

- 管道分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 年至 2034 年

- 主要趨勢

- 皮質類固醇

- 鈣調磷酸酶抑制劑

- 生物製劑

- 磷酸二酯酶-4 (PDE-4) 抑制劑

- 其他藥物類別

第6章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 主題

- 口服

- 注射劑

第7章:市場估計與預測:依病患人口統計,2021 年至 2034 年

- 主要趨勢

- 兒科

- 成年人

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Arcutis Biotherapeutics

- Eli Lilly and Company

- Galderma Laboratories

- Incyte Corporation

- Leo Pharma

- Maruho

- Novartis

- Otsuka Pharmaceutical

- Pfizer

- Regeneron Pharmaceuticals

- Sanofi

- Viatris

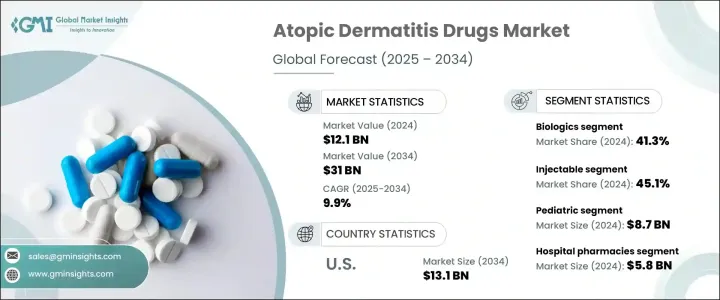

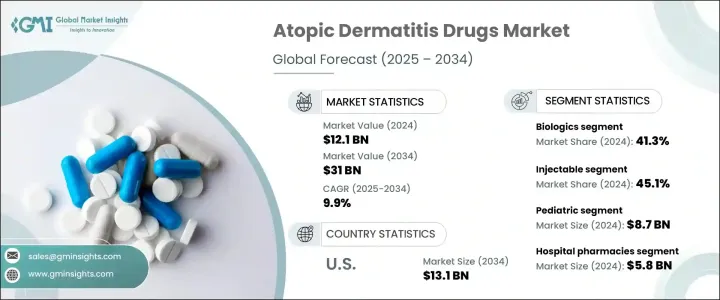

The Global Atopic Dermatitis Drugs Market was valued at USD 12.1 billion in 2024 and is projected to grow at a 9.9% CAGR from 2025 to 2034. Atopic dermatitis drugs help manage skin inflammation, itching, and dryness, targeting flare-ups and controlling the condition. These treatments include topical medications, systemic therapies, and biologics, chosen based on disease severity. The rising prevalence of atopic dermatitis, strong drug pipelines, and increased investment in research and development are fueling market growth. Pharmaceutical companies are launching new products, and positive clinical trial results are driving revenue expansion.

In 2023, the atopic dermatitis drugs market was worth USD 11.1 billion. The biologics segment led the market in 2024, holding a 41.3% revenue share, driven by higher efficacy and long-term symptom control. The demand for biologics continues to rise due to their superior treatment outcomes and growing product approvals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.1 Billion |

| Forecast Value | $31 Billion |

| CAGR | 9.9% |

By route of administration, the market is divided into injectable, topical, and oral treatments. The injectable segment dominated in 2024 with a 45.1% revenue share. New biologic injections targeting inflammatory pathways, such as IL-4, IL-13, and JAK inhibitors, are expanding treatment options. Regulatory approvals have accelerated product launches, increasing accessibility and adoption rates in major markets.

The patient demographic segmentation includes pediatric and adult categories. The pediatric segment led with USD 8.7 billion in revenue in 2024, primarily due to the high incidence of atopic dermatitis in children. The demand for pediatric therapies continues to grow as regulatory bodies approve more treatments tailored for younger patients. Expedited approvals for biologic formulations specifically designed for pediatric use are further driving market expansion.

Distribution channels include hospital pharmacies, retail pharmacies, and e-commerce. Hospital pharmacies accounted for USD 5.8 billion in revenue in 2024. These pharmacies play a crucial role in managing patients who require specialized or systemic treatments, ensuring proper monitoring of therapy outcomes and potential side effects.

The U.S. market has witnessed significant growth, with revenue rising from USD 4.7 billion in 2023 to a projected USD 13.1 billion by 2034. Increased awareness efforts and advocacy initiatives are enhancing research funding and improving patient access to advanced treatment options. Regulatory agencies continue to fast-track the approval of biologics, particularly for severe cases and pediatric patients, further supporting market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of atopic dermatitis

- 3.2.1.2 Advancements in biologic therapies

- 3.2.1.3 Growing awareness and access to dermatological care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biologic and advanced therapies

- 3.2.2.2 Side effects and compliance issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Patent analysis

- 3.7 Pipeline analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroids

- 5.3 Calcineurin inhibitors

- 5.4 Biologics

- 5.5 Phosphodiesterase-4 (PDE-4) inhibitors

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Topical

- 6.3 Oral

- 6.4 Injectable

Chapter 7 Market Estimates and Forecast, By Patient Demographics, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatric

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Arcutis Biotherapeutics

- 10.3 Eli Lilly and Company

- 10.4 Galderma Laboratories

- 10.5 Incyte Corporation

- 10.6 Leo Pharma

- 10.7 Maruho

- 10.8 Novartis

- 10.9 Otsuka Pharmaceutical

- 10.10 Pfizer

- 10.11 Regeneron Pharmaceuticals

- 10.12 Sanofi

- 10.13 Viatris