|

市場調查報告書

商品編碼

1684623

自行車鏈條裝置市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Bicycle Chain Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

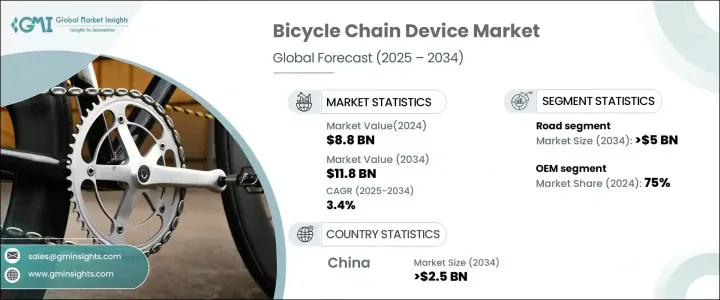

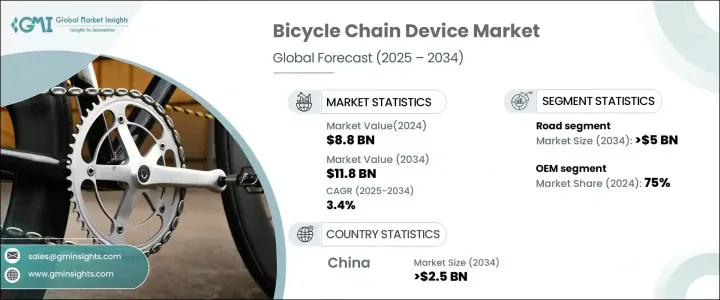

2024 年全球自行車鏈條裝置市場價值為 88 億美元,預計 2025 年至 2034 年的複合年成長率為 3.4%。這一成長可歸因於幾個關鍵因素,包括電動自行車 (e-bikes) 的日益普及,它將傳統自行車與現代機動化支援相結合,提供了一種永續且高效的交通方式。電動自行車正在迅速普及,尤其是對於尋求環保汽車替代品的城市通勤者。隨著城市朝著永續發展的方向發展,騎自行車作為減少交通堵塞和降低碳排放的首選解決方案正日益受到青睞。此外,隨著消費者越來越重視健康,騎自行車已成為一種受青睞的休閒活動,這導致對自行車及其基本零件(包括先進的鏈條裝置)的需求不斷增加。全球範圍內使用自行車健身的趨勢日益成長,進一步推動了這項需求。

自行車鏈條裝置市場的另一個重要促進因素是消費者偏好向優質和技術先進的零件的轉變。隨著騎乘愛好者追求更好的性能、耐用性和舒適性,對高品質鏈條裝置的需求不斷增加。製造商正在創新和開發可增強整體騎乘體驗的產品,提供更平穩的換檔、改進的能量傳輸和更持久的耐用性。隨著都市化進程以及自行車作為實用交通方式在各地區的普及,對優質自行車零件,尤其是鏈條裝置的需求將持續上升。此外,休閒和競技自行車運動的興起趨勢進一步推動了市場的發展,騎乘者要求自行車在休閒和高強度騎乘活動中都具有頂級的表現。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 88億美元 |

| 預測值 | 118億美元 |

| 複合年成長率 | 3.4% |

根據應用,市場分為幾個主要部分,包括公路車、登山車和電動自行車。公路車佔了最大的市場佔有率,2024 年佔比為 55%,預計到 2034 年將創造 50 億美元的市場價值。這些自行車在健身、休閒和競技騎行中很受歡迎,需要高性能鏈條裝置來確保平穩換檔和高效的動力傳輸。由於公路車仍然是全球最受歡迎的類別,該領域對先進鏈條裝置的需求將繼續推動市場成長。

在檢查銷售管道時,市場分為OEM (原始設備製造商)和售後市場銷售。 2024 年, OEM領域佔據市場主導地位,佔有 75% 的佔有率。該部門致力於在生產過程中將鏈條裝置整合到新自行車中,確保相容性、可靠性和一流的品質。隨著全球對自行車(尤其是電動自行車)的需求持續激增,原始設備製造商專注於生產高品質的整合組件,以滿足消費者對性能和耐用性的期望。

在區域主導地位方面,中國在 2024 年佔據全球自行車鏈條裝置市場 50% 的佔有率,預計到 2034 年將保持這一地位。中國在自行車生產領域的主導地位可歸因於其作為世界上最大的自行車製造商和出口國的地位。該國擁有強大、具有成本效益的生產生態系統和廣泛的供應商網路。此外,隨著騎自行車作為交通、健身和娛樂的日益流行,中國對自行車的需求不斷增加,進一步鞏固了該國的市場領導地位。此外,在政府旨在促進自行車基礎設施和綠色交通解決方案的激勵措施的支持下,中國在電動自行車製造業的作用進一步加強了其在全球市場的地位。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 自行車鏈條裝置廠商

- OEM經銷商

- 售後市場供應商

- 最終用戶

- 利潤率分析

- 專利格局

- 成本明細

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 越來越多的人選擇騎自行車進行健身和休閒

- 電動自行車日益流行

- 鏈條裝置的技術進步,例如輕質耐用的材料

- 人們對競技自行車和山地自行車的興趣日益濃厚

- 產業陷阱與挑戰

- 新興市場價格敏感度較高

- 耐用性問題,導致在惡劣條件下頻繁更換

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 自行車鏈條

- 鏈輪

- 變速箱

- 鏈條導軌

- 鏈條張緊器

- 其他

第 6 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 公路自行車

- 登山車

- 電動自行車

第 7 章:市場估計與預測:按銷售管道,2021 - 2032 年

- 主要趨勢

- OEM

- 售後市場

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Bafang Electric

- Campagnolo

- Cane Creek Cycling Components

- FSA (Full Speed Ahead)

- Gates Carbon Drive

- Hawley-Lambert

- KMC Chains

- Mavic

- Microshift

- Prologo

- Race Face

- Rotor Bike Components

- Shimano

- SR Suntour

- SRAM

- Sugino

- Trek Bicycle

- TRP Cycling

- Wippermann Chains

- Zee Industry

The Global Bicycle Chain Device Market, valued at USD 8.8 billion in 2024, is projected to expand at a CAGR of 3.4% from 2025 to 2034. This growth can be attributed to several key factors, including the growing popularity of electric bicycles (e-bikes), which blend traditional cycling with modern motorized support, offering a sustainable and efficient mode of transportation. E-bikes are quickly gaining traction, particularly among urban commuters seeking eco-friendly alternatives to cars. As cities work toward becoming more sustainable, cycling is gaining momentum as a preferred solution for reducing traffic congestion and lowering carbon emissions. Furthermore, with health and wellness increasingly prioritized by consumers, cycling has become a favored recreational activity, contributing to rising demand for bicycles and their essential components, including advanced chain devices. This demand is further driven by the trend of using bicycles for fitness purposes, which continues to rise globally.

Another significant driver for the bicycle chain device market is the shift in consumer preferences toward premium and technologically advanced components. As cycling enthusiasts seek better performance, durability, and comfort, demand for high-quality chain devices is on the rise. Manufacturers are innovating and developing products that enhance the overall cycling experience, offering smoother shifting, improved energy transfer, and longer-lasting durability. With urbanization and the adoption of bicycles as a practical mode of transport growing across regions, the demand for quality bicycle components, especially chain devices, will continue to rise. Additionally, the increasing trend of cycling for leisure and competitive sports is propelling the market further, with cyclists demanding top-tier performance for both casual and high-intensity cycling activities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $11.8 Billion |

| CAGR | 3.4% |

The market is divided into several key segments based on application, including road bicycles, mountain bicycles, and electric bicycles. Road bicycles hold the largest share of the market, accounting for 55% in 2024, and are expected to generate USD 5 billion by 2034. These bicycles are popular for fitness, recreation, and competitive cycling, which require high-performance chain devices to ensure smooth shifting and efficient power transfer. As road cycling remains the most popular category globally, the demand for advanced chain devices in this segment will continue to drive market growth.

When examining sales channels, the market is segmented into OEM (Original Equipment Manufacturer) and aftermarket sales. The OEM segment dominated the market in 2024 with a 75% share. This segment is driven by the integration of chain devices into new bicycles during production, ensuring compatibility, reliability, and top-tier quality. As the demand for bicycles, especially e-bikes continues to surge globally, OEMs are focused on producing high-quality, integrated components that meet consumer expectations for performance and durability.

In terms of regional dominance, China holds a significant 50% share of the global bicycle chain device market in 2024 and is expected to maintain this position through 2034. China's dominance in the bicycle production sector can be attributed to its position as the world's largest manufacturer and exporter of bicycles. The country benefits from a strong, cost-effective production ecosystem and an extensive supplier network. Additionally, the increasing demand for bicycles within China, spurred by the growing popularity of cycling for transportation, fitness, and recreation, further reinforces the country's market leadership. Moreover, China's role in the e-bike manufacturing sector further strengthens its position in the global market, supported by government incentives aimed at promoting cycling infrastructure and green mobility solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Bicycle chain device manufacturers

- 3.2.2 OEM distributors

- 3.2.3 Aftermarket providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Patent Landscape

- 3.5 Cost Breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of cycling for fitness and recreation

- 3.9.1.2 Rising popularity of electric bicycles (e-bikes)

- 3.9.1.3 Technological advancements in chain devices, such as lightweight and durable materials

- 3.9.1.4 Growing interest in competitive cycling and mountain biking

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High price sensitivity in emerging markets

- 3.9.2.2 Durability concerns, leading to frequent replacements in harsh conditions

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Bicycle chains

- 5.3 Chainrings

- 5.4 Derailleurs

- 5.5 Chain guides

- 5.6 Chain tensioners

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road bicycles

- 6.3 Mountain bicycles

- 6.4 Electric bicycles

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2032 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Bafang Electric

- 9.2 Campagnolo

- 9.3 Cane Creek Cycling Components

- 9.4 FSA (Full Speed Ahead)

- 9.5 Gates Carbon Drive

- 9.6 Hawley-Lambert

- 9.7 KMC Chains

- 9.8 Mavic

- 9.9 Microshift

- 9.10 Prologo

- 9.11 Race Face

- 9.12 Rotor Bike Components

- 9.13 Shimano

- 9.14 SR Suntour

- 9.15 SRAM

- 9.16 Sugino

- 9.17 Trek Bicycle

- 9.18 TRP Cycling

- 9.19 Wippermann Chains

- 9.20 Zee Industry