|

市場調查報告書

商品編碼

1684637

自行車中軸市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bicycle Bottom Bracket Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

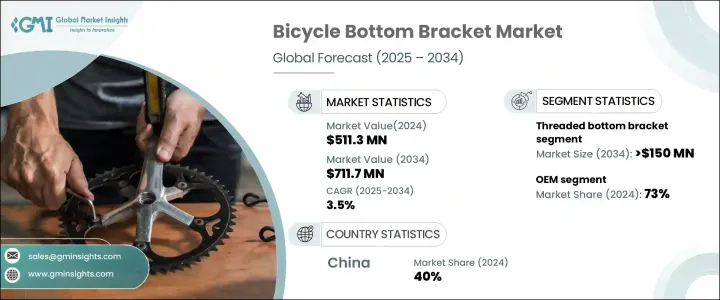

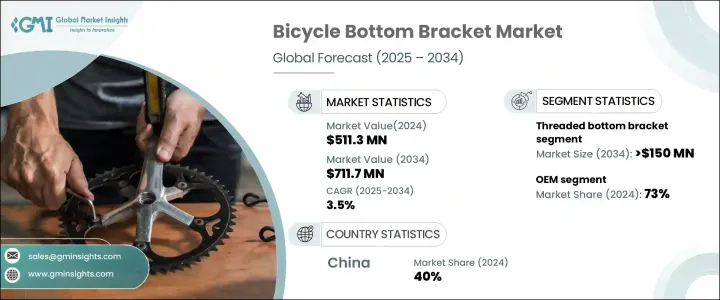

2024 年全球自行車中軸市場價值為 5.113 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.5%。騎自行車作為一種永續且注重健康的交通方式越來越受歡迎,這推動了對高性能自行車零件的需求。世界各地的城市都在加強自行車基礎設施建設,例如自行車道、自行車共享系統和改進的安全措施。這些發展使騎自行車成為更安全、更方便的選擇,特別是在交通擁擠和污染嚴重的城市。此外,騎自行車健身和休閒的人數越來越多,以及競技自行車賽事的日益普及,進一步推動了市場的成長。自行車製造商專注於輕巧、耐用和高效的零件,不斷創新,滿足休閒騎行者和專業人士的多樣化需求。

市場主要分為兩個分銷管道:原始設備製造商(OEM)和售後市場。 2024 年, OEM領域佔據市場主導地位,佔有 73% 的顯著佔有率。為提高自行車性能而客製化的高品質零件的需求不斷成長,推動了該領域的成長。原始設備製造商 (OEM) 在為高階自行車製造商提供優質底部支架方面發揮著重要作用,可以滿足日益成長的重視可靠性和創新性的消費者群體的期望。 OEM領域的突出地位凸顯了業界向專為耐用性和卓越功能而設計的先進、專業零件的轉變。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.113億美元 |

| 預測值 | 7.117億美元 |

| 複合年成長率 | 3.5% |

在產品供應方面,自行車中軸市場包括螺紋中軸、壓入式中軸、外部中軸、筒式中軸和其他類型。其中,螺紋底部支架在 2024 年佔據了 25% 的市場佔有率,預計到 2034 年將產生 1.5 億美元的產值。人們對螺紋底部支架興趣的復甦與經典自行車的復興以及客製化自行車製造趨勢的興起有關。騎乘者重視這些零件的簡單性、堅固性和懷舊魅力,因此它們成為追求可靠性和復古感的愛好者的首選。

受電動自行車產業快速發展的推動,中國將在 2024 年佔據自行車中軸市場的 40%。城市化加上政府對永續交通的激勵措施極大地推動了對專用零件的需求。電動自行車具有更重的車架和機動系統,需要耐用且高效的底部支架以確保最佳性能和使用壽命。這一趨勢凸顯了滿足不斷發展的循環技術需求的先進製造解決方案日益成長的重要性。隨著自行車運動在世界各地日益流行,在創新和消費者需求增加的推動下,中軸市場必將持續成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 最終客戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 定價分析

- 衝擊力

- 成長動力

- 騎自行車作為永續交通方式的普及度不斷提高

- 自行車零件的技術進步

- 擴大城市自行車基礎設施

- 自行車客製化需求日益成長

- 產業陷阱與挑戰

- 跨自行車型號的兼容性問題

- 耐用性和維護問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依供應量,2021 - 2034 年

- 主要趨勢

- 螺紋底部支架

- 壓入式底部支架

- 外部底部支架

- 墨盒底部支架

- 其他

第 6 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 公路自行車

- 登山車

- 賽車

- 礫石自行車

第 7 章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鋼

- 鋁

- 碳纖維

- 鈦

- 複合材料

第 8 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- BBInfinite

- Campagnolo

- Cane Creek

- CeramicSpeed

- Chris King

- Enduro Bearings

- First Components

- Full Speed Ahead

- Hawk Racing

- Hope Technology

- Park Tool

- Praxis Works

- Race Face

- Rotor Bike Components

- Shimano

- SRAM

- Token Products

- VP Components

- Wheels Manufacturing

- White Industries

The Global Bicycle Bottom Bracket Market was valued at USD 511.3 million in 2024 and is projected to grow at a CAGR of 3.5% between 2025 and 2034. The rising popularity of cycling as a sustainable and health-conscious mode of transportation is driving demand for high-performance bike components. Urban areas worldwide are embracing cycling infrastructure enhancements, such as bike lanes, bike-sharing systems, and improved safety measures. These developments make cycling a safer and more convenient alternative, particularly in cities dealing with traffic congestion and pollution. Additionally, the growing adoption of cycling for fitness and leisure, alongside the increasing popularity of competitive cycling events, is further fueling market growth. With a focus on lightweight, durable, and efficient components, bicycle manufacturers are continuously innovating, catering to the diverse needs of both casual riders and professionals.

The market is primarily segmented into two distribution channels: Original Equipment Manufacturer (OEM) and aftermarket. In 2024, the OEM segment dominated the market, accounting for a significant 73% share. The segment growth is propelled by the increasing demand for high-quality components tailored to enhance bike performance. OEMs are essential in providing premium bottom brackets to manufacturers of high-end bicycles, meeting the expectations of a growing consumer base that values reliability and innovation. The OEM segment's prominence underscores the industry's shift toward advanced, specialized parts designed for durability and superior functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $511.3 Million |

| Forecast Value | $711.7 Million |

| CAGR | 3.5% |

In terms of product offerings, the bicycle bottom bracket market includes threaded bottom brackets, press-fit bottom brackets, external bottom brackets, cartridge bottom brackets, and other types. Among these, threaded bottom brackets held a 25% market share in 2024 and are anticipated to generate USD 150 million by 2034. The resurgence of interest in threaded bottom brackets is linked to the restoration of classic bicycles and the rise of custom bike-building trends. Cyclists value these components for their simplicity, robustness, and nostalgic appeal, making them a preferred choice for enthusiasts seeking reliability and a vintage touch.

China represented 40% of the bicycle bottom bracket market in 2024, driven by its rapidly expanding e-bike industry. Urbanization, coupled with government incentives for sustainable transportation, has significantly boosted the demand for specialized components. E-bikes, which feature heavier frames and motorized systems, require durable and efficient bottom brackets to ensure optimal performance and longevity. This trend highlights the growing importance of advanced manufacturing solutions tailored to meet the needs of evolving cycling technologies. As cycling gains traction worldwide, the market for bottom brackets is set to witness sustained growth fueled by innovation and increased consumer demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of cycling as a sustainable transportation option

- 3.9.1.2 Technological advancements in bicycle components

- 3.9.1.3 Expansion of cycling infrastructure in urban areas

- 3.9.1.4 Increasing demand for customization in bicycles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Compatibility issues across bicycle models

- 3.9.2.2 Durability and maintenance concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Threaded bottom bracket

- 5.3 Press-fit bottom bracket

- 5.4 External bottom bracket

- 5.5 Cartridge bottom bracket

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road bike

- 6.3 Mountain bike

- 6.4 Racing bike

- 6.5 Gravel bike

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Carbon fiber

- 7.5 Titanium

- 7.6 Composite materials

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 North America

- 9.1.1 U.S.

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.2.7 Nordics

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 South Korea

- 9.3.6 Southeast Asia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 UAE

- 9.5.2 South Africa

- 9.5.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BBInfinite

- 10.2 Campagnolo

- 10.3 Cane Creek

- 10.4 CeramicSpeed

- 10.5 Chris King

- 10.6 Enduro Bearings

- 10.7 First Components

- 10.8 Full Speed Ahead

- 10.9 Hawk Racing

- 10.10 Hope Technology

- 10.11 Park Tool

- 10.12 Praxis Works

- 10.13 Race Face

- 10.14 Rotor Bike Components

- 10.15 Shimano

- 10.16 SRAM

- 10.17 Token Products

- 10.18 VP Components

- 10.19 Wheels Manufacturing

- 10.20 White Industries