|

市場調查報告書

商品編碼

1684686

中央車輛控制器市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Central Vehicle Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

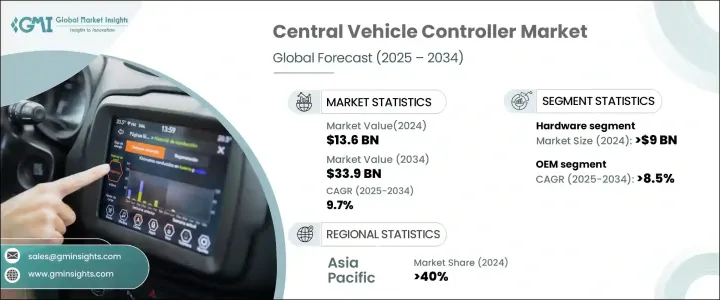

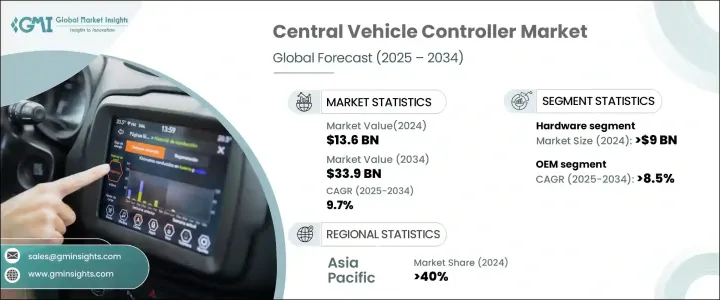

2024 年全球中央車輛控制器市場價值為 136 億美元,預計在 2025 年至 2034 年期間以 9.7% 的複合年成長率成長,這得益於電動車 (EV) 的日益普及以及對先進車輛控制系統的需求日益成長。隨著汽車製造商尋求創新解決方案來提高效率並降低硬體複雜性,CVC 已成為現代車輛架構中的關鍵組成部分。這些控制器將多種車輛功能整合到一個集中系統中,從而提高了能源最佳化、即時資料利用率和整體車輛性能。透過簡化控制操作,CVC 使製造商能夠整合自適應巡航控制、車道維持輔助和自動駕駛功能等智慧功能。

隨著汽車電氣化和連接性成為行業重點,對這些先進控制器的需求持續激增。此外,智慧移動解決方案和軟體定義汽車的興起進一步推動了對 CVC 技術的投資,使汽車製造商能夠提高性能、安全性和永續性。隨著降低排放和提高汽車效率的監管壓力不斷成長,汽車行業正在積極向提供卓越功能、降低成本並與不斷發展的行動生態系統無縫整合的集中控制架構轉型。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 136億美元 |

| 預測值 | 339億美元 |

| 複合年成長率 | 9.7% |

市場分為硬體和軟體元件,其中硬體部分占主導地位,到 2024 年市場規模將達到 90 億美元。該領域的快速擴張歸因於對支援集中式車輛控制的高性能運算系統的需求不斷成長。這些硬體解決方案在實現複雜的車輛功能(包括即時導航、自動煞車和預測性維護)方面發揮著至關重要的作用。隨著電動車產量的增加和先進駕駛輔助系統(ADAS) 的推動,汽車製造商正在大力投資節能硬體解決方案,以提高車輛的智慧性和反應能力。隨著汽車技術的進步,強大的處理器、先進的感測器和基於人工智慧的控制系統的整合預計將推動該領域的進一步成長。

根據最終用途,市場分為原始設備製造商 (OEM) 和售後市場,其中 OEM 佔據主導地位。受汽車製造商轉向集中式車輛架構的推動, OEM市場預計將在 2025 年至 2034 年間以 8.5% 的複合年成長率擴張。這些系統使製造商能夠簡化生產流程,減少硬體冗餘並提高車輛效率。 CVC 的整合使汽車製造商能夠滿足與排放、網路安全和車輛安全相關的嚴格監管標準。隨著車輛變得越來越以軟體為中心,原始設備製造商優先採用這些系統來改善連接性、降低維護成本並確保其車輛設計面向未來。

亞太地區仍然是最大的區域市場,到 2024 年將佔全球佔有率的 40%。中國、日本和韓國等國家正大力投資汽車電氣化,促使汽車製造商整合集中控制系統以增強能源管理和性能。稅收優惠、減排要求以及對智慧行動基礎設施的投資進一步加速了該地區對 CVC 技術的應用。隨著對智慧交通解決方案的日益關注,亞太地區預計將在全球中央車輛控制器市場保持領先地位。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商格局

- 組件提供者

- 製造商

- 經銷商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 成本分析

- 高級駕駛輔助系統 (ADAS) 的演變

- 衝擊力

- 成長動力

- 高級駕駛輔助系統 (ADAS) 需求不斷成長

- 電動和混合動力車的普及率不斷上升

- 越來越重視車輛安全和法規遵循

- 更加重視智慧汽車功能的連接性和整合性

- 產業陷阱與挑戰

- 系統開發成本高

- CVC 系統與現有汽車平台整合的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 微控制器

- 記憶單元

- 通訊模組

- 控制器區域網路 (CAN)

- 本機互連網路 (LIN)

- FlexRay

- 乙太網路

- 其他

- 軟體

- 作業系統

- 中介軟體

- 應用軟體

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 7 章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車

- 純電動車 (BEV)

- 插電式混合動力車 (PHEV)

- 混合動力電動車 (HEV)

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- ADAS 與安全系統

- 車身控制與舒適系統

- 動力系統管理

- 資訊娛樂系統

- 車輛動力學與控制

- 其他

第 9 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aptiv

- Bosch

- Continental

- Denso

- Ford Motors

- General Motors

- Hyundai Motors

- Infineon Technologies

- Magna International

- NVIDIA

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- STMicroelectronics

- Tesla

- Texas Instruments

- Toyota Motor

- Valeo

- Volkswagen

- ZF Friedrichshafen

The Global Central Vehicle Controller Market was valued at USD 13.6 billion in 2024 and is poised to expand at a CAGR of 9.7% between 2025 and 2034, driven by the increasing adoption of electric vehicles (EVs) and the growing need for advanced vehicle control systems. As automakers seek innovative solutions to enhance efficiency and reduce hardware complexity, CVCs have emerged as a critical component in modern vehicle architecture. These controllers consolidate multiple vehicle functions into a centralized system, improving energy optimization, real-time data utilization, and overall vehicle performance. By streamlining control operations, CVCs enable manufacturers to integrate intelligent features such as adaptive cruise control, lane-keeping assistance, and autonomous driving capabilities.

With vehicle electrification and connectivity becoming industry priorities, the demand for these advanced controllers continues to surge. Additionally, the rise of smart mobility solutions and software-defined vehicles has further fueled investments in CVC technologies, allowing automakers to enhance performance, safety, and sustainability. As regulatory pressures for lower emissions and enhanced vehicle efficiency grow, the automotive industry is actively transitioning toward centralized control architectures that offer superior functionality, reduced costs, and seamless integration with evolving mobility ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.6 Billion |

| Forecast Value | $33.9 Billion |

| CAGR | 9.7% |

The market is segmented into hardware and software components, with the hardware segment dominating in 2024 at USD 9 billion. The rapid expansion of this segment is attributed to the rising demand for high-performance computing systems that support centralized vehicle control. These hardware solutions play a crucial role in enabling sophisticated vehicle functionalities, including real-time navigation, automated braking, and predictive maintenance. With the increasing production of EVs and the push for advanced driver assistance systems (ADAS), automakers are investing heavily in energy-efficient hardware solutions that enhance vehicle intelligence and responsiveness. As automotive technology advances, the integration of powerful processors, advanced sensors, and artificial intelligence-based control systems is expected to drive further growth in this segment.

By end-use, the market is categorized into original equipment manufacturers (OEMs) and the aftermarket, with OEMs leading the segment. The OEM market is projected to expand at a CAGR of 8.5% from 2025 to 2034, driven by automakers' shift toward centralized vehicle architectures. These systems allow manufacturers to streamline production processes, reduce hardware redundancy, and enhance vehicle efficiency. The integration of CVCs enables automakers to meet stringent regulatory standards related to emissions, cybersecurity, and vehicle safety. As vehicles become more software-centric, OEMs are prioritizing the adoption of these systems to improve connectivity, reduce maintenance costs, and future-proof their vehicle designs.

Asia Pacific remains the largest regional market, accounting for 40% of the global share in 2024. The region's dominance is fueled by the rising adoption of EVs, strong government incentives, and significant advancements in automotive technology. Countries such as China, Japan, and South Korea are investing heavily in vehicle electrification, prompting automakers to integrate centralized control systems for enhanced energy management and performance. Tax benefits, emission reduction mandates, and investments in smart mobility infrastructure further accelerate the adoption of CVC technologies in the region. With a growing focus on intelligent transportation solutions, Asia Pacific is expected to maintain its leadership in the global central vehicle controller market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Cost analysis

- 3.8 Evolution of Advanced Driver Assistance Systems (ADAS)

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for Advanced Driver Assistance Systems (ADAS)

- 3.9.1.2 Rising adoption of electric and hybrid vehicles

- 3.9.1.3 Growing emphasis on vehicle safety and regulatory compliance

- 3.9.1.4 Enhanced focus on connectivity and integration of smart vehicle features

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of system development

- 3.9.2.2 Integration complexity of CVC systems with existing automotive platforms

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Microcontroller

- 5.2.2 Memory unit

- 5.2.3 Communication module

- 5.2.3.1 Controller Area Network (CAN)

- 5.2.3.2 Local Interconnect Network (LIN)

- 5.2.3.3 FlexRay

- 5.2.3.4 Ethernet

- 5.2.4 Others

- 5.3 Software

- 5.3.1 Operating system

- 5.3.2 Middleware

- 5.3.3 Application software

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric vehicles

- 7.3.1 Battery Electric Vehicles (BEV)

- 7.3.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 7.3.3 Hybrid Electric Vehicles (HEV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ADAS & safety system

- 8.3 Body control & comfort system

- 8.4 Powertrain management

- 8.5 Infotainment system

- 8.6 Vehicle dynamics and control

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Bosch

- 11.3 Continental

- 11.4 Denso

- 11.5 Ford Motors

- 11.6 General Motors

- 11.7 Hyundai Motors

- 11.8 Infineon Technologies

- 11.9 Magna International

- 11.10 NVIDIA

- 11.11 NXP Semiconductors

- 11.12 Qualcomm

- 11.13 Renesas Electronics

- 11.14 STMicroelectronics

- 11.15 Tesla

- 11.16 Texas Instruments

- 11.17 Toyota Motor

- 11.18 Valeo

- 11.19 Volkswagen

- 11.20 ZF Friedrichshafen