|

市場調查報告書

商品編碼

1684714

文件完整性監控市場機會、成長動力、產業趨勢分析與預測 2025 - 2034File Integrity Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

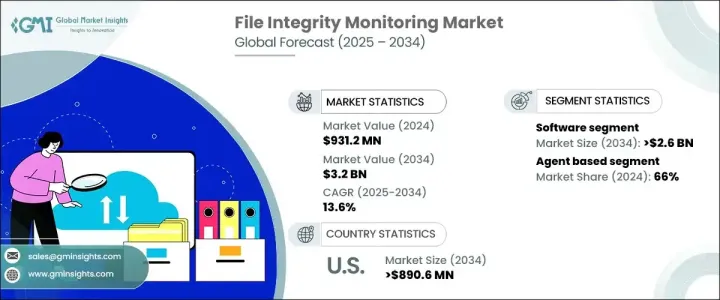

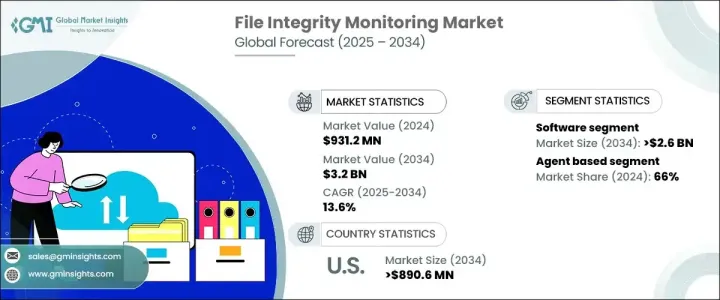

2024 年全球文件完整性監控市場價值為 9.312 億美元,預計隨著企業在不斷升級的威脅中優先考慮網路安全,2025 年至 2034 年期間的複合年成長率將達到 13.6%。駭客攻擊、惡意軟體和檔案篡改等網路攻擊日益複雜,加劇了對即時安全措施的需求。全球各地的組織都在積極投資先進的文件完整性監控解決方案,以檢測未經授權的存取、防止資料外洩並遵守嚴格的監管框架。

隨著勒索軟體攻擊持續擾亂產業,企業尋求主動防禦策略來保護敏感資訊。監管機構制定了嚴格的合規要求,迫使企業採用先進的安全工具。快速的數位轉型加上雲端運算應用的激增,進一步推動了對監控解決方案的需求。雖然雲端環境提供了操作靈活性和可擴展性,但也增加了網路威脅的風險,因此強大的安全協定不可或缺。整合混合雲端模型的企業需要複雜的監控工具來追蹤文件完整性並在異常升級為全面違規之前檢測異常。網路安全領域人工智慧和機器學習的整合正在增強檔案完整性監控,使組織能夠更準確地識別模式並預測潛在的安全漏洞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.312億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 13.6% |

市場按組件細分為軟體和服務,其中軟體部分在 2024 年佔據 74% 的主導佔有率。這些技術最大限度地減少了人為錯誤,降低了營運成本,並簡化了安全合規性。隨著企業面臨的網路風險不斷增加,企業優先考慮自動化以加強其安全態勢,軟體解決方案預計到 2034 年將產生 26 億美元的收入。

根據安裝模式,市場將解決方案分為基於代理的系統和無代理的系統。基於代理的監控將在 2024 年佔據 66% 的市場佔有率,這得益於其在檢測未經授權的文件修改方面的精確度。這些解決方案將監控代理直接部署到端點和伺服器上,提供對潛在安全威脅的即時洞察。金融、醫療保健和政府部門等監管合規性嚴格的行業依靠基於代理的監控來確保資料完整性並滿足法律要求。組織對維護安全基礎設施的需求日益成長,加速了這些先進解決方案的採用。

美國資料是文件完整性監控市場的主導者,到 2024 年佔有 84% 的佔有率。在要求企業實施文件完整性監控解決方案的監管要求的推動下,美國市場規模預計到 2034 年將達到 8.5 億美元。隨著網路攻擊擴大針對金融服務和醫療保健等關鍵產業,企業正在利用預測分析和即時監控來增強安全框架。美國領先的網路安全公司的存在確保了持續創新,為組織提供了最先進的解決方案,以降低風險並加強數位防禦。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 解決方案提供者

- 系統整合商

- 監管機構

- 雲端和混合基礎設施供應商

- 最終用途

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 網路安全威脅日益增加

- 監理合規要求

- 基於雲端的解決方案的採用日益增多

- 對營運效率和成本管理的需求日益成長

- 產業陷阱與挑戰

- 實施成本高

- 誤報和警報疲勞

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 軟體

- 服務

第 6 章:市場估計與預測:按安裝模式,2021 - 2034 年

- 主要趨勢

- 基於代理

- 無代理

第 7 章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第 8 章:市場估計與預測:按企業規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 企業規模

第 9 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 金融保險業協會

- 政府

- 醫療保健與生命科學

- 教育

- 媒體與娛樂

- 零售與電子商務

- 製造和汽車

- 其他

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- AlienVault (AT&T Cybersecurity)

- Cimcor

- Cisco Systems

- ESET

- IBM Security

- LogRhythm

- ManageEngine

- McAfee

- Netwrix

- New Net Technologies (NNT)

- OSSEC

- Paessler PRTG

- Qualys

- Samhain

- SolarWinds

- Splunk

- Symantec (Broadcom)

- Trend Micro

- Tripwire

- Trustwave

The Global File Integrity Monitoring Market, valued at USD 931.2 million in 2024, is projected to expand at a CAGR of 13.6% from 2025 to 2034 as businesses prioritize cybersecurity amid escalating threats. The increasing sophistication of cyberattacks, including hacking, malware, and file tampering, has intensified the need for real-time security measures. Organizations worldwide are actively investing in advanced file integrity monitoring solutions to detect unauthorized access, prevent data breaches, and comply with stringent regulatory frameworks.

As ransomware attacks continue to disrupt industries, enterprises seek proactive defense strategies to safeguard sensitive information. Regulatory bodies impose strict compliance requirements, compelling businesses to adopt cutting-edge security tools. The rapid digital transformation, combined with the surge in cloud adoption, has further propelled demand for monitoring solutions. While cloud environments offer operational flexibility and scalability, they also heighten the risk of cyber threats, making robust security protocols indispensable. Businesses integrating hybrid cloud models need sophisticated monitoring tools to track file integrity and detect anomalies before they escalate into full-scale breaches. The convergence of artificial intelligence and machine learning in cybersecurity is enhancing file integrity monitoring, allowing organizations to identify patterns and predict potential security vulnerabilities with greater accuracy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $931.2 Million |

| Forecast Value | $3.2 Billion |

| CAGR | 13.6% |

The market is segmented by component into software and services, with the software segment holding a dominant 74% share in 2024. Software-based solutions offer automated monitoring capabilities that instantly detect unauthorized file changes while maintaining baseline configurations. These technologies minimize human error, reduce operational costs, and streamline security compliance. With businesses facing increased cyber risks, software solutions are expected to generate USD 2.6 billion by 2034 as enterprises prioritize automation to strengthen their security posture.

By installation mode, the market categorizes solutions into agent-based and agentless systems. Agent-based monitoring accounted for 66% of the market in 2024, driven by its precision in detecting unauthorized file modifications. These solutions deploy monitoring agents directly onto endpoints and servers, providing real-time insights into potential security threats. Industries with stringent regulatory compliance, such as finance, healthcare, and government sectors, rely on agent-based monitoring to ensure data integrity and meet legal mandates. The growing need for organizations to maintain secure infrastructures has accelerated the adoption of these advanced solutions.

The US remains the dominant player in the file integrity monitoring market, holding an 84% share in 2024. The country's leadership in cybersecurity, along with stringent data protection laws and large-scale investments in security technologies, has fueled demand for sophisticated monitoring tools. The US market is set to reach USD 850 million by 2034, driven by regulatory mandates requiring enterprises to implement file integrity monitoring solutions. With cyberattacks increasingly targeting critical industries such as financial services and healthcare, businesses are leveraging predictive analytics and real-time monitoring to enhance security frameworks. The presence of leading cybersecurity firms in the US ensures continuous innovation, providing organizations with access to state-of-the-art solutions that mitigate risks and strengthen digital defenses.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution providers

- 3.1.2 System integrators

- 3.1.3 Regulatory bodies

- 3.1.4 Cloud & hybrid infrastructure providers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing cybersecurity threats

- 3.7.1.2 Regulatory compliance requirements

- 3.7.1.3 Growing adoption of cloud-based solutions

- 3.7.1.4 Growing need for operational efficiency & cost management

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High implementation costs

- 3.7.2.2 False positives & alert fatigue

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Installation Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Agent-based

- 6.3 Agentless

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Enterprise size

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Government

- 9.4 Healthcare & life science

- 9.5 Education

- 9.6 Media & entertainment

- 9.7 Retail & eCommerce

- 9.8 Manufacturing & automotive

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AlienVault (AT&T Cybersecurity)

- 11.2 Cimcor

- 11.3 Cisco Systems

- 11.4 ESET

- 11.5 IBM Security

- 11.6 LogRhythm

- 11.7 ManageEngine

- 11.8 McAfee

- 11.9 Netwrix

- 11.10 New Net Technologies (NNT)

- 11.11 OSSEC

- 11.12 Paessler PRTG

- 11.13 Qualys

- 11.14 Samhain

- 11.15 SolarWinds

- 11.16 Splunk

- 11.17 Symantec (Broadcom)

- 11.18 Trend Micro

- 11.19 Tripwire

- 11.20 Trustwave