|

市場調查報告書

商品編碼

1698266

醫療保健生物融合市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Healthcare Bioconvergence Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

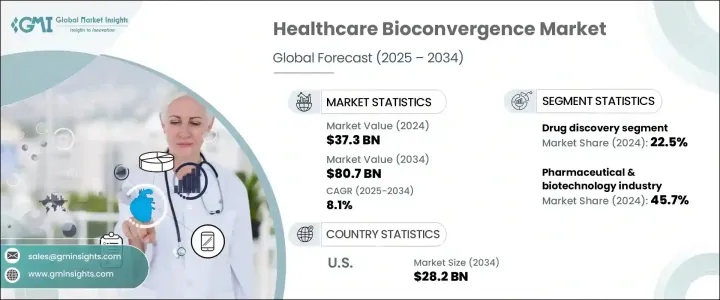

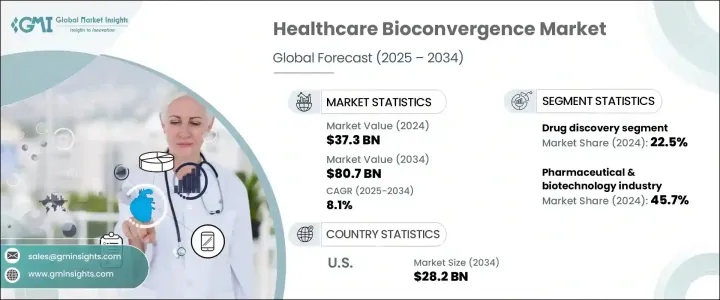

2024 年全球醫療保健生物融合市場規模達到 373 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.1%。這個快速發展的市場正在透過整合電腦科學、人工智慧 (AI)、工程和生物技術等尖端技術重新定義醫療保健的未來。透過彌合生命科學和技術之間的差距,生物融合正在加速醫學研究、診斷和治療個人化方面的創新。

由於慢性病盛行率上升、人口老化和治療成本不斷上漲,全球醫療保健系統面臨越來越大的壓力,對先進的數據驅動解決方案的需求正在激增。個人化醫療、再生療法和人工智慧診斷的推動進一步推動了該領域的投資,使生物融合成為現代醫療保健的重要支柱。此外,大型製藥和生技公司正在與科技驅動的新創公司合作開發突破性的解決方案,從而形成日益激烈的競爭格局。生物電子學、光遺傳學和奈米機器人技術的日益普及將改變醫療保健,改善患者的治療效果並最佳化醫療干預。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 373億美元 |

| 預測值 | 807億美元 |

| 複合年成長率 | 8.1% |

市場細分為各種應用,包括藥物發現、藥物傳輸奈米機器人、再生醫學和精準醫療等。 2024 年,藥物研發將佔據最大佔有率,達到 22.5%,這得益於全球醫療成本的上漲、慢性病盛行率的上升以及關鍵藥物專利的到期。製藥公司正在迅速整合人工智慧工具,以加強藥物發現、縮短研究時間並降低成本。由於奈米機器人能夠改善標靶藥物輸送並最大限度地減少不良影響,預計其藥物輸送將在整個預測期內經歷最快的成長。其他創新應用,如生物電子學和光遺傳學,也正在獲得發展勢頭,為神經治療、視力恢復和慢性病管理開闢了新的可能性。

2024 年,製藥和生技公司佔據醫療保健生物融合市場的 45.7%,鞏固了其作為領先終端用戶的地位。這些行業在推進研究計劃、確保資金和影響醫療保健決策方面發揮著至關重要的作用。製藥巨頭正在利用生物融合來提高營運效率、簡化臨床試驗並開發下一代療法。許多公司也透過利用健康數據擴大研究或轉售來創造額外收入,從而實現健康資料的貨幣化。除了製藥和生物技術公司外,合約研究組織 (CRO) 和醫療保健提供者也在為市場擴張做出貢獻,醫院和研究機構採用人工智慧驅動的生物融合平台來推動精準醫療的進步。

美國醫療保健生物融合市場在 2024 年創造了 142 億美元的產值,預計到 2034 年將達到 282 億美元,這得益於對人工智慧診斷技術的持續投資。領先的醫院、研究中心和生物技術公司擴大採用人工智慧驅動的平台來分析遺傳、環境和生活方式資料,制定高度客製化的治療策略。隨著數位健康解決方案、預測分析和人工智慧輔助臨床決策的日益融合,美國仍然處於醫療保健生物融合創新的前沿,確保了長期的市場成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 提高對個人化治療的認知

- 新治療領域的新興應用

- 製藥生物技術領域研發支出不斷成長

- 機器人技術在醫療保健產業的動態應用

- 產業陷阱與挑戰

- 缺乏個人化治療的長期資料

- 對精準醫療、再生醫學和藥物研發的嚴格監管

- 成長動力

- 成長潛力分析

- 技術格局

- 監管格局

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按應用,2021 年至 2032 年

- 主要趨勢

- 藥物研發

- 用於藥物輸送的奈米機器人

- 再生醫學

- 診斷和生物感測器

- 生物電子學

- 工程生物材料

- 光遺傳學

- 精準醫療

- 其他應用

第6章:市場估計與預測:依最終用途,2021 年至 2032 年

- 製藥和生物技術產業

- 合約研究組織(CRO)

- 其他最終用途

第7章:市場估計與預測:按地區,2021 年至 2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Anima Biotech

- BICO - The Bio Convergence Company

- BioConvergent Health

- Biomx

- Century Therapeutics

- Cytena

- Galvani Bioelectronics

- GE Healthcare

- Ginkgo Bioworks

- Merck

- Pangea Biomed

- Setpoint Medical Corporation

- Singota Solution

- Thermo Fisher Scientific

- Zymergen

The Global Healthcare Bioconvergence Market reached USD 37.3 billion in 2024 and is expected to grow at a CAGR of 8.1% between 2025 and 2034. This rapidly evolving market is redefining the future of healthcare by integrating cutting-edge technologies such as computer science, artificial intelligence (AI), engineering, and biotechnology. By bridging the gap between life sciences and technology, bioconvergence is accelerating innovations in medical research, diagnostics, and treatment personalization.

As healthcare systems worldwide face increasing pressure due to rising chronic disease prevalence, aging populations, and escalating treatment costs, the demand for advanced, data-driven solutions is surging. The push for personalized medicine, regenerative therapies, and AI-driven diagnostics is further driving investments in this sector, making bioconvergence a key pillar of modern healthcare. Additionally, major pharmaceutical and biotechnology firms are collaborating with tech-driven startups to develop groundbreaking solutions, creating an increasingly competitive landscape. The growing adoption of bioelectronics, optogenetics, and nanorobotics is set to transform healthcare, enhancing patient outcomes and optimizing medical interventions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.3 Billion |

| Forecast Value | $80.7 Billion |

| CAGR | 8.1% |

The market is segmented into various applications, including drug discovery, nanorobotics for drug delivery, regenerative medicine, and precision medicine, among others. In 2024, drug discovery held the largest share at 22.5%, fueled by increasing global healthcare costs, the rising prevalence of chronic illnesses, and the expiration of key drug patents. Pharmaceutical companies are rapidly integrating AI-powered tools to enhance drug discovery, reduce research timelines, and cut costs. Nanorobotics for drug delivery is anticipated to experience the fastest growth throughout the forecast period, given its ability to improve targeted drug delivery and minimize adverse effects. Other innovative applications, such as bioelectronics and optogenetics, are also gaining momentum, unlocking new possibilities in neurological treatments, vision restoration, and chronic disease management.

Pharmaceutical and biotechnology companies accounted for 45.7% of the healthcare bioconvergence market in 2024, solidifying their position as the leading end-users. These industries play a crucial role in advancing research initiatives, securing funding, and influencing healthcare decision-making. Pharma giants are leveraging bioconvergence to improve operational efficiencies, streamline clinical trials, and develop next-generation therapies. Many companies are also monetizing health data by utilizing it for research expansion or reselling it to generate additional revenue. Alongside pharmaceutical and biotech firms, contract research organizations (CROs) and healthcare providers are also contributing to market expansion, with hospitals and research institutions adopting AI-powered bioconvergent platforms to drive precision medicine advancements.

The U.S. Healthcare Bioconvergence Market generated USD 14.2 billion in 2024 and is projected to reach USD 28.2 billion by 2034, driven by continuous investments in AI-powered diagnostic technologies. Leading hospitals, research centers, and biotech firms are increasingly adopting AI-driven platforms to analyze genetic, environmental, and lifestyle data, creating highly customized treatment strategies. With the rising integration of digital health solutions, predictive analytics, and AI-assisted clinical decision-making, the U.S. remains at the forefront of healthcare bioconvergence innovation, ensuring long-term market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness towards personalized treatment

- 3.2.1.2 Emerging applications in new therapeutic areas

- 3.2.1.3 Growing R&D expenditure in pharma-biotech sector

- 3.2.1.4 Dynamic adoption of robotics in healthcare industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of long-term data for personalized treatments

- 3.2.2.2 Stringent regulations towards precision medicine, regenerative medicines and drug discovery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Drug discovery

- 5.3 Nanorobotics for drug delivery

- 5.4 Regenerative medicine

- 5.5 Diagnostic and biological sensors

- 5.6 Bioelectronics

- 5.7 Engineered living materials

- 5.8 Optogenetics

- 5.9 Precision medicine

- 5.10 Other applications

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Bn)

- 6.1 Pharmaceutical & biotechnology industry

- 6.2 Contract research organization (CRO)

- 6.3 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Bn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Anima Biotech

- 8.2 BICO - The Bio Convergence Company

- 8.3 BioConvergent Health

- 8.4 Biomx

- 8.5 Century Therapeutics

- 8.6 Cytena

- 8.7 Galvani Bioelectronics

- 8.8 GE Healthcare

- 8.9 Ginkgo Bioworks

- 8.10 Merck

- 8.11 Pangea Biomed

- 8.12 Setpoint Medical Corporation

- 8.13 Singota Solution

- 8.14 Thermo Fisher Scientific

- 8.15 Zymergen