|

市場調查報告書

商品編碼

1698274

石油和天然氣資料管理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Oil and Gas Data Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

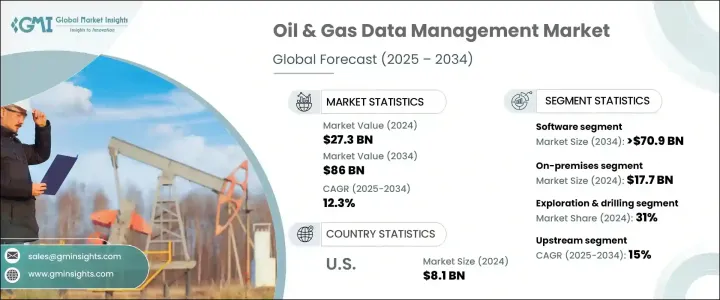

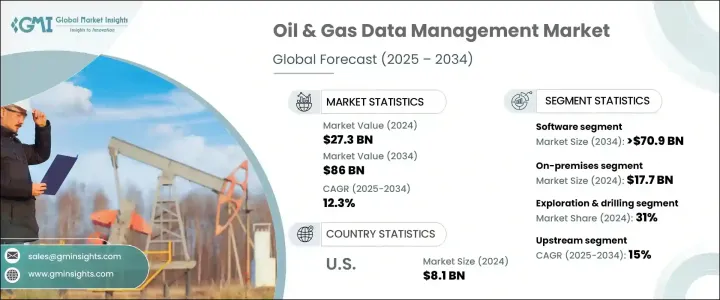

2024 年全球石油和天然氣數據管理市場估值達 273 億美元,預計 2025 年至 2034 年期間的複合年成長率為 12.3%。業界對人工智慧、巨量資料和雲端運算的快速應用正在提高效率、最佳化資產追蹤並減少停機時間。隨著公司努力加強營運,對資料管理解決方案的需求正在激增。世界各地的嚴格法規強化了高效資料管理的必要性,確保遵守環境政策和安全標準,同時避免法律糾紛。

各國政府正在加強有關排放、營運安全和資源利用的監管,迫使石油和天然氣公司實施先進的資料報告和治理解決方案。作為回應,各組織正在整合複雜的軟體來追蹤排放、監控資產並遵守不斷發展的行業標準。隨著數位轉型,網路威脅的風險不斷升級,促使企業投資強大的安全框架。加密、多層身份驗證和即時威脅檢測現在是資料管理系統中必不可少的功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 273億美元 |

| 預測值 | 860億美元 |

| 複合年成長率 | 12.3% |

軟體解決方案在石油和天然氣資料管理市場佔據主導地位,2024 年的市佔率超過 67%,預計到 2034 年將超過 709 億美元。人工智慧、機器學習和巨量資料分析擴大被部署來處理大型資料集,從而實現預測性維護、即時監控和增強決策能力。公司也正在轉向基於雲端和物聯網的平台,確保跨多個地點的遠端存取和無縫資料交換。雲端技術提供經濟高效且安全的資料存儲,而物聯網感測器提供即時營運洞察,進一步提高效率。

內部部署持續佔據市場主導地位,到 2024 年將達到 177 億美元。石油和天然氣行業處理高度敏感的資料,包括地質報告、鑽井分析和生產預測。組織優先考慮內部部署解決方案,以嚴格控制專有訊息,確保遵守法規並最大限度地降低網路安全風險。許多政府執行資料主權法,進一步推動了對內部部署基礎設施的偏好。此外,離岸業務依賴在地化資料儲存來確保在網路連線有限的情況下也能不間斷地進行處理。

探勘和鑽井仍然是石油和天然氣資料管理的關鍵應用,到 2024 年將佔據 31% 的市場佔有率。這些過程會產生大量的地質和地震資料,因此需要先進的管理解決方案來最佳化鑽井精度並最大限度地降低風險。人們越來越重視高效的資源開採,這推動了對人工智慧資料建模的投資,使公司能夠改善決策並減少營運的不確定性。隨著全球能源需求的成長,企業正在加強探勘力度,從而推動對高效能資料管理技術的需求。

上游產業引領產業採用資料管理解決方案,預計到 2034 年將以 15% 的複合年成長率成長。探勘、鑽井和生產活動會產生大量資料集,需要進行複雜的分析才能提高效率和碳氫化合物回收率。石油和天然氣公司正在增加對探勘和生產的支出,需要使用數位工具進行地質測繪、油藏監測和鑽井最佳化。人工智慧、物聯網和巨量資料分析等技術在即時追蹤、預測性維護和整體營運效率方面發揮著至關重要的作用。

北美佔據全球石油和天然氣資料管理市場的最大佔有率,到 2024 年將佔 34%,其中美國的收入為 81 億美元。該地區在將人工智慧、物聯網和雲端解決方案融入石油和天然氣工作流程方面處於領先地位。監管機構執行嚴格的合規要求,迫使公司採用先進的資料管理系統進行排放追蹤、安全監控和風險緩解。隨著數位轉型的加速,高效的資料管理對於最佳化整個產業的物流、倉儲和運輸營運仍然至關重要。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 軟體供應商

- 雲端提供者

- 技術提供者

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 石油天然氣產業數位轉型日益深入

- 擴大採用基於雲端的解決方案

- 對預測分析和人工智慧的需求不斷成長

- 嚴格的監管和環境合規性

- 對能源效率和成本最佳化的需求不斷成長

- 產業陷阱與挑戰

- 實施成本高且遺留系統整合

- 網路安全風險與資料隱私問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按解決方案,2021 - 2034 年

- 主要趨勢

- 軟體

- 數據分析與視覺化

- 資料整合

- 主資料管理

- 元資料管理

- 其他

- 服務

- 諮詢與規劃

- 整合與實施

- 支援與維護

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 探勘與鑽探

- 生產最佳化

- 精煉和加工

- 運輸和儲存

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 上游

- 中游

- 下游

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Argus Media

- AVEVA Group

- Baker Hughes Company

- Cognite

- Emerson Electric

- Halliburton Energy Services

- Honeywell International

- IBM

- IMS PEI

- Infosys

- NetApp

- Oracle

- P2 Energy Solutions

- Quorum Business Solutions

- Rystad Energy

- SAP SE

- Schlumberger

- Teradata

- TGS-NOPEC Geophysical Company

- Wood Mackenzie

The Global Oil And Gas Data Management Market reached a valuation of USD 27.3 billion in 2024 and is projected to expand at a CAGR of 12.3% from 2025 to 2034. The rapid adoption of AI, big data, and cloud computing in the industry is driving efficiency, optimizing asset tracking, and reducing downtime. As companies strive to enhance operations, demand for data management solutions is surging. Stringent regulations worldwide are reinforcing the need for efficient data management, ensuring compliance with environmental policies and safety standards while preventing legal complications.

Governments are tightening regulations around emissions, operational safety, and resource utilization, compelling oil and gas companies to implement advanced data reporting and governance solutions. In response, organizations are integrating sophisticated software to track emissions, monitor assets, and comply with evolving industry standards. The risk of cyber threats continues to escalate with digital transformation, prompting companies to invest in robust security frameworks. Encryption, multi-layer authentication, and real-time threat detection are now essential features in data management systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.3 Billion |

| Forecast Value | $86 Billion |

| CAGR | 12.3% |

Software solutions dominate the oil and gas data management market, holding a market share exceeding 67% in 2024, and are expected to surpass USD 70.9 billion by 2034. AI, machine learning, and big data analytics are increasingly being deployed to process large datasets, allowing predictive maintenance, real-time monitoring, and enhanced decision-making. Companies are also shifting towards cloud-based and IoT-enabled platforms, ensuring remote access and seamless data exchange across multiple locations. Cloud technology provides cost-effective and secure data storage, while IoT sensors offer real-time operational insights, further improving efficiency.

On-premises deployment continues to dominate the market, accounting for USD 17.7 billion in 2024. The oil and gas industry handles highly sensitive data, including geological reports, drilling analytics, and production forecasts. Organizations prioritize on-premises solutions to maintain strict control over proprietary information, ensuring regulatory compliance and minimizing cybersecurity risks. Many governments enforce data sovereignty laws, further driving the preference for on-premises infrastructure. Additionally, offshore operations rely on localized data storage to ensure uninterrupted processing despite limited internet connectivity.

Exploration and drilling remain critical applications within oil and gas data management, holding a 31% market share in 2024. These processes generate vast amounts of geological and seismic data, necessitating advanced management solutions to optimize drilling accuracy and minimize risks. The growing emphasis on efficient resource extraction has driven investments in AI-powered data modeling, enabling companies to improve decision-making and reduce operational uncertainties. As global energy demand rises, firms are intensifying exploration efforts, fueling the need for high-performance data management technologies.

The upstream sector leads the industry's adoption of data management solutions and is projected to grow at a CAGR of 15% through 2034. Exploration, drilling, and production activities generate extensive datasets that require sophisticated analytics for enhanced efficiency and hydrocarbon recovery. Oil and gas companies are ramping up spending on exploration and production, necessitating digital tools for geological mapping, reservoir monitoring, and drilling optimization. Technologies such as AI, IoT, and big data analytics play a crucial role in real-time tracking, predictive maintenance, and overall operational efficiency.

North America holds the largest share of the global oil and gas data management market, accounting for 34% in 2024, with the U.S. generating USD 8.1 billion in revenue. The region is at the forefront of integrating AI, IoT, and cloud solutions into oil and gas workflows. Regulatory bodies enforce strict compliance requirements, compelling companies to adopt advanced data management systems for emissions tracking, safety monitoring, and risk mitigation. As digital transformation accelerates, efficient data management remains essential for optimizing logistics, storage, and transportation operations across the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Software vendors

- 3.1.1.2 Cloud providers

- 3.1.1.3 Technology providers

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Growing digital transformation in the oil & gas industry

- 3.5.1.2 Increasing adoption of cloud-based solutions

- 3.5.1.3 Rising need for predictive analytics and ai

- 3.5.1.4 Stringent regulatory and environmental compliance

- 3.5.1.5 Rising demand for energy efficiency and cost optimization

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High implementation costs and legacy system integration

- 3.5.2.2 Cybersecurity risks and data privacy concerns

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Data analytics & visualization

- 5.2.2 Data integration

- 5.2.3 Master data management

- 5.2.4 Metadata management

- 5.2.5 Others

- 5.3 Services

- 5.3.1 Consulting & planning

- 5.3.2 Integration & implementation

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Exploration & drilling

- 7.3 Production optimization

- 7.4 Refining & processing

- 7.5 Transport & storage

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Upstream

- 8.3 Midstream

- 8.4 Downstream

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Argus Media

- 10.2 AVEVA Group

- 10.3 Baker Hughes Company

- 10.4 Cognite

- 10.5 Emerson Electric

- 10.6 Halliburton Energy Services

- 10.7 Honeywell International

- 10.8 IBM

- 10.9 IMS PEI

- 10.10 Infosys

- 10.11 NetApp

- 10.12 Oracle

- 10.13 P2 Energy Solutions

- 10.14 Quorum Business Solutions

- 10.15 Rystad Energy

- 10.16 SAP SE

- 10.17 Schlumberger

- 10.18 Teradata

- 10.19 TGS-NOPEC Geophysical Company

- 10.20 Wood Mackenzie