|

市場調查報告書

商品編碼

1698515

液氫市場機會、成長動力、產業趨勢分析及2025-2034年預測Liquid Hydrogen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

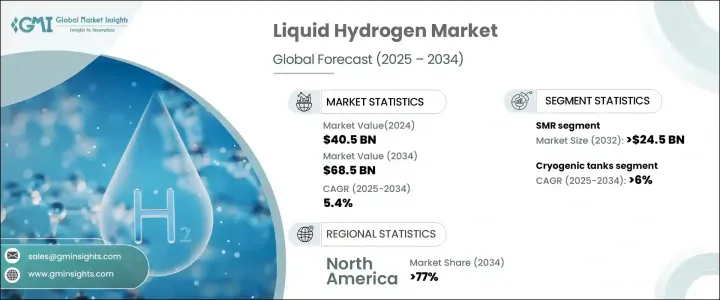

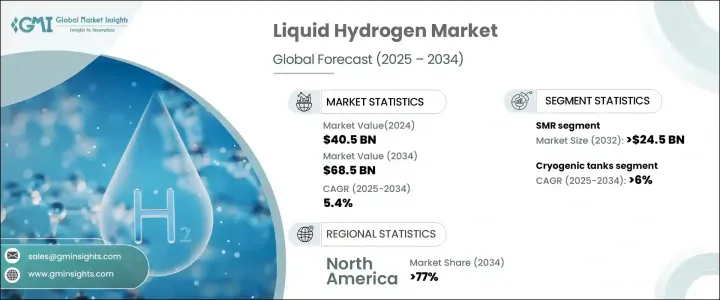

2024 年全球液氫市場規模達 405 億美元,預計 2025 年至 2034 年期間複合年成長率為 5.4%,這得益於氫基礎設施投資的增加、技術進步和國際合作。液態氫在工業脫碳、支持清潔能源轉型和滿足嚴格的減排目標方面發揮作用,因此對液態氫的需求正在上升。世界各國政府正在實施政策和資助計劃,以加速從交通運輸到工業應用等各個領域的氫氣應用。領先的企業也正在組成策略聯盟,開發大型氫氣生產中心,確保穩定的供應鏈,滿足日益成長的能源需求。交通運輸業,尤其是氫燃料電池汽車,正在成為液態氫的主要消費者,進一步推動市場擴張。儲存、處理和分配方面的技術創新正在提高效率,使液態氫成為各種應用的更可行的替代品。

氫氣樞紐的發展是推動市場成長的主要因素。這些中心是氫氣生產、儲存和分配的集中地點,為採用基於氫氣的解決方案的產業創建了無縫的供應鏈。技術供應商和能源公司之間的合作正在促進提高生產效率和成本效益的創新。旨在推進氫技術的全球舉措正在進一步加強該行業,並建立強大的國際供應網路。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 405億美元 |

| 預測值 | 685億美元 |

| 複合年成長率 | 5.4% |

液氫市場根據生產方法進行細分,主要類別包括煤氣化、電解和蒸汽甲烷重整(SMR)。由於其成本效益和大規模氫氣生產效率,SMR 領域仍佔據主導地位。到 2032 年,SMR 預計將創造 245 億美元的收入,這得益於其在天然氣資源豐富的地區的經濟可行性。催化劑、製程最佳化和熱回收系統的不斷進步正在提高SMR操作的效率,同時減少排放,使其成為許多行業的首選生產方法。

液氫輸送主要分為管路輸送和低溫儲槽輸送。 2024年,低溫儲槽佔據85.9%的市場佔有率,反映其在氫氣儲存和運輸中的關鍵作用。增強的絕緣技術顯著提高了低溫儲罐的效率,最大限度地減少了氫氣損失並確保了穩定的儲存條件。先進材料的使用進一步降低了沸騰率,提高了氫氣運輸的可靠性和安全性。氫能樞紐和產業群正在擴大,廣泛的管道網路正在建設中,以簡化氫氣分配並支持大規模工業應用。

美國是液氫市場的主要參與者,2024 年價值將達到 82 億美元。在政府的大力支持、工業投資的增加以及環保意識的增強的推動下,預計到 2034 年,美國將佔據 77% 的市場佔有率。聯邦激勵措施、政策框架和資助措施正在推動多個領域採用氫技術,鞏固美國在氫能創新和基礎設施發展領域的領先地位。隨著各行各業朝著永續發展目標和脫碳努力邁進,美國液氫市場將在未來幾年實現大幅擴張。

目錄

第1章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依生產方式,2021 年至 2034 年

- 主要趨勢

- 瓦斯化

- 小型磁共振

- 電解

第6章:市場規模及預測:以分銷方式,2021 年至 2034 年

- 主要趨勢

- 管道

- 低溫儲罐

第7章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 運輸

- 化學

- 其他

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 世界其他地區

第9章:公司簡介

- Air Products and Chemicals, Inc.

- Air Liquide

- Chart Industries

- ENGIE

- GE Appliances

- GENH2

- INOX India Limited

- Iwatani Corporation

- Kawasaki Heavy Industries, Ltd.

- Linde plc

- Messer

- Plug Power Inc.

- Praxair Technology, Inc.

- Salzburger Aluminium Group

- Shell plc

- Wuxi Yuantong Gas Co., Ltd

The Global Liquid Hydrogen Market generated USD 40.5 billion in 2024 and is projected to expand at a CAGR of 5.4% between 2025 and 2034, driven by increasing investments in hydrogen infrastructure, technological advancements, and international collaborations. The demand for liquid hydrogen is rising due to its role in decarbonizing industries, supporting clean energy transitions, and meeting stringent emission reduction targets. Governments worldwide are implementing policies and funding programs to accelerate hydrogen adoption across sectors, from transportation to industrial applications. Leading corporations are also forming strategic alliances to develop large-scale hydrogen production hubs, ensuring a steady supply chain to meet the growing energy needs. The transportation sector, particularly hydrogen fuel cell vehicles, is emerging as a key consumer of liquid hydrogen, further driving market expansion. Technological innovations in storage, handling, and distribution are enhancing efficiency, making liquid hydrogen a more viable alternative for various applications.

The development of hydrogen hubs is a major factor fueling market growth. These hubs serve as centralized locations for hydrogen production, storage, and distribution, creating a seamless supply chain for industries adopting hydrogen-based solutions. Partnerships between technology providers and energy companies are fostering innovations that improve production efficiency and cost-effectiveness. Global initiatives aimed at advancing hydrogen technology are further strengthening the industry, enabling the establishment of a robust international supply network.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $40.5 Billion |

| Forecast Value | $68.5 Billion |

| CAGR | 5.4% |

The liquid hydrogen market is segmented based on production methods, with key categories including coal gasification, electrolysis, and steam methane reforming (SMR). The SMR segment remains dominant due to its cost-effectiveness and efficiency in large-scale hydrogen production. By 2032, SMR is expected to generate USD 24.5 billion, driven by its economic viability in regions with abundant natural gas resources. Continuous advancements in catalysts, process optimization, and heat recovery systems are improving the efficiency of SMR operations while reducing emissions, making it a preferred production method for many industries.

The distribution of liquid hydrogen is primarily divided into pipelines and cryogenic tanks. In 2024, cryogenic tanks accounted for 85.9% of the market share, reflecting their critical role in hydrogen storage and transportation. Enhanced insulation technologies have significantly improved the efficiency of cryogenic tanks, minimizing hydrogen loss and ensuring stable storage conditions. The use of advanced materials has further reduced boil-off rates, enhancing the reliability and safety of hydrogen transport. Hydrogen hubs and industrial clusters are expanding, with extensive pipeline networks being developed to streamline hydrogen distribution and support large-scale industrial applications.

The United States is a key player in the liquid hydrogen market, valued at USD 8.2 billion in 2024. The country is expected to contribute 77% of the market share by 2034, driven by strong government support, rising industrial investments, and increasing environmental awareness. Federal incentives, policy frameworks, and funding initiatives are promoting the adoption of hydrogen technologies across multiple sectors, reinforcing the U.S. position as a leader in hydrogen innovation and infrastructure development. As industries align with sustainability goals and decarbonization efforts, the U.S. liquid hydrogen market is poised for significant expansion in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Production Method, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Coal gasification

- 5.3 SMR

- 5.4 Electrolysis

Chapter 6 Market Size and Forecast, By Distribution Method, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Pipelines

- 6.3 Cryogenic tanks

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Chemical

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of World

Chapter 9 Company Profiles

- 9.1 Air Products and Chemicals, Inc.

- 9.2 Air Liquide

- 9.3 Chart Industries

- 9.4 ENGIE

- 9.5 GE Appliances

- 9.6 GENH2

- 9.7 INOX India Limited

- 9.8 Iwatani Corporation

- 9.9 Kawasaki Heavy Industries, Ltd.

- 9.10 Linde plc

- 9.11 Messer

- 9.12 Plug Power Inc.

- 9.13 Praxair Technology, Inc.

- 9.14 Salzburger Aluminium Group

- 9.15 Shell plc

- 9.16 Wuxi Yuantong Gas Co., Ltd