|

市場調查報告書

商品編碼

1644940

亞太液氫 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Liquid Hydrogen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

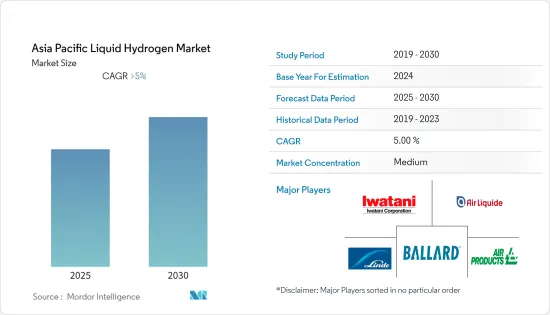

預計預測期內亞太液氫市場複合年成長率將超過 5%。

2020 年,市場受到了 COVID-19 的負面影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從中期來看,預計液氫計劃投資的增加將推動市場成長。

- 另一方面,預測期內資本和生產成本的上升預計將阻礙亞太液氫市場的成長。

- 在預測期內,採用現代技術生產液態氫可能為太陽能光電逆變器市場創造豐厚的成長機會。

- 中國佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。這一成長得益於投資增加和政府支持措施。

亞太液氫市場趨勢

汽車領域佔據市場主導地位

- 由於汽車業對無污染燃料的需求不斷增加,亞太地區液氫市場預計將大幅成長。液態氫具有更大的優勢,因為它更容易儲存和運輸。

- 在汽車應用中,固體電解質燃料電池等新技術使得使用液態氫作為二次能源來源成為可能,不會產生二氧化碳排放,從而為電力驅動產生電能或為內燃機 (ICE) 產生直接燃料。

- 截至 2022 年 9 月,中國的加氫站數量超過世界上任何其他國家。全國約有 250 個加氫站投入運作。接下來是日本,有 161 個地點。鑑於日本汽車製造商豐田和本田是少數向公眾銷售氫動力汽車的汽車製造商之一,日本成為氫動力汽車燃料的主要供應國也就不足為奇了。

- 此外,世界各地汽車和交通運輸產生的污染日益增加。石化燃料動力來源的汽車排放的污染物直接排放到環境中,造成健康危害。

- 根據一項研究,柴油和汽油動力來源汽車佔全球整體碳排放的 30% 左右,其中約 72% 的排放來自道路車輛,包括汽車、卡車和貨運車輛。

- 2022年3月,中國政府發布了全國首個氫能汽車長期戰略。該公司的目標是到 2025 年將 50,000 輛氫燃料電池汽車推向市場,是 2020 年 8,000 輛的六倍多。

- 因此,由於上述原因,預計汽車產業將在預測期內佔據市場主導地位。

中國主導市場

- 中國在液氫市場佔據主導地位,並且由於經濟的快速變化,預計這一地位將繼續保持。

- 液態氫是動力來源;氫可以為火箭提供燃料,並為航太環境中的生命維持系統和電腦提供動力。液態氫也用於金屬的燒結和退火。

- 預計到2060年,中國的氫氣需求將超過9,000萬噸。截至 2020 年,該國的氫氣使用幾乎僅限於精製業和氨生產,總使用量約 2,450 萬噸。預測表明,許多領域的技術進步可能會導致運輸和電力領域對氫氣的使用增加。

- 中國是世界第二大國內航空市場和主要飛機製造國。此外,中國飛機零件及組裝製造業正在快速成長。

- 到2040年,中國航空公司計劃增加約8,700架新飛機,價值1.47兆美元。預計將進一步提振液氫的市場需求。

- 2021年12月,空氣產品公司宣佈在山東省啟動首個加氫站,為公車和卡車提供加氫。該計劃旨在支持中國的「萬戶氫氣」示範和綠色交通。該公司還加快了該省多個氫氣生產和利用計劃,以支持國家計劃。

- 因此,鑑於上述情況,預計中國將在預測期內主導亞太液氫市場。

亞太液氫產業概況

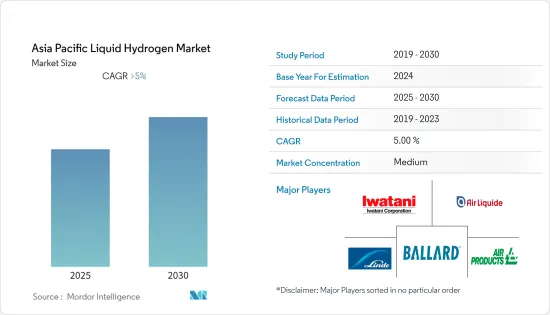

亞太液氫市場適度整合。市場的主要企業(不分先後順序)包括液化空氣集團、林德公司、空氣產品及化學品公司、巴拉德動力系統和巖谷公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 分配

- 容器

- 坦克

- 最終用途產業

- 車

- 化工和石化

- 航太

- 冶金

- 其他

- 地區

- 中國

- 印度

- 日本

- 新加坡

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Air Liquide SA

- Linde plc

- Air Products and Chemicals Inc.

- Ballard Power Systems.

- Iwatani Corporation

- Taiyo Nippon Sanso Holding Corporation

- Messer Group GmbH

- Universal Industrial Gases, Inc.

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93249

The Asia Pacific Liquid Hydrogen Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investments in liquid hydrogen projects are expected to drive the market's growth.

- On the other hand, higher capital and production costs are expected to hamper the growth of the Asia Pacific liquid hydrogen market during the forecast period.

- Nevertheless, adapting the latest technologies in liquid hydrogen production will likely create lucrative growth opportunities for the solar PV inverters market in the forecast period.

- China dominates the market and will likely witness the highest CAGR during the forecast period. This growth is attributed to increasing investments and supportive government policies.

APAC Liquid Hydrogen Market Trends

Automotive Segment to Dominate the Market

- Asia-Pacific's liquid hydrogen market is forecasted to grow substantially due to the rising demand for clean fuel in the automotive industry. Liquid hydrogen offers more significant advantages because of its storage and transportation qualities.

- In an automotive application, liquid hydrogen can be used as a secondary energy source without emitting any CO2 using new technologies like Proton Exchange Membrane fuel cells to produce electricity for an electric drive and a direct fuel for ICE (internal combustion engines).

- As of September 2022, China has the most significant number of hydrogen fuel stations in any country worldwide. There are about 250 operational hydrogen refueling stations in the country. This was followed by Japan, with 161 such stations. Japan's position as the leading provider of hydrogen automotive fuel is unsurprising given that Japanese automakers Toyota and Honda are among only a handful of car manufacturers selling hydrogen cars to the public.

- Furthermore, pollution all around the globe is increasing from vehicles and transportation over time. Pollution from fossil fuel-powered vehicles is emitted directly into the environment, which causes health risks.

- According to a study, vehicles driven by diesel and gasoline account for around 30% of the carbon emission globally, and ~72% of the emission comes from road vehicles like cars, trucks, lorries, and other road vehicles.

- As of March 2022, the Chinese government announced the country's first-ever long-term strategy for hydrogen vehicles. By 2025, the government strives to deliver 50,000 hydrogen fuel-cell vehicles on the road, more than six times the existing units of 8,000 in 2020.

- Hence, the automotive industry is expected to dominate the market during the forecast period due to the above reasons.

China to Dominate the Market

- China is dominating the liquid hydrogen market and is expected to continue further due to the rapidly undergoing economic changes.

- Liquid hydrogen is a power source; hydrogen fuels rockets and powers life-support systems and computers in aerospace environments. Liquid hydrogen is also used for metal sintering and annealing.

- Hydrogen demand in China is forecast to climb to over 90 million metric tons by 2060. In 2020, hydrogen use in the country was largely limited to the refining sector and ammonia production, amounting to a total use of some 24.5 million metric tons. Forecasts suggest that technology advancement in numerous sectors could lead to an increased hydrogen use in the transportation and power sectors.

- China is the world's second-largest national air travel market and the major aircraft manufacturer. Moreover, the aircraft parts and assembly manufacturing sector in China has been growing at a fast rate.

- By 2040, Chinese airline companies are planning to have ~8,700 new airplanes, which would be worth USD 1.47 trillion. This is further expected to boost the market demand for liquid hydrogen.

- In December 2021, Air Products announced the commencement of its first hydrogen fueling station in Shandong Province for fueling buses and trucks. The project aims to support China's 'Hydrogen into Ten Thousand Homes' demonstration and green transportation. The company also accelerated several hydrogen production and application projects in the province to support the national project.

- Therefore, owing to the above points, China is expected to dominate the Asia Pacific liquid hydrogen market during the forecast period.

APAC Liquid Hydrogen Industry Overview

The Asia Pacific liquid hydrogen market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Air Liquide S.A., Linde plc, Air Products and Chemicals Inc., Ballard Power Systems, and Iwatani Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Distribution

- 5.1.1 Containers

- 5.1.2 Tanks

- 5.2 End-use Industry

- 5.2.1 Automotive

- 5.2.2 Chemicals and Petrochemicals

- 5.2.3 Aerospace

- 5.2.4 Metallurgy

- 5.2.5 Other End-use Industries

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Singapore

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Air Liquide S.A

- 6.3.2 Linde plc

- 6.3.3 Air Products and Chemicals Inc.

- 6.3.4 Ballard Power Systems.

- 6.3.5 Iwatani Corporation

- 6.3.6 Taiyo Nippon Sanso Holding Corporation

- 6.3.7 Messer Group GmbH

- 6.3.8 Universal Industrial Gases, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219