|

市場調查報告書

商品編碼

1698527

鈉離子電池市場機會、成長動力、產業趨勢分析及2025-2034年預測Sodium Ion Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

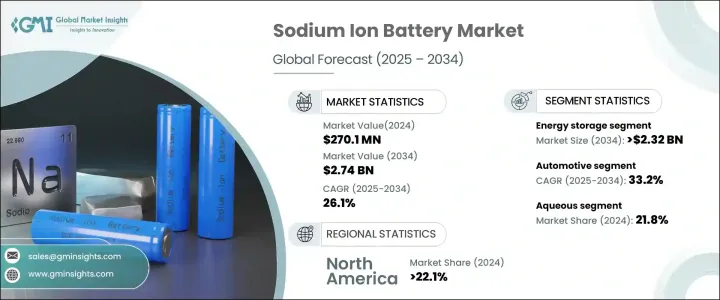

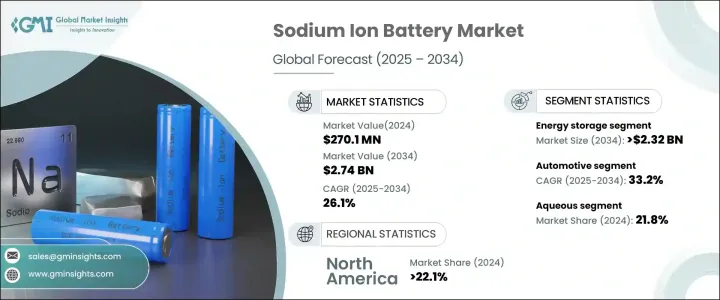

2024 年全球鈉離子電池市場價值為 2.701 億美元,預計在 2025 年至 2034 年期間將以 26.1% 的複合年成長率擴張,這得益於對經濟高效且永續的能源儲存解決方案的需求不斷成長。隨著各行各業尋求增強供應鏈彈性的替代方案,鈉離子技術因其依賴豐富的原料,減少了對稀缺和昂貴資源的依賴,成為可行的選擇。人們對環保能源解決方案的日益重視進一步推動了這種轉變,鈉離子電池成為傳統鋰離子電池的低成本替代品。

鈉離子電池的轉變得益於其解決能源儲存領域關鍵挑戰的能力。再生能源的日益普及加劇了對大規模、經濟實惠的能源儲存解決方案的需求,使得鈉離子技術成為首選。這些電池為汽車到電網等行業提供了永續、高效且可擴展的選擇。此外,與鋰離子電池相比,它們的安全性有所提高,特別是在防止熱失控方面,使其成為穩定性和可靠性至關重要的應用的理想解決方案。隨著電網規模儲能裝置的擴大,鈉離子電池因其降低火災和爆炸風險(傳統電池技術的主要問題)而變得越來越有吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.701億美元 |

| 預測值 | 27.4億美元 |

| 複合年成長率 | 26.1% |

在終端應用中,能源儲存產業預計到 2034 年將創造 23.2 億美元的收入。對於公用事業和大型再生能源專案而言,對經濟高效且持久的儲存解決方案的需求至關重要。隨著世界各國政府推動能源轉型政策,鈉離子電池因其與太陽能和風能系統無縫整合的潛力而受到越來越大的關注。它們的經濟性和安全性優勢進一步增強了其大規模部署的吸引力,解決了與成本、供應鏈脆弱性和營運安全相關的關鍵產業挑戰。汽車產業對鈉離子技術的興趣也日益濃厚,尤其是電動車(EV),因為製造商希望實現電池供應多樣化,減少對鋰基材料的依賴。

鈉離子電池技術分為水系和非水系,其中水系在 2024 年的市佔率為 21.8%。水系鈉離子電池因其增強的安全性能而備受關注,可最大限度地減少火災和爆炸危險。與傳統的鋰離子電池不同,它們即使在過度充電、短路和機械損壞等極端條件下也能保持穩定。這種穩定性,加上無需使用昂貴有機溶劑的成本效益,促使水性鈉離子電池在廣泛的儲能系統中得到越來越廣泛的應用。

2024 年,美國鈉離子電池市場佔全球市場的 22.1%,2023 年市場規模達 4,420 萬美元。聯邦政府支持儲能發展的措施正在加速該領域的研發,促進鈉離子電池技術的創新和商業化。不斷擴大的可再生能源項目以及電網現代化建設進一步推動了對經濟高效且安全的大規模儲存解決方案的需求。隨著國家繼續投資永續能源基礎設施,鈉離子電池有望在塑造未來的能源儲存方面發揮關鍵作用。

目錄

第1章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 汽車

- 能源儲存

- 其他

第6章:市場規模及預測:依技術分類,2021 年至 2034 年

- 主要趨勢

- 水性

- 非水性

第7章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 義大利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 世界其他地區

第8章:公司簡介

- Altris

- CATL

- China BAK Battery

- Farasis Energy

- Faradion Limited

- HiNa Battery Technology

- Li-FUN Technology

- Natron Energy

- Northvolt

- SVOLT

- Tiamat

The Global Sodium Ion Battery Market, valued at USD 270.1 million in 2024, is expected to expand at a CAGR of 26.1% between 2025 and 2034, driven by the increasing demand for cost-effective and sustainable energy storage solutions. As industries seek alternatives that enhance supply chain resilience, sodium-ion technology is emerging as a viable option due to its reliance on abundant raw materials, reducing dependence on scarce and expensive resources. This shift is further fueled by the growing emphasis on environmentally friendly energy solutions, with sodium-ion batteries presenting a low-cost alternative to traditional lithium-ion batteries.

The transition to sodium-ion batteries is being propelled by their ability to address critical challenges in the energy storage landscape. The rising adoption of renewable energy sources has intensified the need for large-scale, affordable energy storage solutions, making sodium-ion technology a preferred choice. These batteries offer a sustainable, efficient, and scalable option for industries ranging from automotive to power grids. Additionally, their improved safety profile over lithium-ion batteries, particularly in preventing thermal runaway, positions them as a compelling solution for applications where stability and reliability are paramount. As grid-scale energy storage installations expand, sodium-ion batteries are becoming increasingly attractive for reducing the risk of fire and explosion, a major concern in conventional battery technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $270.1 Million |

| Forecast Value | $2.74 Billion |

| CAGR | 26.1% |

Among end-use applications, the energy storage sector is poised to generate USD 2.32 billion by 2034. The need for cost-efficient and long-lasting storage solutions is critical for utilities and large-scale renewable energy projects. As governments worldwide push for energy transition policies, sodium-ion batteries are gaining traction due to their potential to integrate seamlessly with solar and wind power systems. Their affordability and safety advantages further enhance their appeal for large-scale deployment, addressing key industry challenges related to cost, supply chain vulnerabilities, and operational safety. The automotive industry is also showing growing interest in sodium-ion technology, particularly for electric vehicles (EVs), as manufacturers look to diversify their battery supply and reduce reliance on lithium-based materials.

Sodium-ion battery technology is categorized into aqueous and non-aqueous types, with the aqueous segment holding a 21.8% market share in 2024. Aqueous sodium-ion batteries are gaining attention due to their enhanced safety features, which minimize fire and explosion hazards. Unlike traditional lithium-ion batteries, they maintain stability even under extreme conditions, including overcharging, short circuits, and mechanical damage. This stability, combined with the cost benefits of eliminating expensive organic solvents, is contributing to the growing adoption of aqueous sodium-ion batteries for extensive energy storage systems.

The United States sodium-ion battery market accounted for 22.1% of the global market in 2024, generating USD 44.2 million in 2023. Federal initiatives supporting energy storage advancements are accelerating research and development in the sector, fostering innovation and commercialization of sodium-ion battery technology. Expanding renewable energy projects, along with grid modernization efforts, are further driving demand for cost-effective and safe large-scale storage solutions. As the country continues investing in sustainable energy infrastructure, sodium-ion batteries are expected to play a pivotal role in shaping the future of energy storage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Automotive

- 5.3 Energy Storage

- 5.4 Others

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Aqueous

- 6.3 Non Aqueous

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Altris

- 8.2 CATL

- 8.3 China BAK Battery

- 8.4 Farasis Energy

- 8.5 Faradion Limited

- 8.6 HiNa Battery Technology

- 8.7 Li-FUN Technology

- 8.8 Natron Energy

- 8.9 Northvolt

- 8.10 SVOLT

- 8.11 Tiamat