|

市場調查報告書

商品編碼

1698541

發電燃氣渦輪機市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Power Generation Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

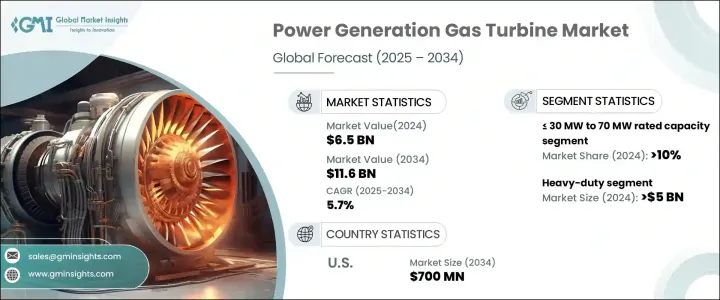

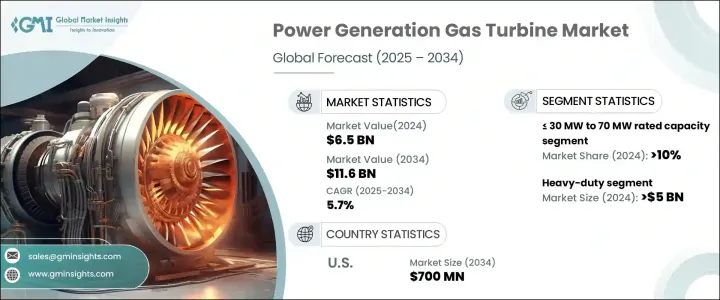

2024 年全球發電燃氣渦輪機市場價值為 65 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.7%。向更清潔能源的轉變以及對高效和永續發電解決方案日益成長的需求正在推動行業成長。消費者意識的增強,加上減少碳排放的嚴格規定,正在促進發電領域對燃氣渦輪機的需求。由於燃氣渦輪機在平衡電網可靠性和再生能源整合方面發揮關鍵作用,從燃煤發電廠向天然氣替代能源的轉變正在加速。隨著燃氣渦輪發電佔有率的不斷增加,市場在快速城市化、工業擴張和人口成長的推動下不斷發展。由於老化發電廠需要現代化改造,先進的燃氣渦輪技術對於滿足全球能源需求變得至關重要。

燃氣渦輪機因其效率高、反應時間快,仍是發電的首選。這些系統將燃料的化學能轉換為機械能,然後再轉換為電能。再生能源的整合、渦輪機設計的進步以及氫混合渦輪機的日益普及正在增強市場前景。分散式電力系統的擴張,特別是在離網和偏遠地區的擴張,正在推動中小型燃氣渦輪機的需求。對實現淨零排放的日益關注進一步推動了正在開發使用替代燃料的下一代渦輪機的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 116億美元 |

| 複合年成長率 | 5.7% |

根據容量,市場分為渦輪機容量範圍從<= 30 MW 到 70 MW、> 70 MW 到 200 MW 和> 200 MW。 2024 年,功率在 <= 30 MW 至 70 MW 範圍內的系統將佔據超過 10% 的市場佔有率,因其效率高、成本效益高以及在聯合循環和氣化廠中的廣泛應用而受到青睞。渦輪機部件(包括翼型和塗層)的不斷發展正在提高其運行性能和可靠性。

根據設計,該產業分為航空衍生型燃氣渦輪機和重型燃氣渦輪機。 2024 年,重型引擎市場的佔有率將達到 50 億美元,這得益於聯合循環燃氣渦輪機 (CCGT) 電廠的廣泛使用以及補充再生能源的能力。航空衍生產品領域預計在 2024 年價值 10 億美元,由於其在電網接入受限地區的效率而越來越受到關注。資料中心的成長及其龐大的電力需求也刺激了對航空衍生渦輪機的需求。

市場進一步細分為開式循環和聯合循環系統。聯合循環渦輪機在 2024 年的市場規模將超過 50 億美元,而開式循環渦輪機預計到 2034 年的複合年成長率將達到 5%。開式循環渦輪機因其啟動快、功能多樣、冷卻要求低而受到青睞。受工業成長、能源效率要求以及政府減排政策的推動,到 2034 年,聯合循環領域的複合年成長率預計將超過 5.5%。

受氫燃燒技術和低碳能源投資增加的推動,美國市場規模預計到 2034 年將超過 7 億美元。受益於豐富的天然氣供應和開採技術的進步,預計到 2034 年,北美燃氣渦輪機產業的複合年成長率將達到 5.5%。聯合循環發電廠的持續發展和燃氣渦輪機效率的提高將在推動產業擴張方面發揮重要作用。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 年至 2034 年

- 主要趨勢

- ≤30MW至70MW

- > 70 兆瓦至 200 兆瓦

- > 200 兆瓦

第6章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 航改型

- 重負

第7章:市場規模及預測:依技術分類,2021 年至 2034 年

- 主要趨勢

- 開放式循環

- 複合循環

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 荷蘭

- 芬蘭

- 希臘

- 丹麥

- 羅馬尼亞

- 波蘭

- 瑞典

- 亞太地區

- 中國

- 澳洲

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 孟加拉

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 約旦

- 黎巴嫩

- 南非

- 奈及利亞

- 阿爾及利亞

- 肯亞

- 迦納

- 拉丁美洲

- 巴西

- 阿根廷

- 秘魯

- 智利

第9章:公司簡介

- Ansaldo Energia

- Bharat Heavy Electricals Limited (BHEL)

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- JSC United Engine

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Opra Turbines

- Rolls Royce

- Siemens

- Solar Turbines

- TotalEnergies

- Wartsila

- Zorya-Mashproekt

The Global Power Generation Gas Turbine Market, valued at USD 6.5 billion in 2024, is projected to expand at a CAGR of 5.7% from 2025 to 2034. The transition toward cleaner energy sources and the rising need for efficient and sustainable power generation solutions are driving industry growth. Increasing consumer awareness, combined with stringent regulations to reduce carbon emissions, is fostering demand for gas turbines in power generation. The shift from coal-fired power plants to natural gas-based alternatives is accelerating adoption, as gas turbines play a key role in balancing grid reliability and renewable energy integration. With an increasing share of electricity generation coming from gas turbines, the market continues to evolve, supported by rapid urbanization, industrial expansion, and population growth. As aging power plants require modernization, advanced gas turbine technologies are becoming essential in meeting the global energy demand.

Gas turbines remain a preferred choice in power generation due to their efficiency and rapid response time. These systems convert the chemical energy of fuel into mechanical energy, which is then transformed into electricity. The integration of renewable energy sources, advancements in turbine designs, and the growing deployment of hydrogen-blend turbines are enhancing market prospects. The expansion of distributed power systems, especially in off-grid and remote locations, is driving demand for small and medium-sized gas turbines. Increased focus on achieving net-zero emissions is further boosting the adoption of next-generation turbines, which are being developed to operate on alternative fuels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 5.7% |

The market is categorized based on capacity into turbines ranging from <= 30 MW to 70 MW, > 70 MW to 200 MW, and > 200 MW. Systems within the <= 30 MW to 70 MW range accounted for over 10% of the market in 2024, favored for their efficiency, cost-effectiveness, and widespread application in combined cycle and gasification plants. The continuous evolution of turbine components, including airfoils and coatings, is enhancing operational performance and reliability.

By design, the industry is divided into aeroderivative and heavy-duty gas turbines. The heavy-duty segment held a USD 5 billion share in 2024, driven by extensive use in combined cycle gas turbine (CCGT) plants and the ability to complement renewable energy. The aeroderivative segment, valued at USD 1 billion in 2024, is gaining traction due to its efficiency in regions with limited grid access. The growth of data centers, with their substantial power requirements, is also fueling demand for aeroderivative turbines.

The market further differentiates into open cycle and combined cycle systems. While combined cycle turbines accounted for over USD 5 billion in 2024, open cycle turbines are expected to grow at a CAGR of 5% through 2034. Open cycle turbines are favored for their quick startup, versatility, and lower cooling requirements. The combined cycle segment is projected to witness a CAGR of over 5.5% through 2034, driven by industrial growth, energy efficiency mandates, and government policies aimed at reducing emissions.

The U.S. market is expected to surpass USD 700 million by 2034, supported by increased investment in hydrogen combustion technologies and low-carbon energy sources. North America's gas turbine industry is projected to expand at a CAGR of 5.5% through 2034, benefiting from an abundant natural gas supply and advancements in extraction technologies. The continued development of combined cycle power plants and improvements in gas turbine efficiency will play a significant role in driving the industry's expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 – 2034 (MW & USD Million)

- 5.1 Key trends

- 5.2 ≤ 30 MW to 70 MW

- 5.3 > 70 MW to 200 MW

- 5.4 > 200 MW

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (MW & USD Million)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 – 2034 (MW & USD Million)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (MW & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Denmark

- 8.3.10 Romania

- 8.3.11 Poland

- 8.3.12 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Bangladesh

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 Lebanon

- 8.5.12 South Africa

- 8.5.13 Nigeria

- 8.5.14 Algeria

- 8.5.15 Kenya

- 8.5.16 Ghana

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Bharat Heavy Electricals Limited (BHEL)

- 9.3 Flex Energy Solutions

- 9.4 GE Vernova

- 9.5 Harbin Electric

- 9.6 JSC United Engine

- 9.7 Kawasaki Heavy Industries

- 9.8 MAN Energy Solutions

- 9.9 Mitsubishi Heavy Industries

- 9.10 Opra Turbines

- 9.11 Rolls Royce

- 9.12 Siemens

- 9.13 Solar Turbines

- 9.14 TotalEnergies

- 9.15 Wartsila

- 9.16 Zorya-Mashproekt