|

市場調查報告書

商品編碼

1698565

光纖電纜市場機會、成長動力、產業趨勢分析及2025-2034年預測Fiber Optic Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

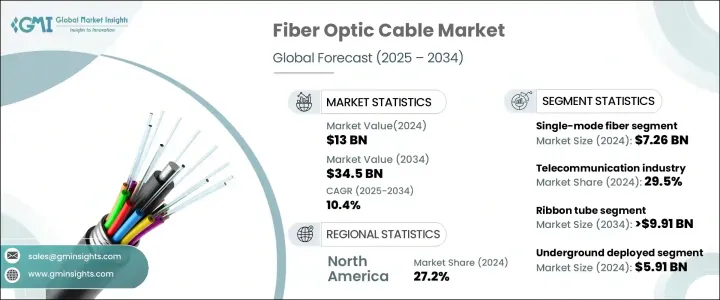

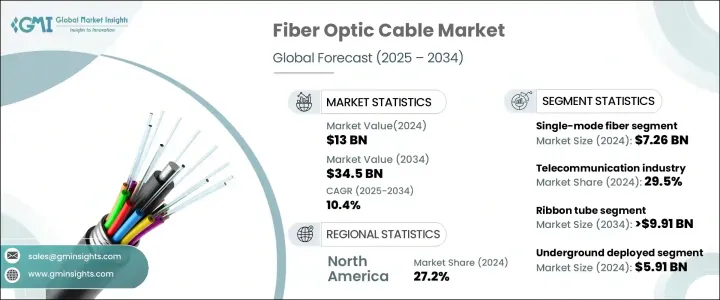

2024 年全球光纖電纜市場價值為 130 億美元,預計 2025 年至 2034 年的複合年成長率為 10.4%。對高速連接的需求不斷成長、5G 網路的擴展以及資料中心部署的激增是推動這一成長的關鍵因素。隨著 5G 技術在全球範圍內的擴展,對支援無縫、低延遲通訊的強大基礎設施的需求日益加劇。為了實現更好的網路覆蓋,小型基地台的部署日益普及,對光纖電纜的需求也十分強勁,因為光纖電纜可確保高效的回程和前傳連接。全球 5G 普及率預計將到 2030 年超過 56%,促使光纖製造商提高電纜效率、耐用性和傳輸速度,以支援現代電信網路。

隨著電信公司和雲端服務供應商大力投資可擴展、高頻寬基礎設施,資料中心營運的擴張進一步促進了市場成長。光纖電纜使資料中心能夠管理複雜的網路需求,確保安全和高速的連接。隨著對電信和雲端運算的投資增加,製造商正專注於光纖技術創新,以提高超大規模和邊緣資料中心的效率和可擴展性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 130億美元 |

| 預測值 | 345億美元 |

| 複合年成長率 | 10.4% |

市場依光纖類型分為單模光纖和多模光纖。單模光纖在 2024 年以 72.6 億美元的市場規模領先,提供卓越的長距離資料傳輸能力。多模光纖預計將以 8.5% 的複合年成長率成長,在高速短距離通訊領域,尤其是在區域網路和資料中心,越來越受到人們的關注。

從產業來看,受 5G 網路高頻寬連線需求不斷成長的推動,電信業在 2024 年佔據主導地位,佔據 29.5% 的市場佔有率。預計電力公用事業部門的複合年成長率將達到 10.9%,並且智慧電網應用中光纖電纜的使用將持續增加。國防工業佔有 14.2% 的市場佔有率,依靠光纖進行安全、高速的資料傳輸,這對於現代通訊和監控系統至關重要。在自動化和數位轉型措施不斷推進的推動下,到 2034 年,工業領域的規模預計將超過 73.4 億美元。醫療產業預計將以 8.2% 的複合年成長率成長,利用光纖進行精密診斷和成像技術。

市場也按電纜類型分類,由於帶狀管光纖電纜具有高光纖密度,預計到 2034 年其市值將超過 99.1 億美元。鬆管光纜在 2024 年的價值為 43.5 億美元,廣泛應用於長程電信網路,而緊緩衝光纜的複合年成長率為 9.8%,為室內應用提供了增強的靈活性。中央核心電纜預計到 2034 年將達到 41.9 億美元,透過光纖到府 (FTTH) 和光纖到樓 (FTTB) 部署支援寬頻擴充。

從部署角度來看,地下光纖電纜在 2024 年將達到 59.1 億美元,為關鍵基礎設施提供安全連接。水下通訊領域預計將以 11.8% 的複合年成長率成長,在跨洋通訊中發揮關鍵作用。預計到 2034 年,空中部署將超過 91.4 億美元,提供經濟高效且易於維護的網路擴充。

從地區來看,受先進網路解決方案的快速採用和政府支持 5G 基礎設施發展的舉措的推動,北美在 2024 年佔據了 27.2% 的市場佔有率。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商矩陣

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 寬頻普及率提高

- 電信公司持續擴張

- 高速網際網路的需求不斷成長

- 資料中心的激增

- 採用5G技術

- 產業陷阱與挑戰

- 實施和維護成本高

- 克服訊號損失和衰減

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依纖維類型,2021 - 2034 年

- 主要趨勢

- 單模光纖

- 多模光纖

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 地下

- 水下

- 天線

第7章:市場估計與預測:依電纜類型,2021 - 2034 年

- 主要趨勢

- 帶狀管

- 鬆套管

- 緊緩衝

- 中央核心

- 其他

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 電信

- 電力設施

- 國防/軍事

- 工業的

- 醫療的

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- MEA 其餘地區

第10章:公司簡介

- Belden Inc.

- Coherent Corporation

- CommScope Holding Company Inc.

- Corning Incorporated

- Encore Wire Corporation

- Finolex Cables Limited

- Fujikura Ltd.

- Furukawa Electric

- Hengtong Group Co., Ltd.

- Hexatronic Group AB

- LS Cable & System Ltd.

- Nexans SA

- Proterial Cable America Inc. (Proterial Ltd)

- Prysmian Group

- Sterlite Technologies

- Sumitomo Electric Industries Ltd

- Yangtze Optical Fiber and Cable Joint Stock Ltd Co.

The Global Fiber Optic Cable Market, valued at USD 13 billion in 2024, is expected to grow at a CAGR of 10.4% from 2025 to 2034. Rising demand for high-speed connectivity, the expansion of 5G networks, and the surge in data center deployments are key factors fueling this growth. As 5G technology expands worldwide, the need for robust infrastructure to support seamless, low-latency communication has intensified. The increasing adoption of small cell deployments for better network coverage has created a strong demand for fiber optic cables, which ensure efficient backhaul and fronthaul connectivity. The rise in global 5G penetration, expected to surpass 56% by 2030, is driving fiber optic manufacturers to enhance cable efficiency, durability, and transmission speeds to support modern telecommunication networks.

Expanding data center operations further contributes to market growth, with telecom firms and cloud service providers investing heavily in scalable, high-bandwidth infrastructure. Fiber optic cables enable data centers to manage complex networking demands, ensuring secure and high-speed connectivity. With increased investments in telecom and cloud computing, manufacturers are focusing on fiber technology innovations that enhance efficiency and scalability for hyperscale and edge data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $34.5 Billion |

| CAGR | 10.4% |

The market is segmented by fiber type into single-mode and multi-mode fibers. Single-mode fiber led the market with USD 7.26 billion in 2024, offering superior long-distance data transfer capabilities. Multi-mode fiber, projected to grow at a CAGR of 8.5%, is gaining traction for high-speed, short-distance communication, particularly in local area networks and data centers.

By industry, telecommunications dominated in 2024, accounting for 29.5% of market share, driven by the growing demand for high-bandwidth connectivity in 5G networks. The power utilities sector, projected to expand at a CAGR of 10.9%, is seeing increased adoption of fiber optic cables for smart grid applications. The defense industry, with a 14.2% market share, relies on fiber optics for secure, high-speed data transmission, essential for modern communication and surveillance systems. The industrial segment is set to surpass USD 7.34 billion by 2034, supported by rising automation and digital transformation initiatives. The medical industry, expected to grow at a CAGR of 8.2%, leverages fiber optics for precision diagnostics and imaging technologies.

The market is also categorized by cable type, with ribbon tube fiber optic cables projected to exceed USD 9.91 billion by 2034 due to their high fiber density. Loose tube cables, valued at USD 4.35 billion in 2024, are widely used in long-haul telecom networks, while tight-buffered cables, growing at a CAGR of 9.8%, offer enhanced flexibility for indoor applications. Central core cables, expected to reach USD 4.19 billion by 2034, support broadband expansion through Fiber-to-the-Home (FTTH) and Fiber-to-the-Building (FTTB) deployments.

Deployment-wise, underground fiber optic cables led with USD 5.91 billion in 2024, providing secure connectivity for critical infrastructure. The underwater segment, expected to grow at a CAGR of 11.8%, plays a key role in transoceanic communication. Aerial deployments, forecasted to surpass USD 9.14 billion by 2034, offer cost-effective and easily maintainable network expansion.

Regionally, North America held a 27.2% market share in 2024, driven by the rapid adoption of advanced networking solutions and government initiatives supporting 5G infrastructure development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increased broadband penetration

- 3.8.1.2 Continuous expansion of telecom companies

- 3.8.1.3 Growing demand for high-speed internet

- 3.8.1.4 Proliferation of data center

- 3.8.1.5 Adoption of 5G technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Implementation and maintenance cost

- 3.8.2.2 Overcoming signal loss and attenuation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.10.1 Supplier power

- 3.10.2 Buyer power

- 3.10.3 Threat of new entrants

- 3.10.4 Threat of substitutes

- 3.10.5 Industry rivalry

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Million)

- 5.1 Key Trends

- 5.2 Single-mode fiber

- 5.3 Multi-mode fiber

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD Million)

- 6.1 Key Trends

- 6.2 Underground

- 6.3 Underwater

- 6.4 Aerial

Chapter 7 Market Estimates & Forecast, By Cable Type, 2021 - 2034 (USD Million)

- 7.1 Key Trends

- 7.2 Ribbon tube

- 7.3 Loose tube

- 7.4 Tight buffered

- 7.5 Central core

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million)

- 8.1 Key Trends

- 8.2 Telecommunication

- 8.3 Power utilities

- 8.4 Defense/military

- 8.5 Industrial

- 8.6 Medical

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Belden Inc.

- 10.2 Coherent Corporation

- 10.3 CommScope Holding Company Inc.

- 10.4 Corning Incorporated

- 10.5 Encore Wire Corporation

- 10.6 Finolex Cables Limited

- 10.7 Fujikura Ltd.

- 10.8 Furukawa Electric

- 10.9 Hengtong Group Co., Ltd.

- 10.10 Hexatronic Group AB

- 10.11 LS Cable & System Ltd.

- 10.12 Nexans S.A.

- 10.13 Proterial Cable America Inc. (Proterial Ltd)

- 10.14 Prysmian Group

- 10.15 Sterlite Technologies

- 10.16 Sumitomo Electric Industries Ltd

- 10.17 Yangtze Optical Fiber and Cable Joint Stock Ltd Co.