|

市場調查報告書

商品編碼

1687745

光纖電纜:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Fiber Optic Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

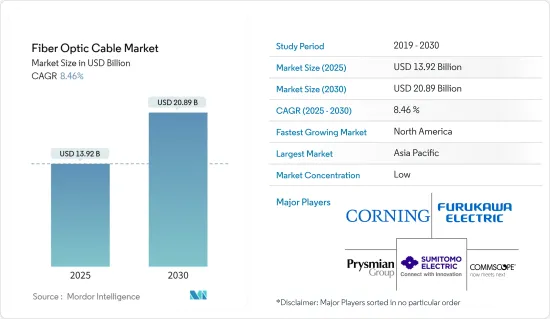

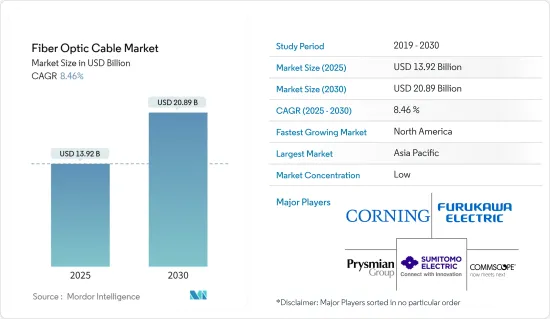

光纖電纜市場規模預計在 2025 年為 139.2 億美元,預計到 2030 年將達到 208.9 億美元,預測期內(2025-2030 年)的複合年成長率為 8.46%。

寬頻普及率的提高、網路電視串流服務的興起以及通訊業的整體成長是主要促進因素。所有這些因素都在推動光纖電纜的使用增加。

5G網路和光纖基礎設施的發展正在推動各行業的數位轉型。光纖電纜比銅纜具有更高的安全性、可靠性、頻寬和保密性。寬頻的廣泛應用、網路電視串流服務的興起以及通訊業的整體成長導致 FTTH 大幅成長。然而,也出現了物聯網和在家工作等新興趨勢。

此外,愛立信預計,2022 年至 2023 年期間,全球 5G 用戶數將從 5.5 億多成長至 16.7 億多。 5G用戶數量的大幅成長預計將推動市場發展。

由於全球連通性的增強,對光纖通訊的投資不斷增加也是推動市場成長的主要因素之一。例如,2023年10月,蘇伊士運河經濟區與中國電力和光纖電纜製造商亨通簽署了一項價值1,800萬美元的投資協議,以擴大後者在泰達埃及區的業務。該協議將使該地區能夠生產多達200萬公里的光纜。該協議還將有助於履行光纖電纜、光分配網路和地面通訊製造的合約義務。包括但不限於光纖通訊通訊工程、電纜製造、電力工程服務、海底光纜營運維護等。

光纖電纜具有許多優點,包括高頻寬、低延遲、高可靠性和靈活性,但安裝設備的成本可能高達數千美元。對於開發中國家的光纖製造商來說,不斷成長的連接需求提供了巨大的商業前景。然而,市場成長也伴隨著一些營運挑戰,例如鋪設光纖電纜。

COVID-19 疫情和停工影響了全球資本投資和工業活動。繼 COVID-19 引發的全球景氣衰退之後,市場在 2020 年經歷了成長乏力,這一趨勢在 2021 年得以延續。電子商務、銀行、零售、製造和醫療保健等所有行業都在迅速採用人工智慧、雲端和分析等數位技術來保持市場競爭力,從而在 2022 年和 2023 年實現顯著成長,光纖網路覆蓋範圍的顯著擴大促進了預測期內的市場成長率。

光纖電纜市場趨勢

通訊產業可望大幅成長

- 網際網路、電子商務、電腦網路和多媒體(語音、資料和視訊)等各種來源的資料流量需求不斷增加,需要能夠處理頻寬的傳輸介質來處理如此大量的資訊,從而推動預測期內通訊基礎設施中光纖電纜的成長。

- 此外,在通訊網路中,光纖電纜用於連接不同的網路節點,如手機訊號塔、資料中心和網路服務供應商,從而實現不同位置之間大量資料的交換。光纖電纜還促進了高速網際網路連接和視訊會議、線上遊戲和雲端處理等先進通訊技術的發展。

- 光纖電纜在通訊業中的優勢包括比銅纜更高的速度和頻寬、更少的衰減、抗電磁干擾、更高的可靠性和更容易維護,而且更難竊聽或竊聽。

- 此外,選擇光纖電纜還因為其安全性、擴充性和無限頻寬潛力,可以處理大量回程傳輸流量,以支援5G、巨量資料和物聯網等嚴重依賴即時資料收集和傳輸的先進技術所需的頻寬水平,從而推動了全球通訊業者對光纖電纜的擴張。

- 根據GSMA報告,預計2022年5G連線數將突破10億,2025年將達到20億。 2025年終,5G將佔據五分之一以上的行動連線,全球五分之二以上的人口將生活在5G網路中。隨著5G連接需求的不斷成長,許多參與者正在擴大生產能力。預計這將為所研究的市場提供巨大的吸引力。

北美有望成為成長最快的市場

- 北美對光纖電纜的需求不斷成長,這主要受到幾個關鍵因素的推動,這些因素主要凸顯了該地區對高速、可靠和擴充性通訊基礎設施的重視。

- 近年來,北美由於其光纖部署速度的加速而變得越來越突出。根據光纖寬頻協會發布的報告,到2023年,美國光纖到戶(FTTH)將成長13%,達到7,800萬戶家庭,而目前這光纖寬頻已穿過美國約6,900萬戶家庭。

- 該協會還表示,加拿大對 FTTH 的需求正在蓬勃發展。例如,在加拿大,到 2023 年這一數字將增加 12%,達到 1,210 萬戶。 FTTH 部署的激增是 BEAD、RDOF 和 ReConnect 等大規模政府資助計劃的直接結果。例如,寬頻公平、存取和部署(BEAD)計劃提供424.5億美元用於資助規劃、基礎設施部署和實施計劃,以擴大美國所有50個州、華盛頓特區、波多黎各、美屬維京群島、關島、美國屬薩摩亞和北馬裡亞納群島聯邦的高速網路存取。

- 此外,隨著需求的成長,許多公司都專注於產品發布、夥伴關係和其他策略投資。例如,2023年3月,康普宣布擴大光纖電纜生產,以加速美國的寬頻部署,連接更多社區和服務不足的地區。該光纜預計每年將支援50萬戶家庭的光纖到府(FTTH)。

- 康寧公司宣布計劃在亞利桑那州吉爾伯特建立全新的電纜製造工廠,以擴大其光纖電纜製造能力。該工廠計劃於 2024 年投入營運,將成為該行業美國最西端的光纜製造地,並將能夠滿足美國西部和加拿大日益成長的需求。

光纖電纜市場概況

光纖電纜市場高度分散,主要參與者包括康寧、工業、普睿司曼集團、古河電工和康普控股公司。市場參與者正在採用聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023年10月,長飛光纖光纜股份有限公司在SCTE CABLE-TEC EXPO 2023上推出了新型光纜變體、高密度資料中心解決方案和精簡的F.ODN預連接解決方案。新型全乾式光纖纜線具有直徑緊湊、重量輕且無需任何填充物的即接即用設計。針對快速、無憂部署進行了最佳化。

2023 年 9 月-Coherent Corp. 宣布其與 Windstream 的合作已擴展到支援 400G 服務,以利用業界首款 100G QSFP28 0dBm 數位連貫光學 (DCO) 收發器在網路邊緣支援 100G 服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 影響與恢復評估

第5章 市場動態

- 市場促進因素

- 網路的普及和資料流量的增加

- 5G 和 FTTX 的採用率不斷提高

- 資料中心設施數量不斷增加

- 市場挑戰

- 實施成本高且相關複雜性

- 價格及價格趨勢分析

- 技術藍圖

第6章 市場細分

- 按最終用戶產業

- 通訊業

- 電力設施

- 國防/軍事

- 產業

- 醫療

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 馬來西亞

- 印尼

- 泰國

- 越南

- 新加坡

- 菲律賓

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Corning Inc.

- Sumitomo Electric Industries Ltd

- Prysmian Group

- Furukawa Electric

- CommScope Holding Company Inc.

- Coherent Corporation

- Finolex Cables Limited

- Proterial Cable America Inc.(Proterial Ltd)

- Sterlite Technologies

- Yangtze Optical Fiber and Cable Joint Stock Ltd Co.

第8章投資分析

第9章:未來市場展望

The Fiber Optic Cable Market size is estimated at USD 13.92 billion in 2025, and is expected to reach USD 20.89 billion by 2030, at a CAGR of 8.46% during the forecast period (2025-2030).

Increased broadband penetration, rising Internet TV streaming services, and the overall growth of the telecommunications sector are the main drivers. All these factors drive the increased use of fiber optic cables.

The evolution of fifth-generation networks and fiber optic infrastructure has driven digital transformation across industries. Optic fiber cable offers better security, reliability, bandwidth, and security than copper cables. Broadband penetration, increasing Internet TV streaming services, and the overall growth of the telecommunications industry have led to a substantial increase in FTTH. But there is also the newly emerging Internet of Things and working from home movement.

Furthermore, according to Ericsson, 5G subscriptions were expected to increase globally between 2022 and 2023, rising from over 0.55 billion to over 1.67 billion. Such a huge rise in 5G subscriptions was expected to drive the market.

The growing investments in fiber optic communication expansions with the growing connectivity globally are one of the major factors contributing to the market's growth. For instance, in October 2023, the Suez Canal Economic Zone signed an agreement worth USD 18 million in investments with the Chinese power and fiber optic cable manufacturer Hengtong to expand the latter's business in the TEDA-Egypt zone. Under the agreement, it sought to manufacture fiber optic cables with a capacity of up to two million kilometers in the region. The agreement will also contribute to fulfilling its contract obligations in connection with producing fiber optic cables, optical distribution networks, and ground telecommunications. This includes, but is not limited to, optical communications engineering, wire production and power engineering services, and the operation and maintenance of submarine fiber optic cables.

Although fiber optic cable offers many benefits, such as higher bandwidth, low latency, and a higher degree of reliability and flexibility, installing these devices may cost thousands of dollars. The growing demand for connectivity for optic fiber producers in developing nations presents significant business prospects. Yet factors such as installing fiber optic cables provide several operational difficulties for the market's growth.

The COVID-19 pandemic and lockdown affected capital investments and industrial activities globally. Following the global economic recession led by COVID-19, the market witnessed slow growth in 2020 and continued in 2021. All industries, including e-commerce, banking, retail, manufacturing, and healthcare, rapidly adopted digital technologies such as artificial intelligence, cloud, and analytics to stay competitive in the market, thereby experiencing significant growth in 2022 and 2023 with substantial expansions in the fiber optic network coverage contributing to the market's growth rate during the forecast period.

Fiber Optic Cable Market Trends

Telecommunications Sector Expected to Witness Significant Growth

- The increasing demand for data traffic from various sources, such as the internet, e-commerce, computer networks, and multimedia (voice, data, and video), has led to the need for a transmission medium capable of handling higher bandwidth to handle such significant amounts of information, driving the growth of fiber optic cable in the telecom infrastructure during the forecast period.

- Additionally, in telecommunication networks, fiber optic cables are used to connect different network nodes, such as cell towers, data centers, and internet service providers, allowing for the exchange of vast amounts of data between different locations. Fiber optic cables also allowed for developing high-speed internet connections and other advanced communication technologies like video conferencing, online gaming, and cloud computing.

- Benefits associated with fiber optic cables in the context of the telecommunication industry involve high speed and bandwidth, low attenuation, immunity to electromagnetic interference, high reliability and less maintenance compared to copper cables, and difficulty in tapping or intercepting, thus facilitating high security.

- Additionally, owing to their security, scalability, and the unlimited bandwidth potential to handle the vast amount of backhaul traffic being generated, fiber optic cables are also being chosen to support the bandwidth levels catering to advanced technologies like 5G, Big Data, and IoT that rely heavily on real-time data collection and transfer, supporting the growth of Fiber optics cable expansion among the telecom players globally.

- According to the GSMA report, 5G connections were expected to surpass one billion in 2022 and two billion by 2025. By the end of 2025, 5G will account for over a fifth of mobile connections, and more than two in five people globally will live within a 5G network. Due to the increasing demand for 5G connections, many players are expanding their production capabilities. This is expected to drive the market studied significantly.

North America is Expected to be the Fastest Growing Market

- The increasing demand for fiber optic cables in North America is mainly driven by several key factors highlighting the region's emphasis on high-speed, reliable, and scalable communication infrastructure.

- North America has recently obtained a prominent position owing to the increasing pace of fiber optic deployment in the country. With data-intensive activities like video streaming, cloud computing, online gaming, and remote working, the need for high-speed and dependable internet connections has increased and according to the report released by the Fiber Broadband Association, US fiber-to-the-home (FTTH) witnessed a 13% growth in the United States in 2023 to 78 million homes, with this fiber broadband now passing nearly 69 million unique US homes.

- Also, according to the association, Canada witnessed a surge in the demand for FTTH. For instance, Canadian passings had a 12% growth in 2023 to 12.1 million. The jump in FTTH deployments results from significant government funding efforts, such as BEAD, RDOF, and ReConnect, which are beginning to have a direct effect. For instance, the Broadband Equity, Access, and Deployment (BEAD) Program provides USD 42.45 billion to expand high-speed internet access by funding planning, infrastructure deployment, and adoption programs in all 50 states, Washington DC, Puerto Rico, the US Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands.

- Furthermore, as the demand grows, many companies focus on product launches, partnerships, and other strategic investments. For instance, in March 2023, CommScope announced expanding fiber-optic cable production to accelerate broadband rollout across the United States, connecting more communities and underserved areas. The lines were expected to support 500,000 homes per year in fiber-to-the-home (FTTH) deployments.

- Corning Incorporated announced its plans to expand the manufacturing capacity for optical fiber cables by constructing an all-new cable manufacturing facility in Gilbert, Arizona. The facility, expected to open in 2024, will be the industry's westernmost US manufacturing site for optical cable, allowing the company to serve the growing demand in the western United States and Canada.

Fiber Optic Cable Market Overview

The fiber optics cable market is highly fragmented, with the presence of major players like Corning Inc., Sumitomo Electric Industries Ltd, Prysmian Group, Furukawa Electric, and CommScope Holding Company Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

October 2023 - Yangtze Optical Fiber and Cable Joint Stock Limited announced new optical cable variants, high-density data center solutions, and streamlined F.ODN pre-connected solutions at SCTE CABLE-TEC EXPO 2023. The new all-dry fiber optic cable features a compact diameter, reduced weight, and splice-ready design without filling compounds. It is optimized for swift, hassle-free deployment.

September 2023 - Coherent Corp. announced its partnership with Windstream to enable 400G services has been extended to enable 100G services at the edge of the network, leveraging the industry's first 100G QSFP28 0 dBm digital coherent optics (DCO) transceiver.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of and Recovery from COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of Internet and High Data Traffic

- 5.1.2 Increasing Adoption of 5G and FTTX

- 5.1.3 Rising Number of Data Center Facilities

- 5.2 Market Challenges

- 5.2.1 High Cost of Installation and Associated Complexities

- 5.3 Analysis of Pricing and Pricing Trends

- 5.4 Technology Roadmap

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Telecommunication

- 6.1.2 Power Utilities

- 6.1.3 Defense/Military

- 6.1.4 Industrial

- 6.1.5 Medical

- 6.1.6 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Malaysia

- 6.2.3.5 Indonesia

- 6.2.3.6 Thailand

- 6.2.3.7 Vietnam

- 6.2.3.8 Singapore

- 6.2.3.9 Philippines

- 6.2.3.10 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Corning Inc.

- 7.1.2 Sumitomo Electric Industries Ltd

- 7.1.3 Prysmian Group

- 7.1.4 Furukawa Electric

- 7.1.5 CommScope Holding Company Inc.

- 7.1.6 Coherent Corporation

- 7.1.7 Finolex Cables Limited

- 7.1.8 Proterial Cable America Inc. (Proterial Ltd)

- 7.1.9 Sterlite Technologies

- 7.1.10 Yangtze Optical Fiber and Cable Joint Stock Ltd Co.